BCG’s Retail-Banking Excellence benchmarking study (REBEX by BCG) profiles the operational and digital practices and performance of 20 of the world’s leading retail banks, a group of 40 institutions chosen for their size and the strength of their capabilities. (REBEX refers to our report as well as its underlying benchmarks, surveys, databases, and tools.) We refer to these banks as the “premier league.” This edition of the REBEX benchmarking, conducted in 2015, assessed premier-league banks, which together represented approximately 220 million customers and 26,300 branches worldwide.

This year’s benchmarking showed, once again, that banks leading in measures of operational and digital excellence reaped the lion’s share of financial rewards. They achieved 50% higher average pretax profit per customer than the median, while their operating expenses per customer were 30% less, a savings largely driven by lower personnel and IT costs.

At the heart of the benchmarking are core operational metrics. These include full-time employee (FTE) productivity by activity mix, cycle time, and degree of automation as well as an assessment of the bank’s digital maturity—for example, the functionalities available through various digital channels.

Global Retail Banking 2016

- Banking on Digital Simplicity

- Customers Steer Digital Trends Driving Retail Bank Transformation

- Retail Bank Operational and Digital Leaders Reap the Rewards

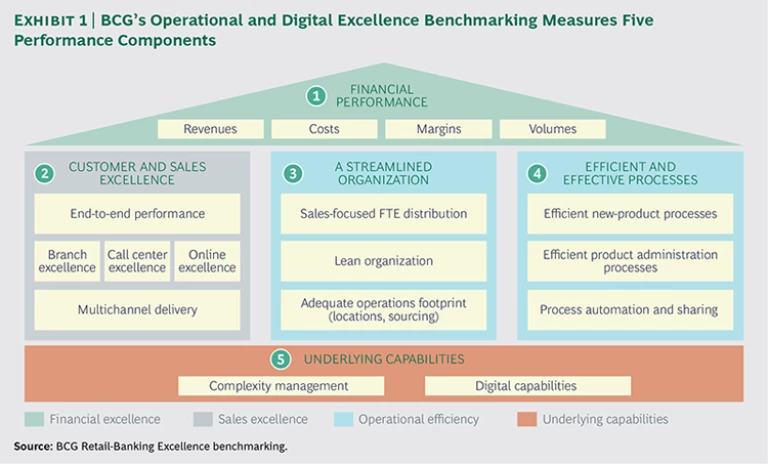

The scope of the benchmarking is broad, providing an end-to-end view that comprises five components of retail bank performance and operational and digital excellence: financial performance, customer and sales excellence, efficient and effective processes, a streamlined organization, and underlying capabilities. (See Exhibit 1 and “The Five Levers of Operational and Digital Excellence.”)

The Five Levers of Operational and Digital Excellence

Retail banks that aspire to improve and prevail must master the five levers of operational and digital excellence. The following, drawn from our annual benchmarking and our experience with clients, are among the best practices and success factors for each lever.

Financial Performance. Banks with the best financial performance show not only higher net-interest margins but also higher noninterest income per customer. Operating expenses per customer are another important variable, driven largely by lower personnel and IT costs.

Customer and Sales Excellence. Leading banks need to provide effective sales and service across all channels, seamless transition between channels, and easy-tobuy, easy-to-sell, easy-to-service products that are immediately functional.

Efficient and Effective Processes. Successful banks develop processes that are simple and fast, using automation, paperless processes, workflow tools, and automated task management. The goal is not only to reduce costs but also to deliver an excellent experience for customers.

A Streamlined Organization. The strongest banks create an organization that is truly customer focused, with a high proportion of customer-facing roles, and that has lean back- and middle-office functions. These banks eliminate multiple layers of management, bringing executives closer to the front line.

Underlying Capabilities. Leading banks are reducing complexity and building capabilities in digital channels (for example, by offering a rich set of functions for mobile devices), using digital technologies to automate end-to-end processes, and building capabilities in data management and analytics to better serve customer needs.

