Insurers today face a host of digital to-dos if they want to stay competitive—much less gain an advantage on their peers. These undertakings include digitizing the customer experience, building digital offerings and business models, and constructing in-house digital capabilities. Underpinning them all is the question of how to adapt legacy IT systems and architectures to the needs of digital business models. This challenge can require new front-end architectures to mimic the mobile-first customer experience of digital natives. It can also necessitate a fundamental overhaul of core insurance systems to digitize end-to-end customer journeys and automate decision making in basic functions such as underwriting and claims handling. The prospect is daunting.

Most insurers need to overcome significant constraints in their current IT landscape. For example, BCG research shows that about 35% of all applications in the industry run on legacy technology stacks that are not “cloud ready” and that a similar percentage of incumbents still rely on static HTML-based digital channels that do not work well on mobile devices—the consumer’s digital device of choice.

We recently researched the readiness of insurers to go digital. We interviewed CIOs and IT architects at leading insurance companies worldwide. We also

Insurance CIOs and other IT executives will not be surprised to learn that we found multiple pain points at all levels of IT architecture. For example, only 36% of insurers use a central customer-data repository or CRM application to engage with clients, and only 64% have mobile apps. Such shortcomings limit insurers’ ability to gain a full view of client needs and to provide omnichannel interactions. The average age of core insurance systems in the companies we interviewed and benchmarked was 13 years.

Insurance companies have their IT work cut out for them. This article provides a framework for their efforts that is based on three questions:

- What are the main technological building blocks of a digital insurer?

- What emerging architectural strategies can help insurers accommodate future developments in technology?

- How do incumbent insurers jump-start digital implementation and stay ahead of the competition?

Key Trends, Developments, and Building Blocks

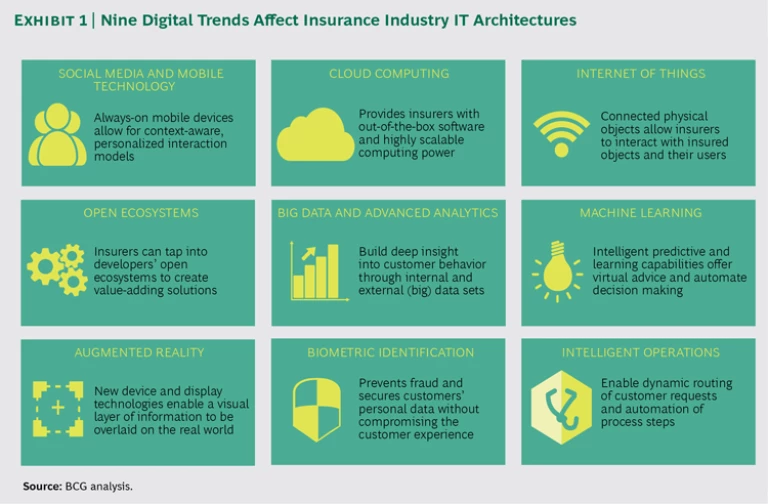

The complexity of the digital IT challenge is due in large part to the sheer number of technology trends and developments that have an impact on IT architectures today. There are no fewer than nine—including social media and mobile technology, the Internet of Things (IoT), open ecosystems, big data and advanced analytics, and cloud computing. (See Exhibit 1.)

