There is something sublime about a well-played symphony. The woodwinds and the strings, the brass, and even the percussion hang so well together, offering a leading tone, a moment of emphasis, or complementary counterpoint and harmony. It’s easy to get lost in the sweep of the composition and simply overlook the orchestrator who made it possible. This leader painstakingly coordinated the mélange of disparate sounds and timbre from each section, arranging them into a cohesive whole. In many ways, these orchestrators are the difference between coherence and failure.

The impact of arranging symphonic ensembles to produce a rich and desirable outcome has an apt analogy in today’s digital ecosystems. Consider a vacuum cleaner manufacturer collaborating with companies that make sensors, cameras, and AI software to produce a fully autonomous smart vacuum robot. The small ecosystem of companies responsible for this feature-rich vacuum cleaner creates a popular product, but the ecosystem’s value is limited (like a single section in an orchestra) if it is not integrated into a larger platform-based ecosystem (with other instrument families). In this case, an orchestrator is needed to integrate the vacuum with a smart home platform that combines disparate household electronics into a single network.

There are numerous well-known orchestrators managing platform-based ecosystems engaged in social media, e-commerce, transportation, banking, and even mining. These include tech leaders Google, Amazon, Facebook, and Apple, as well as longer-established companies, such as Maersk and Cisco. And there are many emerging leaders among new startups, including the Switzerland-based credit platform MoneyPark, and GlobalSpec, a US-based information platform serving the engineering, industrial, and technical communities.

In the realm of digital platforms, orchestrators are the pivotal players.

In the realm of digital platforms, orchestrators are the pivotal players and therefore stand to gain significantly as platform-based ecosystems increase market share and eat into the profits of traditional companies. Still, while many companies participate in platform-based ecosystems—approximately 40% of the world’s top-30 highest-valued brands and 70% of startup unicorns—few have been able to reap the benefits. Orchestrators often face challenges with scaling the ecosystem, expanding it beyond its initial use case, or simply with monetization and value extraction.

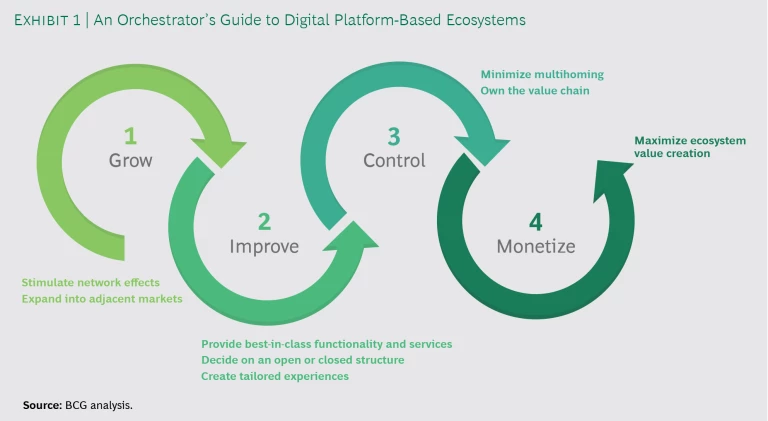

There are ways, however, to overcome these challenges. And orchestrators that do this successfully will gain from embracing and leading a digital business model built upon a platform, while also ensuring that ecosystem partners (call them “complementors”) benefit, enhancing the scope and attractiveness of the ecosystem. What follows is a step-by-step strategic guide for orchestrators, which will help them grow their platform-based ecosystems, attract and retain partners and customers, and maximize their share of the pie generated by the digital ecosystem. (See Exhibit 1.)

Step One: Grow the Platform

The first step is to expand the ecosystem by increasing the number of complementors on the platform and widening the user base. Orchestrators can grow existing business by using network effects. These players can broaden their reach by moving into adjacent areas.

Stimulate network effects. Leveraging network effects is the most potent method for amplifying the range and influence of an existing ecosystem quickly. The theory governing network effects is relatively straightforward: new members are attracted to the ecosystem by a growing user base producing more and better content and by a larger variety of product offerings from new complementors seeking to reach these members. The growth, in turn, is exponential. Network effects also function as an entry barrier for potential platform rivals. Studies of the competitive dynamics of platform-based ecosystems suggest that it is extremely difficult for challengers to topple established, dominant ecosystems that have strong network effects in place.