Financial Performance

Our benchmarking reveals a significant disparity in financial performance separating the leaders in operational and digital excellence from the rest. Average pretax profit per customer was $367 for top-quartile banks, more than 50% higher than for the median, which came in at $239.

Although differences in net-interest margins account for some of this gap, a distinguishing factor of leading banks was their ability to generate more income per customer that was not derived from interest. Top banks relied less heavily on net-interest income, which made up 70% of total income at top-quartile banks and 84% of total income at the median. At top-quartile banks, operating expenses per customer were also 30% lower than at the median, driven largely by lower personnel and IT costs. The average cost-to-income ratio for top-quartile banks was 47%, compared with 54% at the median. We observed less variation, however, in risk costs among benchmark participants; the value was 16 basis points for top-quartile banks versus 19 basis points for the median.

Customer and Sales Excellence

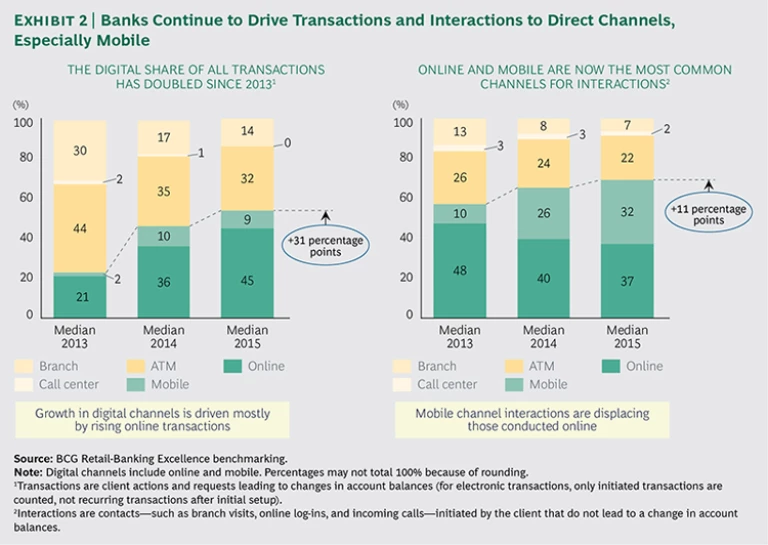

Banks continued to drive interactions and transactions away from branches and toward direct channels—that is, mobile and online

Banks encouraged customers to self-serve through direct channels for basic needs, reserving other channels for more complex needs and relationship-based selling. This migration to digital is achieved more easily when banks make these channels demonstrably easier to use. In this year’s benchmarking, two in five new accounts at leading banks were sold directly, outside of branches. The vast majority of customers at top-quartile banks, approximately 71%, are now enrolled online, representing 43% of all transactions. Mobile enrollment rates are similar, 66% at top-quartile banks. But just 15% of all transactions at top-quartile banks take place on mobile.

Many banks are providing positive incentives for using direct channels. More than 50% of banks participating in this year’s survey reported that they reward customers for using direct channels; for example, some provide higher interest rates for savings products that are set up and administered exclusively online. Likewise, approximately a third of participants said that they use negative incentives like charging a fee for a transaction that could have been conducted via a direct channel but instead was undertaken in a branch.

The best banks are also encouraging customers to use mobile by developing functionalities for that channel. However, despite the growing emphasis on direct channels, branches still constitute a critical component of banks’ interactions with customers.

While customers increasingly demand digital features as a basic requirement, they still want personalized, face-to-face contact at certain points in their banking relationship.

Thus, the role of branches as well as their network density and formats are evolving. Banks are trying to maintain their distribution reach while reducing their distribution cost. They are also reducing the density of their branch footprint, experimenting with lower-cost formats, developing video capabilities, and deploying hub-and-spoke models—with main-branch “hubs” that provide full services and smaller “spoke” offices focused on self-service. Going forward, we expect to see a wider variety of formats such as transaction-only, “light,” full-service, and flagship branches, as well as increased variation in hours of operation and staffing profiles. These new formats will require higher-level, more differentiated support, such as paperless services, remote support from specialists through videoconferencing and mobile interfaces, and prebooked appointments.

