The construction industry’s adoption of 3D printing has been hitting the headlines. The Economist announced, in its understated way, in June 2017, “3D printing and clever computers could revolutionize construction,” and the CNN website earlier that year posed the question, “Will the world’s next megacity drip out of a 3D printer?” As the headlines suggest, the media excitement has been due far more to the technology’s potential than to its current record of accomplishments. The technology is getting there, but it’s not there yet.

The construction industry has traditionally been very conservative—slow to innovate and unsuccessful at boosting productivity. Many companies, however, have recently embarked on a makeover, specifically by exploiting digital technologies. (See The Transformative Power of Building Information Modeling, BCG Focus, March 2016.) The innovations so far have occurred mainly in the early and late phases—design and engineering, and operations and maintenance—rather than in the actual construction phase. But that phase too will soon see some drastic changes. The elusive productivity boost will finally happen, thanks to building information modeling (BIM) and other collaboration tools, and construction sites will be modernized dramatically by digital fabrication technologies—brick-laying and tile-laying robots, for example; automated cutting, milling, and assembly of timbers; a digitized supply chain; automated prefabrication. And 3D printing.

Eventually, 3D printing will become a common or even standard feature in the fabrication process. The timeline and details remain uncertain. For almost a decade now, researchers have been investigating and refining techniques for 3D printing, or additive manufacturing, in construction. Several specialist companies have emerged, and several large established companies—not just construction firms but also manufacturers of building materials—have started investing in earnest. There is a strong sense of anticipation. But several issues first need to be resolved: how ready the market really is; how ready the industry is to embrace rather than resist the creative-disruptive force that 3D printing represents; how ready the technology itself is; and how companies should best leverage the technology and adapt to it.

Eventually, 3D printing will become a common or even standard feature in the fabrication process.

A Natural Fit for Construction

Before we address these tricky questions, it’s worth taking a closer look at what 3D printing in construction involves.

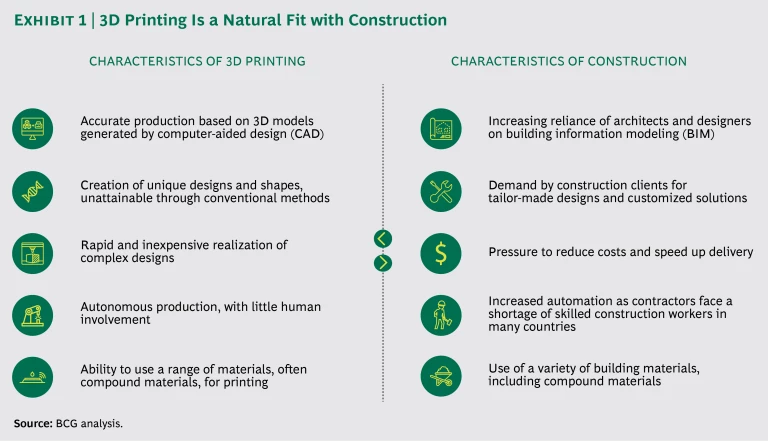

The term 3D printing refers to the production of physical objects layer-by-layer by an automated and usually computer-controlled machine. The machine, most often guided by digital 3D models, either melts metal or powdered solids or ejects liquid or semiliquid materials. The technology provides for a wide range of applications—from surgical implants to spare parts for cars to lightweight structures for aerospace projects. Such versatility is due to three main factors: the variety of suitable materials (notably, polymers, metals, ceramics, and mortar or concrete); the almost limitless freedom of design; and the ability to fabricate complex shapes onsite or offsite, flexibly and inexpensively. Add to those characteristics the power of automated and autonomous production, and you have a near-perfect match for the construction industry. (See Exhibit 1.)

Consider some of the parallels: construction projects often require customized designs; they involve liquid or pliable materials—often compound materials—that harden onsite; they are becoming more and more reliant (at least in developed countries) on automation to avoid delays, overspending, and skilled-labor shortages. For construction companies, under increasing pressure from clients, taxpayers, and governments alike, the opportunity to autonomously print buildings or components 24/7 is bound to be a hugely welcome prospect.

