Strategic planning is one of the least-loved organizational processes. Executives at most companies criticize it as overly bureaucratic, insufficiently insightful, and ill suited for today’s rapidly changing markets. Some even argue that strategic planning is a relic that should be relegated to the past and that organizations seeking to prosper in turbulent times should instead invest in market intelligence and agility.

Although the diagnosis is largely right, the prescription is wrong.

More than ever, companies need to devote time to strategy. Nearly one-tenth of public companies disappear each year—a fourfold increase in mortality since 1965. And the life span of the average company has halved since 1970. (See “Die Another Day: What Leaders Can Do About the Shrinking Life Expectancy of Corporations,” BCG article, December 2015.) Faced with those odds, it doesn’t make sense to put all your chips on agility. Agility is great, but it’s more powerful when paired with preparedness. And achieving strategic preparedness takes a structured, organized thought process to identify and consider potential threats, disruptions, and opportunities—which is, for want of a better term, strategic planning.

In short, the problem isn’t strategic planning. It’s that most companies lack an effective strategic-planning process.

Although there is no one-size-fits-all approach to strategic planning, we have found that the companies that get the most benefit from their strategic-planning activities have four things in common:

- They explore strategy at distinct time horizons.

- They constantly reinvent and stimulate the strategic dialogue.

- They engage the broad organization.

- They invest in execution and monitoring.

Explore Strategy at Distinct Time Horizons

It is important to think about strategy at different time horizons. Each has different goals and requires different approaches, a different frequency, and the involvement of different people. Much of the frustration expressed about strategic-planning processes arises when companies try to address the long, medium, and short terms through a single, inflexible process. Leading companies often think of strategy at three time horizons (see Exhibit 1):

- The Long Term. The purpose of long-term strategic thinking should be to define, validate, or redefine the vision, mission, and direction of the company. It’s about projecting more than five years into the future. How might megatrends, including technology advances and demographic shifts, alter the business environment? What strategic risks and opportunities are revealed when considering future scenarios? Will the company’s traditional sources of advantage remain strong or be compromised? What new opportunities could arise and give the organization an opportunity to win? It’s the forum to challenge and redefine the boundaries of the market and the rules of the game. Philips’s decision to shift its focus from consumer electronics to the health care sector is an example of this kind of thinking. Looking forward, the company’s executives could see that an aging population and the fitness trend would provide strong tailwinds for a change in course toward the health care sector, while continuing commoditization would leave the traditional consumer electronics business at best becalmed. It was a vision for the future around which they could then align the organization for a multiyear journey. The long term is also a great perspective from which to consider how to project skills and brand into new domains. BIC a good example: it recognized that its capabilities positioned it to be not just a pen company but a broad-based disposable-device company, a realization that created the foundation for its move into lighters, shavers, and more.

- The Medium Term. The purpose of medium-term strategic planning should be to enumerate the steps necessary to realize the vision—typically over a three- to five-year period. The focus is on developing clear, actionable business plans that describe the multiyear strategic initiatives required to transform vision into value. Which customer and geographic segments should we prioritize? What is the innovation strategy and roadmap? Where will we likely need strategic partnerships and acquisitions? What new business models are required?

- The Short Term. The purpose of short-term strategic planning should be to challenge the current strategy, evaluate progress, and explore options to accelerate execution. Is execution above, at, or below plan—and why? Do the plan’s strategic assumptions remain valid? How should the company adapt to changes in the business environment? What are management’s best new ideas to strengthen or adjust the plan? What’s critical is to encourage creativity and real dialogue—and to avoid a budget-centric process that focuses mostly on the numbers. The best companies break the process into stages that progress from a review of the critical and emerging strategic issues toward a detailed plan for the year and beyond.

Clearly, long-term vision, medium-term strategy, and short-term plans need to be revisited with different frequencies—and those frequencies need to reflect the particulars of the sector. The key is to match the rhythm of the process to the “body clock” of the sector. For a sector like mining, a ten-year horizon for the long term could be just right. In a fast-moving tech sector, five years could be too long even for the long term.

