Banks continue to adapt to a competitive environment that has been evolving in developed markets since the 2008-2009 financial crisis and the subsequent global recession. Some of the forces shaping this postcrisis environment have yet to fully play out, but their practical implications are now discernible. Overall, there is an emerging equilibrium in the banking industry.

It is already apparent that the postcrisis environment has a faster pace of change, a lower margin for error, and less predictability. It is generally less forgiving of institutions unable to adapt. Many banks have taken substantive steps in balance sheet rationalization, cost reduction, and, in some cases, cultural change. But more fundamental measures are still required—especially because many banks built a presence in a wide range of noncore activities before the crisis that have now become dead weight. Over the coming decade, banks will need to make more changes to their status quo than ever before.

Five primary dynamics are shaping the postcrisis environment across banking segments today. In order to move forward successfully, banks must fully grasp these forces. They must then use a tool kit that involves taking bold action to get back into the race for market leadership.

Five Key Dynamics Are Shaping the Banking Industry

Banks must understand the following five dynamics: changing regulatory frameworks and risk cultures, the digital and data revolution, shifting client behaviors, new competitors, and a multispeed world.

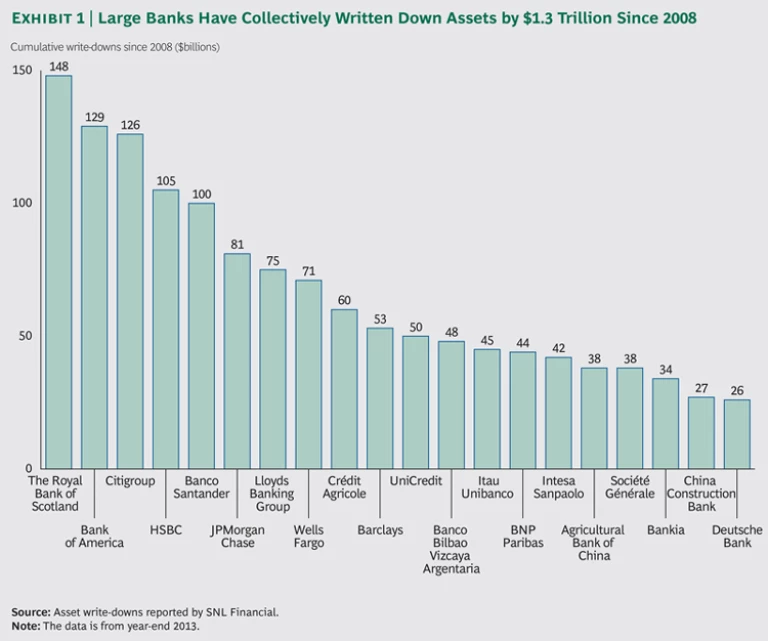

Changing Regulatory Frameworks and Risk Cultures. The tsunami of losses that hit the banking industry in the wake of the financial crisis resulted in asset sales, considerable retrenchment and consolidation in the market, and unprecedented write-downs. (See Exhibit 1.)

Because of macroeconomic and policy variances, the aftermath has played out differently across regions, with continental Europe just starting to stabilize, the U.S. and UK further ahead, and Asia mostly unscathed. But banks everywhere have felt the impact of structural shifts.

As banks continue to digest these losses, management—along with investors, markets, and especially regulators—are putting stability and risk management under a microscope. Requirements imposed by regulators on capital, liquidity, and funding are rising, although most banks have been proactive in responding. In addition, across regions, there has been legitimate but intense regulatory pressure on banks to improve compliance practices and business conduct, with increased scrutiny and real consequences for failure to comply.

Although the ultimate shape of the regulatory environment is becoming more discernible, several requirements have yet to be fully defined. In Europe, the reforms proposed in the Liikanen report would separate proprietary trading from the rest of the bank. In the UK, the proposed ring-fencing of retail-banking activities is still surrounded by unanswered questions, such as the amount of capital a ring-fenced bank would be required to hold. Leverage ratio requirements are expected to increase in the future. Multinational banks face rising requirements for fully self-sufficient operations in each country where they are present, driving internal fragmentation of the business. New buffers, such as total loss-absorbing capacity, have come into play. The result of these ongoing changes is that banks are facing a highly complex regulatory landscape, which—combined with trends toward greater customer protection and clearer tax transparency—is pushing costs higher at a time when efficiency and agility are more important than ever.

