More than a century ago, rail was king when it came to medium- and long-distance transportation.

The thought of everyday travel by AV seemed far-fetched until recently. New participants in the automotive arena, such as Tesla and Google, along with a growing roster of OEMs, have made tremendous technological progress with AVs. Smaller tech companies and startups are rapidly joining the race to develop driving software and artificial intelligence for AVs. Several national governments are moving ahead with policy preparations and infrastructure planning. And public perception has changed dramatically. In a recent BCG survey of 5,500 consumers in ten countries, at least 50% of the respondents expressed interest in buying or riding in an AV.

A number of studies have been published on the potential impact of AVs in areas as diverse as urban planning, public safety, and parking. In a recent report, BCG concluded that these effects could be dramatic and largely beneficial, particularly in terms of increased safety, reduced road congestion, and more productive travel time. (See Revolution Versus Regulation: The Make-or-Break Questions About Autonomous Vehicles, BCG report, September 2015.) The report also suggested that AVs could capture market share from public transportation in urban and metropolitan areas. Until now, however, little has been written on the impact of AVs on passenger rail.

Making predictions is inherently problematic, and it’s especially so with a technology as complex and game-changing as that of AVs. AVs must maneuver through a gauntlet of obstacles, such as the unpredictable behavior of other motorists, road construction, and bad weather. Many in the industry believe that AVs will be highway-ready by 2020. However, most observers think that a fully autonomous vehicle, one that is completely safe for use in residential areas, where vehicles contend with pedestrians and children playing, won’t be a reality until 2025 at the earliest.

Who knows which predictions will be right? Considering the stunning pace of technological progress in the past few years—the innovations include self-parking, traffic-jam autopilot, and lane-keeping technology—and the intensive investments made by OEMs and suppliers, it’s hard to discount the optimists. Not to mention that disruptive technologies tend to take off increasingly quickly.

Our purpose is not to speculate on timing but to examine the “what if” possibilities. Let’s assume that at some point within the next 10 to 20 years, AVs will become commercially available and fully operational on urban and residential roadways. In this report, we explore the potential impact of AVs on the passenger rail industry: how AV use facilitates vehicle and ride sharing, the economics of passenger travel by AV versus by rail, and the effect of AV adoption on different types of rail service. Finally, to help rail executives prepare for various scenarios, we offer a high-level strategic agenda for the rail industry. We believe that rail executives should view AVs as a serious competitive threat, and we urge them to begin strategizing today about how best to confront this looming revolution in passenger transport.

The Impact on Passenger Travel: The Big Picture

For commuters, highway-only AVs will clearly make travel by car more attractive than it is today. Highway travel will no longer represent downtime because passengers can use the time to work, read, or sleep, as they would on a train. So a certain percentage of train travelers would switch to AVs. BCG’s consumer survey revealed that increased productivity is the reason many drivers cite when they say they would consider buying or using an AV.

When AVs constitute a large percentage of cars on the highway, road congestion will ease substantially, and travelers will enjoy a smoother and faster trip. However, for most train travelers, the availability of highway-only AVs won’t suddenly make car ownership or use a vastly more attractive transportation option: because a highway-only AV cannot drive itself to a house in a residential neighborhood to pick up a passenger, travelers will probably still need to own a traditional vehicle. According to our analysis, highway-only AVs would thus have a limited impact on passenger rail, prompting only about 10% of travelers to switch.

When AVs become capable of safely driving in residential areas, however, AV adoption will likely disrupt rail significantly—probably making the biggest impact since the emergence of the automobile itself. That’s because AVs ready for both urban and residential use could speed the widespread adoption of both car sharing and ride sharing, which would dramatically improve the advantages of the car relative to the train.

“Car sharing” refers to the ownership of a vehicle, not the ride in the vehicle. SnapCar, Zipcar, DriveNow, and car2go are examples of car-sharing providers. More than 86,000 car-sharing vehicles were in operation in 2015 around the world, with some 5.8 million users, 2.1 million of whom were in Europe.

With ride sharing, multiple passengers share the same, third-party-owned car simultaneously to travel to the same or nearby destinations. UberPool is one example of a ride-sharing enterprise.

Still, although car sharing and ride sharing are growing rapidly in popularity, these transportation options represent only a small percentage of total passenger car traffic. That could change significantly with the rollout of fully autonomous vehicles.