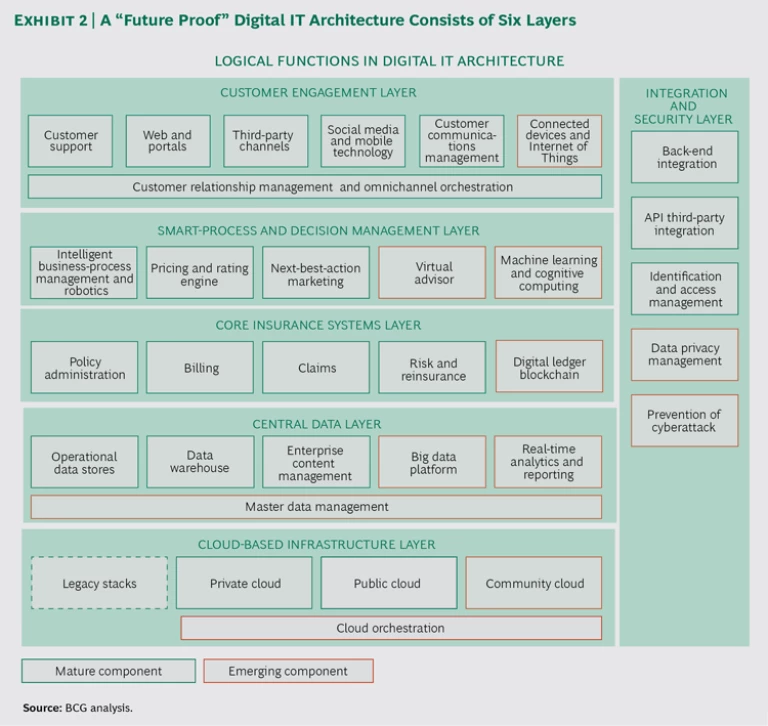

The combination of these digital developments affects the entire IT landscape, which leads many insurers to go beyond building digital channel functionality and undertake an integrated front-to-back overhaul of the IT landscape across six architecture layers. (See Exhibit 2.) Others decide to focus on one or more layers as initial priorities. Substantial amounts of venture capital have been pouring into these six layers, indicating that tech players and their financial backers see big opportunities for improvement in current systems, platforms, applications, and approaches.

Front End, or Customer Engagement. This layer provides device-, location-, and context-aware customer interfaces and enables digital companies to deliver tailored advice and recommendations, as well as a rich multichannel, multidevice digital customer experience. More than $4 billion of venture capital is backing innovation in omnichannel user-experience platforms, social-network listening tools, and IoT and telematics platforms.

Smart Process and Decision Management. By using automated decision engines and artificial intelligence, this layer offers tailored customer-centric services based on microsegments and personalized risk profiles. Some $3.5 billion in venture funding is at work here. In contrast, legacy systems, in which core business processes (such as pricing and underwriting) are “hard coded,” allow for only static decision making based on broad customer segments and statistical patterns.

Back End, or Core Insurance Systems. This layer contains all systems of record for the core insurance business (the policy-administration, claims, and billing functions) and its support (risk management and finance, for example). Digital platforms integrate modular product architectures and “zero touch” processes. The former enable insurers to package multiple product and service components into a broad customer proposition, while the latter are completely automated processes that can be changed with minimal involvement from IT. This layer has attracted some $500 million in venture capital.

Central Data. This layer captures all data (both structured and unstructured) for real-time processing and analytics. The recipient of more than $4 billion of venture funding, it provides a “single source of truth” that gives insurers a 360-degree view of the customer and can reduce customer churn or detect fraudulent claims. In contrast, in today’s legacy IT landscape, data is typically scattered across multiple systems and not available for real-time analysis.

Cloud-Based Infrastructure. This layer allows for scalable high-performance digital services and rapid time to market for new digital solutions. Some $500 million of venture capital has been committed here. Cloud solutions replace on-premises legacy systems that depend on (expensive) self-owned data centers and a central team to manage the IT infrastructure and provide IT services.

Integration and Security. This layer manages these two functions by decoupling front-end from back-end platforms, integrating applications with external parties on the basis of open application programming interfaces (APIs), and managing security and privacy across the IT landscape. It has attracted more venture funding than any other layer—more than $5 billion—for good reason: data security and customer privacy are huge issues. Integration and security for most insurers today involve proprietary interfaces with partners, aggregators, brokers, and clients, with perimeter security and data privacy confined to enterprise IT systems.

Emerging Architectural Strategies

Given the complexity of the challenge, it’s no surprise that across the industry, insurance companies are taking fundamentally different approaches to building their digital platforms. Digital architecture is moving beyond mainstream software, with most digital functionality available now through ready-to-go software as a service (SaaS) platforms or open-source software. Four architectural patterns are emerging: mainstream software platforms, integrated core insurance suites, cloud platforms, and open-source platforms.