The Digital and Data Revolution. Many long-anticipated technological innovations are finally coming of age, creating new opportunities along the entire banking value chain. As a consequence, an increasing array of core banking processes can be carried out faster, more cheaply, and more accurately through digitization. Meanwhile, the use of digital distribution platforms is growing, fueled by evolving client expectations and needs. According to BCG research, the online and mobile shares of retail-banking sales and advice contacts globally are expected to rise from 15 percent in 2012 to more than 40 percent in 2020.

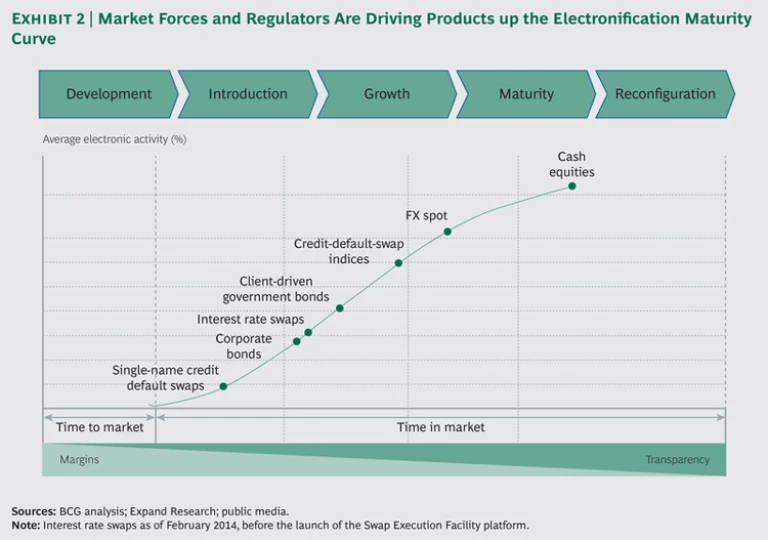

In retail banking, branch interactions are decreasing in number but increasing in duration as customers use digital platforms for simple interactions but visit branches to purchase complex products and ask for customized advice. Banks therefore face the challenge of thinning branch networks while maintaining the scope of their distribution. In capital markets and investment banking (CMIB), market forces and regulators are driving products up the electronification maturity curve. (See Exhibit 2.)

Indeed, electronification is increasing transparency and commoditization—shrinking spreads while forcing companies to rethink the appropriate balance between investments in people and technology across the entire business, from front to back. In addition, we are seeing many innovations, particularly in emerging markets. Such markets—which are not hampered by legacy, predigital infrastructure—are often leapfrogging more developed markets to become “digital natives.”

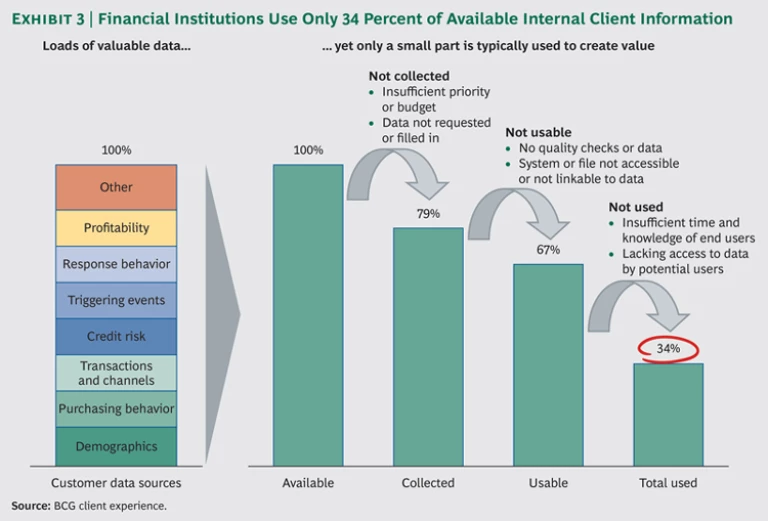

Banks also have access to a large, valuable pool of client information through payment and transaction data, but they are underutilizing this rich asset. BCG’s experience with clients indicates that nearly 70 percent of client data globally is not used by banks. (See Exhibit 3.)