Against that background, the adoption of 3D printing by the construction industry has, sure enough, been accelerating. The reasons for this upswing can be summarized as follows:

- Technological Advances. The equipment and materials for 3D printing in construction are improving constantly, and their costs are falling. Novel types of printers are becoming available—those that exploit robotics more ingeniously, for instance, or are better adapted to compound materials—and are enabling new applications. Hardly a month goes by without the demonstration of some new device or technique by a go-getting startup or a major research institution such as MIT, ETH Zurich, TU Delft, or Loughborough University.

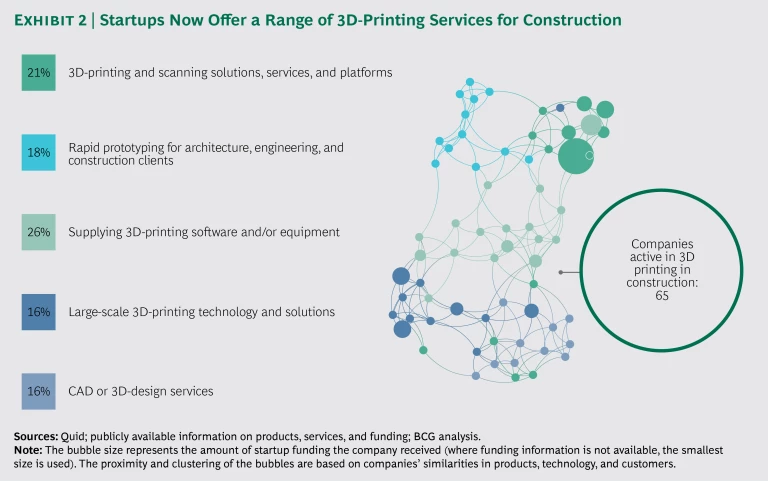

- New Entrants. The number of companies active in 3D printing in construction has soared recently. At the start of 2013, there were barely 20 startups in the field; today, there are about 65 offering services such as prototyping solutions for architects and engineers, software and design tools, and large structural components or even entire buildings. (See Exhibit 2.)

One of the most prominent companies dedicated to 3D printing in construction is the Chinese firm Winsun, which made global news in 2014 by printing a batch of ten complete houses. Since then, it has developed several prototype edifices and conducted bold projects, such as printing a stylish office building for the Dubai Future Foundation.

- Strategic Moves by Established Construction Companies. The big-name construction companies will have to adapt to the new reality, whether they like it or not, and several have made the strategic decision to be early adopters of the new technology. In February 2017, France’s leading construction firm, Vinci, bought a stake in the French startup XtreeE, which specializes in printing concrete structural elements. Bouygues, another French construction giant, is partnering with the University of Nantes team that helped develop the Batiprint3D process, and is starting to print social housing in Nantes. The multinational contractor AECOM has signed a three-year agreement with Winsun to jointly enhance their client work in 3D-printing in construction.

Several suppliers of building materials have also begun engaging with the technology. The cement manufacturer LafargeHolcim, like Vinci, teamed up with XtreeE and has developed a range of experimental concrete mixes specifically suited to 3D printing. And the Austrian formwork specialist Doka Ventures has acquired a 30% share of the US-based startup Contour Crafting, a producer of gantry-style 3D printers for the construction industry.

- Political Push. Regulation, subsidies, and other public policy measures are encouraging the adoption of 3D printing in construction in many parts of the world. In the Middle East, the UAE is aiming for 25% of new buildings to be printed by 2030; and Saudi Arabia seems intent on using 3D printing to reduce its housing deficit. Elsewhere, the United Kingdom has developed a National Strategy for Additive Manufacturing, which estimates that in construction alone the technology could contribute more than $1 billion to annual GDP and create 15,000 jobs by 2025. In the United States, the Department of Defense is studying the idea of printing military barracks, using local materials, for its personnel worldwide.

Stimulated by these four factors, 3D printing in construction will continue increasing its participation in the sector. The various forms and applications of the technology are already well defined and classified. For a summary of them, see “Three Main Types, Six Main Applications.”

