An unprecedented effort by private equity firms offers data-driven insights into the progress private companies are making against their ESG goals.

How are private companies performing on meaningful environmental, social and governance (ESG) metrics? How is the ESG performance of these companies changing over time? And how does their progress on ESG link to their financial results?

These are critical questions for all private equity firms, their current and prospective limited partners, and the companies they’ve invested in. In the hope of answering them, more than 200 general partners (GPs) and limited partners (LPs), including many of the largest PE firms and asset managers from around the world, have joined together to collect and report on a variety of key ESG metrics. The ESG Data Convergence Initiative, cochaired by CalPERS and Carlyle, was formally launched in the fall of 2021 and is supported by BCG as a neutral partner. The initiative is a first-of-its-kind, industry-led effort by the private equity community to drive consensus around meaningful ESG metrics and generate comparable, performance-based ESG data.

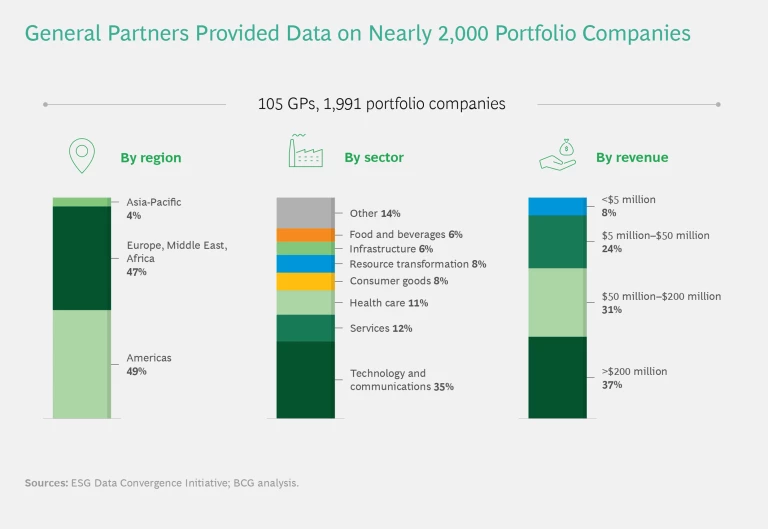

Last year, we published an article introducing the initiative’s objectives and providing preliminary insights into the data gathered to that point from the founding members. Since then, the initiative has grown rapidly, with more than 22,500 data points collected during its inaugural year from a far larger cohort of 105 GPs and nearly 2,000 underlying portfolio companies.

On average, privately owned companies are behind their publicly owned peers on key climate and diversity metrics.

It is still early days for the initiative. But the results of our analysis of the first year’s data are illuminating. On average, privately owned companies are behind their publicly owned peers on key climate and diversity metrics. On the other hand, these private companies have been highly effective at creating new jobs in recent years.

With ESG topics top of mind for many stakeholders, companies will be increasingly focused on driving progress in these areas. And this is where the data indicates that the private equity investment model can excel: these managers can be highly effective at rolling up their sleeves and promoting change.

A huge opportunity for private equity—and for society as a whole—now exists. Our hope is that the greater transparency and comparability of this data will prove to be a critical enabler in helping private markets improve ESG performance.

Creating the Benchmark

The lack of a consistent ESG data collection and reporting framework across the private equity industry has made it challenging for GPs to ensure that their portfolio companies are making progress on material ESG goals, to assess the link between ESG and financial performance, and to share meaningful ESG performance metrics with their LPs, who have their own ESG investment goals. LPs, in turn, have not been able to benchmark the ESG performance of the managers they invest in. And portfolio companies have not been able to prioritize their own ESG efforts without a clear understanding of their likely impact and value.

In response to these challenges, over the past 12 months, the ESG Data Convergence Initiative’s member GPs have begun voluntarily sharing ESG data on their portfolio companies. Historically, many GPs have found it challenging to gather ESG metrics from these companies, many of which are still building the capabilities needed to capture and report their metrics accurately. And requests from LPs for a wide range of ESG data have made the challenge that much greater.