Why AVs Make Car Sharing More Attractive. As with sharing a conventional car, sharing an AV will be substantially cheaper and less aggravating than owning a car in the traditional way: instead of bearing these burdens themselves, co-owners pay a membership fee to a fleet service that provides management and maintenance services and makes sure that owners get the type of car they need for each trip. But door-to-door autonomous technology makes car sharing even more attractive, by eliminating or reducing several common barriers.

The first barrier to conventional car sharing is ensuring that one is available nearby. The second, once having obtained the car, is dealing with the inconvenience of having to walk to its parking spot. The AV solves both problems by driving itself directly to the user’s front door, just like a traditional taxi. Even if an AV is not available in the immediate vicinity, one can be summoned from a more distant location. (Admittedly, this might add a short delay that inconveniences the passenger, as well as additional costs incurred to the fleet owner over time from the extra fuel or wear-and-tear. But such costs would be more than offset by other efficiencies—and passed along in the form of lower membership fees.) What’s more, because AVs do not require a parking space near the user’s residence, parking costs are reduced, if not eliminated.

Finally, some people dislike the idea of car sharing because they worry that they will not get the type of car they want. We believe that the other advantages that car sharing offers passengers—the ability to work, read, or sleep during their trip—will make people far less likely to care about the car’s appearance or style.

The Cost Advantage. Fully autonomous vehicles not only overcome the most common objections to car sharing, but they also reflect substantially reduced costs of transportation per kilometer. We calculated the overall cost per kilometer of owning an average (midsize) car and then looked at each type of cost—such as depreciation, fuel, maintenance, repair, and insurance—to see how much it would change under the shared AV ownership model.

First, depreciation costs per kilometer would most likely be substantially lower for AVs than for traditional passenger cars. Given that AV use most commonly takes the form of shared ownership or ride-sharing arrangements, far fewer AVs than traditional cars would be needed to drive any given number of passenger kilometers, resulting in dramatically better asset utilization and thus lower depreciation per passenger kilometer. For example, there are 8 million cars in the Netherlands, but at no time are even 2 million of those cars on the road. Note, however, that these benefits would be somewhat offset by the kilometers accumulated during the process of picking up passengers from their homes, offices, and elsewhere.

In addition, smaller cars can cover most of the passenger kilometers that are currently traveled by larger vehicles. Most people who own a large car rarely make use of all of its space all the time. Typically, car buyers choose the size of their car based not on what they need on an average day, but on what they might need occasionally. With shared AVs, co-owners would requisition the size of car they need for the immediate purpose: a smaller car for the commute to work, an SUV for a shopping trip, or a minivan for the kids’ birthday outing. The average car size would drop, and so would the depreciation cost per passenger kilometer.

AVs should incur lower fuel costs as well, mostly because of a reduction in the amount of braking and acceleration thanks to AVs’ ability to communicate with other vehicles. Shared AVs will likely also have lower maintenance costs per kilometer, because (as with shared traditional cars) they will be managed by professional fleet managers that are generally better at car maintenance than the average owner and know how to source it most effectively. For the same reason, repair costs would be lower; volume gives fleets the advantage of economies of scale and better bargaining power.

All in all, the costs per passenger kilometer would most likely drop by 20% to 40% for a shared AV, on the basis of our calculations for the Netherlands. (See the sidebar.) Such a substantial reduction will invariably ignite AV adoption and erode passenger rail’s market share.

OUR METHODOLOGY

The costs of each mode of transportation vary a great deal by country. As a result, we chose to use the Netherlands as a representative example for our analysis. The country’s car and taxi costs are higher than those in many other countries, but train costs are relatively low. We are confident, therefore, that our projections, as extrapolated to other nations, are conservative.

For our scenario analysis, we used publicly available data on car, taxi, and public transportation costs. Of course, such scenarios are never perfect; travelers’ choices are not always based on purely rational criteria. Moreover, some travelers may have preferences other than those we modeled. As a cross-check, we matched our scenario analysis with the results of earlier BCG consumer surveys. Findings from both sources generally aligned.

Clearly, further segmentation and differentiation will sharpen our analysis and findings. Meanwhile, we hope that readers will regard this report as a starting point for a dialogue within the industry on how autonomous technology will affect the public transportation sector.

It’s worth noting that if car sharing takes off, AVs might also trigger a rise in the adoption of electric cars. The high threshold for breaking even in mileage has inhibited the growth of electric cars, but a fleet of AVs could hit that breakeven point faster. Because AVs have lower carbon emissions per passenger kilometer than conventional cars, sharing electric AVs would erode another competitive advantage that the train currently has over the conventional car.

