Welcome to the weirdest—and potentially most consequential—planning cycle of your career. Amid heightened uncertainty, it’s understandable to think that planning for 2021 is pointless. But that would be a mistake. The data shows that leadership positions are more fragile and volatile in the aftermath of crisis. If history is any guide, the companies prepared to make smart, decisive, and rapid moves in this environment will be disproportionately rewarded.

In addition, investors are offering management unprecedented flexibility. Approximately 90% of institutional investors told BCG that they support companies’ efforts to build strategic capabilities even at the expense of EPS, and about two-thirds say they are on board with management sacrificing current margins to gain future advantage. Given that, the question is not whether to plan, but how to do so in a way that maximizes both ambition and flexibility.

Leaders are well aware of the need to do things differently, faster, and better. But most are still approaching their annual planning rituals in the same tired ways—sending out budget templates, holding two days of round-robin pitches, setting stretch goals based on last year’s results, and allocating capital based on expected 12-month returns.

But bold plans do not come from old plans. Dusting off last year’s approaches and incrementally improving them could cede potentially transformative moves to nimbler rivals. In the new postcrisis reality, tempo advantage will go to those who rip up the conventional planning process and begin anew.

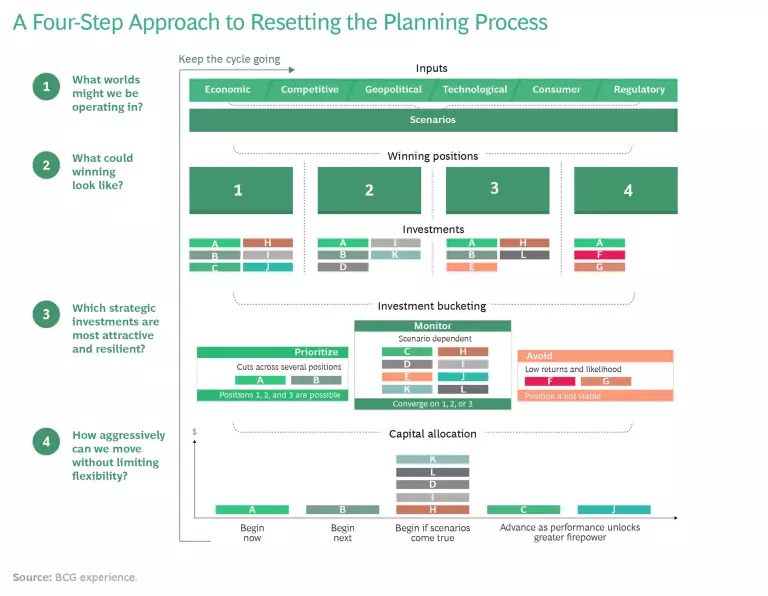

This four-step approach shows how. (See the exhibit.)

What Worlds Might We Be Operating In?

Normally, companies craft one view of the future—based on the current state with a target for modest growth and margin improvement. But a single view won’t work in 2021. The disruption caused by COVID-19 creates openings, enabling companies to accomplish in one year what would normally take five. Even before the pandemic, business model and strategy lifecycles have been shrinking for years. Since the future is fluid, organizations need a more diverse set of options that will allow them to capture growth no matter which way the wind blows.

The disruption caused by COVID-19 creates openings, enabling companies to accomplish in one year what would normally take five.

No one has a crystal ball. But everyone has imagination. So start with a thought exercise. Ask yourself: what worlds might we be operating in three to five years from now? The idea is to go beyond what is merely likely and consider what is plausible. How could critical uncertainties in areas such as geopolitics, the regulatory environment, or technological change reshape the future strategic landscape? How might trends—and interdependencies among them—combine to create or close opportunities? An automaker, for example, might conceive a world in which the internal combustion engine is banned or commuting plummets as working from home takes hold. Likewise, a tech company might imagine a major shift in global trade regimes or scarcity in a critical raw material due to stepped-up regulation.

How could critical uncertainties in areas such as geopolitics, the regulatory environment, or technology reshape the strategic landscape?

The exercise can be as simple as listing a set of questions—the answers to which could shape very different futures—or as complex as developing a detailed set of scenarios for the organization. Companies can also use scenarios created by external experts to assess the progress of the pandemic or the shape of the future competitive environment.

What Could Winning Look Like?

Now do the exercise again. Only this time, rather than conceiving different worlds, ask participants to imagine several different—radically advantaged—versions of the current organization. Each one should be linked to a set of plausible core and adjacent actions that, while disruptive, build on the company’s strengths, act on competitive openings, and capitalize on megatrends and emerging technologies.

This exercise can take different forms. During the planning meeting, for example, the CEO of one major company asked its leadership team to dream up newspaper headlines about the company in 2025 and write the opening paragraphs of those articles. There was one rule: the story couldn’t just be about the company’s stock price or revenue. It had to detail the specific capabilities, people practices, or competitive innovations that differentiated the company from the rest of the field and made it front-page news. In another example, an insurer had leaders create different archetypes, each reflecting different value propositions based on customer, competitive, and market data.

Human nature prefers change to come in steps instead of bounds, so it’s crucial for planning to force ambitious thinking.

