Think of the word home, and you may conjure up an image of a cozy bungalow, high-rise condo, or tidy garden apartment.

But the concept of a home is changing, and so is the way that homes are constructed. The abode that people equate with comfort, safety, and family is being transformed into something new by a confluence of factors. Among them are population growth, a shortage of affordable housing, sustainability regulations, and a construction industry that’s in the middle of a technology revolution.

Around the world, the industry is building new forms of housing that are affordable, shared, ecofriendly, flexible, stylish, or healthy. These alternatives to traditional homes already make up 4% to 6% of all new residential units built in any given year, according to research from Boston Consulting Group. The indicators of future demand in our study suggest that the portion of new units represented by futuristic housing forms will continue to increase over the next dozen years.

The industry is building new forms of housing that are affordable, shared, ecofriendly, flexible, stylish, or healthy.

It’s not a given, however, that the construction industry can provide the types of housing that people will want in the future. For that to happen, building owners, real estate developers, contractors, and building materials manufacturers must transform the ways they do business. Among other things, they must act early to secure property in desirable areas and use modern construction and building technologies to provide the types of dwelling units that people want to live in. They will also need to use digital tools for just about all their tasks, including to obtain financing and to improve communications with end customers. If they manage to accomplish this, then they may retain or advance their current competitive standing. Otherwise, they risk being left behind.

The Ten Forces Transforming Residential Housing

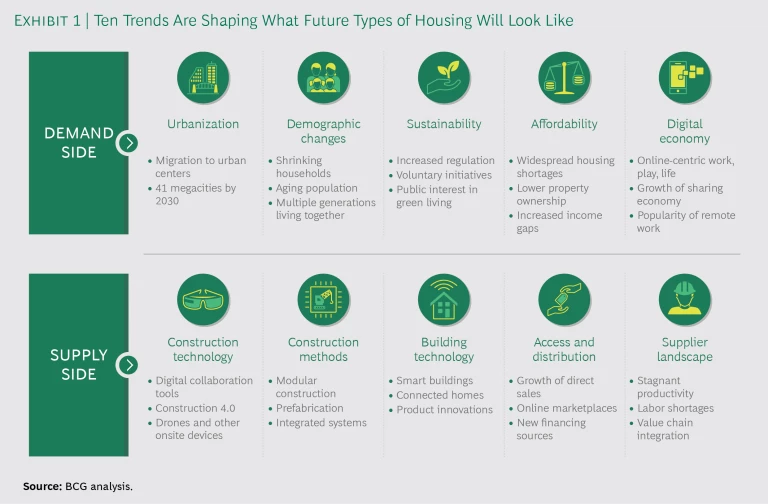

The factors that are changing the concept of “home, sweet home” include both consumer trends, which are creating demand for new forms of housing, and construction industry trends, which affect how organizations operate and what they can supply. (See Exhibit 1.)

Five consumer trends influence where and how people want to live.

Urbanization. People continue to migrate to cities, increasing urban density and the need for compact living quarters. By 2030, the number of people living in cities with more than 1 million residents will jump from 3.1 billion to 3.8 billion, a rise of 22%. This trend is already evident in big cities in Germany, where 80% of residential units constructed in 2018 were in multistory buildings, compared with approximately 60% ten years ago.

Demographic Changes. Family sizes are shrinking, and the world’s population is aging, increasing interest in living spaces that are either smaller or larger than are typical today. By 2030, 43% of households worldwide will consist of just one or two people, increasing demand for smaller living quarters. At the same time, an aging population will encourage the development of larger housing to accommodate multiple generations living under one roof, especially in eastern countries such as China and India.

Sustainability. Consumers’ greater appreciation for sustainability and tighter regulations on energy consumption and green development are spurring the production of more ecofriendly housing options. By 2018, 88 countries had mandatory or voluntary guidelines for building-related energy consumption or greenhouse gas emissions, compared with 38 countries in 1994. Such developments have been bolstered by global pacts, including the 2015 Paris Agreement on climate change, which had been adopted by 195 countries as of early 2019.

Affordability. Rent increases that continue to outstrip wages, along with other factors, have contributed to affordable-housing shortages around the globe. To combat the issue, cities have approved such measures as inclusionary up-zoning, where a portion of new buildings in a given area are allocated to affordable housing. They’ve also used infill development, which targets vacant or underused urban areas for residential housing.

Digital Economy. As the economy becomes more digital, what people look for in a house is changing. More than half of the world’s population now has internet access, and in developed countries, 65% of millennials and Generation Z interact with each other more through digital means than they do in person. Such trends are increasing interest in remote work, home offices, smart homes, and shared living, among other things.