Many insurers continue to rely on mainstream software platforms from vendors such as Oracle and IBM. (The old adage “Nobody got fired for hiring IBM” still holds.) These platforms offer broad functionality ranging from mobile-first capability to API managers that span all the layers of the reference architecture, with the exception of core insurance. This architectural strategy appears most suitable for companies with complex legacy-integration challenges that need industrial-strength solutions. For example, one European insurer built a business-process-management layer with IBM software on top of its legacy system and accelerated the time to market of process changes by a factor of ten.

Other companies, most notably in the property and casualty segment, are betting on integrated core insurance suites. Core insurance software vendors such as Guidewire Software and SAP are rapidly expanding their offerings into digital portals and analytics so that they too can offer end-to-end solutions across all layers of the reference architecture. This approach is best suited for insurers that want an out-of-the-box or zero-touch solution to managing customers throughout their life cycle. For its MyDirect auto insurance offering in the US, for example, MetLife implemented a “wall to wall” Guidewire solution. The platform now handles 80% of all customer transactions through fully self-service channels.

A new generation of technology vendors is making rapid inroads into the insurance industry by challenging established software vendors and bypassing the central IT department with cloud platforms. A prime example is Salesforce.com, which has established a dominant position in the customer engagement layer with a client base of more than 2,000 insurers. Amazon Web Services (AWS) and Microsoft Azure are also entering the mainstream. Some insurers are moving completely away from internal data centers to these cloud platforms. The main advantage of this approach is its low-cost usage-based pricing model. One insurance startup runs its entire core insurance solution at AWS and manages 50,000 quotes a day at a cost of only €2,000 per month.

We are also seeing the rapid adoption of open-source platforms such as Liferay for portals and Hadoop for big data. About 40% of the insurers we interviewed use these types of solutions to tap into the innovation speed and talent pool of the open-source community. A good example is The Wall, which gives MetLife a 360-degree view of its 118 million customers and was built on MongoDB in just three months.

Jump-Starting Implementation

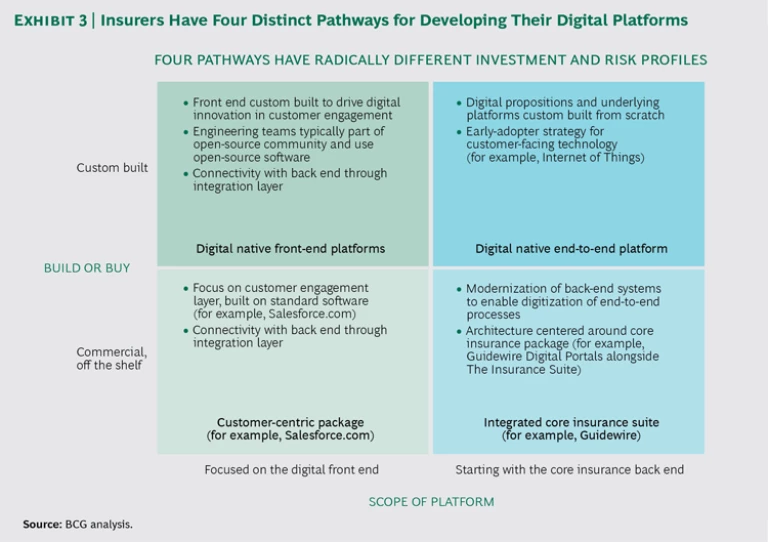

As with their architectural strategies, insurers are also taking fundamentally different pathways toward their desired digital technology end state. (See Exhibit 3.) The two principal decision axes are whether to buy or to build and whether to focus expressly on the digital front end or to start with the core insurance back end. The tradeoffs create four pathways with radically different investment and risk profiles. Each also has a different business impact.

Four factors substantially determine the suitability of each approach for a particular company: speed of change, investment required, implementation flexibility, and appetite for risk.