Although many banks have already developed the capability to capture, store, and analyze their data, they are often lacking the data management organization and processes that are needed to get the most out of it.

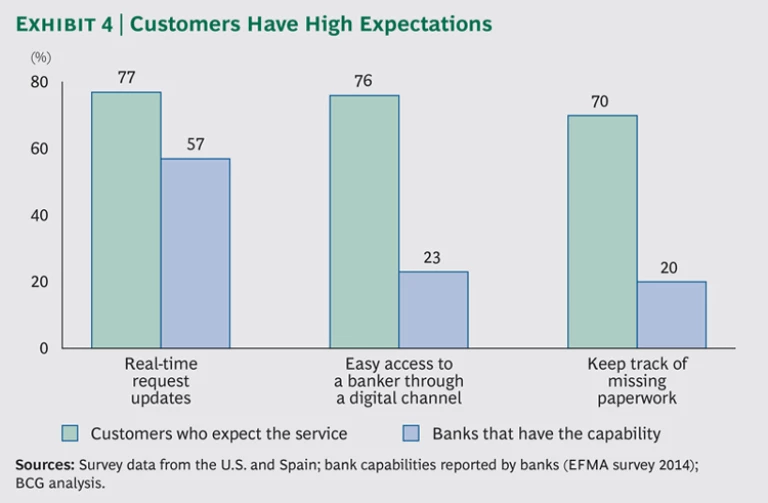

Shifting Client Behaviors. Banking clients are reframing and raising their service expectations as they interact with innovative, client-centric models in other industries that provide a standout digital experience. Examples include Amazon.com’s speed and innovation in distribution, JetBlue’s use of mobile technology to constantly update customers, and Nordstrom’s empowerment of its frontline employees to deliver an outstanding customer experience in retail. Overall, banking clients are demanding faster fulfillment and more flexible ways of interacting with their banks—but relatively few institutions are stepping up. (See Exhibit 4.)

Clients are gaining an increased appreciation for tailored services and greater transparency. And they are engaging with each other more, relying on the opinions of friends and relatives when choosing a bank.

Banking clients are also increasingly willing to switch banking providers, making client advocacy more important than ever. In corporate banking and CMIB, the growing imperative to better manage scarce funding is further compounding the need to cement relationships with attractive clients. However, many banks are struggling to pull even the basic levers of client advocacy sufficiently.

New Competitors. Although retrenchment and consolidation have reduced competition among traditional banks in some areas since the crisis, innovative new business models from outside the industry are targeting core segments of the banking business.

For example, digital- and mobile-payments operators such as PayPal, Alipay, and M-Pesa are advancing rapidly in emerging markets because of the absence of strong, local legacy-payments platforms and greater customer adoption of electronic and mobile payments. Apple’s recent entry into the payments markets will further change the mobile-payments and contactless-payments landscape. Meanwhile, digital banks, monolines, and peer-to-peer players are attracting a small but increasing share of business, despite a reduction in monoline activity in the wake of the crisis. Digital banks are capitalizing on their lack of legacy technology issues to deliver innovative products and services. Banks in developed markets should not assume that these new entrants will not eventually compete with them.

In CMIB, as banks step back from certain activities in order to shrink their balance sheets, less-regulated nonbank competitors are increasingly filling the void. Banks must be wary of the risks, both competitive and systemic, but they should also assess the opportunities—via well-timed exits or partnership models—to profitably reduce exposure to areas in which the number of new entrants is growing. At the same time, new trading platforms have the potential to increase disintermediation.

To avoid being leapfrogged or sidestepped, banks need to assess which threats represent significant long-term challenges that will require preemptive adaptation.