There are two ways for an orchestrator to build up a critical mass of users and complementors in a short span of time. First, orchestrators can deploy pricing strategies, subsidizing one side of the ecosystem (customers or complementors) with sharp discounts in the hopes of enticing the other side to participate. For example, many recruiting platforms, including the popular German site Monster, charge hiring firms to place ads, but they are free for job seekers because these platforms benefit from a large talent pool. When e-commerce giant Alibaba launched in China in 1999, it faced intense competition from incumbent players like eBay. To attract businesses to its platform, Alibaba did not charge membership fees to Chinese merchants, and its marketplace, Taobao (a C2C e-commerce platform), still doesn’t. Instead, Taobao makes money by taking a percentage from sales, advertising, display marketing, and storefront services.

Second, an orchestrator can use “smart” marketing, through which specifically designed algorithms are used to drive relevant buyers or sellers to the platform. SkinVision, a Dutch skin cancer detection platform, is a good example. To use it, a person takes a photo of a potentially cancerous spot on their skin, which the app then analyzes and—within 30 seconds—suggests a level of cancer risk based on a comparison with millions of other skin images in the company’s database. On the strength of its algorithm, SkinVision has been able to expand its platform’s reach to more than 1 million users globally.

Expand into adjacent markets. Another option for expansion is to offer adjacent (usually complementary) offerings to new and existing users.

Some companies choose to develop adjacent products or services organically. Meituan, a Chinese firm that debuted as a Groupon company in 2010, leveraged its existing user base to move into food delivery and hotel reservations in 2013, and into ride-hailing in 2017. Alipay, which began as an online payment service, has since offered its customers wealth management services, insurance, consumer lending, and credit score reviews.

Orchestrators may instead decide to acquire an adjacent ecosystem.

Orchestrators may instead decide to acquire an adjacent ecosystem. Facebook’s purchase of Instagram in 2012 was a natural step into a new social network sector. Sharing photos (and the stories behind them) on a smartphone-driven platform wasn’t the tech giant’s forte, but Facebook had a huge number of engaged subscribers, a robust engineering team, a global web-based infrastructure, and a strong financial backbone, all of which could support Instagram’s growth trajectory. Indeed, Instagram’s user base has ballooned to more than 1 billion today from 30 million at the time of the acquisition.

Step Two: Improve the Platform

In a competitive environment, a platform can only prosper if it is maintained at the highest level of quality. This means that a platform must be technologically sound and persistently innovative—using technology to respond to the needs and preferences of its users and complementors.

Provide best-in-class functionality and services. From a technical standpoint, platform quality depends on reiterative innovation targeted at achieving the highest standards for speed, information-processing capacity, and frictionless interfaces with other relevant platforms. These benchmarks can serve as a foundation for an orchestrator to add advanced features and functions to improve the platform’s overall experience.

As an example, tech-savvy Alibaba describes its mission as, “make it easy to do business anywhere.” The company has accordingly added multiple services over time to support its merchants and to make online shopping seamless for merchants and consumers alike. For one thing, Alibaba has moved into logistics services through its Cainiao Network to improve delivery proficiency, especially during high-volume periods like the “11.11 Global Shopping Festival,” held in China in November. Alibaba has also expanded its cloud-computing offerings to ensure consistently high site-service levels at a relatively low cost. Additionally, the platform is offering a full suite of technologies and tools, such as livestreaming, short videos, and interactive games, to help merchants reach Chinese consumers in an appealing way.

Decide on an open or closed structure. Orchestrators may choose one of two technical approaches to attract the right type, number, and quality of complementors: open or closed interfaces, with the level of openness measured by access to the ecosystem and its relevant resources.

In certain platform-based ecosystems, quality depends on having uniquely reliable complementors on the platform. When that’s the case, a relatively closed structure is the right choice. This is true, for instance, in Cisco’s smart city and smart mining platforms, on which a network glitch or mishap could have disastrous consequences. Thus, to ensure the safety and security of its platform services, Cisco uses a stringent vetting process for complementors and limits the number of companies able to participate on the platform.

By contrast, platforms that decide on a more open approach are often interested in encouraging many partners to join to boost customer variety and service. Such is the case with Grab, a Singapore-based ride-hailing and food delivery platform, which relies on having many drivers and restaurants in the network to provide an appealing and wide-ranging consumer experience. Grab has adopted an automated system to simplify the sign-up process for new complementors and offers an always-available support hotline to deal with customer issues, freeing up drivers and food outlets to focus on their jobs.

Another reason for having an open-platform architecture could be to encourage innovation that would benefit the entire ecosystem. For instance, in Baidu’s Apollo autonomous vehicle ecosystem, programming and application-development architectures are left virtually unsealed to make it easy for high-caliber partners (including BMW, Intel, and Softbank) to join and accelerate the design of new components, parts, and products for self-driving cars. While the development platform itself is open, the final product, the autonomous vehicle, is heavily protected against cyber attacks.