The Rise of Ride Sharing. The rise of AV car sharing would also mitigate some of the objections to ride sharing, such as concern over a given driver’s abilities. In addition, about 40% of our survey respondents (a large percentage of whom are women) said that they are unlikely to share a traditional taxi ride because of safety and privacy concerns. But private, glass-walled compartments, cameras, and other security features of AVs, together with online rating systems, would go a long way toward alleviating these concerns.

Yet another objection to ride sharing is the inconvenience of managing the first and last miles. Two passengers might share 98% of their route, but the first and last miles of their trips usually differ, so either the driver must make a detour to pick up or drop off one passenger, or one or both passengers must use another means of transportation to get to the driver’s location (for pickup) or their ultimate destination (for drop-off). In a fully autonomous scenario, the AV would pick up one passenger after the other, so the detour inconvenience remains, but the first passenger picked up and the last one dropped off could be offered discounts.

Removing or mitigating these impediments may hasten the adoption of ride sharing quite a bit. However, the considerable economic incentive offered by AV ride sharing would likely accelerate adoption even more. Because the costs per kilometer would be distributed across several passengers, ride sharing could reduce the car cost per passenger kilometer by anywhere from 40% to 60% (assuming three passengers per AV), on top of the 20% to 40% cost reduction realized from car sharing. For those willing to ride in shared AVs, the cost could be 50% to 75% lower than the cost of driving one’s own car.

AV Versus Rail: A Cost Comparison. Cost projections depend critically on a number of assumptions that vary from country to country, such as vehicle age, number of kilometers driven per year, and parking costs. For example, annual parking costs in New York City are approximately $4,000, but they are only about one-tenth of that amount for an average city in the Netherlands. In a sensitivity analysis featured in a report last year—where we assumed a newer car, lower annual mileage, and urban parking-garage costs—the ownership costs of both traditional passenger cars and AVs were nearly double those calculated for this report. (See Revolution in the Driver’s Seat: The Road to Autonomous Vehicles, BCG report, April 2015.)

To compare the costs of riding in AVs with those of travel by train, we examined the experience of the typical Dutch commuter, who logs 25,000 kilometers per year and incurs typically low suburban parking costs.

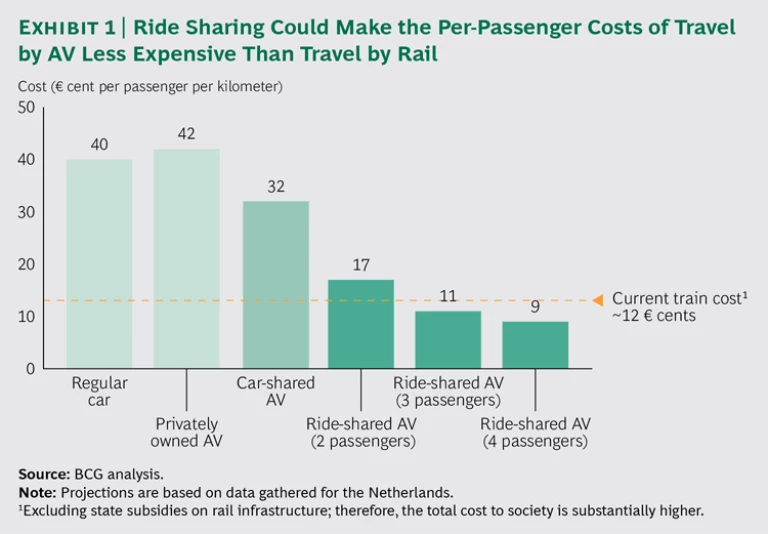

We compared the costs of a commute conducted by train, by traditional car, and by AV. (See Exhibit 1.) Currently, taking the train is much less expensive than traveling alone in one’s own traditional car. If the car is a privately owned AV, however, the difference in cost would be somewhat greater because fully autonomous technology will add roughly $3,000 to the purchase price of AVs. Our calculations show that the cost per passenger kilometer would then be approximately 3% to 4% higher. Shared AV ownership should reduce the cost per kilometer by about 25%, but it is still, on average, more expensive than travel by train. For three or more passengers willing to share rides, however, traveling by AV becomes less expensive than traveling by train. Riders willing to share an AV will not only be guaranteed a seat, save time going to and from the railway station, and benefit from greater availability, but they may also save money compared with travel by train.