A Multispeed World. Banks operate in an increasingly diverse economic landscape characterized by high (but slowing) growth in many emerging markets, some growth in the recovering U.S. and UK markets, and stagnating performance throughout most of continental Europe. In emerging markets in particular, some large players have raised their games considerably, leading the charge on innovation. Moreover, client behaviors, talent sourcing, and the regulatory landscape continue to vary widely across regions.

Banks with a strong multinational presence need to carefully work out how to adapt to the idiosyncrasies of each market in which they operate while maintaining an efficient and controlled global organization. Striking the right balance between empowering local adaptation while managing a global organization is a key challenge.

A Tool Kit for Success: Taking Action to Get Back in the Race

Contrary to conventional wisdom, there are no business-model archetypes that will guarantee success in the postcrisis banking environment. Therefore it is once again critical to get traditional banking fundamentals right, including deposits, wealth management, and transaction banking. Whatever the model, banks need to take practical measures to blaze their own trails. Altogether, these measures constitute a tool kit for success. Senior management should apply each tool judiciously while considering the institution’s specific context, challenges, and aspirations.

Our work with clients, combined with our analysis of current trends, has allowed us to identify seven measures for banks to take: enable the CEO as an investor, simplify every dimension of the bank, reinvent the client experience, ensure built-in compliance and risk management, embrace data centricity, drive digital transformation, and adapt preemptively. These steps are relevant across all banking segments and can be applied in both developed and emerging markets.

Enable the CEO as an investor. As the pace of change in the market increases, the role of the CEO is shifting from focusing on the oversight of business planning and execution to actively managing the portfolio of business lines, products, and markets based on well-defined criteria that include profitability, returns, strategic fit, and, increasingly, regulatory and risk filters.

Achieving this shift requires a new approach to strategic planning. CEOs must have a clear investment thesis—a focused summary of how the bank will create value over time—to assess the competing trade-offs in the business. Capital allocation and leverage must be at the heart of this planning, with more extensive testing of alternative options and a longer investment horizon (at least three to five years).

Active portfolio management requires an unflinching readiness to sell or rationalize business and product lines. The capital restored to the bank will open up a greater range of options.

Simplify every dimension of the bank. Rigorous simplification of every dimension of the bank is necessary to offset rising complexity in regulation, customer demands, and technology. Without an active effort to simplify, banks face weakening controls, spiraling costs, and an inability to successfully execute change programs. Simplification must take place along four axes: products, channels, organization, and processes.

Simplification through the rationalization of products and payment options can reduce operating costs and risks, as well as eliminate sources of confusion for clients—while increasing productivity. Banks must map the entire product book and filter according to economics and the fit within the broader portfolio and market. For institutional clients, the increased need for tailoring may necessitate a wider range of product options in certain areas, but an ongoing process of active rationalization is still essential.

Simplifying the channel and coverage model first requires establishing clear roles for each channel, aligning channel capabilities with segment and product profitability and complexity, and forging processes that guide client interactions to the ideal channel. Next, channel integration is necessary to make interactions across channels simpler. Not every channel needs to support every interaction at all times. Rather, the key is to find a smart balance of available functionality and cost that maximizes each channel’s value for each product and segment.

Finally, organizational parameters can be simplified by removing unnecessary layers of management, adjusting for the right spans of control, and realigning along one dominant organizational axis. Process inputs and activities should be standardized.

Reinvent the client experience. Improving market share and share of wallet requires redesigning the operating model around client experience and needs—including organization, experience proposition, and distribution—while still staying focused on the bottom line and keeping the cost to serve aligned with revenue potential. Different segments are at different points on this journey—with CMIB behind retail banking, for example—but top performers in all segments are already becoming more client centric. The crucial first step for any bank is ensuring clear articulation of the bank’s experience proposition—outlining the offer, execution, and tone of service. In particular, this also means identifying where to differentiate and where to match competitors.