A customer-centric-package approach is the best option for insurers that are looking for mature mainstream digital functionality and don’t see a need to establish a digital competitive edge. These packages, which employ standard software, work well with stable legacy systems that allow for easy integration with the front end (such as through an enterprise service bus). The packages also require little upfront investment owing to their pay-per-use models, but they constrain rapid experimentation or radical innovation. Their biggest implementation risk is in data consistency, particularly maintaining a full customer view across legacy systems. Speed of change is typically less than six months.

Digital native front-end platforms are the best option for insurers facing competitive pressures and needing fast-differentiating digital solutions. They are custom built to drive digital innovation in customer engagement. Like the customer-centric-package approach, they require stable legacy systems and the ability to integrate them with new platforms. Speed of change depends primarily on how fast the insurer can build an internal engineering capability. These platforms can be significantly less expensive than customer-centric packages. They offer full control of the front end, but implementation of end-to-end digital customer journeys is constrained by the legacy IT back-end systems.

AIG moved to a digital native approach for its new front-end applications. It established a mobile innovation-and-delivery center in the heart of the California tech industry and assembled a dedicated data sciences team to develop custom-built analytics engines. The company gradually phased out legacy back-end systems, taking a natural end-of-life approach and replacing them with core insurance solutions from a leading software provider. AIG is also constructing a “data lake” to create a “single version of truth” across channels and products.

An integrated core-insurance suite is typically the best option for insurers facing a scattered legacy landscape at the end of its useful life. This approach, however, which involves the modernization of back-end systems to enable digitization of end-to-end processes, requires top-down commitment to endure the disruption of a large-scale transformation that encompasses significant reengineering of business processes as well as major data migration. It also involves a big upfront investment (which can be 100% to 150% of the annual IT budget). Transformations take time—typically two or more years (often even longer in the life insurance segment), although this can be shortened to about six months in the case of a greenfield project that starts with a clean slate.

Achmea, a large multiline insurer in the Netherlands, chose to modernize its application and data landscape through an SAP solution rolled out in a phased manner. On the basis of the SAP core insurance suite, Achmea is implementing digital customer-service and process chains with integrated front-to-back functionality, from quotation and underwriting to claims handling. The insurer expects efficiency gains, improvements in flexibility, and access to innovations. For example, the solution enables Achmea to configure new products within weeks, including front-to-back functionality.

A digital native end-to-end platform is the best option for insurers that put a strategic priority on technology-led innovation. This approach requires a world-class engineering capability that helps the insurer compete with actual digital natives. The level of investments depends heavily on the complexity of the business model, but it is not necessarily prohibitive or even large. One company built an auto insurance startup from scratch with a development team composed of a handful of people. Greenfield implementation can also be fast (as little as 12 months); regulatory approvals are often the bigger constraint. The main risk factor can be the difficulty of maintaining custom-built software owing to the competition for, and attrition of, key engineers.

One Asian insurer that pursues an agile early-adopter strategy for customer-facing technology manages all of its software development in-house. It applies a regular multiyear renewal cycle to its fully integrated core insurance platform in order to avoid large-scale legacy issues. It also taps into the open-source community, rather than traditional vendors, to keep pace with innovation.

Three Major Considerations

The extent of any insurer’s digital IT task is a factor of its digital business strategy and ambitions. Insurers should focus on three overall considerations. First, digital affects the entire IT landscape. Many successful companies take an integrated front-to-back approach that goes beyond mere digital-channel functionality. For those that choose to focus more narrowly, at least initially, the smart-process and decision-management layer is key to offering customer-centric tailored services and maximizing lifetime value.

Second, digital architectural strategy should extend beyond the solutions offered by mainstream software. Most digital functionality today is available through ready-to-go SaaS platforms or open-source software. Third, implementation pathways (such as build or buy) should be carefully designed because they pose radically different investment and risk profiles. Insurers that aspire to radical innovation typically invest in building an internal engineering capability, while those with less extensive goals can rely on mainstream commercial software. Insurers with major legacy IT constraints should take an end-to-end transformation approach. Others have the option of a front-end focus.

The complexity can be confounding, but companies should not be put off. The range of solutions available today, both tailored and off the shelf, vary widely, but they make it possible for every company to determine how best to address its particular circumstances.