Three Main Types, Six Main Applications

Three Main Types, Six Main Applications

Three types of 3D-printing technology are used in the construction industry, each with distinctive applications and features.

Material Extrusion. Also known as deposition modeling, concrete printing, or contour crafting, this technique involves extruding material through one or more nozzles mounted on a robot arm, gantry, or crane. The process differs from the long-established sprayed-concrete method, in that it applies the material precisely and takes a layer-by-layer approach. It was developed for construction by such pioneers as Behrokh Khoshnevis, the founder of Contour Crafting, and is valued by many companies for its versatility in materials (concrete or mortar, gypsum, ceramics, polymers) and applications.

Powder Bonding. Also known as selective state change or binder jetting, this technique involves applying a laser or a liquid (adhesive or solvent) to a bed of sand mix, powdered metal, or other granulate feedstock, thereby fusing the material and creating a firm solid such as sandstone or steel. During the chemical or heat reaction, each new layer of material hardens on top of the previous layer. In the construction industry, the process was developed by Enrico Dini and his company D-Shape with the aim of producing overhangs and geometrically complex objects that are not possible with conventional building methods.

Wire Arc Additive Manufacturing (WAAM). This method involves the use of an electric arc to melt wire and a robotic welder or drip feeder to construct a metal object drop by drop. The process has gained wide publicity through MX3D’s bridge project in Amsterdam. At MIT, the Mediated Matter Group, in developing its digital construction platform system, has been experimenting with a related technique—robotic chain welding—to create rigid reinforcement structures.

The construction industry has, to date, adopted six main applications of 3D printing. They vary not just in character but also in their maturity. (See the exhibit below.)

Buildings. So far, companies have generally limited their efforts to smaller-scale buildings, especially compact single-story houses. The foremost exception is Winsun. In keeping with its founder’s mantra—“If you believe it’s impossible, we’ll print a prototype”—the company has successfully printed a five-story apartment block and a 12,000-square-foot (1,100-square-meter) villa, not to mention the Dubai Future Foundation office building. The Winsun factory near Shanghai contains a printer that is more than 330 feet (100 meters) long. Using a mix of cement, sand, and fibers—up to 50% of which derives from recycled demolition waste—this printer produces hollow walls that are then transported to their destination, filled with reinforcing and insulating materials, and quickly assembled onsite. The resulting building is a form of “printed prefab.” The automated printing process, according to Winsun, reduces the overall construction time by 50% to 70%, labor by 50% to 80%, and materials by 30% to 60% (thanks to the use of recycled debris and the minimization of waste). And all of that means much lower building costs—so much so that the Saudi company Al Mobty Contracting has reportedly made a $1.45 billion deal with Winsun to lease 100 3D printers and build 1,500,000 affordable homes.

Bridges. 3D printing can take maximum advantage of topology and of the properties of metals and concrete—ideal attributes for creating pedestrian bridges and perhaps eventually traffic bridges, too. The first full-scale printed footbridge opened in December 2016, in a park near Madrid. The 40-foot (12-meter) structure, assembled onsite from eight printed sections of reinforced concrete, is the result of a joint project by the Institute for Advanced Architecture of Catalonia and the Spanish contractor Acciona, in collaboration with Enrico Dini and D-Shape.

Another substantial printed bridge, intended for cyclists rather than pedestrians, was inaugurated in October 2017 in Gemert in the Netherlands. It stretches 26 feet (eight meters) across a ditch. The printing of the components took place offsite, involved some 800 layers of concrete, and took three months to complete. The project was once again a collaborative venture, among the Eindhoven University of Technology, the construction company BAM Infra, and others.

The best-known project is MX3D’s steel bridge, which is currently being printed by means of industrial robots and WAAM. The printing is scheduled to conclude in March 2018, and by the end of 2018 pedestrians should be using it to cross an Amsterdam canal.

Even though bridge building and other infrastructure work still constitute a niche application for 3D printing, because of the need for reinforcement, researchers are no doubt investigating the obvious next step: printed bridges that are strong enough to carry motor traffic.