Retail and corporate banking need strong, integrated multichannel capabilities geared toward natural client pathways, along with convenient and flexible banking options. Further transformation of the front office and strengthening of the coverage model is also needed, as the front office becomes more focused on the advisory role and less focused on administration. Amid branch closure programs in many markets, one trend has been the migration of human interfaces, such as chat and video, to digital devices. Despite this trend—and the fact that digital banking is increasing the number and type of interactions—branches remain important for high-quality service and advice.

In addition, sales teams and relationship managers will need to be firmly aligned around client relationships (not just channels and products) to enable them to better meet client needs and offer access to specialized expertise. In CMIB, the focus should be on breaking product silos—giving clients a consolidated view of the bank’s full suite of products, with ready access, and giving relationship managers the tools and training necessary to guide customers efficiently and effectively.

It’s also important to note that banks’ efforts to deliver an integrated customer journey have historically been constrained by internal challenges to core processes (front office versus back office), by technological limits (necessitating multiple requests for the same information), and, increasingly, by regulation. Banks can move in the right direction by installing two key enablers. First, the client experience must be integrated into organizational design. Staff hiring, training, and incentives must revolve around client excellence. The client experience must be constantly tracked, incorporating feedback into process design. Employees should be explicitly empowered to provide product advice and recommendations, even if the suggestion may reduce revenue in the short term. The uplift in client advocacy will more than compensate for the revenue loss in the long run. Second, rich client insight is required to develop a clear customer view and achieve granular segmentation. It is critical to map client journeys and identify key moments of truth, as well as to accurately align service and the cost to serve with the value of the relationship.

Ensure built-in compliance and risk management. Navigating the increasingly complex regulatory environment is a tall challenge. The starting point is establishing a coherent framework for compliance and risk management in each business line. This requires clear delineation of responsibilities between first, second, and third lines of defense. The business should be primarily responsible for its own risk exposure, including execution, compliance, and the effectiveness of risk control. Compliance must translate regulations into clear, actionable, groupwide standards for the business and provide guidance on, and monitoring of, risk.

Although these standards are critical to defining target behaviors, changing behaviors requires a bottom-up approach. Employees must be motivated to align their own comportment with the appropriate standards and risk appetite. Good conduct and sound risk management must be integrated into hiring and promotion, job roles, KPIs, and incentives.

Finally, as complexity can only be mitigated and not eliminated, the new reality requires bold changes to the risk function itself. The risk strategy must be set with more of a mid- to long-term view, and with more frequent modifications. In corporate banking and CMIB, client risk assessment needs to become bolder and more forward looking, incorporating business plans and cash flow projections rather than just historic values. Rigorous client assessment enables aggressive targeting of the most attractive clients.

Embrace data centricity. Fully capitalizing on a bank’s rich pool of data requires capturing and analyzing data more effectively, as well as putting insights from data at the core of decision making.

Yet there is a crucial prerequisite—one that requires improving the underlying data-capture processes and validation while ensuring that client data is complete, coherent, consistent, and comprehensive. Following the journey can then begin in earnest. The next step is to establish a clear and disciplined enterprisewide data strategy and operating model, with a specifically accountable senior executive. It is also important to systematically catalog the bank’s own client information as well as the full universe of freely accessible public data and other external data that is available for purchase.

Banks must then improve both data management, including organization and processes, and the system architecture itself. They need to integrate data and analytics teams across business units and establish clearly assigned roles and responsibilities. Further, banks must ensure that data is integrated across applications and channels and stored in clearly identified, consolidated “sources of truth.” Doing this allows for data to be refreshed naturally in the course of normal client interactions. Also required is an engine that can integrate structured internal data with unstructured external data to refine insights.

Drive digital transformation. Digital transformation, at its core, is about creating a better overall customer experience—not just improving efficiency. It requires digitizing processes end to end, an initiative that is a key enabler of better multichannel client journeys and richer client insight, as well as simpler processes for clients overall. In CMIB, process digitization also enables a shift to full straight-through processing.