Perspectives on Strategy and Value: Learn how to lead with advantage

Forums in which strategy can be discussed outside the rhythms of these three processes are also important; they can allow for real-time adjustments throughout the year. Increasingly, we see companies pursuing an approach we call “always-on strategy,” which typically takes the form of monthly strategy reviews by the executive committee. Some sessions may focus on a deep dive into a critical initiative, for example, whereas others may concentrate on exploring an emerging threat, a new competitor, or a disruptive business model.

Constantly Reinvent and Stimulate the Strategic Dialogue

With strategic planning—unlike sports or music—repetitive practice doesn’t make perfect.

The classic story goes as follows. A new chief strategy officer is appointed. He or she interviews the executive team and hears about the pain points in the process: too much work, not enough big ideas; too financially oriented, too inward looking. A new process is designed that calls for new analyses to describe the market, competitors, and external trends. In the first year, it is a big, painful effort. But it is also quite useful because the new analyses uncover new ideas and stimulate valuable dialogue. In the second year, the process is less painful, because most analyses can simply be adjustments of last year’s analysis—but, typically, it is also much less useful. The same inputs lead to similar conclusions. After a few years, the new process feels just as uncreative and bureaucratic as the old one.

Breaking out of this kind of cycle is challenging. Some companies have attempted to change the process every year, designing different exercises for managers. One year—to use a famous dot-com-era example from General Electric—it’s “destroy-your-business.com.” The next, it’s a search for underleveraged assets. The year after that, it’s a business-model-reinvention exercise. These can certainly be useful, but learning a new process each year adds a lot of overhead and repeating any exercise too soon is pointless.

A more sustainable solution is to follow the same process year to year but to refresh it with different questions each year. Such an approach breaks the compromise between process efficiency and fresh thinking. By focusing a standard process on new questions, the strategic dialogue will remain rich, because participants will have new analyses to consider and fundamentally different ideas to discuss. Of course, the success of this approach depends heavily on the quality of the questions. As noted management consultant and writer Peter Drucker once said, “The most common source of mistakes in management decisions is the emphasis on finding the right answer rather than the right question.”

Great strategists—and great business leaders—have to learn the “art of questioning.”

The right questions should be neither too broad (“How do we save the world?”) nor too narrow (“How do we price the next new product?”). Rather, they should help managers stretch their thinking beyond the current boundaries of their day-to-day activities. Good practices abound. One is to have the leadership team engage in a strategic workshop to articulate and prioritize—but not debate—the key questions that the company will have to answer in the next three to five years. Another good approach is to ask the leaders of the business units to identify the most important questions that the center should be asking them—being clear that the business unit leaders will be judged on the quality of the questions that they propose. It’s important to limit the number of questions to two or three per business unit or department.

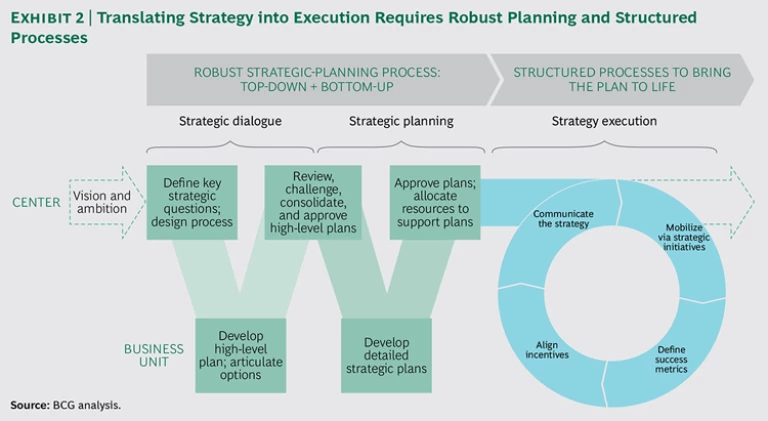

Once the right questions are selected, the leadership team can let go, knowing that the teams are working on the right issues. The teams will design novel relevant analyses, amass new knowledge, and develop new recommendations. Question-driven strategic dialogue is inherently an iterative process—even when it occurs on an annual basis. One highly effective approach is known as the “W-shaped model,” and it begins with the center communicating the critical questions for the year to divisional and functional managers, who are charged to return with the answers, along with an update on progress against plan and a series of ideas—some bold and disruptive—for consideration. (See the left side of Exhibit 2.) After a constructive dialogue (shown at the middle of the W in the exhibit), the leadership team selects from among the options and sends management back to develop detailed plans, which are then discussed and approved in a second meeting.

