Our Approach to IPO Consulting

IPOs don’t always deliver value. Our research shows that three out of ten IPOs with more than $500 million in annual revenues fail to outperform the market in the first year; this rises to about 50% for smaller IPOs. BCG’s IPO consulting services help clients navigate the demanding deal process while maximizing returns and long-term value.

- Before the process starts, we help you develop the overall IPO strategy by defining the deal rationale and the right perimeter (or scope), and assessing the value potential for the company, potential investors, and existing shareholders.

- We can also deploy a thorough readiness assessment, identifying any gaps and helping you close them quickly and efficiently ahead of the IPO.

- We focus on creating a powerful, integrated IPO equity story to demonstrate expected value creation through a combination of growth, cost reduction, and improved cash flow. Only by shaping the right equity story can companies meet funding targets and tread a successful path in the market.

- We help build a detailed, investor-proof business plan supporting the value creation story. A deeply substantiated and sufficiently ambitious plan, backed by clear proof points, provides a strong basis for investor and analyst guidance and communication.

- We enable you to continue running your business without distraction and manage complexity across stakeholders, from markets and existing shareholders to employees and advisors. No matter how high your IPO launch-day proceeds may be, an offering is only as successful as the business—or businesses—you’re left with after the stock exchange’s closing bell rings.

Creating and Executing an IPO Strategy

Every BCG engagement begins with a deep exploration of your business. From there, we launch the IPO process by examining whether an IPO is in fact the best option. A private sale to another industry player, known as a trade sale, or to a private equity firm may be preferable or equally promising.

IPO planning often takes place in parallel with a carve-out process, separating the target entity from its corporate parent operationally and financially. Like IPOs themselves, carve-outs typically are large-scale, high-stakes projects involving complex activities and a multitude of details.

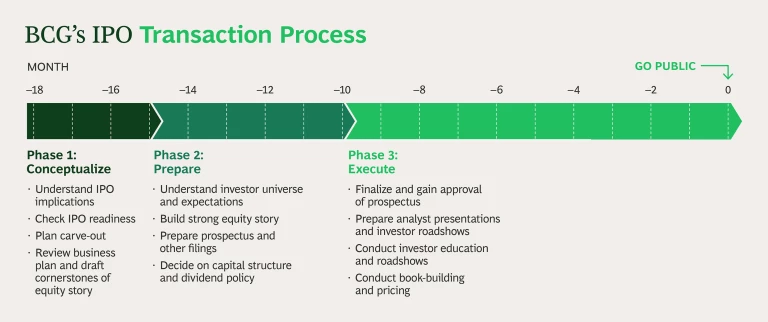

Once a company has decided to pursue an IPO, the real work begins. While IPOs can happen in as few as 6 months, 12 to 18 months is a more realistic timeline to ensure the company is well prepared for its journey as a publicly listed entity.

Our comprehensive, proven approach divides the IPO runway into three phases: conceptualize, prepare, and execute–each aiming to improve the chances of a successful IPO.

Throughout the IPO process, BCG challenges management to take the investors’ perspective and helps find solutions to the following questions:

Conceptualize

- IPO Strategy. What is the rationale for the IPO? Is it the optimal exit route? What is the right perimeter?

- Financial Readiness. Is the business plan sound and investor-proof? Is a convincing equity story in place?

- Reporting Readiness. How will regulatory requirements be met? Does the company have the necessary processes and infrastructure?

- Corporate and Governance Readiness. What structural changes, new capabilities, and new processes are vital?

- Investors. Whom do you expect to invest in your business? What are their criteria and metrics? Must your strategy adapt?

- Equity Story. What differentiates your IPO, and why? What is most compelling and supportable?

Prepare

- Capital. How will capital and dividends be structured? What about debt: inherited, new, none?

- Technical. On what exchange will you list, and why? With which underwriting manager? How?

- Transaction Process. Does your prospectus fulfill regulatory requirements? What IPO due diligence is crucial?

Execute

- Regulatory. How will prospectus deadlines be met? Financials submitted within a legal window?

- Messaging. How will analyst and investor IPO communications strategy materials be created?

- Financial. How will book-building, or price discovery with institutional investors, be conducted?

Supporting Tech IPOs

The technology industry is the fastest-growing sector for IPOs. It also faces significant risks, especially in an uncertain economy. To stand out in a competitive, often volatile tech IPO market, tech startups must offer investors compelling evidence of their potential for long-term success. Together with BCG’s growth tech experts, our tech IPO consultants offer a unique combination of expertise and experience in launching IPOs for tech companies. This tailored, holistic understanding has allowed BCG to play a significant role in supporting the growth tech sector in hundreds of successful cases.

IPO Readiness Assessments for Tech Companies

Our suite of services, including IPO readiness assessments, support pre-IPO growth and ensure successful execution. We provide an overview of key IPO requirements and a deep dive into growth tech-specific equity stories, searching for indicators of strong performance that resonate with your tech company's unique subsector. The topics we consider include:

- Unit Economics and Scalability. For internet platform companies, showcasing robust unit economics and scalability potential is crucial. A high rate of recurring orders from loyal customers, for instance, helps demonstrate a reliable revenue stream.

- Approval Phases. Biotech and pharmaceutical companies should emphasize their success in the authorization process. Investors crave insights into how innovative products are advancing through clinical development stages.

- Minimum Viable Product. Technology product companies must demonstrate a successful minimum viable product (MVP) and a clearly defined path to further development and commercialization. Working prototypes and strategic partnerships show that the company is poised for a successful tech IPO journey.

- Disruptive Approach. Disruptive companies need to underscore their unique business models and potential to revolutionize industries. At the same time, investors want to see a real impact from innovations, as well as a well-considered strategy for increasing customer adoption.

Our Latest Insights on IPOs