The first step is redefining the target IT architecture to reduce complexity in line with the requirements of the new service model, including higher volumes, multichannel interactions, and end-to-end tracking. While in the process of reducing complexity, progress can still be delivered by adopting a data-only integration approach between the legacy infrastructure and the new digital platform. With this approach, it is important to manage the end-to-end logic of the digital platform while maintaining system-level logic in existing systems. The focus should be on integrating customer data and documents into digitized processes on the new platform. Moreover, instead of incrementally optimizing each step, the processes to be implemented should be redefined from front to back before digitizing them, including compliance and risk elements—taking care to accommodate the average client as well as more advanced digital users.

Adapt preemptively. The best way to respond to a changing environment is through rapid adaptation of strategy and organization before the full force of change is felt. This is a new challenge for banks, as incremental, reactive adaptations have mostly been sufficient in the past. Truly successful transformations happen in two phases. In the immediate term, major threats require an initial phase of rapid reorganization and restructuring. This initiative serves to not only reduce costs and increase efficiency but also to enable more agile management in the long term. The effort includes ruthlessly shedding aspects of the business model that are no longer compelling, as well as reallocating released resources to other areas of the business.

The impact of operational measures, however, can decrease over time—necessitating a second phase focused on growth and innovation. This initiative requires developing new strategies and renewing the operating model to deliver value to new clients in fresh ways. This is not an easy task: it requires sustained effort as well as change in multiple dimensions of the business, not just products.

How Much Value Can Banks Restore?

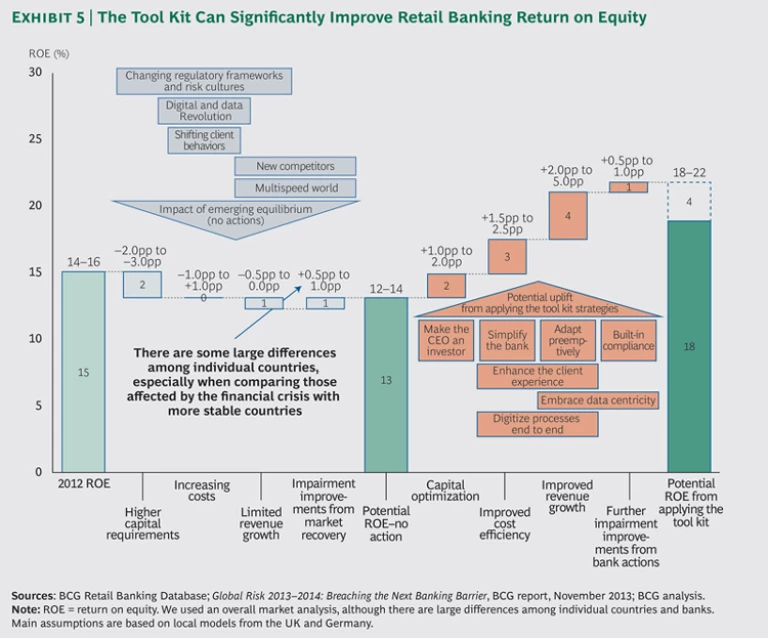

There is a strong imperative for banks to take quick action if they hope to succeed in the emerging equilibrium. If they act now, they can indeed restore significant value. In retail banking, for example, return on equity (ROE) has the potential to reach more than 20 percent. (See Exhibit 5.)

Although the projected ROE uplifts will vary in magnitude across segments, use of the tool kit will have a positive impact on all segments.

The ROE of banks that take no action will continue to be hit by the dynamics we have described, but banks that respond proactively will more than recover. Although it is unlikely that the ROE of even high-performing retail banks in established markets will return to percentages in the high twenties (as those in emerging markets are doing), the high teens and low twenties can still be achieved. By contrast, in CMIB, the story is different.

We expect the ROE of investment banks that take no action to continue to fall to 4 to 8 percent, while banks that respond well can achieve sustainable ROE of up to 15 percent.

Taking the bold action needed to address tough challenges (and seize opportunities) is never easy. Banks must be proactive, not reactive—a tall order in a fast-moving environment that requires daily adjustments in multiple areas. Institutions must invest in a wide set of new capabilities throughout management, staff, and technology. Banks that do this successfully will be well positioned to get ahead of the pack—and stay ahead for years to come. Those that wait will inevitably fall further behind and face huge hurdles getting back into the race.