In countries where fuel costs or automobile taxes are significantly lower than in the Netherlands, the economics of travel by AV are likely to be even more attractive than those of travel by train. Further research is needed to better understand the differences in economics throughout the countries where AVs are emerging.

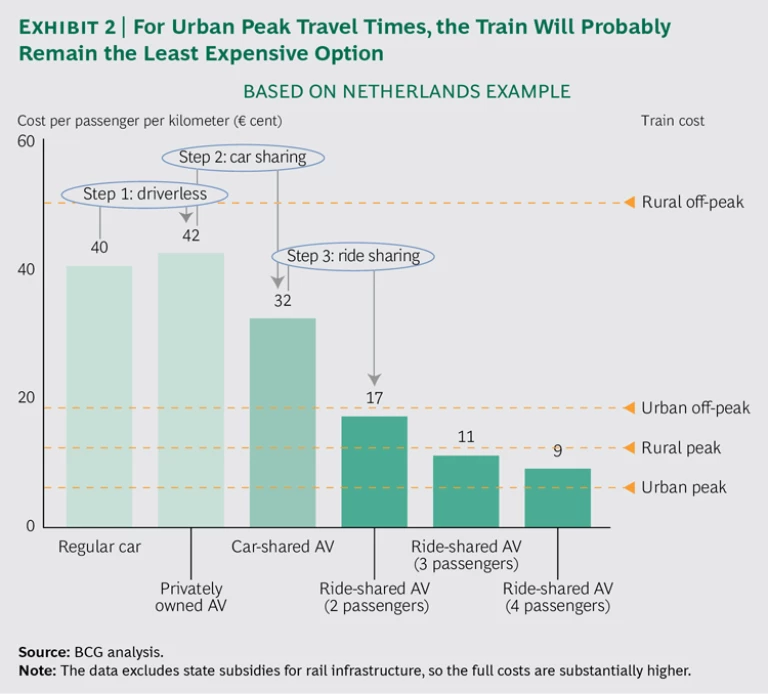

Because per-passenger train costs vary by location and time of day, we compared costs on the basis of these two factors. Exhibit 2 shows that commuting by train will probably remain the least expensive mode of transportation in urban areas during peak times—costing less than even AV ride sharing. However, outside urban areas and at nonpeak times, the cost advantage of shared AV ownership and ridership can be significant.

Beyond Costs. Passengers might prefer an AV over the train for reasons other than cost. For example, AVs will typically be more available than trains: our simulations show that a shared AV is likely to go from any given neighborhood in Amsterdam to one in Rotterdam every five minutes.

For most passengers, taking an AV will be faster door-to-door than traveling by subway, commuter, or medium-distance rail because AVs eliminate the trip to and from the railway station. In the report Revolution Versus Regulation, we showed that car travel time could be reduced by up to 40%. (Note that high-speed trains are excluded from our analysis here because, for the foreseeable future, they will continue to provide faster door-to-door service for most medium- and long-distance travelers.)

AVs will also attract people who currently prefer traveling by car but who take the train for any number of practical reasons: for example, because they lack a driver’s license, cannot afford a car, dislike driving or parking (or both), or are physically unable to operate a car.

But there will always be a certain segment of rail travelers who would never make the switch: for example, those who suffer from motion sickness and those whose privacy and safety concerns cannot be appeased. The number of casualties per traveled kilometer is currently 10 to 20 times lower for passenger rail than it is for cars. While AV technology may reduce this gap over time, it seems fair to assume that for the foreseeable future the train will remain the safest option.

The Disruption to Rail

Our research suggests that the number of travelers who will opt for AVs in the future could be considerably larger than expected: about 50% of the respondents to our survey said that they would consider buying an AV. Our analysis also suggests that, over time, at least 40% of current train passengers will come to prefer taking an AV over the train. Resistance to AVs is concentrated among older drivers: according to our survey, 33% of those age 55 or older are not interested in them, as opposed to only 10% of drivers under age 35 who feel the same way. Thus, the percentage of those who are interested will probably grow.

Similarly, we expect this transition from rail to AV to occur sooner and faster in countries with a high population density (such as the Netherlands) as well as in countries with a high-quality road network (such as Denmark). Countries with tech-oriented consumers who relish new technologies (such as the US) are also likely to see an earlier and more rapid switch.

