For banks around the world, a centralized, standardized payment platform is quickly becoming a must-have, not a nice-to-have. The more streamlined the transaction platform, the more cost-efficient and nimble banks can be in responding to regulatory changes, threats from traditional and nontraditional competitors, and heightened customer expectations. That’s true for both domestic banks and those that serve multiple countries.

Nonetheless, a

That’s leaving value on the table. It’s also leaving the door open to fast-moving digital entrants that are not tethered to legacy IT constraints and that are able to offer real-time payment capabilities and other innovative payment services more quickly and economically than many established players.

Reasons for the relative lag include the perceived cost and complexity of integrating transaction platforms among subsidiary and partner banks, many of which have their own legacy issues. In addition, bank leaders are dealing with a number of front-burner agenda items: improving growth, digitization, and compliance capabilities. By comparison, optimizing what has typically been seen as a necessary but dull staple—the transaction-processing platform—can be a hard sell.

But our research and client experience show that banks that take steps to optimize their payment platforms can gain a number of advantages. These include superior cost efficiency, the ability to support instant payments, and greater convenience, access, and security for customers and employees.

Using the results of our benchmarking study, this article describes the reasons for optimizing the payment platform and the three broad archetypes into which most banks fall with respect to their payment platform architectures. It also recommends actions that banks can take to optimize their own payment platforms for greater operating agility, efficiency, and speed. Banks can achieve these gains by focusing on five architectural building blocks—those shown to move the needle further and faster in promoting consolidation.

Imperatives for Payment Platform Optimization

Banks’ payment platforms, long seen as a back-office function, are receiving renewed attention. Payment and transaction services such as cash management, card services, and the real-time transfer of funds power the global economy. But amid many other transformation initiatives, optimizing payment platforms and the supporting IT architecture has not been seen as having the same criticality—until recently.

The combination of the continued low-interest market and accelerating advances in technology has exacerbated the need for faster, cheaper, more efficient payment-processing engines.