Regardless of how the exercise is structured, its goal is to spur leadership teams to think in leaps, not increments, and define several distinct “winning” strategic positions. Those propositions should include a sense of the new customer-centric offerings and business models that could be launched—as well as the investments, acquisitions, divestitures, or partnerships they would require. Human nature prefers change to come in steps instead of bounds, so it’s crucial for planning to force ambitious thinking in this way.

Which Strategic Investments Are Most Attractive and Resilient?

Having done the bold imagining, leaders now need to kick the tires of the strategies they’ve identified to see which offer the most attractive risk-adjusted ROI under different scenarios. But since the future is uncertain, they need to look for common threads. Of the strategies under consideration, which investments make sense across all scenarios, which require the resolution of a key uncertainty or trend, and which should fall off the table? This exercise usually reveals a set of no-regret moves and helps validate which investments to continue monitoring so that companies can pounce when conditions allow. Such prioritization lets companies move forward decisively while preserving flexibility.

For example, a shipping and logistics player developed three ideas as part of its visualization exercise. One was to become the “Amazon of the Sea” by using M&A to consolidate its hold in all major markets. Another was to become a “Last-Mile Leader” by exploiting novel delivery options. The third was to become a “Green Renewal Champion” by embracing low-carbon technologies.

Putting these ideas under the microscope helped to vet the potential ROI. The M&A strategy initially seemed the most straightforward, but integration costs and regulatory hurdles would delay returns in a steady-state world—and if trade tensions intensified, the strategy would rapidly lose attractiveness. The Last-Mile Leader approach would introduce valuable new revenue streams but also high regulatory uncertainty, and questions about the rate of customer adoption raised concerns. It could work if a changed environment radically limited customers’ delivery options and forced the hands of regulators, but not in a largely undisrupted world. Ultimately, the Green Renewal strategy proved most resilient across different futures. It also offered the highest near-term ROI, driven by increased valuation multiples and the potential for pricing upside and medium-term cost advantages. Given that, the company chose to prioritize the Green Renewal strategy and mapped out the capabilities needed to execute it, ranking them based on criticality. In addition, it agreed to monitor the other strategies and advance them if conditions proved favorable.

How Aggressively Can We Move Without Limiting Flexibility?

With a strategic direction and prioritized actions in place, it’s time to commit capital—something that’s much easier to do at this stage given that planners have already done the work of mapping out the key plays as a team. However, because leaders can’t know exactly which version of the future will emerge—or the implications on the investable resources required—they need to develop two systems. The first is an indicator dashboard to track the critical market shifts that trigger key actions, such as orders, inventory levels, and foot traffic at priority retail locations. The second is a scenario-based capital allocation model that captures the amount of investable “firepower” available in each of the next eight quarters under different economic and financial conditions. The modeling lets companies identify which strategic moves they can afford to pursue immediately—insights that enable decisive action.

For example, acknowledging that there was no single path to recovery in 2021, a Fortune 500 professional services company created multiple scenarios for how its revenue, earnings, and ability to raise debt would recover over the coming quarters. The scenario-based capital allocation model showed them which strategic capabilities they could fund under any recovery scenario, without waiting for retroactive confirmation. They then defined which indicators to watch for in the market that would trigger the remaining initiatives and allow them to build needed capabilities prudently. Together, the indicator dashboard and capital allocation modeling helped leaders maintain momentum, avoiding the delays and missed opportunities that often result from waiting for quarterly balance sheet confirmation.

Keep the Cycle Going

Strategic and financial planning cannot be a one-time thing. It needs to be an all-the-time thing. Upstart competitors, technology breakthroughs, or geopolitical shifts can appear unexpectedly. Ongoing monitoring can help companies spot these changes. By scanning the landscape, orienting themselves to new circumstances, deciding how to respond, and acting quickly, leaders can extend advantage over the medium and long term. For example, one retailer has developed a real-time, automated monitoring system that tracks high-frequency indicators such as disease progression, consumer mobility, and credit defaults, enhancing its ability to seize critical opportunities ahead of its rivals.

Strategic and financial planning cannot be a one-time thing. It needs to be an all-the-time thing.

Reporting and reevaluation also need to become more frequent. Having weathered one of the most tumultuous years on record, business leaders need no reminder that the best-laid plans can change. Instead of refreshing strategy on a yearly or semi-annual basis, as is common, we recommend that leaders establish a monthly rhythm where management teams assess the latest business guidance, review progress, and release resources in priority order based on specific triggers. Building this muscle allows companies to reimagine future scenarios, envision new transformative moves, and reprioritize and sequence the action portfolio.

Leaders must go into this year’s planning season with a view to permanently changing their strategy and budget-setting approach. As always, communication is essential. Let stakeholders and management team members know that this year’s process will be a break from the past. Explain the outlines of the program, the outputs, and the goals, and lay out clear expectations for a path to substantially higher growth and resilience.

Japanese samurai Miyamoto Musashi said, “In strategy, it is important to see distant things as if they were close and to take a distanced view of close things.” The sentiment, expressed over 400 years ago, remains apt now. Pandemic-created dislocations can cause short-term thinking to dominate the field of view. Executives must challenge such short-termism by enabling bold vision-setting, backstopped by clear and robust planning. Doing so can create a once-in-a-lifetime opportunity to change the trajectory of their organizations in a profoundly positive way.