The everyday consumer world of 2020 will look radically different from today’s. Many ordinary products and devices—heating systems, televisions, cars, watches, toys, light bulbs, sporting goods, home appliances—will have gone digital. They will no longer be islands unto themselves: they will be connected to the Internet and to each other in altogether new ways.

Consumers will increasingly access, monitor, and control their connected digital products and services remotely over the Internet, using smartphones, tablets, laptops, desktop PCs, and other devices. Massive streams of complex, fast-moving “big data” from these digital devices will be stored as personal profiles in the cloud, along with related customer data.

Digital ecosystems are playing a key role in this transformation. An ecosystem is a network of companies, individual contributors, institutions, and customers that interact to create mutual value. In consumer-oriented digital markets, ecosystems are being enabled by standard technical platforms that allow devices, applications, data, products, and services to work together in new ways. For example, insurance companies can collaborate with telecommunications providers to create new pay-per-use insurance products based on shared data.

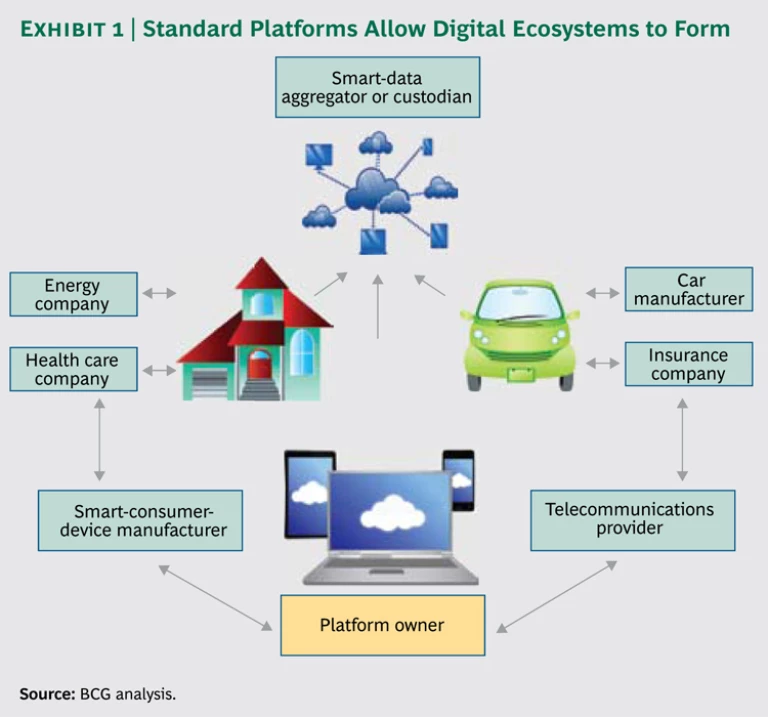

We see three types of organizations collaborating in a digital ecosystem. At the center of interconnected devices and services are ecosystem platform owners—in many cases, Apple or Google. Platform owners create the standards-based technical foundation—comprising, for example, operating systems, devices, an app store—that allows the components of the ecosystem to collaborate and interconnect much more easily than if the individual products operated alone. In addition, providers of products and services from different industries collaborate and compete to create value for customers through applications, data, and new digital devices. And in many industries, data aggregators and custodians are emerging to manage the data created by devices and customers and to find new ways of adding value. (See Exhibit 1.)

We believe that digital ecosystems will profoundly disrupt businesses in nearly every consumer-centric industry, including less obvious candidates such as energy. On the positive side, these ecosystems will tap into better connectivity and customer data to create major new products and services and, eventually, profitable markets that do not yet exist. As a result, competing successfully in the future will require a host of new and different capabilities.

The Connected Home Goes Mobile

This stage in the evolution of consumer products and services isn’t a far-fetched dream. It’s already a reality. New devices and services—ranging from energy thermostats that can adjust the temperature in your home on the basis of your smartphone’s location to intelligent devices in cars that monitor performance and location—appear every day, and they operate together well beyond the confines of the home. (See “Feathering the Digital Nest.”) These ever more mobile devices are encouraging diverse industry players to work together and move into new markets. For instance, energy companies have the potential to partner with health care companies to offer a full spectrum of remote home-based monitoring services through smart devices.