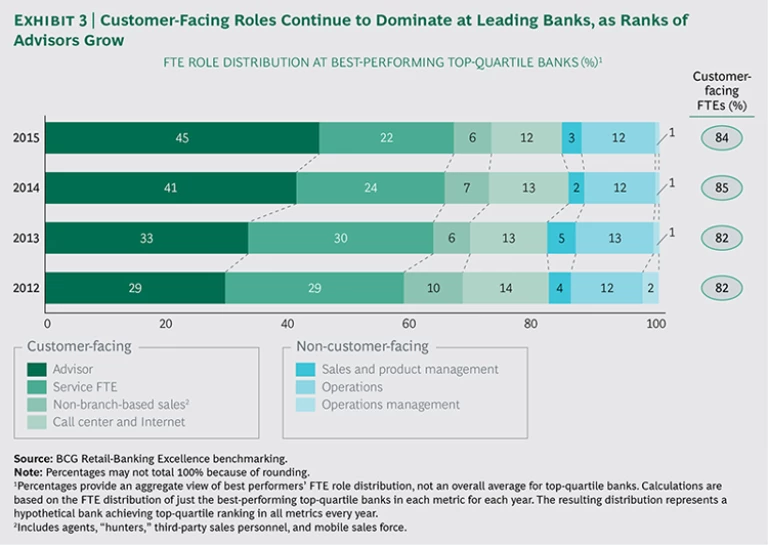

Our Operational Excellence in Retail Banking 2015 report highlighted the trend toward banks becoming “bionic,” and this year’s study provided further evidence that the trend continues. Leading banks focused a greater share of their FTEs on advisory activities in branches; 45% of FTEs at top-quartile banks worked in advisory roles, compared with 41% in 2014. (See Exhibit 3.) Advisory roles for the median totaled 38% of FTEs, up from 31% the previous year.

As top-quartile banks focused more FTEs on customer-facing advisory activities, their advisors also spent more of their time preparing for and attending customer meetings. These appointment-related activities made up 60% of an advisor’s time at top-quartile banks, compared with 50% at the median. Optimizing the productivity of branch staff will remain a priority for leading banks.

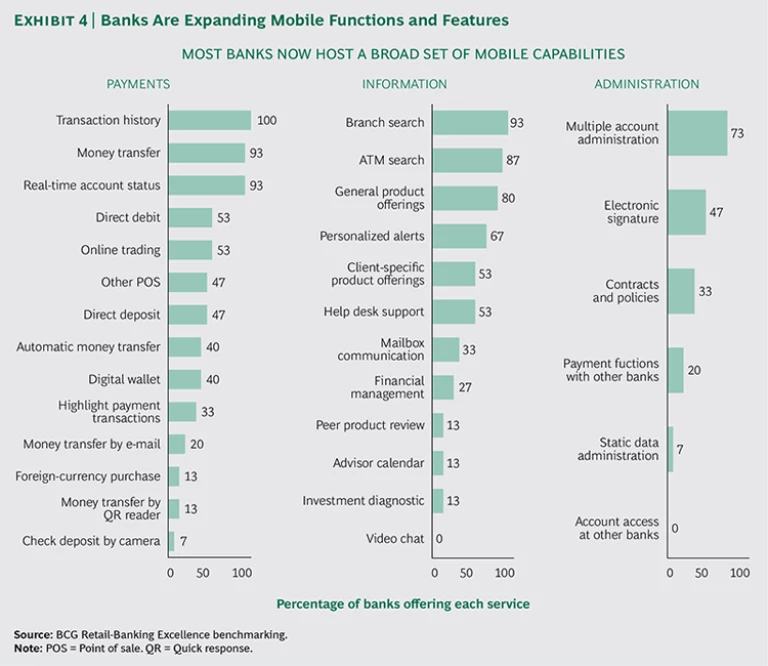

Responding to customer demand, banks continued to boost mobile functionality and add new mobile-app features. For instance, 93% of participating banks said they offered online money transfers and real-time account status functions, and 73% planned to add mobile payments with other banks; currently, just 20% offer this functionality. And 87% intend to provide check deposit by mobile camera, compared with just 7% currently. (See Exhibit 4.)

