This article—the second in a series exploring the practicalities of going public—looks at what drives a premium IPO valuation. The previous article, “Anatomy of an Ideal IPO Candidate,” dispelled some myths about barriers to going public.

Planning for an initial public offering is a lot like planning a wedding. Some factors that affect success, such as investor sentiment, are beyond a company’s control, while others, such as the offer price, can only be dealt with shortly ahead of the big day. But many others should be addressed proactively with thorough planning over an extended period. Indeed, new research by BCG finds that some of the most important factors driving a premium IPO valuation are those for which preparation should begin well before the opening bell rings.

Our research focused on the issuer’s valuation multiple as determined by the offer price on the listing date. If the multiple exceeds the industry average at the time of listing, the issuer has listed its shares at a premium. Among European companies that went public from 2010 through mid-2017, 56% achieved a premium valuation, although there were wide variations among industries. The remaining companies—almost half—failed to reach the average multiple for their industry when they listed their shares.

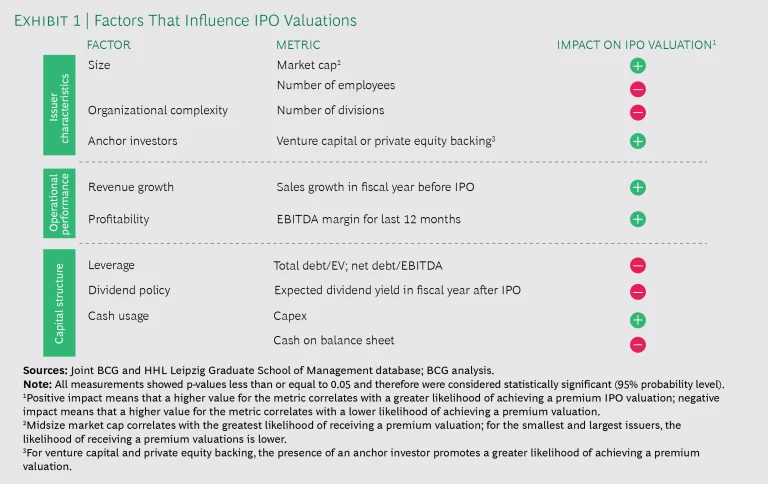

What are issuers that achieve a premium valuation doing better than their peers? To find the answer, we analyzed the influence of 24 factors in three categories: issuer characteristics, operational performance, and capital structure and financial ratios. (See Exhibit 1 and the sidebar, “Study Methodology.”)

STUDY METHODOLOGY

STUDY METHODOLOGY

BCG’s study sampled 497 IPOs at the ten largest stock exchanges in Europe from January 2010 through June 2017. To control for very small IPOs (mainly technology and pharmaceutical companies tapping the market for seed money), we excluded IPOs of companies with less than €5 million in annual revenue in the year before the offering. We also excluded financial services firms because of the limited comparability of their revenues and margins.

We compared each issuer’s valuation multiple, as determined by the offer price on the listing date, with the average val-

uation multiple of its peers in the relevant Stoxx Europe 600 sector index. First, we determined whether an issuer listed at a premium or a discount valuation relative to the industry average. Second, we calculated the exact magnitude of each issuer’s premium or discount.

To ensure that results were not distorted by differences among companies and accounting standards, we separately analyzed four trailing multiples: EV/revenue, EV/EBITDA, EV/EBIT, and P/E. The four analyses yielded similar results. For simplicity, we focus in this article on the results relating to EV/revenue.

To understand what influences an IPO valuation, we looked at how it correlates with 24 company characteristics. Those characteristics with a significance level of 1% or 5% were considered to be influential. To ensure the robustness of our analyses, we conducted several statistical crosschecks, such as multivariate tests.

We recorded results for the overall sample and at the industry level. Our industry-level analyses sought to understand whether the factors that influence a valuation are different for growth industries (such as health care and technology) than for more mature industries (such as building materials, chemicals, industrial goods, oil and gas, and transportation).

Our study confirmed that some intuitive factors, such as strong revenue growth and above-average margins, are indeed highly influential. But we also found that some less obvious factors, including organizational complexity, leverage, and expected dividend yield, are equally important. The relative importance of each factor depends on the maturity of the issuer’s industry and the size of the company. Surprisingly, some factors that are generally regarded as important in the IPO process, such as timing and the number of underwriters, appear to have little or no influence on the IPO valuation.

The Issuer Characteristics That Matter Most

We sought to understand which characteristics influence an issuer’s valuation on the IPO date. Among the characteristics we explored, three stood out as having the greatest influence.