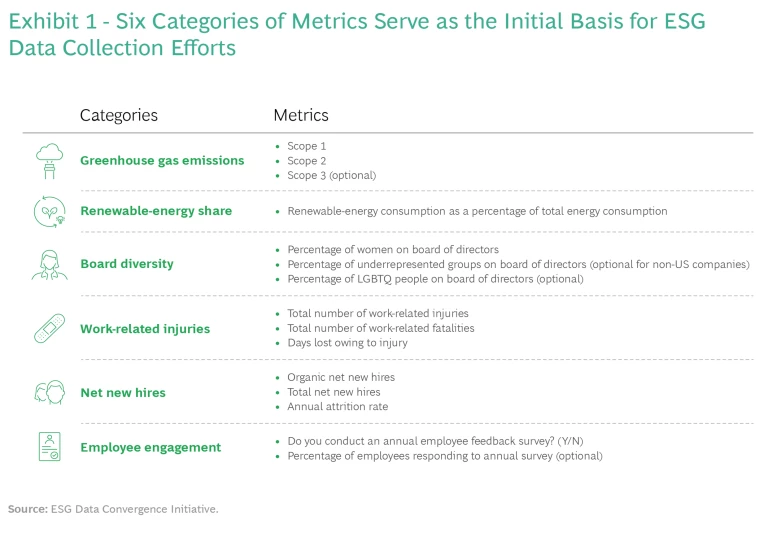

But by creating alignment around consistent, meaningful categories of ESG metrics that are relevant across all sectors and regions, the initiative anticipated that GPs would be able to more effectively work with their portfolio companies to gain the expertise needed to report on their ESG progress regularly. (See Exhibit 1.) This has come to fruition, with more than 80% of portfolio companies submitting data for the majority of the mandatory metrics. (See the sidebar “Portfolio Company Demographics.”)

Portfolio Company Demographics

Portfolio Company Demographics

In the inaugural year of the project, 78% of portfolio companies provided data for just one year. We expect that in future years, as more data is collected, trends over time will become clearer. But progress is already being made.

Designed to promote greater standardization and transparency, the six categories of ESG metrics selected by the GP- and LP-led steering committee were drawn from existing market-leading ESG frameworks, with the goal that they be consistent enough to establish meaningful benchmarks but flexible enough to be updated as future circumstances demand. This data was then analyzed in comparison with similar ESG data from companies in the public markets. (See the sidebar “Methodology.”)

Methodology

Methodology

To create the benchmark, the participating GPs gathered the ESG metrics from their underlying portfolio companies, anonymized them, and shared them securely with BCG, which is acting as a neutral facilitator for the initiative. BCG then reviewed and validated the data before aggregating it centrally into a benchmark.

This benchmark was then analyzed relative to an equivalent dataset for the public markets drawn from around 3,800 comparable public companies across 13 major stock exchanges, sourced from Refinitiv. This data was used to develop insights into the relationship between private equity ownership and ESG performance. The benchmark, aggregated to protect confidentiality, has been shared with all participating GPs and LPs for their internal use through an online platform, with participating funds able to conduct their own customized analysis on the benchmark.

Because this is the first year of the ESG Data Convergence Initiative, the insights gained so far should be considered indicative. In future years, as the dataset continues to grow, the initiative will have significantly more time series data. In addition, comparisons with public companies are not entirely precise, as the average private company in our dataset is somewhat smaller, and more likely to be in the technology and services industries, than the average public company.

The State of the Art

So what does the benchmark reveal about the current and future state of ESG in the private markets? Four themes stand out.

Lagging Indicators. Many privately owned companies are newer to making progress on ESG topics than publicly owned companies. This should come as no surprise, given the increased regulatory pressure and disclosure requirements that the public markets have been subject to in recent years. As a result, privately owned companies are, on average, starting from a lower ESG baseline than companies in public markets.

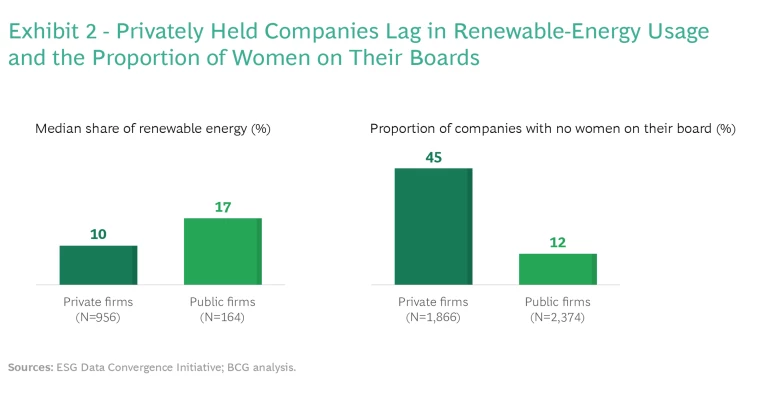

For example, the private companies in the benchmark use significantly less renewable energy than public companies. (See Exhibit 2.)

Globally, the median public company obtains 17% of its energy from renewable sources, while the median private company only obtains 10%. (See the sidebar “The Renewable Differential.”) Similarly, gender diversity on the boards of private companies lags that of public companies, with 45% of private companies having no women on their boards, compared with just 12% of public companies.

The Renewable Differential

The Renewable Differential

New Perspectives. While we expected to find that privately owned businesses lagged their public peers on key climate and diversity metrics, the benchmark confounds stereotypes about job creation in the private markets. Contrary to the historic perception of private equity funds as corporate raiders, privately owned companies have been seeing higher rates of job creation, net of employee attrition, than their publicly owned peers. This finding is consistent across geographies and industries and indicates that private equity firms can be very effective job creators across their portfolios.