Printed Molds. Architects and designers like to make their mark by devising urban structures of unique shape and form that will define a cityscape for decades. These nonstandard objects tend to be very pricey and time-consuming, however, when created by means of traditional casting. 3D printing holds the promise of greatly reduced lead times, costs, and waste. One front-runner in this field is the FreeFAB system, operated by the Australian-European contractor Laing O’Rourke. FreeFAB uses 3D printing to create complex wax molds, which can then be filled with concrete to produce the desired objects—for example, the double-curved wall panels of London’s Crossrail project. The molds, once they have served their purpose, are simply melted off, and the wax is then recycled. Compare that with customary molds fashioned from wood or polystyrene—labor-intensive and destined for landfill.

A rather different approach is taken by researchers at the Digital Fabrication Lab of ETH Zurich and by the startup Branch Technology. In each case, the aim is to replace external formwork with a “mesh mold” technique, whereby a robotic printer or welder fabricates a matrix of reinforced carbon fibers or steel wire in the exact shape of the desired object. This mesh structure is then filled with insulation foam or concrete, thereby serving not just as formwork but also as reinforcement. The ETF researchers, for their experimental DFAB House currently under construction in Switzerland, are deploying the robotic welder to create the mesh for double-curved load-bearing walls.

Building Components. Thanks to CAD and 3D printing, architects and designers can now add a personal touch to building components such as façades, joints, partition walls, and even power sockets. Some companies have started to print unique objects with special aesthetic or functional properties. The Swedish contractor Skanska was one of the first to exploit 3D printing in a commercial real-estate project: for the office building 6 Bevis Marks in the City of London, the roof canopy’s network of steel support struts needed decorative cladding at the nodal points, and Skanska found an economical and innovative solution by printing complex nylon sleeves. Since those daring days—all of four years ago—the company has worked with Loughborough University and various industry collaborators (such as ABB and Foster + Partners) on concrete-printing projects. One project involves printing high-spec concrete façades with special properties of insulation, light transmission, and structural strength. Such façades would be extremely expensive if built in traditional ways, so the use of 3D-printing technology could prove to be very cost-effective.

Architectural Models. Architects were early beneficiaries of 3D printing, which enables the rapid creation of small-scale models. Instead of the tedious traditional process of gluing paper cutouts, studios can print accurate polymer models direct from their CAD or Revit files as the basis for modifications or discussions with clients. Foster + Partners used such models as early as 1999, for their flagship Gherkin project in London. Since then, the firm has embraced 3D printing wholeheartedly, acquiring its own capabilities in 2004 and establishing a full in-house prototyping suite in 2011. The firm is now working to improve the printing of metal components and, with Branch Technology, is refining methods for printing full-scale structures: in August 2017, the two firms won NASA’s Centennial Challenge for constructing an “off-world habitat” (in effect, a house for use on Mars).

The most highly publicized 3D-printed models are probably those of the Sagrada Família church in Barcelona. As far back as 2001, the construction team began printing plaster models of various sections for tweaking by craftsmen, prior to concrete casting or robotic stone cutting. The models are based on Gaudí’s visionary and complex drawings (and on fragments of handcrafted models that were smashed during the Spanish Civil War). With the help of these new printed models, progress on the building has accelerated, and the scheduled completion date is now 2026—exactly 100 years after Gaudí’s death and a mere 144 years after construction began.

Interior Design. Finally, 3D printing is widely used for interior and furniture design, to the delight of designers, whose creativity can now find outlets well beyond the familiar limits. Witness Emerging Objects, a trailblazing manufacturer, consultancy, and self-styled “3D printing Make-Tank.” The studio applies various 3D-printing techniques to numerous materials (cement, metal, sand, waste rubber, sawdust, and even salt) to create unique domestic objects inspired by biological shapes. The products range from a twisting, honeycombed structural column and a decorative screen to planters, footstools, and lampshades.

The State of Play

The outlook is very promising, then, but at the moment, 3D-printed construction is clearly still a niche market. The outputs so far have for the most part been relatively small-scale and low-volume. As of the start of 2018, fewer than 40 large-scale demonstration projects and prototypes have been fully realized around the world, and the total value of all outputs is estimated at less than $100 million (in an industry with annual revenue of $10 trillion globally).