- Size. The sweet spot for IPO valuations is occupied by midsize companies, not the largest issuers. Midsize companies—with a market cap of €300 million to €1 billion—enjoy the highest likelihood (64%) of receiving a premium valuation. The smallest issuers (market cap of less than €50 million) have the lowest likelihood (45%). The largest issuers (market cap exceeding €10 billion) also show a very low likelihood (20%) of receiving a premium valuation, reflecting the fact that very large IPOs often are priced conservatively, or even at a discount, to ensure successful share placements. We also found that companies with a large number of employees compared with their industry peers are less likely to receive a premium valuation.

- Organizational Complexity. IPO investors seem to have a preference for simpler organizations. To assess the importance of organizational complexity, we looked at how the number of divisions influences the IPO valuation. In the year before the IPO, issuers receiving a premium valuation had fewer divisions (2.8 versus 3.2), on average, than companies with a discount valuation. Companies with simpler organizations—typically those focused on a single business—fare better in the IPO market because it is easier for investors to understand their operations and set expectations for their performance. This is in line with the trend toward using spinoffs, carve-outs, and divestitures to give investors an opportunity to invest in specific divisions, each with its own cash flow profile.

- Anchor Investors. To understand the importance of anchor investments, we looked at whether backing by a venture capital fund or private equity firm influences valuations on the IPO date.

VC-backed companies have a higher likelihood of receiving a premium valuation than other companies.

We found that VC-backed companies have a higher likelihood of receiving a premium valuation than other companies (78% versus 54%). VC backing appears to boost investors’ confidence that the issuer can deliver on the promises in its equity story. Further, investors seem to regard VC backing as certifying higher growth expectations and validating the claims in the business plan and equity story.

We found even clearer implications relating to ownership by a PE firm. In the overall sample, PE backing had a statistically significant influence on the likelihood that issuers would receive a premium valuation: the EV/EBITDA multiple for PE-backed companies exceeded that of other companies by 1.6x. Investors may have greater trust in PE-backed IPO candidates because they believe that PE ownership focuses the entire company on growth and value creation. Or it may be that PE firms are simply more aggressive in demanding and achieving higher multiples for IPO companies exiting their portfolios. The results varied by industry cluster, however. PE backing did not significantly influence the valuation of companies in growth industries, but it strongly promoted premium valuations for issuers in more mature industries. PE backing appears to help large, mature companies secure share placement without having to price at a discount on the IPO date.

It is clear that investors are looking at an issuer’s characteristics in order to find clues about the company’s intrinsic ability to create value. An IPO candidate must take several steps to determine the characteristics that matter most given its industry context and address them before the IPO date. First, it must identify which investor groups to target and determine their expectations with respect to key characteristics. It can then ensure that its equity story addresses these topics and mitigates investors’ concerns. For issuers with a complex structure or multiple business models, it is especially valuable to present a convincing and reassuring discussion of company characteristics. Very large companies can use a convincing equity story to rally sufficient demand, so that they can list their shares without pricing at a discount to support share placement.

Strong Operational Performance Over Time Makes a Difference

Unsurprisingly, strong revenue growth and above-average margins promote a premium valuation. But investors are not shortsighted. They want to see a convincing track record for sales and profits leading up to the IPO, ideally starting two years before the offering.

- Strong Revenue Growth. Companies that post double-digit revenue growth in the years before the IPO are more likely to have a premium valuation than those that experience a lower growth rate. Companies with above-average revenue growth in the year prior to an IPO are twice as likely as other issuers to experience a premium valuation. Further, IPOs that receive premium valuations achieve a 10% higher growth rate in the first and second years after their IPO.

Because issuers are not able to disclose their forward-looking business plan in most jurisdictions, the pre-IPO revenue development needs to provide investors with sufficient assurance that the company can sustain its growth in the years ahead. An IPO candidate’s equity story should reflect its revenue development and show that historical growth has been driven by strong fundamentals.

- Above-Average Margins. It goes without saying that companies with margins above their industry average are more likely to attract a premium valuation. Underscoring the importance of having strong margins, we found that earnings significantly influence IPO valuations in all industry clusters. Companies with above-average EBITDA margins have a much higher likelihood of achieving a premium valuation than those with below-average margins (80% versus 37%). We also found that margins have a statistically significant impact on the size of the premium or discount. For companies with above-average margins, multiples are 0.76x higher than the average of their respective sector indexes. For those with below-average margins, multiples are 0.46x less than the sector average.

Investors want to see a convincing track record for sales and profits leading up to the IPO.

Realizing above-average margins and revenue growth is challenging and requires hard work and a disciplined approach in the years before the IPO. When planning for a public listing, the company should be even more diligent than usual in preparing and executing a sound business plan. The plan should support the company’s growth ambitions with detailed initiatives and place special emphasis on the areas that the target investor groups care about most. A stringently executed business plan provides the basis for a strong financial section in the equity story and boosts investors’ confidence that the company’s ambitions are supported by a credible track record. It will also help executives deliver against expectations once they are in the glare of the capital markets after the IPO.

