Global trade has been transformed repeatedly throughout history, driven by a combination of new technologies and new policy rules that unlock their power. In the 1970s, the new technology was the container, and the new policy environment was the GATT, later the WTO, which drove down tariff barriers. The result was a dramatic drop in trade costs, a huge increase in trade, the emergence of global firms and value chains, and the integration of a vast range of countries into the global economy.

Digitization is now promising another transformation of international trade, one with similarly far-reaching consequences for economies, companies, and individuals. Our examination of the evidence shows global trade in the initial chapters of this transformation, with some industries and business models already deeply affected.

It is easy to overstate the short-term implications of digitization for global trade for the average firm; but it is equally easy to understate the long-term transformational potential of these technologies for almost everyone. Companies should recognize digitally enabled trade as a key emerging field, where early preparation has the potential to yield significant long-term dividends.

We argue for a de-averaged approach, in which companies assess their exposure to digitally enabled trade, integrate their digital and global strategies on this basis, and ground their choices in a sound understanding of how the relevant policy context is evolving and can be shaped.

Defining Digitally Enabled Trade

All types of economic activity are affected by digitization, and so in some ways all commerce has become e-commerce. We define digitally enabled trade as cross-border economic transactions in which digitization has materially changed how trade happens or what is being traded. We break down digitally enabled trade into three categories:

- Digitally sold trade changes the how. Digital sales and marketing platforms, either a company’s own website or an external offering like Alibaba’s Electronic World Trade Platform (eWTP), dramatically reduce the transaction costs of extending a company’s existing offering into a foreign market. Trade still looks the same—the same goods and services cross the border—but it happens only because digitization has enabled a cost-efficient matching of buyer and seller based in different countries.

- Digitally enhanced trade changes the what. It is the cross-border trade of digital offerings that have substituted for or complemented existing goods and offline services. Full substitution has happened, for example, through Kindle e-books, streaming services like Netflix, and Adobe’s SaaS solutions. Complements have emerged in add-on digital services that enhance the value of physical goods or offline services—for example BMW’s ConnectedDrive platform for predictive maintenance or Caterpillar’s remote diagnostics services.

- Digitally native trade changes both the how and the what. It is centered on an entirely new offering, one based fully on digital technologies. It is the global offering of new services that have, from the start, been fully digital. The channels are digital, the offering is digital, and the value proposition is anchored in the provision and analysis of digital data. This is the very definition of digital giants such as Google, Facebook, and Uber.

Measuring Digitally Enabled Trade

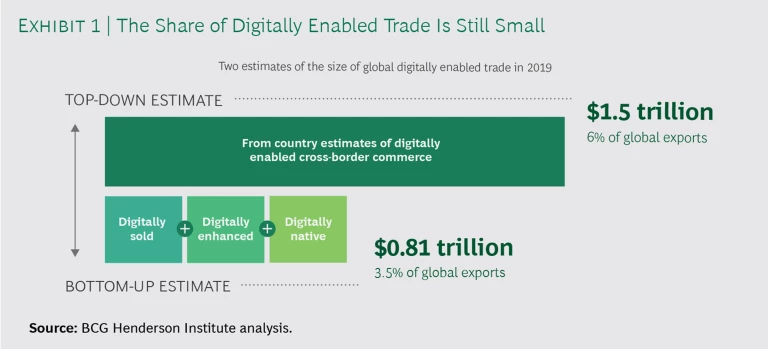

How large is the share of current trade that is fundamentally affected by digitization? The data to answer this is surprisingly shallow and fragmented. We have tackled this question in two ways: First, we have taken a bottom-up approach, using the categories of digitally enabled trade defined above and then estimating their respective sizes given a range of indicators. Second, we have taken a top-down approach, using data from the limited number of countries that have tried to empirically measure the cross-border component of digitally enabled commerce. Given the significant limitations in available data, we have in both approaches applied the lower bound of estimates.

Using these conservative measurements, we estimate that in 2019 digitally enabled trade will be worth about $800 billion (the bottom-up estimate) to $1.5 trillion (the top-down estimate). (See Exhibit 1.) This is meaningful in overall size, but at a share of about 3.5% to 6% of global trade, it is far from dominant. For individual market segments and firms, however, the share might already be much higher. In fact, digitally enabled trade categories are growing faster than trade overall, and we estimate that up to 70% of all global trade flows could eventually be meaningfully affected by digitization, with 22% of trade, especially in service sectors, most susceptible.