Leading banks are also increasing the number of products available through mobile. Today, most products once accessible only at branches or online are now available on mobile devices—including unsecured loans, mortgages, and investment accounts. In some countries, though, regulatory attitudes limit the remote interactions that banks can offer without face-to-face contact.

The objective of many banks is to create a seamless multichannel experience, facilitating natural customer pathways between channels without the need to repeat actions or enter the same data twice and with all the required information available regardless of channel. (See “Poland’s mBank Puts Digital Tools in Customers’ Hands.”)

Poland’s mBank Puts Digital Tools in Customers’ Hands

With more than 5 million customers across Eastern Europe, mBank has become Poland’s leading digital bank. In 2013, the bank revamped its online-banking platform, designing, testing, and implementing more than 200 new features in just 14 months.

The enhanced website gives customers an intuitive online interface for interacting with the bank through Google-like search and self-serve functions. Customers can review all account and product details on the same platform, along with tools to analyze their spending patterns, project account balances on the basis of upcoming bills, and transfer funds to social media and mobile contacts.

Customers receive product recommendations based on their activity and preferences, with access to human support by phone, Web, and online video chat.

The new digital tools are an important part of mBank’s multichannel strategy across all of its markets.

In its home market of Poland, the bank has enhanced its branch network with differentiated branch formats. The bank’s Light branches, for example, specialize in customer enrollment, using digital tools to highlight a commitment to easing the customer experience.

In the Czech Republic, mBank is adding to its distribution network to reach even more customers and increase convenience—for example, it is working with a Czech financial-planning firm to distribute mBank products in 70 of the Czech firm’s branches, and it will open 20 to 30 of its own outlets in a new and modern format.

Efficient and Effective Processes and a Streamlined Organization

Banks continue to simplify and digitize end-to-end processes to reduce costs, increase efficiency, and improve the customer experience. However, only top-quartile banks have full straight-through processing for simple products such as credit cards and unsecured loans. For more complex products such as mortgages, even top-quartile banks still use semimanual processes. (See “PNC Bank Puts It All Online with the Tracker.”)

PNC Bank Puts It All Online with the Tracker

PNC Bank, a US-based bank, launched the Home Insight Tracker in December 2014. The Tracker enables customers to manage all aspects of their mortgage application from start to finish, using online and mobile channels exclusively.

Applicants can initiate their application online, submitting personal details and uploading relevant verification documents. They can view the status of their application online or within the mobile app, receiving e-mail updates and push notifications when their application reaches key milestones.

The messaging service gives applicants the ability to keep in touch with their account manager online, uploading any additional verification documents as required.

Applicants can even give restricted-view access of their application status to their real estate agent. The tracker offers many benefits:

- It automates the end-to-end application process.

- It enhances the customer experience.

- It reduces cycle times.

- It allows applicants to monitor their application’s progress.

- It eliminates time-consuming branch visits.