Capital Structure and Dividend Policy Are Also Influential

Because capital structure and other financial ratios offer important insights into a company’s setup and establish expectations for future investment returns, they strongly influence IPO valuations. However, we found that investors’ expectations are often determined by the maturity of an issuer’s industry.

- Leverage. In the prevailing environment of low interest rates, it has become even easier for companies to take on debt to finance operations and corporate development. However, IPO investors still seem somewhat skeptical about high levels of debt financing. For issuers with a premium valuation, the ratio of total debt to equity is 19%, compared with 24% for those listing at a discount. The leverage ratio that investors regard as favorable depends on the issuer’s industry. In growth industries, lower leverage correlates with a higher likelihood of receiving a premium valuation. Investors are less likely to punish highly leveraged companies in mature industries, however, where higher debt-to-equity ratios are more common.

- Dividend Yield. Although investors will not receive dividends until months after the IPO date, the expected dividend yield has a significant impact on IPO valuations. In our overall sample, a lower dividend yield one year after the IPO correlated with a higher likelihood of premium valuations. For issuers with premium valuations, the dividend yield one year after the IPO was 2.1%, compared with 3.4% for those with a discount valuation. However, the same relationship did not hold at the industry level. In mature industries, issuers earning a premium valuation had an expected dividend yield, on average, of 3.8%. For their counterparts in growth industries, this figure fell to 1.6%—an indication that investors usually favor growth companies that use their IPO proceeds to finance expansion rather than to pay out dividends. In some mature industries, including industrial goods, oil and gas, and chemicals, a higher dividend yield correlated with a higher likelihood of premium valuations.

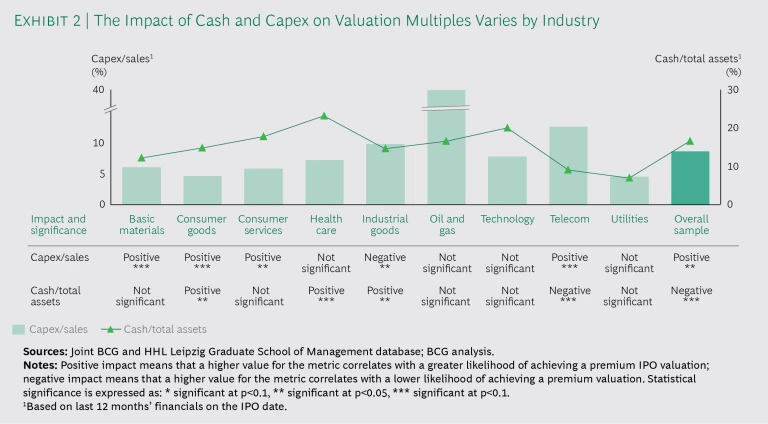

- Cash Usage. IPO investors favor issuers that put their cash to work (using it to grow the business, for example) over those that sit on their cash. Issuers with balance sheets that show low cash levels and high capex on the offering date are more likely to receive a premium valuation. When capex levels are high, IPO investors have higher expectations for the company and see a greater opportunity for market disruption, especially if the company is in a growth industry. Cash and capex levels are less relevant for companies in mature industries and thus have less influence on valuation multiples. (See Exhibit 2.)

To optimize their capital structure for an IPO, companies need to make a variety of difficult decisions and tradeoffs. For example, if target investors expect a high dividend yield, the company might need to reduce capex and accumulate cash on its balance sheet for higher payouts. The appropriate tradeoff between reinvesting cash and paying dividends can theoretically be made shortly before or after the IPO date. However, if the payout strategy is not consistent with the issuer’s historical profile and business plan, investors will question the substance of the dividend and investment strategies. To make a convincing case to investors, the company’s IPO-adjusted capital structure and payout strategy should be reflected in its business plan one to two years before the IPO.

Investors’ expectations are often determined by the maturity of an issuer’s industry.

Some Factors Have Surprisingly Little Influence

Several factors that are seen as important considerations in IPO planning and execution have little or no influence on achieving premium valuations.

- Timing. Global equity markets generally enjoyed a positive run during the period covered by our analysis (2010 through mid-2017). But market performance and IPO activity experienced significant swings over those years. To gauge the impact of the variability, we analyzed whether the year of the IPO correlates with the likelihood of achieving a premium valuation. Although the likelihood of a premium valuation varied from 43% in 2012 to more than 60% in 2011 and 2017, the effects are statistically insignificant. However, we observed a greater likelihood of higher valuations for offerings in periods that landed within the so-called IPO window—that is, a combination of high forward P/E multiples (a multiple of at least 13x on the IPO date) and low volatility (less than 20% in the 180 days before the IPO date) for the Stoxx Europe 600 index. (For additional information about the IPO window, see the first article in this series.)