It may take more than one cycle to address a question fully. The process can lead to refreshed long-term visions, adapted or new medium-term strategies, and decisive short-term actions.

Another emerging approach is to leverage big data and advanced analytics for systematic market intelligence, including information that is hidden in unstructured data or local languages. This allows companies to explore weak and emerging signals of opportunity and risk—such as subtle changes in customer or competitive behavior—in core markets as well as in peripheral or adjacent markets.

Engage the Broad Organization

As a general rule, organizations that engage a broad group of internal and external stakeholders in their strategy development efforts yield better results than organizations that leave strategy in the hands of a small, central team. When going broad, the strategy team still has a critical role as orchestrator. It should drive the process, set timelines, coach teams on methodology, ensure the sanctity of proprietary information, and generally facilitate and coax the dialogue toward an organizational consensus.

Going broad prevents groupthink. By involving people from different backgrounds, generations, and geographies, an organization is more likely to surface alternative ideas and perspectives. Some companies even engage outsiders, among them customers and suppliers, in the process. Nonexecutive directors—who are charged with bringing an outside perspective to evaluating and approving the company’s strategy—can play a powerful role too. However, the most common complaint we hear from nonexecutive directors (and boards in general) is that they are not sufficiently engaged in the strategy process to play a truly valuable governance role. One good practice is to include directors in the questioning phase and in specific conversations along the “W” process described above.

Leveraging a diverse group of stakeholders improves an organization’s strategic “peripheral vision.” The best strategists are adept at spotting both opportunities and risks early—which provides a valuable head start over rivals. Particularly in today’s turbulent competitive environments, a well-chosen extended strategy team can be a powerful early-warning system. It makes it easier to spot the emerging competitors, new business models, and changes to customers’ economics that could undermine the long-term vision or challenge key strategic assumptions.

Engaging stakeholders early also increases buy-in and smooths implementation. When key managers at multiple levels are involved in the strategy process, they are more aware of the strategy and they feel ownership of it. Even if their personal ideas aren’t adopted, they will feel heard, understand the rationale for the chosen strategy, and be prepared to support its execution.

Invest in Execution and Monitoring

Having a great strategic-planning process is only half the challenge. The other half—translating the strategy into results—can be even harder, particularly when the new strategy involves moves outside the core. (See the right side of Exhibit 2.)

An all-too-familiar story: A company spends productive time exploring exciting strategic options and making clear choices. A few months later, managers look back and realize that, despite best intentions, the pressure of day-to-day operations and organizational inertia have kept them from making measurable progress on the new strategy.

Investments in several areas can help avoid that fate. (For a glimpse of scenarios that require special consideration, see “Three Special Cases.”)

Three Special Cases

The best practices outlined in this report may need adjusting in certain special situations.

Matrix Organizations. Many companies have at least a three-dimensional matrix: for example, brands or product lines, geographies, and functions. Each needs to build a multiyear strategy, but how can the company ensure that the dots connect in the end? The cascading memo can help, but it’s often helpful to “linearize the matrix”—that is, to start with one dimension and use its output as input for the next dimension. One common order is product plans (with input from key countries), geography, and then function. Some iteration will inevitably be necessary, but in our experience linearizing simplifies the process.

Conglomerates. Multibusiness companies need, of course, to go through a thoughtful strategy development process for each business. But they also need to orchestrate a complementary thought process about the value each business adds to the overall corporation. This thought process needs to cover issues like the balance of the portfolio—and the synergies across the group, whether soft synergies such as training and talent sharing or hard ones like cross-selling and shared services.