The sizing of the market is most difficult where digital features are embedded in traditional goods or services. (Indeed, this may account for some of the gap between our bottom-up and top-down estimates.) The experience of individual companies suggests that this form of digitally enabled trade is still relatively modest in size. But it is growing and has strategic importance. As a senior executive of a multinational manufacturing conglomerate told us, “The digital segment of our business is growing significantly, but currently it is still small, around 5% of the business. The shift toward purchasing products as a service is happening, but it varies by industry and by the customer’s digital maturity.”

Digital-Trade Policy Is Evolving

Because digitally enabled trade sits at the intersection of trade and digitization, it is affected by the wide range of policies in both areas. Data localization regulations are a particularly powerful example of the emerging crop of digital trade barriers: Since 2000, these measures have increased by a factor of four, with 33% falling into the “most restrictive” category, including an outright ban on the cross-border transfer of data. But more traditional trade policy measures, like investment screening through CFIUS (Committee on Foreign Investment in the United States), also matter, as do the full range of domestically focused digital policies, like the EU’s GDPR (General Data Protection Regulation) and PSD2 (Second Payment Services Directive).

Because digitally enabled trade sits at the intersection of trade and digitization, it is affected by the wide range of policies in both areas.

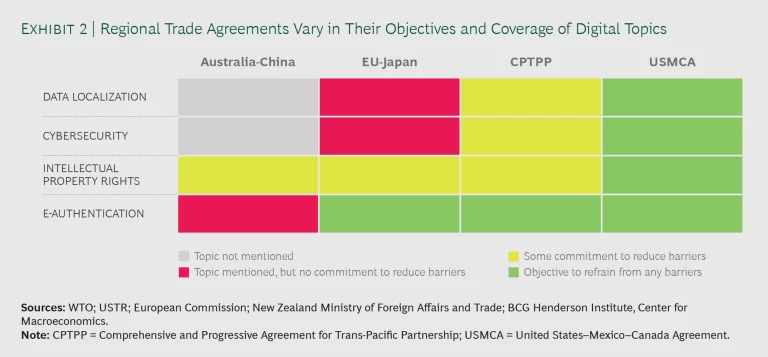

The legal context for digitally enabled trade consists of a mosaic of national and multilateral rules. At the multilateral level, progress has been slow. Recent bilateral and regional trade agreements (RTAs) have started to fill the void, but each RTA has its own objectives and rules. The United States–Mexico–Canada Agreement (USMCA) has the widest coverage of digital-related provisions and the strongest language concerning the removal of restrictions related to digitally enabled trade. Others have less comprehensive coverage and weaker rules. (See Exhibit 2.)

With the policy environment very much in flux, assessing the implications for individual firms is a complex endeavor that must take into account a firm’s specific context. Take the example of data localization rules: On the one hand, data localization barriers can lead to additional costs and, in extreme cases, can close markets entirely. PayPal, for example, suspended its service in Turkey after its business license was denied because of new legislation requiring all IT systems to be localized. This cost PayPal $22 million in revenue and access to 20 million Turkish customers. On the other hand, data localization issues are less of a concern for firms with decentralized data infrastructure. And whether the need for multiple data centers and the inability to use all global data to “train” algorithms is really critical depends on quickly evolving technologies.

The Agenda for Companies

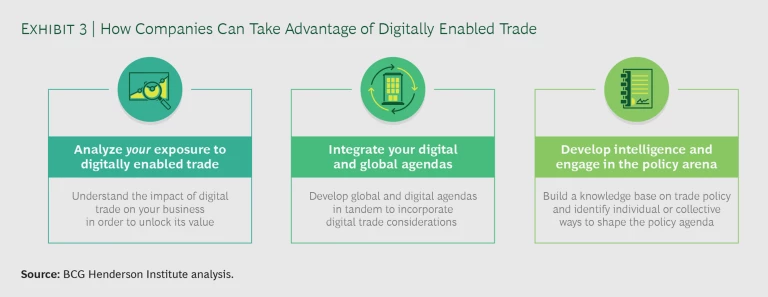

How should companies respond to this complex and rapidly shifting environment, which offers significant new opportunities but also contains traps? We identify three key areas of action, enabling firms to act in ways that are aligned with their specific circumstances, coordinated across key dimensions of their strategy, and informed about the external context they face. (See Exhibit 3.)