Feathering the Digital Nest

The future has already arrived in the form of products such as the sleek Nest Learning thermostat. The Nest learns your household’s energy-use patterns, turning down the heat when you go to work, warming things up when you get out of bed late on weekends, and turning the system off when you’re on vacation. It works much better than the previous generation of programmable thermostats, which few homeowners have the time or patience to set up and adjust regularly.

An app lets you use a mobile device to adjust your home’s thermostat from anywhere. It also helps you learn how to save energy. One estimate claims that the Nest can reduce household energy consumption by 20 to 30 percent. The device connects through Wi-Fi to a range of Apple devices and is sold in Apple stores along with other products in the Apple digital ecosystem.

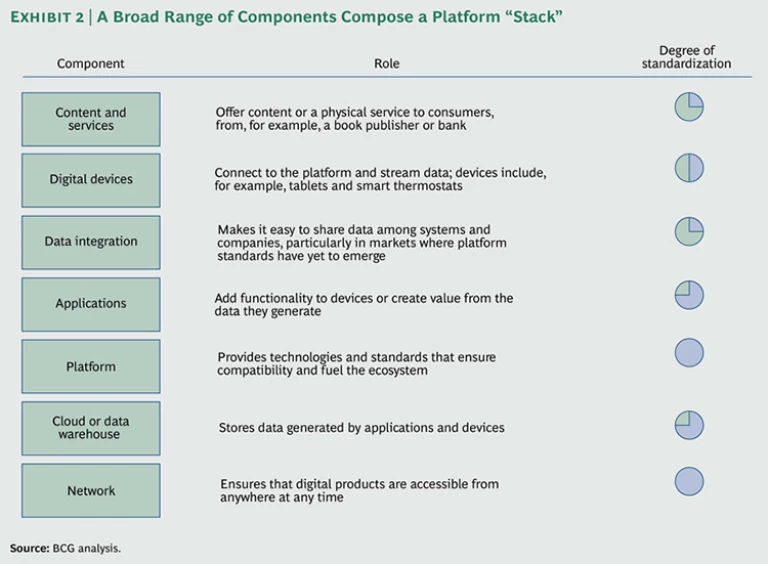

Platform owners such as Apple and Google are fueling an intense acceleration of this trend. For an ecosystem to operate efficiently, platform owners and operators must work with a host of others in the platform “stack.” Standardization provides the glue that binds the ecosystem. Exhibit 2 shows the components and degree of standardization in the business-to-consumer platform stack.

It will prove unlikely that a company in the business-to-consumer space will succeed at becoming a platform owner. The costs of building a sustainable platform and competing against the dominant owners are prohibitive. Still, some companies might be able to carve out a niche in which they can add value. However, in the business-to-business market, although a small number of platforms will likely become dominant, it remains far from clear that these platforms will be universal across industries. More opportunities exist to become a platform owner.

The Evolution of Digital Ecosystems

We see five consequences of the rise of digital ecosystems. Companies that master their complexities will thrive.

A Surge of Big Data. Devices and ecosystem apps generate huge amounts of fast-moving data in a variety of forms. Customers will expect to receive value from the use of their data. A company that is skilled in analytics and can convince customers that it will use the data well will outcompete those that don’t. (See “How to Get Started with Big Data,” BCG article, May 2013, and Rethinking Personal Data: Strengthening Trust, a World Economic Forum report produced in collaboration with BCG, May 2012.) Organizations that control and drive the most benefit from the data will win.

Blurred Boundaries. The lines separating industries such as automobiles, retail energy, consumer goods, insurance, digital media, and telecommunications will continue to dissolve as new entrants move into the adjacencies and niches created by digital ecosystems.

Connected Products and Services. Consumers will evaluate products on the basis of their ease of use anywhere and at any time. Products and services will no longer be judged only on their ability to function independently; they will also be judged on how they function as part of a digital ecosystem of other products and services.

The Emergence of New Industry Roles. Data custodians, such as organizations that offer customer loyalty cards that work across companies, manage data on behalf of an industry. Meanwhile, digital-data aggregators insert themselves between the customer and the traditional product or service provider to add value—for example, services that allow customers to compare and apply for products from a range of competing financial companies. Companies that are slow to react to the latest digital disruptions may find themselves replaced by an ecosystem provider or may discover that an aggregator is standing between them and the customer.