We expect AVs to constitute a tangible threat to passenger rail within the next one or two decades regardless of the rate of adoption. Trains will remain the least expensive mode of transportation during peak times in urban areas. But during off-peak hours and in rural environments, they will lose riders to AVs. Rail companies may even end up in a downward spiral: with reduced overall ridership, rail companies’ overall unit costs for all remaining passengers will escalate because of the inherently high proportion of fixed costs in operating a train network. This could trigger price increases or reduced schedules, which would result in a further reduction in ridership. The off-peak impacts of declining demand in rural areas could reverberate throughout the entire rail network, since it’s difficult to operate fewer off-peak trains without affecting the costs of peak trains.

With diminishing passenger volumes, retail revenues at railway stations, which can represent as much as 20% to 25% of a rail company’s revenue, could also drop. At a minimum, revenue would decline correspondingly with the decline in passenger volume. But retail revenue could fall more sharply if swift and wide-scale AV adoption prompts employers to relocate their offices away from train stations and closer to highways.

This isn’t to say that passenger and retail revenues would vanish overnight. But because of rail companies’ inherent fixed-cost structure, even relatively modest reductions in passenger volume could turn respectable profits into massive losses; for example, a 20% reduction in passenger volume could turn a 5% margin into a –10% margin.

How AVs Will Affect Different Types of Rail Service

Passenger attrition will vary by type of train service—subway, commuter, regional, and high-speed.

Initially, subway and commuter trains won’t feel a big pinch, because the first generations of AVs will not have the ability to take passengers from door to door, which is of particular concern in complex urban environments. However, once AVs are fully autonomous, many more commuters will be motivated to switch from trains to AVs.

Traveling in a fully autonomous taxi carrying at least three passengers will be less expensive and faster door-to-door than travel by a regional train. Furthermore, we foresee no major constraints on road capacity to inhibit the rise of AVs in rural areas. Rural trains will therefore also be most significantly affected.

We expect that the impact on high-speed trains, however, will be relatively limited because, for the foreseeable future, high-speed trains will continue to be a much faster means of transportation for both medium-distance and long-distance trips than AVs.

Taken together, these impacts suggest a snowball effect. In the early stages of AV technology, when AVs are primarily highway-only, they would be competing only with high-speed and standard medium- to long-distance trains, where the advantage is slim. Over time, however, as AVs’ technology improves so that the cars become fully operational in residential areas, AVs will pose a threat to subway, commuter, and regional trains. At that point, AVs could conceivably cause an enormous shake-out in the rail industry. Further quantitative research on economics, road capacity, infrastructure, and other critical factors is needed to validate these scenarios and gain a better understanding of the types of rail service that will be most affected, and when.

Although AVs represent a competitive threat to passenger rail, it is simplistic to view them only in that way. The government of Singapore, for instance, has stated that it considers AVs’ greatest benefits to be in the first- and last-mile service between the subway station and the passenger’s front door. Thus, in the government’s view, AVs are more of a complement to, than a substitute for, public transportation. Public transportation providers should therefore regard AV fleet managers not only as competitors but also as potential partners in offering passengers door-to-door service.

Get Ready for the AV Revolution

Rail companies face a difficult question: how to deal with a radically new technology whose potential to reshape the competitive landscape is enormous—but by no means assured? Whether or when the AV becomes a mainstream form of transportation is unknown. But if it emerges successfully, it could truly disrupt the rail industry, and do so fast. Given the uncertainty that surrounds AVs, it’s tempting for rail executives to take a wait-and-see approach. We believe that would be wrong.

