Our Approach to Family Business Consulting

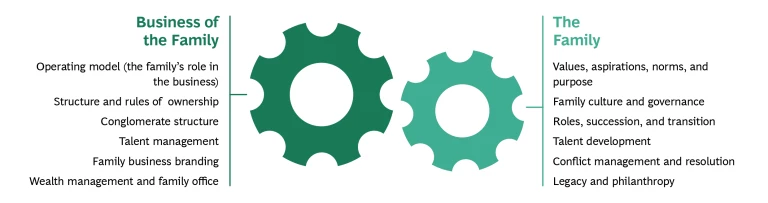

In addition to our full range of consulting services on corporate finance and strategy, organization, marketing and sales, operations, digital transformation, and more, we also help families in business navigate their unique challenges, among them:

We develop deep relationships with family business owners. We understand their distinct risk profiles, longer-term growth perspectives, and approach to stewardship. And we develop bespoke solutions for family-owned companies by answering critical questions.

Seven Critical Questions for Family Businesses

- What is the purpose of the business for the family?

- How should governance of the family business be structured?

- What is the desirable relationship between ownership and management, particularly in the case of large conglomerates?

- How should the company manage family business transitions—for example, succession planning and generational shifts?

- How do family members diffuse emotional tension and maintain harmony?

- How can growth be funded without diluting family control?

- How do family businesses attract the best nonfamily talent and set clear expectations for their partners and investors?

Our Focus on Family Business Governance

Although corporations are required by law to embrace formal governance rules, the families that own them are not. But good governance of family businesses is essential. The lack of a clear and mutually agreed governance structure can cause unnecessary conflict and destroy business value. Families need to take four steps to define an effective model for governance of family businesses.

- Agree on the family’s overarching goal. As the owner, the family has the right to run the business as it chooses—but the family must choose. Is the goal to run the business to maximize wealth creation for current family shareholders—or to create opportunities not only for this generation but also for future ones?

- Anticipate potential family hot spots. Any governance framework needs to be designed with an understanding of the issues most likely to jeopardize family harmony. Every family is different, but common examples include potential tension on leadership changes, wealth sharing, or intergenerational equity. Unless these issues are considered up front, small disputes can spark larger rifts that can threaten both family and business.

- Understand the family and business context. As owners, it is important for family members to understand the business and the challenges it faces. What is the ownership structure and succession plan? What are the business’s holdings and its future strategy? What constraints—financial, regulatory, and societal, to name a few—does it face?

- Create structure for the family. Good governance of the family business requires a structure that reflects and address the decisions and learnings from the prior three steps. Many families create a shareholders’ agreement laying out the definition of family and rules for family owners and managers—and establish governing bodies and a family code of conduct.

Untangling Conflict: An Introspective Guide for Families in Business

Drawing on decades of lessons learned from the authors’ work supporting families and the businesses they own, this book guides family businesses through an introspective process that helps them determine their own bespoke approaches to preventing and mitigating conflict.

Our Insights on Family Business