The Rise of Ecosystem-Platform-Endorsed Products. Ecosystem platform providers aim to generate additional revenues from their network. So they will increasingly give an advantage to “preferred” digital devices, such as those that feature proprietary embedded chips or are sold through their own networks of stores.

As products in the home, office, stores, and streets become more connected, companies in a range of industries will find that they are no longer in the business they once thought they were. For example, this is playing out today in the auto insurance industry, which is about to be dramatically restructured as telemetric and sensor data from devices in cars record driving behaviors and integrate the data with insurance pricing, product design, and claims management. (See “Big Data: The Next Big Thing for Insurers?” BCG article, March 2013.) But who will dominate the emerging space? Will it be insurance companies, car manufacturers, network providers, or new entrants that specialize in devices and analytics? Companies that stand still in the face of such change will not be deft enough to adapt.

New Challenges Require New Capabilities

We believe that in order to succeed in the future, companies must develop new capabilities.

The first capability involves partnering. Many traditional companies might choose to collaborate with “digital native” organizations rather than risk trying to build an ecosystem product or service themselves. But many of them will not be accustomed to the level of third-party integration necessary or the need for a collaboration model that is fast, responsive, and outcome oriented. At a basic level, these companies may not understand the ways digital-ecosystem players form partnerships and the common terms for their deals.

In the digital domain, product development and improvement cycles are also significantly more accelerated than in traditional businesses. Rapidly moving companies strive to fail fast and move on. However, many traditional organizations are not used to operating in this faster lane of product and business model change: in many cases, product development processes, technology organizations, and company cultures lack the agility and responsiveness required.

For example, one leading European energy company that moved into the smart-home market found it difficult to make rapid progress within its existing structure, even though it had established separate teams to manage its new offering. The teams were hampered by their limited technology capabilities, the lack of speed in decision making, and the need to train field forces and telephone agents in how to use new products.

Finally, customers will demand new levels of experience and service. Customer expectations concerning interface design, functionality, 24-7 customer service, and always-on availability will be high. Organizations must, therefore, dramatically improve their ability to analyze customer needs and behavior if they hope to compete for customers more effectively, especially as business is conducted over a wider range of channels and devices. Having the right technology, analytical skills, and data integrity in place will be critical.

Facing the Future

We believe that in the face of such dramatic change, CEOs must take five key actions in order to prepare themselves to compete in the world of digital ecosystems.

Understand the economic opportunity. First, CEOs will need to understand how their existing products and services can add value in the ecosystem and how they can create new sources of value. Furthermore, they must understand the potential for new revenues and profits, as well as the second-order effects that can come from better cross-selling and up-selling of existing offerings. Market leaders should also assess the value at risk: What could happen in terms of customer churn or reduced market share as events unfold in this rapidly evolving space?

Let company strengths help prioritize offerings. Although some companies will succeed with totally new digital products and services, success will come most readily when companies can connect their offerings with what they are already good at doing and where they can add real value to the ecosystem. For example, an energy company would more likely succeed in the smart-home market with energy-related products that improve on the gas, electricity, and energy management services it already provides.

Build the right organization. Companies should decide whether their current organization structure will support change at the pace required or whether a dedicated greenfield organizational unit is required.

Partner strategically. No company has the end-to-end capabilities internally to succeed in a digital ecosystem. Companies can save themselves an enormous amount of effort and considerable resources if they choose the right partners. Some partners excel at providing digital technologies, data analysis, or customer service. Others might provide complementary data, products, or services, perhaps from another industry. Forward-thinking companies intentionally select the criteria by which they will work with others, and they ensure that those partners will still be delivering value five years from now.

Start small and scale up quickly. Many companies build a product and simply hope that customers will, somehow, find it. In many cases, they spend hundreds of millions of dollars over many months and manage to sell only a few thousand units. Successful companies avoid making huge investments by taking small, quick steps and using test-and-learn approaches until they find demand. Only then do they rapidly scale up what works.

Standing still represents a high-risk option for any company whose products and services are capable of being connected to the shifting world of digital ecosystems. The business environment is changing, and organizations must be prepared to make the most agile moves on the chessboard.