Five supply-side industry trends also affect what types of homes are built and how they are constructed.

Construction Technology. A technology revolution has upended the construction industry. Organizations are starting to integrate such innovations as robotics, onsite drones, and building information modeling into routine construction practices. In the US, a boom in construction startups that create or use such innovations attracted more than $1 billion in venture capital investments in the first half of 2018, a 30% increase over the total in the previous year.

Construction Methods. More residential home builders are using prefabrication—where sections of a structure are built in a factory and then assembled on site—to improve productivity and decrease costs. Modularization, a subset of prefab construction where parts of a structure are built in box-like portions, gives builders more opportunities to customize what they offer. In India, construction companies are beginning to use more of these processes to combat prices for raw materials, which are up to three times higher today than they were in 2005.

Building Technology. Contractors are incorporating the internet of things and intelligent and agile systems to make buildings “smart” and energy efficient. For example, startup Bumblebee Spaces claims that its automated and artificial intelligence-based storage system doubles or triples usable living space by stowing an occupant’s items in ceiling-mounted modules when they’re not needed.

Access and Distribution. Such new technologies as virtual reality, augmented reality, and interactive websites are bringing construction industry players closer to end customers. (See Building Materials Makers Forge a Digital Path to Homeowners, BCG Focus, June 2018). New cloud-based financing platforms are also closing the gap between industry players and consumers.

Supplier Landscape. Stagnating productivity in the construction industry and an ongoing labor shortage have pushed organizations to search for new ways to complete projects with fewer people. In the US, 90% of contractors, builders, and managers have trouble finding skilled workers. The situation has led construction industry players to integrate along their value chains and to collaborate with industry newcomers, including tech companies. For example, Amazon partners with Lennar to install Alexa devices in all the US homebuilding giant’s new units and has invested in a prefabrication construction company to diversify and strengthen its smart-home business.

Six Emerging Housing Types

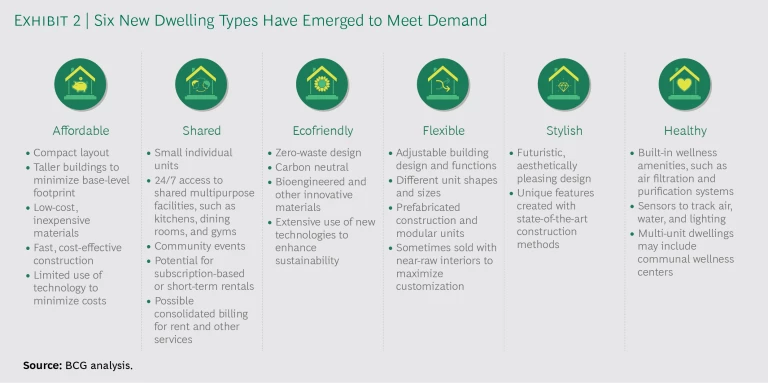

Conventional single- and multifamily homes aren’t going away. But over time, new forms of residential housing will become more widespread and, eventually, could surpass traditional dwellings. BCG has identified six new types of housing that meet the demands created by the trends we outlined above. Future residences will probably include elements of multiple types. (See Exhibit 2.)

Affordable. Budget-conscious housing typically consists of mid- to high-rise structures with relatively small units that are built with basic, inexpensive materials and comparatively little technology in order to make construction fast and cost-effective, which lowers prices for buyers. One example of modern affordable housing is the Dortheavej Residence in Copenhagen, which has been recognized for creating generous living spaces on a strict budget through the use of modest materials and prefabricated components.

Shared. The economy that’s produced ride-sharing services and coworking spaces has come to housing. Shared-housing structures have small individual units and larger, multifunctional spaces that all residents use: think university dormitories but for all ages and with upgraded amenities. The Collective, for example, is one of the largest shared-housing developments built to date. Designed as a microcity and located in the outskirts of London, the complex includes 550 bedrooms plus communal kitchens, laundries, outdoor areas, a gym, a restaurant, a spa, and even a cinema.

Ecofriendly. Sustainability is the watch word for residences that are built in the most environmentally conscious ways possible. One example is the Genesee Park Net Zero home project in Seattle, Washington. The single-family home, which serves as a model for future projects, was constructed with responsibly harvested and recycled materials. It uses rooftop solar power to generate more energy than it consumes in a year, which eliminates 3.7 tons of carbon dioxide emissions annually—equal to the amount that a midsize car would produce.

