Most U.S. and European companies have spent the past 20 years concentrating more and more of their manufacturing in East Asia to reduce costs by exploiting labor-arbitrage opportunities and address the promise of that rapidly growing market. It’s time for them to rethink their supply-chain strategies. Adjusting to new economic realities as well as political and economic uncertainties will require making their supply chains much more resilient.

There are three reasons a rethink is due:

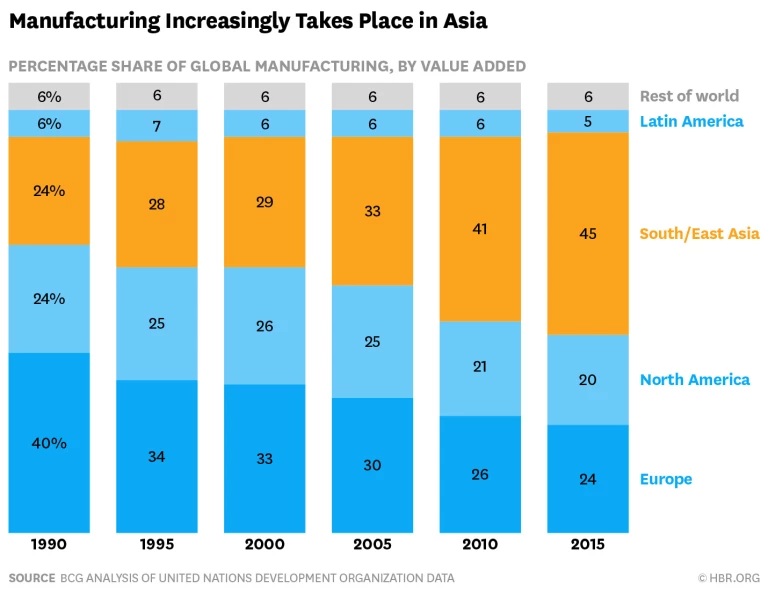

East Asia’s Shrinking Cost Advantage. The fraction of global manufacturing done in Asia (measured by value added) jumped from 29% in 2000 to 45% in 2015. We’ve been warning for years that this shift had gone too far and had urged global companies to rethink their manufacturing and sourcing footprint.

Our argument has been that a number of trends have leveled the playing field around the globe. They include years of 15% to 20% annual increases in labor costs without compensating productivity growth in manufacturing titans such as China, cheap energy in North America unlocked by hydraulic fracturing, and the increasing complexity and cost of managing global supply chains. In 2004, the cost of manufacturing on the east coast of China was approximately 15 percentage points cheaper, on average, than in the United States. In 2016, that gap was down to about 1 percentage point. This trend has triggered significant interest in reshoring production to and sourcing from North America. One high profile example is Walmart’s commitment to source an additional $250 billion in products made, assembled, or grown in the United States.

Advances in Manufacturing Technology. Manufacturing is on the cusp of a robotics revolution. We estimate that robotics could cost effectively replace or augment 50% of the tasks done in a plant today. As robotics and other advanced manufacturing technology are deployed over the next 10 years or so, global manufacturing cost differentials will shrink further, accelerating the “relocalization” of supply chains—which means many companies will serve regional markets with goods largely sourced within that region.

A Shift Toward Protectionism. Exhibits A and B are the United Kingdom’s vote to exit the Europe Union and Donald Trump’s victory in the U.S. presidential election. But there may be more to come. All this adds up to an unprecedented level of uncertainty about trade policies and their effect. Take the idea of a U.S. border tax, which President Trump has floated. Such a policy alone could have a major impact on companies operating in the United States. Some retailers that are big importers could see their net profits plummet by almost 80%, while exporters of manufactured goods could see their net profits soar by 50% or more (see these exhibits). Yet whether and how such a policy will be implemented remains uncertain; so does its impact on exchange rates and a large number of other policies that could influence trade economics.