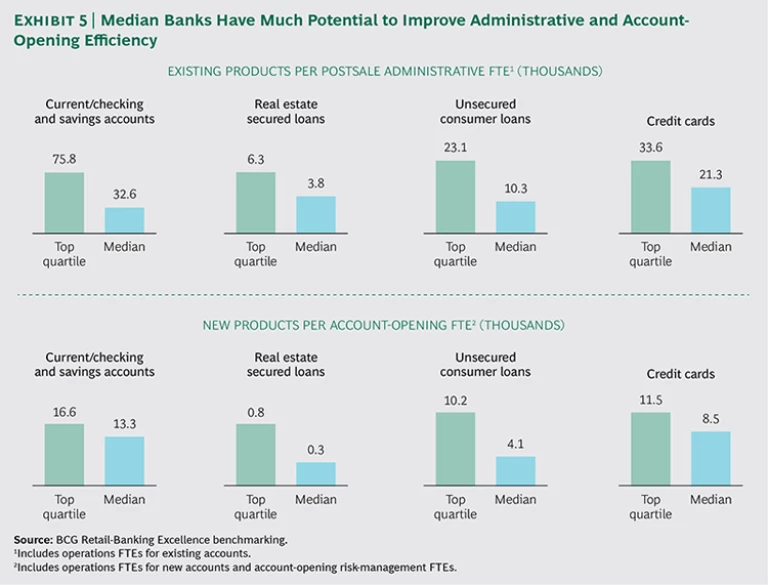

Although many banks have been successful in automating applications, fewer have achieved high levels of automation in middle- and back-office processes. As a result, productivity varies significantly. For example, in unsecured loans, account-opening FTEs at top-quartile banks opened approximately 10,000 accounts over the course of the year, while their counterparts at median banks managed just 4,000. Similar differences were observed for administration of existing accounts: at top-quartile banks, FTEs dedicated to postsales administration managed about 23,000 existing unsecured loans each, whereas their peers at the median managed just 10,000. (See Exhibit 5.)

Overall, lean operations processes at top-quartile banks resulted in a significant difference in the number of operations FTE required for a given number of customers: top-quartile banks have approximately 4,400 customers per operations FTE; at the median, the number is just 2,900.

As a result of banks’ efforts to improve processes, cycle times have continued to fall across all products. For example, for unsecured loans, median cycle time has fallen from approximately two hours in 2012 to about 50 minutes in 2015.

To facilitate improvements in end-to-end processes, banks are reducing their out-sourcing scope, bringing some activities back in-house. At top-quartile banks, 7% of all FTEs were outsourced in 2015, down from about 11% just two years before. Owning processes from end to end enables banks to optimize more extensively.

As banks focus on optimizing end-to-end processes, the proportion of FTEs in customer-facing roles is rising. At top-quartile banks, approximately 85% of FTEs were in customer-facing roles in 2014. At the median, 74% were in customer-facing roles, a slight increase from 71% in 2014.

However, as the percentage of customer-facing FTEs increased, sales productivity for top-quartile banks—such as new accounts per customer-facing FTE—fell by about 20% in this year’s study, after having steadily increased in recent years. Productivity at the median also fell, after having largely stagnated. A challenge for banks will be to resume gains in sales productivity while continuing to increase the ranks of sales employees.

Despite significant progress to date, substantial opportunity remains to industrialize and increase efficiency from end to end. Many banks have undertaken a first round of lean process redesign. But a second wave of efficiency is needed to embed practices in the business—paperless processes, workflow tools, and automated task management are only now being introduced in many institutions.

While all participants in our benchmarking survey claimed to have a digital roadmap, by far the biggest motivator was improving sales and enhancing the customer experience rather than enhancing the efficiency or quality of processes. Only 19% of respondents said that the main focus of their digital efforts was process automation.

Underlying Capabilities

Banks are reducing product complexity in order to lower costs and improve the customer experience. Less complexity improves back-office efficiency and also makes front-office processes simpler for sales staff and customers alike. Leading banks continued to reduce the number of inactive (administered only) legacy products: the average for top-quartile banks was 4; at the median, it was 18. Overall product sets for top-quartile banks continued to fall and were 35% lower in our survey than two years ago.

Leading banks are also simplifying their IT architecture to boost agility, flexibility, and efficiency. This may include rationalization of applications—decommissioning legacy applications, for example, and replacing or consolidating applications—which can drive IT cost reductions of 15% to 20% while significantly improving overall agility and speed. Reducing the number of technology patterns can realize savings of up to 15% of IT costs and enhance agility.

Banks have focused on data management and analytical capabilities, both to increase sales and to improve the customer experience. But significant progress remains to be made.

Banks are seeking to future-proof themselves against decreased traffic to branches (which offers easy lead generation) by improving generation and conversion rates of other channels.