Flexible. People change, and flexible homes are designed to change with them, with designs and functions that can be adapted, added to, or improved upon as needed. In some types of flexible homes, builders sell properties in an unfinished condition so that homeowners will be free to design or redesign the interior. The Superloft residences built in Amsterdam by a Dutch developer are examples of such properties. The company uses prefabricated concrete modules, along with other modern construction techniques and technologies, to configure the buildings into housing blocks, townhomes, or high-rises.

Stylish. This future home type has original features that may be constructed using 3D printing or other modern technologies.

Healthy. Homes that are designed to improve the inhabitants’ health and well-being might have state-of-the-art air filtration and purification systems, illumination systems that mimic natural light to improve biorhythms, or community spaces for wellness facilities.

Future Housing Types Are Expected to Continue to Gain Ground

Alternatives to traditional housing may sound futuristic. But they already represent 4% to 6% of current new residential units, according to BCG research. We predict that, as the consumer and industry trends described above continue to take hold, the portion of new residential units represented by futuristic housing forms will continue to increase through 2030.

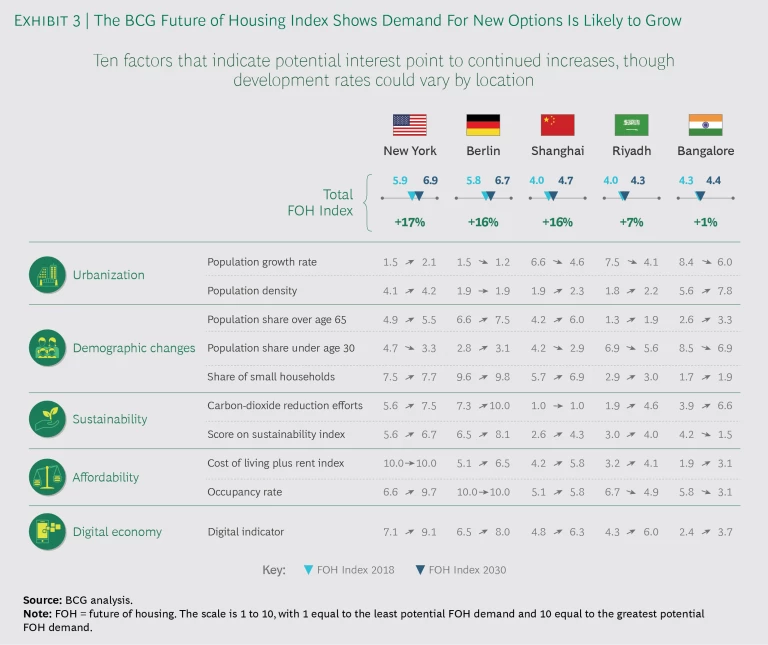

To reach this conclusion, we analyzed ten factors that indicate housing industry demand, among them population growth rate and density, household size, and residential occupancy rate. (See Exhibit 3.) The ten factors also include indicators of consumer demand that have a bearing on the type of housing that people choose to live in, such as carbon-dioxide reduction efforts and sustainability index scores. We studied the indicators separately and then compiled them into an index to score the overall demand for various types of future housing. On the index’s scale of 1 to 10, the lowest score indicates the least potential demand and the highest indicates the greatest potential demand. We used the index and the scale to estimate the change in demand from 2018 to 2030.

We also used the index to look at how demand for housing options in five specific cities could change during that period. We chose New York, Berlin, Shanghai, Riyadh, and Bangalore because they are located on different continents with different economic and demographic circumstances and thus produce a more complete picture of how demand for new housing types could play out around the world.

According to our analysis, although new housing options should increase in all five places, the rate of change will likely vary by location. The greatest potential demand for future housing options is in New York, whose total index score shows a potential increase of 17%, from 5.9 in 2018 to 6.9 in 2030. Growth in demand in that city is most likely to come from the need for affordable housing and from a large population of younger residents who want to live in places that match their digital lifestyle.

The index scores for Berlin and Shanghai are each expected to climb by 16%. In both Berlin, where the index score shows a potential increase from 5.8 to 6.7, and Shanghai, where it may improve from 4.0 to 4.7, stronger demand comes from an expected uptick in sustainable housing and residents’ digital lifestyles.

The index also predicts demand for new housing types in Riyadh to increase from 4.0 to 4.3, thus rising by 7%, on the strength of expected growth in demand for sustainable housing, among other factors.

Of the five cities, Bangalore has the weakest predicted increase in demand for new housing forms. Its index score could rise by a mere 1%, from 4.3 to 4.4. This is largely because although demand is expected to grow as a result of residents’ digital lifestyle, it will be partially offset by other indicators.

