The global M&A market remains in a deep freeze. Following a weak 2011, the value of M&A deals fell by 13 percent in 2012, and the number of deals fell by 5 percent. The first half of 2013 showed little improvement, with deal quantity almost as low as it was after the bursting of the dot-com bubble in 2000–2001.

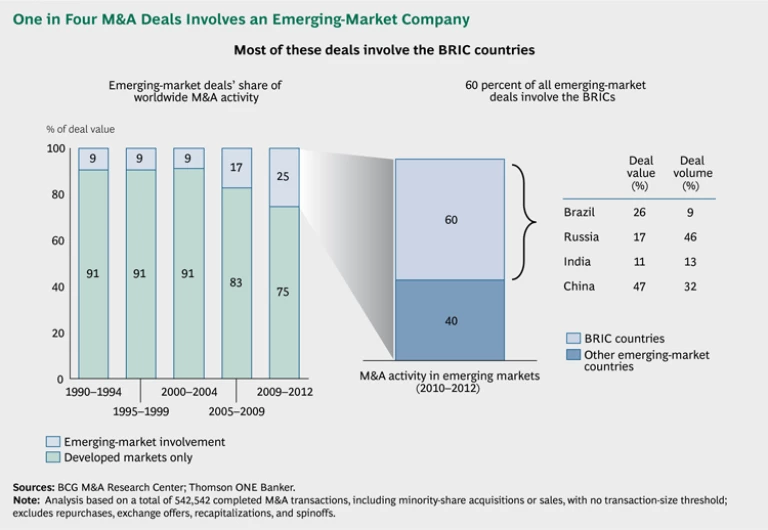

The emerging markets, especially the BRIC countries, stand out as a relative bright spot. Although emerging-market M&A values and volumes declined in 2012, deals involving emerging-market countries account for an increasing share of activity. One in four M&A transactions involves an emerging-market company as buyer or seller. Sixty percent of these deals involve a BRIC country.