Substantial opportunities remain in lead generation; only 11% of banks consider 75% or more of their leads to be high quality. Data management and enhanced analytics are critical capabilities that banks should develop to increase the quantity and quality of leads. Banks that focused on lead quality in 2015 achieved nearly three times as many annual sales per customer as banks focusing on quantity, with more than 50% of their high-quality leads resulting in a sale. Today, only 31% of banks are using needs-based analytics to improve the quality of lead generation and boost sales. Instead, nearly half of all leads were the result of inbound customer inquiries. Only 33% of banks used transactional or behavioral data to generate leads, with 56% using internally generated static data and the remaining 11% using both internal and external data.

Improved data warehousing is critical for effectively managing multiple channels and providing a “single view” of the customer as well as improving the customer experience. Just one in three banks reported having a unique customer ID across all channels—a crucial capability for offering a seamless, multichannel customer experience.

What Does It Take to Succeed?

As the world’s top-performing retail banks continue to widen their lead over the rest, banks that aspire to join them at the top will need to jump-start their digital transformation. This is true no matter how much or how little disruption a bank has encountered to date, or how far along the path of digital development it has progressed.

Digital development cycles are extremely rapid—far faster than traditional product and service cycles. The overly deliberate and cautious approach that many banks take is already outdated, leaving them fighting yesterday’s battles and shrinking in today’s markets.

Achieving the REBEX Leadership Goals

Given the pervasiveness, lower cost of entry, and potential impact of digital technology, it is imperative that banks act today to launch new digital products and services and to digitize internal processes. A committed, full-scale digital implementation will be the only way for banks to achieve the four REBEX leadership goals that will allow them to rise above the median and lead the pack:

- Understand, strengthen, and deepen customer relationships.

- Reimagine customer journeys from front to back using digital technologies.

- Create agile, simple, and highly collaborative organizations.

- Enhance digital capabilities.

Understand, strengthen, and deepen customer relationships. With the proliferation of fintech competitors and the evolution of customer attitudes and behaviors, banks face the danger of becoming increasingly commoditized over the next five years. To prevent this, they must focus on customers’ needs and priorities. They must become customer centric, not product centric.

Banks should seek to increase their interactions with customers and to consistently deliver a positive experience—perhaps extending offerings to include nontraditional banking products and services, through online and mobile channels. Banks should consider engaging customers in life events rather than simply offering products—they could, for example, design offerings that support a customer’s move to a new home in its entirety, rather than just financing the purchase.

They should also continue to push for fresh and innovative means of developing deeper relationships with customers, including multiproduct and multichannel relationships. Deeper relationships are more profitable and offer a lower cost to serve. Banks should seek to push customers up the relationship hierarchy; current accounts alone are no longer the benchmark of a customer’s main banking relationship. Instead, banks should aim for customers to have at least two high-quality cross-holdings and to make active use of online functionality.

Banks must develop capabilities in digitally based data and analytics and embed them at the heart of the business. Advanced data analytics greatly increases value creation through improved customer understanding and higher-quality lead generation. More efficient and effective use of information also reduces costs. The very best banks will buy or partner with fintechs to learn from their methodologies, tools, and capabilities, thereby achieving a step change in performance.

Reimagine customer journeys from front to back using digital technologies. Banks should redesign customer journeys to focus on customers’ needs and simplify the customer experience by overcoming both visible and hidden customer compromises and frictions. This should be based on a deep understanding of natural customer pathways across channels and should allow customers to move seamlessly among channels.

Digital roadmaps should include middle- and back-office processes, allowing full automation of certain functions while focusing on the front-end customer experience. Digital advances made to date, even at the front end, have primarily focused on sales. Even the most advanced banks need to do more to digitize and improve service.

Banks should embed compliance activities within core processes, streamlining compliance as a function rather than bolting it onto existing processes. Compliance should be integrated into the customer journey, ensuring rather than hindering an excellent end-to-end experience. Banks that achieve this transformation can earn 50% more revenue per customer than their peers and reduce costs by as much as 20%, among other financial gains.

Create agile, simple, and highly collaborative organizations. Banks need to adapt their working styles and incorporate agile approaches to development. Deploying cross-functional teams that focus on individual product features and working in short cycles will increase product ownership, decrease errors, and speed time to market. This means that banks must implement far more nimble development processes and become more comfortable with decision making amid uncertainty.