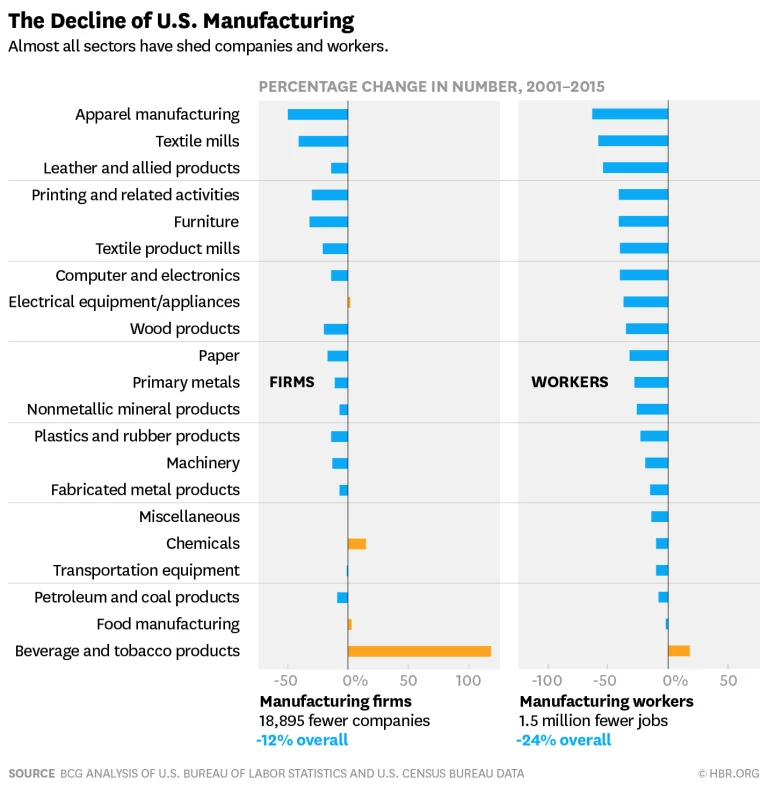

With all of the changes and uncertainty, companies in a wide range of industries—from autos and chemicals to electronics and appliances—are moving quickly to rethink supply chains and make them more resilient. However, they are encountering some formidable challenges. For companies looking to produce in the United States, one of the most significant is the decimation of the U.S. supply base: The United States suffered a net loss of nearly 19,000 manufacturing firms between 2001 and 2015, according to our analysis of U.S. Bureau of Labor Statistics and U.S. Census Bureau data. Many sectors saw 30% to 50% of firms close their doors, which has added complexity to manufacturing in the United States. Of the major manufacturing sectors, only chemicals, food, and beverages and tobacco products saw a meaningful increase in the number of firms.

Companies in a wide range of industries are moving quickly to rethink supply chains and make them more resilient, but they are encountering some formidable challenges.

One firm that appears to be creatively addressing the challenges is CY TOP, a mid-sized company that makes stainless-steel, indoor trash cans. While the bulk of its production is still in Asia, it has started building production in the United States in the last 24 months—in part to support Walmart’s initiative to buy more U.S.-made products. CY TOP has been able to do this while maintaining its low manufacturing costs by aggressively reengineering and automating its U.S. production lines: It only uses seven to 10 people on a line that would have 80 people in Asia. (It also saves money because transportation costs on those U.S.-made goods are lower.) Its medium-term goal—if its first U.S. facility is successful—is to add as many as three more U.S. manufacturing sites. In the longer term, the company might supply global demand from the United States.

CY TOP has not been able to find U.S. suppliers of some key inputs (e.g., the specialized coating that prevents stainless steel from showing finger prints, which it continues to source from Asia). For now, that means extra shipping cost and logistics costs. Over time, however, its goal is to develop its supplier ecosystem in the United States—either by persuading its existing Asian suppliers to produce in the United States or by sharing its plans to increase its own production in the United States with potential domestic companies that could enter the business. Other firms in the same boat are using a variety of creative approaches to persuade potential suppliers to produce things that are now not made in the United States: helping them finance new plants, sharing the savings on freight and logistics, and even collaborating with competitors in the hope that their combined volume will draw suppliers’ interest.

Given this emerging new world, manufacturers should take these steps:

- Evaluate your existing and future customer footprint and map it against your existing manufacturing and supply chain capabilities.

- Analyze the total costs of supply for each alternative location.

- Explore advanced manufacturing technologies and possibilities, especially flexible robotics and automation and understand how these change the equation.

- Proactively try to rebuild your atrophied supply-chain ecosystems, if possible in conjunction with similar manufacturers and large customers.

- Engineer your supply chains to be resilient to further shifts and instabilities in trade policies and exchange rates.

Taking these actions may challenge your conventional corporate wisdom on how to configure and optimize your supply chain. But in these uncertain times, even the most fundamental assumptions must be questioned.

This article was originally published at www.hbr.org. It is reposted with permission of Harvard Business Publishing.

The BCG Henderson Institute is Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration from the Institute, please visit Featured Insights.