Create tailored experiences. Orchestrators can use technology to provide a distinctive experience for users and improve the platform’s performance by leveraging “learning effects,” which stem from using advanced analytics to examine user activities and customizing content and recommendations based on people’s specific interests. In turn, this move will increase user activity and provide the orchestrator with additional forward-looking insight into consumer behavior and preferences. Orchestrators that have benefited from network effects to build an enormous customer base can gain particularly from such learning programs.

An excellent example is Netflix, which among subscription-based streaming services has the highest number of paying users in the world and, therefore, the most voluminous and detailed data on user activities. By making specific product recommendations based on this data, as well as demographics and other statistics, and then observing how people react to their recommendations, Netflix can deliver even more precise evaluations. The company can generate better decisions about programming, content development, and subscriber preferences. The combination of network and learning effects enables Netflix to invest more in new productions than its rivals, such as Hulu and HBO, while effectively paying less per hour and per user.

Step Three: Control the Platform

Users and ecosystem partners can be fickle. In many cases, they are seeking high platform quality at the lowest cost, based on such factors as convenience, variety, reliability, and beyond. Orchestrators must be proactive about managing relationships with their customers and complementors to ensure they don’t stray.

Orchestrators must be proactive about managing relationships with their customers and complementors to ensure they don’t stray.

Minimize multihoming. The phenomenon of multihoming entails complementors participating on several platforms simultaneously to provide the best profit potential and largest customer base. Complementors jump between platforms as conditions change. Likewise, users are not shy about switching between platforms that offer the best service or deal. In either case, multihoming is a big problem for orchestrators. It’s commonplace when barriers to ecosystem entry are relatively low, such as in the ride-hailing sector, where passengers generally opt for the provider that offers the best deal and shortest waiting time for a given trip. Drivers are partial to services with the most active customers in the region, and they may actively drive for more than one provider.

Multihoming can result in severe and damaging price wars among platforms, and orchestrators must take steps to avoid this issue.

Multihoming can result in severe and damaging price wars among platforms, and orchestrators must take steps to avoid this issue. The most effective approach is an exclusivity arrangement, which is common in the video game industry. Nintendo, for example, uses strict exclusivity clauses to ensure that certain top game developers only offer their best sellers on Nintendo's gaming consoles. This of course strengthens the Nintendo platform by increasing the size and loyalty of its user base, whose members cannot get these popular games elsewhere. It also lessens the need for developers to adapt their games for multiple platforms.

Another way to reduce the effect of multihoming is to incentivize complementors to remain highly active on the platform. For instance, orchestrators can offer gift certificates or additional services to ecosystem participants that achieve certain sales targets. A similar program can also be set up for users.

Own the value chain. An additional threat to ecosystem loyalty is disintermediation—that is, complementors and users connecting directly after their first interaction, bypassing the platform and thus depriving it of income from future transactions. Platforms that provide handyman referrals, physical services (such as cleaning, gardening, and the like), and the exchange of used goods are among the most likely to be affected by disintermediation. They are particularly vulnerable because the lion’s share of their transactions involves offline interactions, allowing users and complementors to develop a relationship outside of the platform and make alternative contact and payment arrangements.

Protecting against this practice isn’t easy. One method would be for an orchestrator to provide services that add value to the transaction, which users or complementors will find appealing. Another approach involves using technology to make it impossible for buyers and sellers to communicate directly. Airbnb does both. It offers insurance and other protections to hosts that would be forfeited if they dealt directly with customers. Airbnb routes all contact between the two parties exclusively through the platform until a transaction fee has been paid.

Step Four: Maximize Ecosystem Monetization

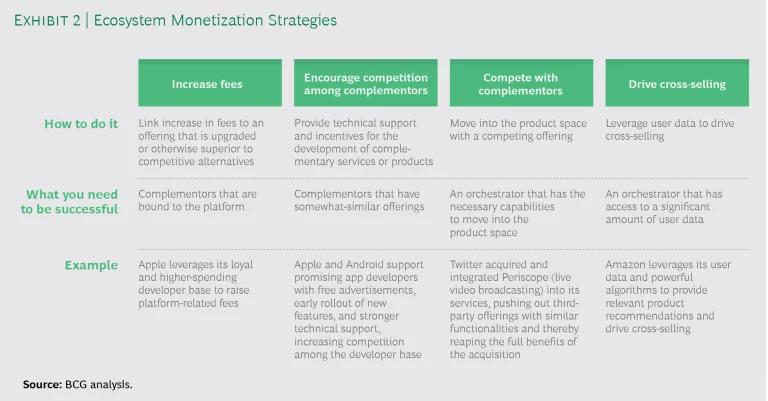

Although an ecosystem is made up of partnerships (albeit a loose set), of all its participants, orchestrators have the most to gain or lose. They make the most substantial financial investment and allocate significant resources to ensure the platform’s survival and growth. Naturally, they would be seeking ways to enhance their share of the profits generated by the platform. Four actions for improving platform monetization stand out as the most effective (see Exhibit 2):