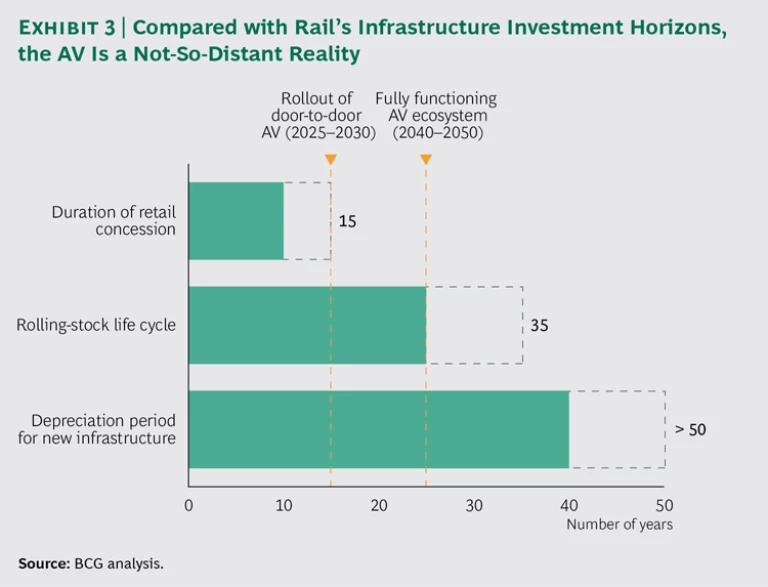

Disruptive technologies not only arise increasingly rapidly, but they are also adopted increasingly quickly. And rail companies, with their rigid networks, generally unionized workforces, and long investment and depreciation cycles, will then be unlikely to be able to respond quickly enough. Moreover, in the coming years, rail companies need to make decisions regarding their investments in rolling stock and infrastructure, which typically involve payback periods of 20 to 50 years.

A better response would be to assume that AVs will emerge sooner or later as a serious competitor that can swiftly disrupt passenger rail. For rail executives who want to be prepared, we’ve identified four actions to consider to insulate their companies from this potential and powerful new competitive threat.

Understand the impact of AVs in your country of operation, using a worst-case scenario. The degree to which AVs will win over train travelers en masse will differ, of course, among countries. Therefore, every rail operator should first determine which country-specific scenarios to prepare for. Which segments of the current train passenger population will be willing and able to switch to AV transportation? Which regions and cities will be affected, and at what times of the day? Where can you still compete, and where are you likely to lose market share?

Sharpen rail’s competitive value proposition. Rail executives must seek ways to accelerate improvements that make train travel less costly and more convenient. The better the value proposition of rail travel, the smaller the share of ridership will be lost to AVs.

Faster trains and more frequent service are among the obvious measures that rail executives could pursue to augment convenience and comfort for rail passengers. They might also explore ways to provide integrated door-to-door service by, for example, offering bikes and affordable taxis. In addition, they could seek ways to reduce the cost of train service outright, such as by increasing asset utilization and reducing maintenance costs, so that rail can more effectively compete with the lower-cost AVs. Reducing overhead would also be helpful, especially because the new competition will not have high overhead costs. The rail industry should also explore the possibility of autonomous trains for passenger service. None of these concepts are new, but in light of the momentum that AV development is gaining, we believe that rail companies should revisit these opportunities seriously—and accelerate their efforts to develop them.

Stress-test your investment pipeline. Investments in rolling stock are typically depreciated over a period of 30 to 40 years; infrastructure investments often stretch 50 years or beyond. Rail executives who continue business as usual and keep funding such investments automatically could well end up with stranded assets and large write-offs in 10 to 20 years, well within the projected timeframe for widespread AV adoption.

Executives should reassess the business rationale for new rolling stock, infrastructure, and railway stations, and ask themselves whether these investments will provide the necessary return when AVs gain traction. Rail executives will want to hedge the risks of, and infuse more flexibility in, their large capital investment projects by adopting risk-sharing strategies and considering incremental, rather than big-bang, investments. For example, it might make sense to move forward with plans to expand a route within a city center but not to build a new line to a suburb where the disruption by AVs would likely be greater.

Establish a foothold in the AV arena. Rail executives should also consider getting in on the AV action. By offering their own autonomous type of transport to ferry passengers to and from rail stations, they could override one of rail’s major disadvantages. They might also consider providing data and expertise to AV fleet managers. Or, they might even develop their own nationwide AV fleet management.

Clearly, adoption of AVs could have a dramatic impact on the passenger rail industry in many countries. To gauge its impact more precisely, however, and to consider the consequences of AV adoption for other forms of rail service, we need to probe further. In particular, several important questions remain unanswered:

- How will the comparative economics of travel by AV and travel by train play out in different countries?

- What will the rollout scenarios look like?

- How will adoption of AVs affect the freight rail industry?

The rail industry has been one of the most stable industries of the past century. So far, it has managed to escape the digital storm that has disrupted many others, including retail, postal service, and telecom. But rail will not be insulated forever. Sooner or later, AVs are likely to disrupt the rail industry as well. And when that happens, the disruption could occur quickly.

Acknowledgments

The authors would like to thank their BCG colleagues Vincent Chin, Mary Leonard, Jan Willem Maas, Jan-Hinnerk Mohr, and Irene Perzylo for their contributions to this report.