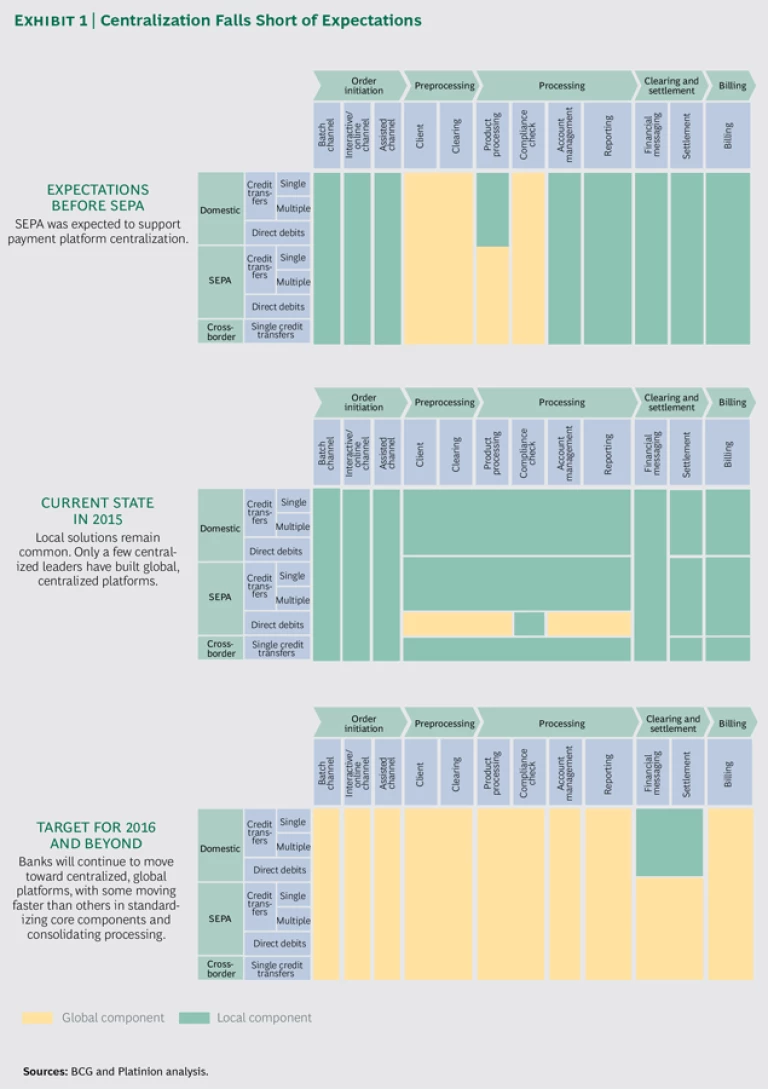

Regulatory pressures have added to the sense of urgency. Initiatives like SEPA have fanned demand from consumers and corporate-banking clients for faster, more flexible, and more accessible ways to transact. However, although our benchmarking survey found that all participating banks met the 2014 deadline for SEPA compliance, as expected, all but a few were unable to leverage the SEPA initiatives to advance their target payment architectures, owing to implementation times and resource demands that exceeded expectations. Payment Services Directive 2 (PSD2), which encompasses new services and players, will change the payment environment again in Europe, and banks will need to find ways to respond to those directives that advance their digital and business strategy.

Many banks recognize that the ability to process instant payments is a growing necessity, especially as the number of countries with that capability grows: 18 countries have the ability to process instant payments and 13 more, including Australia and the US, are in the process of adopting such a system. We expect that by 2018, local and even transnational instant-payment systems will be in wide operation.

The push for instant payments reflects a rising need for corporate clients to process transactions quickly, analyze financial data in real time, and gain greater visibility into their domestic and cross-border payments for reconciliation and other purposes. The upside for banks can be observed in countries like the UK, where early movers won market share on both the retail and the wholesale sides for commercializing new services, such as advanced cash-management capabilities, that were built on faster payment rails. Banks that are slow to improve the performance of their payment platforms risk losing market share as well as valuable experience in innovative product development.

Three Payment Model Archetypes

Bank payment platforms vary in their maturity and optimization. Most banks contend with legacy systems that have been stretched and strained by years of growth and acquisition. Many times, the result is a patchwork of systems and databases that is costly to update and requires significant manual intervention. For banks operating in multiple markets, the need to support different payment infrastructures across different core banking systems only increases the complexity.

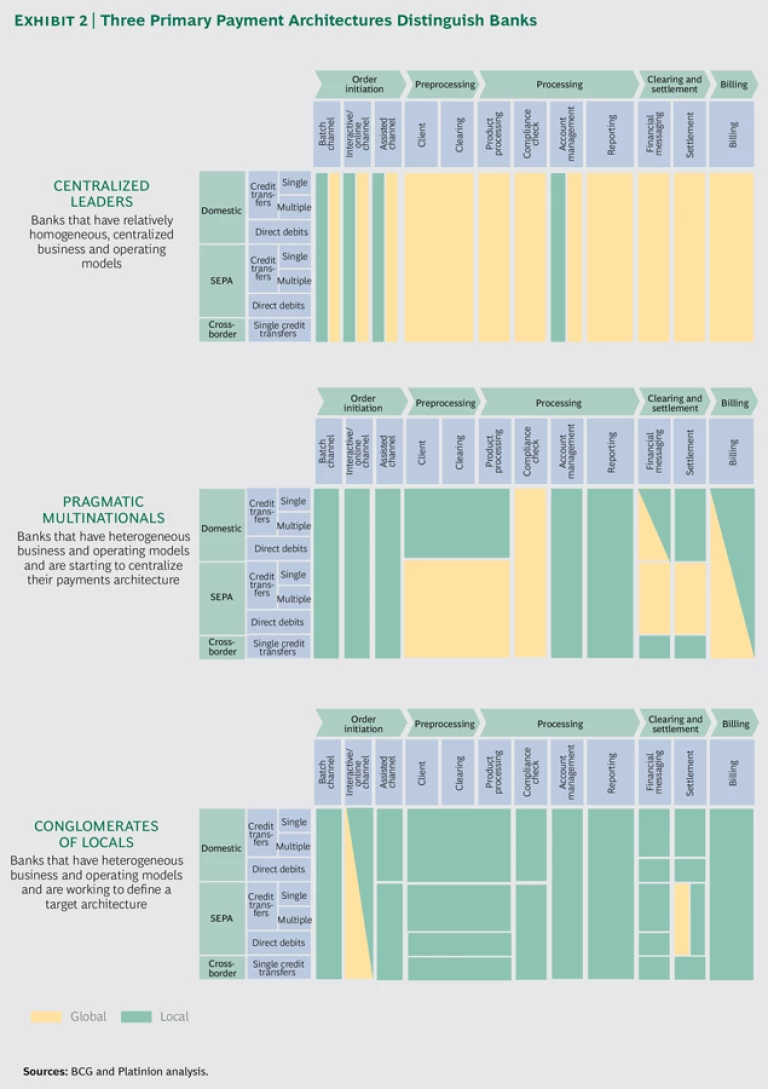

To help banks better understand where they fit relative to their peers and the sector as a whole, BCG and Platinion have defined three payment platform archetypes: centralized leaders, pragmatic multinationals, and conglomerates of locals. (See Exhibit 2.)