Family Businesses. In many ways, family businesses are businesses like any other, but inevitably their strategic-planning process needs to include the family dimension. What are the goals and long-term aspirations of the family? And how can the business strategy best be harmonized with them? Generally, it is important to include key family shareholders in the planning process.

Clear and Engaging Communication to Foster Alignment. In most companies, if you ask ten managers one level below the executive committee to describe the company’s strategy in a couple of sentences, you get a set of responses that are not fully aligned. Move down the organization and the signal-to-noise ratio progressively degrades. It’s hard to overestimate the importance of clear communication that promotes the strategy with a common, proprietary vocabulary. One organization that adopted a strategy to increase its share of wallet with individual clients found a way to sidestep the risk of misalignment on strategy. Leadership memorialized the strategy with a simple chart that showed share of wallet on the y-axis and wallet size on the x-axis. Successful realization of the strategy would be tracked by upward movement on the chart over time. They called the strategy “go north.” The phrase became an important element of the company’s internal language—almost a rallying cry.

Beyond simple slogans, the classic cascading-memo exercise can also be quite powerful. It starts with the CEO sending to direct reports a one-page memo that summarizes the strategy. The memo charges them to write their own version for their team that expresses the strategy and what it means for their slice of the organization. The process continues downward. At each stage, the strategy group reviews the memos for clarity and consistency with the overall strategy. This approach not only helps managers get their heads around the new direction (the act of creating a written synthesis forces concentration and drives alignment) but also pinpoints areas of the organization where the strategy is not well understood—before that misalignment has a chance to affect performance.

High-Profile Strategic Initiatives to Build Traction. To ensure that the new strategy isn’t drowned out by day-to-day concerns, leading companies convert it into a set of manageable strategic initiatives that give the strategy both visibility and traction. Each initiative needs to be properly chartered, staffed, and resourced and given a clear timeline. The strategy department typically plays the role of process manager, providing support and keeping the team on course. Particularly for strategies that involve adjacent moves or new business models, initiatives may not have a natural organizational home. In these cases, it is essential to have a strong executive sponsor and clear funding sources. Sometimes, organizational independence is necessary as well. When the company’s dominant core model is potentially dissonant or even competitive with the new opportunity, the best way to drive a successful result is to insulate the new effort from the core, to give it time and space to find its footing. The company Nespresso was born this way. Once a small entrepreneurial project nurtured within Nestlé, Nespresso became a worldwide success—but only after it was set up as an independent unit.

It is important that initiative teams and the organization overall understand that these initiatives are priorities for the executive committee. Progress reviews and “pressure tests” should have a regular place in the executive committee’s monthly always-on strategic dialogues.

A Strategy Dashboard to Highlight Success Metrics. Another powerful way to encourage the organization to embrace the new strategy is to identify quantitative metrics and goals that can measure progress. (For example, when Procter & Gamble decided to embrace open innovation in 2003, the CEO set a target of 50% of innovations sourced from outside the company.) Complementing the organization’s financial and operational metrics, the strategy metrics should concentrate on new measures tied to the new strategy. And incentives for key players should be tied to these metrics and goals. Today’s new and intuitive digital tools make it possible to have a real-time and “clickable” view of critical strategic variables that drive performance against plan. At the same time, powerful analytics increasingly allow you to automate many first-level analyses. Optimizing human and machine roles enables companies to act more quickly and effectively in the face of changing market conditions.

At a time when technological progress is blurring industry boundaries, when globalization is expanding geographic horizons, and when new competitors are arising from emerging and adjacent markets, it is more important than ever to be prepared strategically, to be able to look sideways, and to have a sound strategy firmly coupled with a system to translate it into action.

Far too many strategic-planning processes fall short. They focus on analyzing the current market and current competitors, rather than searching for or anticipating disruptive new entrants or business models. They make work but don’t offer insight.

It doesn’t have to be that way. By emulating the four strategic-planning best practices, you can boost the ratio of insight to effort and align the organization around a strategy that is faithfully executed, constantly questioned, and regularly refreshed.