- Increase fees. Generally, such increases are only effective when linked to new ecosystem features or when complementors are bound to the platform because there aren’t any others on which they could market their offers successfully. Orchestrators should raise fees when complementors would incur switching costs (from the technology adjustments needed to go elsewhere) or the services provided by a competitor platform are significantly inferior. Apple has been able to charge developers both an annual fee to access the iOS ecosystem and a commission on every app sold—all while raising its rates more frequently than its rival Android—thanks to its loyal, higher-spending users.

- Encourage competition among complementors. Give technical support and incentives to ecosystem partners or would-be partners for the development of highly competitive applications on the platform. This step would result in more and higher quality offerings, which in turn render the platform more attractive to consumers, driving greater hardware and software sales and allowing the orchestrator to enjoy an ever-expanding revenue pool. Both Apple and Android have adopted this approach, providing promising app developers with free advertising (for instance, a listing in their top-ten charts), an early rollout of new features, and greater technical assistance.

- Compete with complementors. By moving into the product space of its complementors, orchestrators can squeeze the complementors out and take their share of revenue. One example is Twitter’s acquisition of Periscope, an app that enabled Twitter users to broadcast live video streaming to their followers. After Twitter integrated Periscope into its services, all other third-party offerings with similar functions were pushed off the Twitter platform. This tactic is only advisable when the orchestrator can increase revenue by replacing a complementor or complementors without diminishing the breadth and attractiveness of the platform to users and other members of the ecosystem.

- Drive cross-selling. Orchestrators can drive additional platform sales through cross-selling and upselling to existing users. In order to do this effectively, orchestrators must understand the needs of users in near real-time and make relevant recommendations based upon this understanding. Amazon has been using powerful and complex algorithms for over two decades to provide its customers with helpful and relevant product recommendations based on previously purchased and rated products. This system has historically generated approximately 35% of Amazon sales. In a similar fashion, Toutiao, the news and information content platform from ByteDance, has employed algorithms to analyze users’ content preferences to produce customized lists of additional material that they might want to explore. With this service, ByteDance is now second only to Alibaba in China in user time and advertisement revenues.

Overall, the relative interdependency between an orchestrator and its complementors generally determines the distribution of profits.

Overall, the relative interdependency between an orchestrator and its complementors generally determines the distribution of profits. If an individual complementor is central to the success of a platform, it will accordingly demand and receive a higher-than-average share of added value. However, if the platform is not dependent on "star" complementors, but instead is able to support a broadly diversified offer, orchestrators can retain most of the profits while the complementors receive less—but still enough to stay engaged.

The Way Ahead

Virtually every industry has been digitized due to the emergence of a wide variety of digital platform-based ecosystems. By now, companies see the value of these partnerships, which provide users a broader palette of services and products under one digital roof. But despite knowing the potential of platform-based ecosystems, orchestrators often struggle to scale, cultivate, fully monetize, and expand them so that all participants can benefit. And in the end, many platforms fail to reach their potential, especially as the competition among ecosystems heats up.

Solving this problem is not easy, but it is essential for executives. The strategies shared here outline a pathway to begin to turn struggling platforms into profitable businesses. The role of the orchestrator, however, is crucial. The quality of the orchestrator’s leadership, ability to forge successful collaborations, and creativity will ultimately determine whether an ecosystem is harmonious and successful, or otherwise out of tune.

For more on this topic, please see the following:

Zhu, F., Iansiti, M., “Why Some Platforms Thrive and Others Don't” (Harvard Business Review, 2019).

Dexheimer, M., Lechner, C., “Ökosystem-basierte Wettbewerbsstrategien” (Die Unternehmung, 2019).

Eisenmann, T., Parker, G., Van Alstyne, M., “Platform Envelopment” (Strategic Management Journal, 2011).

Jacobides, M., Lang, N., Louw, N., von Szczepanski, K., “What Does a Successful Digital Ecosystem Look Like?” (BCG, 2019).

Lang, N., von Szczepanski, K., Wurzer, C., “The Emerging Art of Ecosystem Management” (BCG, 2019).

Ozalp, H., Cennamo, C., Gawer, A., “Disruption in Platform‐Based Ecosystems” (Journal of Management Studies, 2018).