In time, however, we expect that the majority of banks across all archetypes will progress toward centralization of global core components, including real-time-capable systems. Such modernization efforts will allow the processing of most product types within one application, thus reducing overall complexity within the payment architecture.

Centralized Leaders. These banks have relatively homogeneous and centralized business and operating models, gained in part from being rigorously disciplined in implementing postmerger system-integration programs and from requiring country-level subsidiaries to adopt group solutions. Centralized leaders are also more likely to have centralized and standardized components across their payment platforms and to require that peripheral systems used in conjunction with their platforms be highly standardized.

As a result, centralized leaders enjoy greater cost efficiencies and faster, smoother upgrades than their peers. That’s especially useful when it comes to implementing regulatory changes or bringing a new country or system on board.

Our benchmarking survey found that centralized leaders are the only group to have gone beyond the requirements of SEPA compliance to aggressively pursue greater centralization of their payment platforms. In doing so, these banks were able to take advantage of the fact that key markets were already on a centralized platform, which meant they could apply more focus and resources to raising smaller markets to the same standard.

Pragmatic Multinationals. Often, pragmatic multinationals have a history of major cross-border mergers with strong and well-established banks. The acquired banks, given their clout and strong internal cultures, have generally retained their own business and operating models and, as a result, many aspects of the banks’ IT infrastructure tend to be segmented. Centralization initiatives typically require considerable consensus building and trade-offs. While most pragmatic multinationals have succeeded in centralizing core components in their payment platforms, many elements in the payment stack are still managed locally. Peripheral systems also tend to be only partly standardized.

Our benchmarking survey found that pragmatic multinationals are in the process of consolidating platforms regionally and functionally, focusing on all but the most locally specific product lines. Those furthest along are beginning to harmonize the most relevant processing steps and bring them onto a globally centralized payment platform.

Conglomerates of Locals. This group includes banks whose country-level subsidiaries are of roughly the same size and stature but whose business, operating, and IT architecture models vary. The core elements of their payment platforms tend to be local and, thus, heterogeneous. The peripheral environment is also fragmented, leading to significant redundant functionality. Applications are usually driven by individual product needs and are rarely standardized. Across the platform, centralized solutions are often adopted only to satisfy specific client needs, such as for global cash management.

Our benchmarking survey found that most conglomerates of locals remain in the design phase when it comes to platform centralization. Some are targeting regional standardization and outsourcing certain supporting components to move a subset of products to a centralized European platform.

Five Ways to Optimize Payment Platforms

Over the next decade, several catalysts will spur greater centralization of payment platforms. These include external drivers such as instant payments, disruptive new entrants, and new regulations along with internal drivers such as inefficiencies, errors, and unplanned downtime due to outdated systems that create an unacceptable level of system instability. The centralization of payment platforms will be necessary to address these factors and to position banks to play in an increasingly ubiquitous instant-payment world.

To help banks understand which specific actions they should take to optimize their payment platforms, we have pinpointed areas within each of the five core architectural building blocks of an optimized payment platform: channels, order manager and payment engine, the client and contract data system, cash management systems, and account management systems.

Channels. Channels are the sets of applications that provide clients and employees with the ability to submit and edit orders, such as initiating a payment, interacting with master data (like customer account information), and accessing reports.

Our benchmarking survey found that relatively few banks have the ability to facilitate multicountry, multichannel access. In fact, among the participants in our survey, only one centralized leader has a multicountry approach in place.

One reason for the scarcity of such channels is that local market growth has typically driven channel applications. Branches, call centers, and messaging and communication formats were tailored to the needs of local customers. But it’s also because, at the regional and international levels, few multicountry channels are in place for banks to tap into. In Europe, for instance, Isabel (the Belgian interbank standards association) is the only channel with multicountry coverage. Further, only a few regional multibank protocols exist (one is the electronic banking Internet communication standard, or EBICS, used in Germany and France). Globally, only SWIFT provides an offering for large corporate banks.