The technical limitations are sure to ease, however, as a result of further breakthroughs in equipment, materials, and processes. In due course, 3D printing will begin to compete with conventional in-situ construction and with prefab, and will likely be harnessed to produce greater quantities, to build larger-scale structures, and to fabricate everyday objects and objects that are more specialized and complex.

Champions of 3D printing have identified a number of ways the technology is benefiting, or could be benefiting, the construction sector.

- Freedom of Design. By reducing the costs associated with nonstandard shapes, 3D printing gives free rein to architects and designers. The technology can turn complex designs into real structures that are beyond the capabilities of traditional builders. As the new slogan goes, “If you can’t build it, print it.”

- Autonomous Construction. The skills shortage affecting the construction industry in many high-income countries could soon become less relevant—autonomous or semiautonomous 3D printers require minimal human surveillance. In addition, some of these printers are lighter and more mobile than conventional construction machinery such as cranes, and they can be used in hazardous areas or on remote sites, where prefabrication would be impracticable. Despite their high price, their effect will be to reduce overall equipment costs, which typically account for 20% to 25% of the cost of a traditional construction project.

- Predictability and Speed of Delivery. By operating 24/7 and by reducing onsite glitches and hence delays, 3D printers can cut construction times dramatically. Deliveries of building materials, for instance, will dwindle, as will the complex interactions between various trades.

- Sustainability. 3D printing will reduce the construction sector’s harmful impact on the environment. For a start, a large proportion of the feedstock—as much as 50%, according to some experts—could be recycled material. Furthermore, 3D printing allows contractors to use less material in the first place: by creating complex shapes, such as overhangs and folds, for functions such as insulation and shading, it dispenses with the need for additional material or separate structural units. In many cases, the form enables the function.

- Special Properties. Thanks to its mastery of “topology optimization”—through the use of conical, hollow, or honeycomb structures, for example—3D printing can endow its products with special properties, such as increased tensile strength or enhanced thermal insulation, without adding to their weight. Once again, form enables function.

The full benefits will materialize only when 3D printing is applied at scale. That time lies in the future—exactly how far depends on the rate at which the various obstacles are overcome. The main issues are as follows:

- Printer Technology and Economics. A mainstream onsite concrete printer costs $500,000 to $2,000,000, though prices should fall. At less than 33 feet (10 meters) in height, and with a throughput of less than 550 pounds (250 kilograms) per hour, it is limited to printing fairly small buildings. For larger-scale buildings, such as multistory office blocks or large-surface-area malls, a far more ambitious machine would be needed. Note that some startups are addressing these issues of cost and scale by experimenting with a different approach—deploying mobile, multi-axis industrial robots with a mounted printing nozzle. A used robot of this kind can cost $50,000 or less.

- Printing Process and Materials. Given the erratic weather on a typical construction site, it is not easy to accurately control the cooling or setting of materials, and hence to guarantee structural stability. Automatic adjustment has proved challenging, and in-line quality control remains far from perfect. More complex outputs, involving the printing of compound materials, are proving difficult to master: walls of reinforced concrete, for example, or walls with printed piping and wiring inside. The finishing and resolution of printed structures represent further challenges: the most promising solution here is to supplement the additive process with a traditional subtractive process, such as surface milling.

- Design and Engineering. Most architects and designers have yet to take advantage of their new creative freedom, and many show little interest in doing so. Tradition-bound as it still is, the construction industry will not easily adjust to the very untraditional concept of design for additive manufacturing. Even when architects and designers do produce excitingly innovative designs, that is not the end of the story. The blueprint has to be translated into a realized structure—a task that many construction engineers still struggle to complete. As professional education modernizes, however, and as a new generation of professionals takes over, the traditions should lose their power.

- Regulation, Procurement Rules, and Client Skepticism. The adoption of 3D printing in construction has been hampered by bureaucratic factors: slow incorporation into building codes, the imposition of arbitrary prescriptive standards rather than performance-based standards, and wide regional variation in regulations. (In many regions, building codes make no provision at all for 3D-printed construction techniques, materials, and testing.) Meanwhile, many prospective clients and tenants are underinformed or unconvinced about the safety and durability of 3D-printed buildings.