Analyze your exposure to digitally enabled trade. Firms can assess their exposure along two dimensions: their approach to internationalization (that is, whether they serve foreign markets as separate multi-local entities or as an integrated global market) and their level of digital maturity (the extent to which digitization has transformed their offering and value chain). These dimensions relate in systemic ways to the type of digitally enabled trade:

- Companies focused on selling digitally essentially turn local markets into global markets. Many of these businesses will naturally come from consumer goods industries. The level of digitization in their operations then depends to a large degree on firm-specific choices about go to market, value chains, and the nature of the value proposition. These companies will face traditional tariff-related trade barriers on their goods and will have to consider additional regulations concerning their customers’ data.

- Companies that enhance their offering through digital elements by definition increase their level of digitization, and can be in either global or multi-local industries. Many of them will naturally come from industrial goods industries, and digitization could shift a larger number of industries from multi-local toward global. Here, too, firm-specific choices will make an important difference. These companies will face new types of regulations related to cross-border transactions, but much will be driven by the country’s general legal framework for digital activities, whether for domestic or foreign companies. The considerations can be complex. As the senior executive of a multinational automotive company framed it, “We gather data in one country, store it in another country, and process it in a third. Do we need to cover all the regulations in all of those countries?”

- Companies that are digitally native have high levels of digitization and may have been “born global.” Many of them will naturally be in tech, media, and telecom, where digital business models lend themselves to international rollouts. These companies will face the broad range of policy barriers: recent regulations like those on data localization but also traditional policies like taxation, which have new relevance in an entirely digital space.

Integrate your digital and global agendas. Firms that have identified a current or emerging exposure to digitally enabled trade need to ensure that their digital and global agendas are aligned. This seems trivial but organizationally might be anything but.

Fully integrating your digital and global strategies circumvents extra costs and unlocks additional opportunities.

Fully integrating your digital and global strategies circumvents extra costs and unlocks additional opportunities. A global agenda that treats digital as an afterthought might create a need for duplication of digital processes to align with national regulations. It might leave markets untapped that could become accessible through digital channels. And it might neglect the ways in which the integration of digital services could significantly strengthen a company’s positioning in a foreign market. Conversely, a digital agenda that does not fully consider global implications is prone to fall into similar traps.

Companies that are integrating digital dimensions into their existing offering may well already have a global strategy, so digital considerations will come as a second step. However, companies can reap benefits from recognizing the global dimensions in their digital transformation work from the start. And often this will provide new opportunities to review and enhance global strategies at a time when globalization overall is entering a new phase, with different conditions.

Develop intelligence and engage in the policy arena. Companies need to make choices about an integrated digital and global strategy with a view to how the relevant technological, market, and policy context will evolve. While the first two will be covered in the broader market intelligence, the latter might not be as developed. So far, digitally native firms and their industry associations are most active in the policy discussions around digital trade.

Digitally enabled trade policy is still in flux and, at least for now, varies greatly across locations. Firms that understand these differences and broader trends will be able to identify opportunities and avoid costly surprises. With trade rules changing more generally, and firms needing to align their capabilities with these new conditions, digital should be an integral part of the trade policy coverage agenda.

Companies must decide whether to be “rule takers” or “rule shapers.”

Companies will also need to decide whether to be “rule takers,” aligning their decisions with the evolving digital trade policy context, or “rule shapers.” In the short term, this can mean influencing the policy agenda to address specific policies or rulings that hinder your business success. In the long term, it can mean working collectively with your industry to shape the overall digital policy framework. In an environment where the international trading system is struggling to deliver new globally enforced rules, such efforts of industry leaders can be particularly important. The goal then needs to be a set of policies on digitally enabled trade that is both economically sensible and politically robust.

Digitization is transforming our industries and societies. Digital technologies are game changers, but not just for the digital-native frontrunners. Companies in all industries should start engaging now on the implications for global trade, even if technologies, consumer behavior, and policies are still in flux. Those that get out ahead and work to understand their unique circumstances will ensure that they have a strategic approach to manage the changes in the short term and seize the opportunities over the long term.