That said, as the number of clients requiring cross-border support has grown, some banks have started to follow a dual strategy. To support the needs of large multinationals, for example, a few participating banks in our benchmarking survey have begun to offer basic functionality such as reporting and authorizations over a consolidated global interface or portal and to facilitate access to different country services with features like one-step sign-on. At the same time, most other channel services continue to operate on a country level.

We believe that banks have a significant opportunity to consolidate both batch oriented (messaging and communication protocols) and interactive channels (such as branches and call centers) by providing shared functionality on a global level while allowing adaptations on a country-specific basis. Although formats, languages, and front-end layouts will vary by client and market, the underlying functionality (for example, account administration and reporting) is essentially the same across clients and geographies from a payment and IT architecture point of view.

By consolidating that underlying channel architecture, reusing shared functionality for such things as authorizations and authentications, and improving connectivity to global data management systems, banks can gain significant cost benefits and realize faster time to market for global offerings.

Order Manager and Payment Engine. Order manager (OM) is the core architectural component used in preprocessing payment orders. It governs such things as transaction authorizations and the formatting, splitting, and scheduling of transaction requests. The payment engine (PE) is the core architectural component involved in executing payment transactions.

Our survey data shows that, with the exception of centralized leaders, the majority of participating banks continue to maintain nonintegrated OMs and PEs. Although a dedicated OM and PE can help banks specialize their service offerings, the demand for high-volume execution in a 24-7 environment elevates performance requirements and can make an integrated OM and PE the better choice, because that structure allows for modular extension and the modification of functionality.

In addition, an integrated OM and PE database can make it easier for banks to meet new business requirements, such as instant payments. Leveraging a joint database with functional modules on top allows banks to manage large transaction volumes more easily and to reduce the exchange of messages between systems. That exchange is crucial for performance-sensitive, real-time processing. Most off-the-shelf solutions provide database integration, but banks will need to customize the OM component, which provides differentiating functionality. As always, the optimal setup will depend on the bank’s current architecture.

Client and Contract Data Systems. These systems hold relevant client and contract data and support the distribution of relevant master data to the processing systems.

Given the increasing regulatory and operational need for a single, global view of customer and account data, we had expected to find more banks to be further along in centralizing their client databases (and, albeit to a lesser extent, their contract databases).

Instead, our benchmarking found that many banks are still forced to replicate full data sets across processing systems, sometimes daily, and only a few have event-triggered, incremental mechanisms in place. In part, that’s because client and contract data is often tightly bundled in local data-management systems, which makes it hard to extract relevant pieces. Compounding the issue, few banks have a master-data-management (MDM) system that can synchronize data between such elements as account management, PEs, and channels. Only one bank in our survey has a fully centralized client and contract data system in place. The rest must access this data from local systems.

Given the difficulty of replicating local data in a centralized database, we anticipate that most banks will continue to toggle back and forth with local systems on a short-term basis. That means that central-processing components will require a strong integration layer. We expect to see increasing use of MDM solutions that connect local client and contract data to a centralized payment platform and synchronize this data across the different systems that need it.

Going forward, international payment architectures need to be supported by a central MDM component to orchestrate master data exchange between source systems and processing engines. Because local systems are most likely to remain the source of customer and contract data, synchronization will require specialized systems to ensure that master data is distributed in the required intervals to all relevant systems.

Cash Management Systems. Cash management (CM) systems provide advanced transaction-banking functionality for products (such as cash pooling) and enable global connectivity for multinational clients.

A centralized CM system with global connectivity is critical for banks that wish to meet the demands of international commercial clients. Currently, many banks maintain redundant CM functionality across their global and domestic systems. That makes it harder and more costly to update and share data. Efficiency gains can be made by consolidating these systems into a single system, especially given that the CM must be integrated with local and back-end systems anyway.

Account Management Systems. An account management system (AMS), often referred to as a core banking system, is the record-keeping system where credits and debits are booked and account balances are calculated.

Survey responses indicate that AMSs have seen the least progress toward centralization. Participants indicated that banks typically run separate systems in each country and have a low degree of standardization. This decentralization is likely to remain commonplace owing to country-specific (often regulatory-driven) requirements. Nonetheless, we believe the efficiency gains from standardization—in particular for small markets—are attractive enough to spur banks to integrate and standardize the business product portfolio, ideally in combination with a system consolidation.