The obstacles are frustrating but not insurmountable. Some applications are already well-developed and even commercially viable, such as 3D-printed molds, architectural models, and some building components. But further improvements are needed in quality, speed, and cost. Sam Stacey, the director of innovation and business improvement at Skanska, sums up the status quo: “If we had a customer who wanted a 3D-printed concrete façade, we could do it now, but it would cost that customer quite some money.”

A business case can certainly be made for persevering with 3D printing in construction. Exhibit 3 compares 3D printing with conventional construction, demonstrating the overall advantages that the new technology could bring (once the obstacles are surmounted). Cost savings should be considerable, mainly owing to the reduction in materials and onsite labor. Important secondary factors are the reduction of delays, the lower risk of accidents, and the decrease in environmental impact.

Regarding the market segments, the leading application so far is small-scale vertical construction, both residential and commercial; 3D printing is particularly suited to the nonstandard shapes and components proposed by adventurous architects. Larger-scale commercial buildings might soon catch up and thereby increase demand and decrease costs. Richard Buswell of Loughborough University, expressing an optimism shared by most experts, believes that there could be a number of viable 3D-construction-printing businesses in five to ten years.

The most resistant segment is infrastructure and industrial construction, which uses many standardized components and requires structural reinforcement—two factors that traditional precasting can address less expensively than 3D printing. But 3D printing is bound to make the necessary technical advances sooner or later—sooner if investment in the technology continues its upward trend.

The Upcoming Evolution of the Value Chain

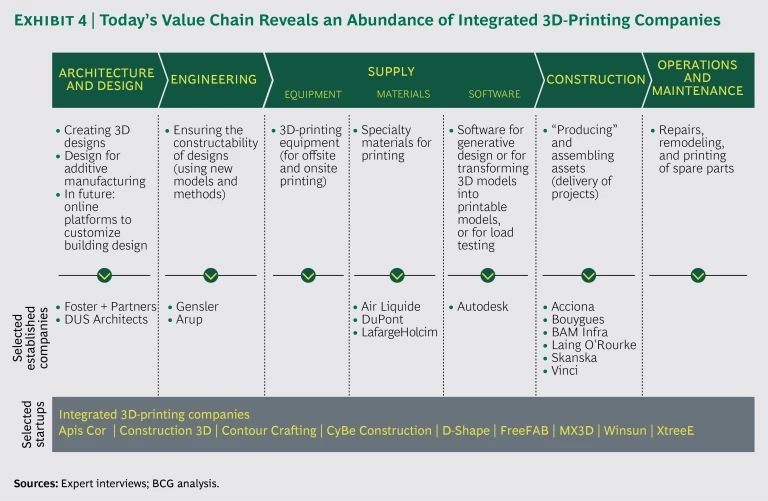

Study the numerous companies involved in 3D printing in construction today, and you will notice a curious pattern. As Exhibit 4 shows, a surprisingly large number are active in the construction phase of the value chain, and many of them are using equipment, materials, and software that they themselves have supplied.

One likely explanation is that equipment suppliers that have become involved with 3D printing are driven to dabbling in construction projects because they cannot find customers among established contractors. Many contractors are still too conservative to commit to 3D printing; others might be holding back because they have security concerns or because they are busy refining their own 3D software or developing in-house robotics skills. In the near term, then, the tendency will likely be toward integrated solutions: bolder companies might undertake the engineering (and even the design), supply the equipment and software (and even the materials), and carry out the actual construction—in other words, they might deliver entire turnkey projects using in-house resources.

In the longer term, though, as the technology and the market mature, 3D printing might graduate to the status of a construction technique such as prefab—one that contractors can access, as needed, from specialized subcontractors. Or the emphasis might fall on specialized equipment, which contractors can rent or lease from equipment suppliers. In this scenario, a 3D-printing-as-a-service model would develop: technology firms would concentrate on producing complex 3D-printed structures to order, or they would hire out equipment and skilled work teams to contractors; studios would specialize in generative design or 3D modeling; and software firms would emerge that specialize in design automation. For such companies, this more fragmented, more specialized scenario is much more appealing than the turnkey scenario: it looks much more scalable; it requires less capital and local knowledge and a smaller workforce; and most of the risk remains with the contractor.