To Stay Competitive, Industry Players Must Adjust

To prepare for these shifts in the housing market, construction industry stakeholders must understand what the changes mean for their existing operations and figure out how to adapt. It is especially important for established companies to make adjustments sooner rather than later in order to retain market share and address new forms of competition. Ultimately, a company’s specific actions will depend on its industry segment and specific circumstances.

Property Owners. Property owners have to own real estate in locations where people want to be. With more of the world’s population migrating to big cities, that means offering housing units in premium urban locations and suburban hubs.

Property owners also should aim to de-emphasize midsize units and acquire the smaller and larger units that are expected to become more popular. To stay in step with the sharing economy, they should offer or expand shared spaces and communal living services, including coliving spaces and spaces for community-building activities.

Property owners should offer or expand shared spaces and communal living services.

Finally, they must use digital tools along the entire value chain. For example, they can incorporate virtual reality into end-consumer marketing programs or use smart sensors in maintenance and facility management systems to increase efficiency.

Real Estate Developers. Because urbanization will make acquiring desirable land in popular city settings more difficult, real estate developers must find and secure ideal locations as early as possible to beat competitors. Developers also can buy second-tier or suburban locations and collaborate with local authorities or other partners to upgrade transportation and infrastructure in order to make the areas as appealing to potential residents as the housing options in high-profile neighborhoods. And because developers may need to respond to demands for both customization and affordable housing, they can use prefabricated and modular building components to speed up projects and minimize costs.

What’s more, now that crowdfunding is starting to take off, new sources of financing in a variety of industries are emerging, including in construction. Developers can gain access to alternative financing sources by using new types of crowdfunding platforms that let individuals invest in real estate.

The disintermediation that the digital economy has created has made customers comfortable with engaging directly with the proprietors of the things they buy. Developers can capitalize on this trend and use digital tools, such as virtual reality, to make it easy for customers to learn what they have to offer.

Contractors. A global construction industry labor shortage is not expected to improve any time soon. (See An Action Plan to Solve the Industry’s Talent Gap, a World Economic Forum report produced in collaboration with BCG, February 2018.) To deal with a prolonged scarcity of skilled labor, contractors must figure out how to boost productivity with existing labor and resources. For example, they can adopt certain construction methods, such as prefabrication, and use data-based technologies, such as building information modeling, to operate more efficiently.

Contractors face other challenges as well. At many job sites, work crews are being asked to forgo manual, hands-on building methods in favor of programming and operating devices—endeavors that require new skills. Contractors can offer training in order to retain their best people and attract potential hires. Moreover, if contractors opt to build affordable housing, they must find ways to mitigate the associated cost pressures. Toward that end, they can promote industry-wide standardization, offsite production, supply chain coordination, and lean approaches—all of which help achieve higher productivity while increasing project quality.

To respond to increased demands for sustainable—and sustainably built—buildings, contractors can strive to make their work state of the art, ecofriendly, and resource efficient.

Building Materials Manufacturers. Companies that make building materials must be ready to respond to increased demand for customization and new functions. One way they can prepare is to sell state-of-the-art materials that can be integrated into overall solutions. For example, they could sell energy-producing glass products, translucent wood, or self-healing concrete to building contractors. To mitigate any risks associated with jumping into new products early on, building materials manufacturers can monitor trends, bolster their ability to customize, and fund R&D in targeted areas.

In all the areas we studied, homeowners and governments alike support the use of more sustainable building materials, a sentiment that will likely get stronger over time. To respond, building materials companies can support R&D in sustainability. They also can use energy and waste-efficient technologies in manufacturing processes; for example, making 3D-printed parts to reduce construction waste.

Homeowners and governments alike support the use of more sustainable building materials.

E-commerce, mobile payments, and other markers of the digital economy now allow consumers to communicate directly, and comfortably, with suppliers. Building materials manufacturers can capitalize on this trend by creating or using online marketplaces to distribute products and services directly to end customers.

Homes will always have walls and doors, ceilings and floors. But what those materials are made of, where they’re made, how they’re installed, where they’re situated, and who lives within the spaces that they create will change. The entire concept of housing is evolving—and the construction and building industry needs to evolve, too. Industry stakeholders will need to respond to the challenges that demand for new housing forms will create through planning, ingenuity, investing in R&D, and collaborating with value chain partners. If they cannot do so, they may find themselves shut out, like a homeowner who’s forgotten their key. But if they can, they will unlock the door to new opportunities.