Next Steps

When it comes to making needed changes, banks can pursue an incremental approach or look to overhaul their entire payment architecture. That bolder approach can accelerate the transformation, but it can also raise the risk. For most banks, the better choice will be to transform in phases, focusing first on those areas that stand to deliver the greatest overall cost-benefit. The exception might be a conglomerate of locals or a less-mature pragmatic multinational, for which the degree of change required might be so great that it justifies a complete overhaul. (For options that banks can use when taking next steps, see “Consider Commercial Off-the-Shelf Solutions.”)

Defining the optimal payment strategy requires banks to articulate how their payment platforms fit into their larger digital and strategic aspirations. It also requires a thorough assessment of their current architecture and IT capabilities. That may seem like a tall order, but the effort becomes manageable when broken into phases. The following considerations can help leaders plan their approach:

- Settle on a clear strategy. It is essential to achieve management consensus regarding the target platform. Senior management must participate in those discussions and agree on the overall objectives (in terms of both bank strategy and the customer experience), the roadmap, and performance criteria.

- Establish a baseline. Understanding the capabilities involved in transforming the payment platform architecture is key to formulating a realistic and measurable implementation plan. As part of those discussions, management must determine the bank’s current level of digital maturity.

- Build the business case. Corporate-banking executives will need to assess how best to stage the transformation, the overall cost-benefit, and the opportunity cost vis-à-vis digital competitors. This requires detailed analysis to determine the required level of investment, the profit potential, and the impact on key financial ratios.

- Align the organization and culture. Platform transformation requires working with multiple parties to bring together local and global needs. A shift in mind-set is often required: platform optimization needs to be seen as the core around which value can be created.

Although optimizing a bank’s payment platform can seem daunting, we believe that our recommendations can facilitate this critical initiative. By determining their current position relative to the established archetypes, banks can chart their own course at the pace that is right for them.

CONSIDER COMMERCIAL OFF-THE-SHELF SOLUTIONS

Over the past ten years, commercial off-the-shelf solutions (COTS) for payment processing have improved significantly. In fact, in our estimation, many currently available COTS components are a better option than in-house custom efforts for banks that are interested in centralizing their back-office payment infrastructure.

Yet our benchmarking survey showed that while banks are using COTS for peripheral components, such as anti-money-laundering and compliance tools, most are still relying on custom-developed components for their front- and back-end needs, in part because this has been the traditional means of getting around legacy application issues.

In our view, custom solutions will remain a sound choice for front-end channel components in the near term, but we believe banks should consider COTS for core processing solutions, such as OM, PE, and peripherals. That’s because COTS can help banks accelerate implementation times by using proven functionality and limiting custom development to strategic, differentiating functionality only.

Defining the optimal payment strategy requires banks to articulate how their payment platforms fit into their larger digital and strategic aspirations. It also requires a thorough assessment of their current architecture and IT capabilities. That may seem like a tall order, but the effort becomes manageable when broken into phases. The following considerations can help leaders plan their approach:

- Settle on a clear strategy. It is essential to achieve management consensus regarding the target platform. Senior management must participate in those discussions and agree on the overall objectives (in terms of both bank strategy and the customer experience), the roadmap, and performance criteria.

- Establish a baseline. Understanding the capabilities involved in transforming the payment platform architecture is key to formulating a realistic and measurable implementation plan. As part of those discussions, management must determine the bank’s current level of digital maturity.

- Build the business case. Corporate-banking executives will need to assess how best to stage the transformation, the overall cost-benefit, and the opportunity cost vis-à-vis digital competitors. This requires detailed analysis to determine the required level of investment, the profit potential, and the impact on key financial ratios.

- Align the organization and culture. Platform transformation requires working with multiple parties to bring together local and global needs. A shift in mind-set is often required: platform optimization needs to be seen as the core around which value can be created.

Although optimizing a bank’s payment platform can seem daunting, we believe that our recommendations can facilitate this critical initiative. By determining their current position relative to the established archetypes, banks can chart their own course at the pace that is right for them.

Acknowledgments

The authors are grateful to the banks that generously participated in this study and that shared their experience and insights with us. In addition, we thank the following BCG and Platinion colleagues for their valuable contributions and input: Thorsten Brackert, Kaj Burchardi, Guido Crespi, Hanno Ketterer, Olivier Morbé, and Niclas Storz.