Strategic Implications for Stakeholders

As this evolution proceeds, the construction industry as a whole will be transformed. Companies and governments would do well to prepare for this transformation and to influence it as far as possible to their own advantage.

Suppliers of Building Materials. Some cement manufacturers have developed special admixtures for 3D printing. In parallel, however, many 3D-printing startups have been developing proprietary mixtures in-house, based on Portland cement or other standard materials. So the competition to sell value-added products is intensifying. Established heavy-side companies will need to take action on several fronts if they are to stay ahead of the new entrants. They should keep enhancing their formulations. They should also leverage their local networks to attract 3D-printing firms as clients. And they should find ways to collaborate with equipment suppliers and contractors in order to reduce the risk of substitution or commoditization.

For light-side building-materials companies—those providing insulation, drywall products, or coatings, for instance—3D printing raises more serious concerns, because it reduces demand. No longer will so many different materials be needed. And special functions, such as sound or heat insulation, will be incorporated directly into the printouts. The need for finishing will likewise decline, as new additive and subtractive techniques improve the resolution of the printouts.

Contractors. The current skepticism among contractors is unlikely to last. They can see how some of the big-league contractors—Skanska, Laing O’Rourke, Vinci, and Bouygues, for instance—are introducing 3D printing into their projects, especially for residential construction. Progressive companies are starting to acquire the specialized skills and capabilities in robotics, programming, design, and material science. Others are no doubt poised to buy or lease the relevant equipment, or to subcontract for 3D-printing services. Others might seek to collaborate formally with research institutions or specialist companies in a consortium.

Once a contractor has integrated 3D printing into its toolkit, along with prefab and classic in-situ construction, it will be able to choose the most appropriate technology mix for a given project and bid for advanced commercial projects involving complex designs. The construction work itself will be speedier, less expensive, and less liable to rework than it would be if limited to traditional techniques. As for infrastructure and large industrial projects, contractors will require more patience: for many tasks, as mentioned, 3D printing cannot yet compete with prefab and casting on price or quality (structural strength). For some tasks, however, such as complex piping and sewage systems, 3D printing is almost project-ready.

Regulators and Owners. Governments can foster innovation by actively shaping the regulatory environment—setting performance-based standards and expanding building codes to include 3D-printing technology, materials, and testing. An encouraging precedent is the UK government’s approach to BIM: a clear regulatory framework coupled with strategic investment stimulated the adoption of the technology and gave UK companies an advantage internationally. Dubai seems poised to follow a similar path with 3D printing in construction. What’s more, governments tend to be major project owners in their own right—from infrastructure megaprojects to low-cost housing and disaster relief missions—and so stand to benefit directly from the efficiencies of 3D printing.

Equipment Suppliers. The future business model, as suggested above, will probably be less favorable for integrated turnkey-project providers and more favorable for companies that offer specialized 3D-printing services or that rent or lease equipment to contractors. Existing 3D-printing firms are well positioned to take on that role and to sell know-how and training as well as equipment, software, or special materials. Another possibility is a razor-and-blades business model, in which equipment suppliers make most of their profits by selling feedstock and other materials that the equipment uses. For suppliers of some construction machines—such as loaders and cranes—3D-printing technology poses a fairly serious threat because it greatly reduces the need for traditional equipment once the site has been prepared.

The Future, Near and Far

One day, perhaps, large buildings will be printed in their entirety by a single printer, with no onsite human input apart from the pressing of a switch and the topping up of feedstock. That is a very distant prospect. A more modest and realistic vision involves retaining several separate procedures and autonomous or semi-autonomous systems—including reinforcement, concrete extrusion, surface milling, and insulation—but integrating them closely with one another and with human workers. In the more immediate future, 3D printing in construction will extend its role further by popularizing and refining its special applications, such as printed molds or complex components, and keeping pace with ever more complex and ambitious designs. The momentum should continue, provided that the investment continues flowing as well.