In the front office, for example, banks should reduce their product portfolios and complexity, simplify account-opening processes, and make straightforward transactions as simple and hassle-free as possible for the customer. Greater opportunities await in middle- and back-office functions, however, where digital technologies offer enormous potential to simplify, remove activities that can be automated or are unnecessary, eliminate unnecessary bureaucracy and management layers, and industrialize core processes.

Retail banks need to attract and retain scarce entrepreneurial talent to rapidly drive ambitious plans. This requires identifying new roles and skills to be recruited, a clear strategy for acquiring new talent (build, borrow, or buy), and a compelling value proposition that will allow banks to compete with technology companies to attract employees with digital talent. Generally, these individuals will be hired from outside the organization or even “acqui-hired”—through the acquisition of digital studios. Digital expertise should not be restricted to expert teams in charge of innovation; it should also be embedded in the leadership team.

Banks must develop a digital culture to disrupt their own business before rivals do it to them. They should implement a cultural program that clearly supports cross-functional work, collaboration, customer centricity, and risk taking.

Our experience with clients shows that success with this kind of trial-and-error approach requires a structured transformation built on three steps: securing quick wins at the outset, scaling up successful initiatives, and leading and sustaining change through a renewed and agile operating model.

Fresh organizational models are likely to evolve for banks during this transformation. Whatever the model, however, we believe that digital strategy must be embedded within the business to ignite and fan successful innovation at the core. In contrast, a truly disruptive business model reinvention is generally conducted more effectively from outside the core business.

In recent years, ING Netherlands felt growing pressure from digital innovators that were relentlessly raising consumer expectations for service, speed, and connectivity. The bank responded by undertaking an agile transformation that involved—and empowered—employees throughout the organization by breaking down traditional silos. The transformation enabled the bank’s customer proposition teams to accelerate the pace of software deployments from a few per year to one every few weeks. (See The Power of People in Digital Banking Transformation, BCG Focus, November 2015.)

Enhance digital capabilities. Rather than use the top-down, strategy-driven approach of the past, banks need to innovate to enhance their digital capabilities using build, assess, and learn cycles, even when they are not entirely sure of the outcome. Banks should focus on pilot tests and prototypes that can be developed and rolled out quickly, assessed for performance, and scaled up (or shut down) accordingly. They need to embrace the concept of “fail fast and fail cheap” and build digital capabilities through direct experience. And rather than making a single big, strategic bet, they need to manage multiple initiatives, trying out new business models with low sunk costs, killing off the losers, and scaling up the winners.

IT architecture can also be heavily simplified to boost agility, flexibility, and efficiency. This may include rationalization of applications—for example, decommissioning legacy applications—or simplification of the IT infrastructure by eliminating redundant technologies. Beyond IT simplification, there is also a need to address how the behavior and activities of individuals affect an organization’s structures, processes, and layers. This requires understanding how people behave—and why—in order to change the context and encourage desired behavior while removing restrictions that create complexity.

Simplification and digitization are two sides of the same coin: simplification helps accelerate digitization, and digitization forces a bank to simplify. Transformations should therefore entail both elements.

The Path to Measurable Results

Our research and case experience show that banks focusing on the four key goals can achieve significant, measurable results.

One bank in Western Europe strengthened customer relations by improving data sources and adopting new analytical models. As a result, it increased its marketing up-sell rates by 500%. Another bank boosted its offer conversion rate sixfold by employing advanced analytics to implement dynamic segmentation.

Banks moving from a median to a top-quartile position on each of the four key goals can reduce operating expenses by 15% to 25%, depending on the initial position of the bank. For the median premier-league bank in our benchmarking study, this translates to a pretax profit increase of 20% to 30%, and a 5- to 10-percentage-point increase in pretax profit margin.

Indeed, our experience confirms that for banks willing to undertake the transformation to digital simplicity, using tested toolkits and methodologies, these benefits are entirely achievable.