- Number of Underwriters. Underwriter selection is important to an IPO’s success. For example, a company may choose to engage multiple underwriters to improve access to specific regions and investor groups. However, we found that the involvement of multiple underwriters does not have a statistically significant impact on the IPO valuation.

- Innovation. Using R&D expenditures as a proxy, we found that an issuer’s pursuit of innovation—at least as expressed through high R&D spending—does not significantly affect its IPO valuation. Investors appear to give equal weight to the potential upside of stronger revenue growth and higher operating margins and the downside of higher expenses. Although the most innovative companies usually receive a great deal of favorable attention, they do not appear to perform better than their less innovative peers with respect to premium IPO valuations.

Innovative companies do not appear to perform better than their less innovative peers with respect to premium IPO valuations.

The Deliberate Journey to a Premium Valuation

An IPO candidate cannot address all the factors that influence a premium valuation. It is not practical—or even advisable—to completely overhaul a company’s setup, strategy, and financial structure leading up to an IPO. Nor is there a single initiative that will serve as a magic bullet to guarantee a premium valuation. Instead, the company must find the appropriate middle ground. It should thoroughly review the key drivers of a premium valuation and prioritize the factors to address on the basis of impact and feasibility of implementation. Putting in place a sound and stringent business plan to promote superior growth and margins is a no-regrets move. The plan is crucial to promoting a high share price far beyond the listing date, because it guides investors’ expectations and sets the stage for the company’s capital markets communications for many quarters going forward. Determining the value of other adjustments, such as divesting business units to reduce complexity before the IPO, requires a deeper assessment.

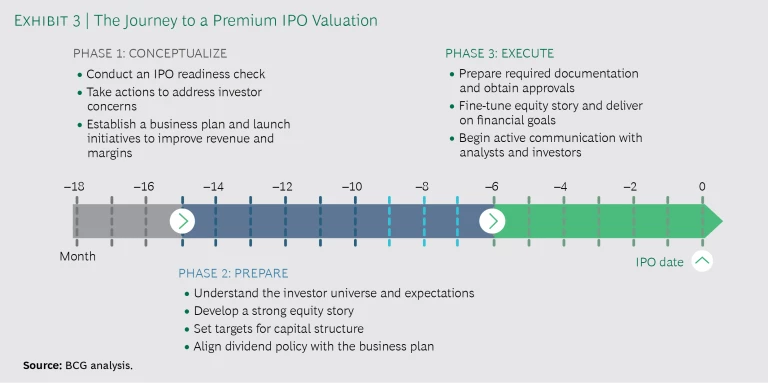

To juggle the varied (and potentially conflicting) factors affecting the IPO’s success, the issuer should establish a detailed timeline and project plan 15 to 24 months beforehand. The plan should comprise three phases. (See Exhibit 3.)

- Conceptualize. At least 15 months before the IPO, the company should conduct a comprehensive IPO readiness check. Beyond a basic assessment of potential gaps in the operational setup (for example, the ability to produce sufficient financial reports), the readiness check should review factors that can strongly influence the IPO valuation. In particular, the company should determine whether any of its characteristics (such as organizational complexity and business model) could raise concerns with investors. If required, the company can take a variety of mitigation actions, including specifically addressing the concerns in the equity story, adjusting the setup or business model (by reorganizing divisions, for example), or divesting business units. The company also needs to put in place a strong business plan that extends past the IPO date and launch the initiatives required to fulfill its ambitions for strong revenue growth and margin improvement.

- Prepare. At least six months before the IPO date, the company should focus on compiling a strong equity story so that it can proactively address investor concerns, promote investment highlights, and present a strong financial section. To lay the foundation, the company must set a target for its capital structure and ensure that the envisioned post-IPO payout strategy is consistent with its overall business plan.

- Execute. During the six months leading up to the IPO, the company should devote its attention to avoiding late-arising obstacles. In addition to preparing the required documentation and obtaining approvals, the company must define and communicate its dividend policy and fine-tune its equity story and financial information. It is crucial to deliver on financial goals during this period and take measures to avoid any slippage.

Our study shows that multiple factors influence whether an IPO lists at a premium valuation. No IPO candidate can control each one in an optimal way. But every issuer can improve its chances of achieving a premium valuation by identifying the most important factors in its industry context and addressing them through thorough and comprehensive planning well before the IPO date. Strong IPO candidates are made, not born.