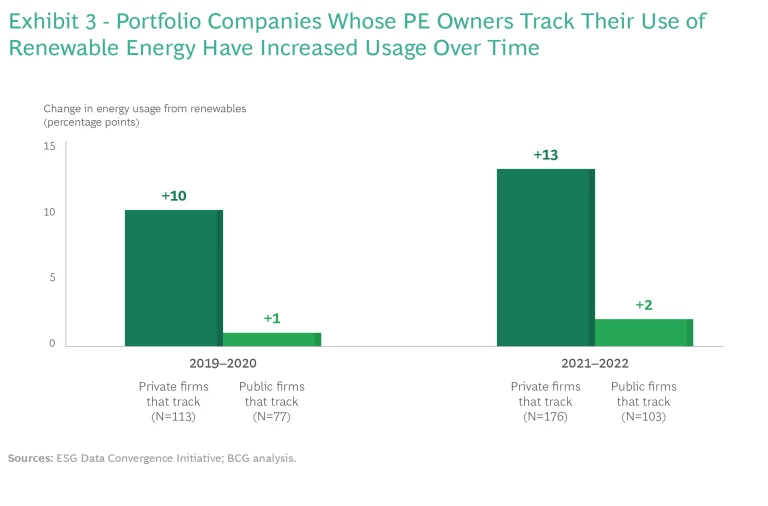

Making Progress. Despite the lower average ESG baseline, the benchmark’s initial trending data illuminates another aspect of the private equity model: the ability of funds to effectively drive change. In the typical private equity investment model, firms maintain both ownership and control, with a long-term mindset. This helps ensure that when funds turn their attention to ESG issues, they can maintain their focus and promote change—by measuring the ESG indicators that matter, establishing clear targets, working with management to ensure improvement, and tracking progress over time. (For more on how this can work in practice, see our recent article in Harvard Business Review.)

This is indeed what the initial evidence from the benchmark shows. PE funds that have tracked their portfolio companies’ use of renewable energy over time, for example, report significant improvement: their portfolio companies increased usage by 10 percentage points from 2019 to 2020 and by 13 percentage points from 2020 to 2021. This compares very favorably to the progress being made by their publicly owned peers, which have increased usage far less over the past two years. (See Exhibit 3.) Of course, it’s important to note that those private equity funds that have been tracking this data over time are also likely to be funds that are particularly engaged on ESG topics, which introduces a selection bias for comparisons with the public markets. However, this does not detract from the fact that private equity can be an effective model for driving positive change.

Privately owned portfolio companies have also been making strong progress on reducing their greenhouse gas emissions. Over the past two years, their scope 1 emissions have declined by an average of 26% and scope 2 emissions by 32% These reductions are generally more rapid than the reductions seen among public companies.

The Performance Advantage. As industries transition towards more sustainable and inclusive business models, BCG believes that those private equity funds that actively invest in driving ESG improvements ahead of the curve will likely see significant financial returns from these investments. For example, while it is too early to draw definitive conclusions from the benchmark, it is worth noting that revenues at private businesses with at least one woman on their boards have been growing at 13% a year over the past two years, compared to just 9% at companies with none. This correlation is in line with similar findings among public companies. For example, a study by Credit Suisse found that companies with at least one female board member generate slightly higher returns and profits owing to the greater diversity of perspectives and better decision making that results.

In the coming years, as the ESG Data Convergence Initiative continues to collect data, it will enable more robust analysis of the relationship between ESG and financial metrics.

Following Through

The private equity industry has a critical role to play in helping our society tackle climate change and other major challenges. As this analysis of the first full year of data makes clear, there is considerable work to be done. However, as the data also reveals, there is clear evidence of the power of this investment model in driving rapid, meaningful improvements in ESG.

And this is only the beginning. In years to come, as more private equity firms join the initiative and more data accumulates, the benchmark will provide an increasingly valuable tool for LPs, GPs, and portfolio companies alike to drive meaningful ESG progress—and value creation. (See the sidebar “How to Get Involved.”)

How to Get Involved

How to Get Involved

- Visit this website for more information about the initiative, including how to participate. Several informational sessions will be held in the fall of 2022.

- Contact the ESG Data Convergence Initiative with any questions at esgmetrics@bcg.com.

- Download the data guidance and standard reporting template and adapt your internal data collection system to align with the initial core metrics.

- Complete 2022 data collection by April 30, 2023.

We wish to express our deep gratitude to the more than 200 GPs and LPs who joined the initiative in its first year, gathering and sharing this data, and thus playing critical roles in helping the private markets to make significant progress on ESG data convergence and transparency. We encourage all private equity stakeholders to consider joining this initiative and supporting this important endeavor.