In 2018, OP Financial Group owned a solid share of Finland’s home mortgage, corporate loan, and nonlife insurance markets. But the company, the nation’s biggest banking and insurance institution, needed to act faster to keep up with a more competitive business environment and new technologies. In addition, a survey of employees showed that they weren’t as engaged as they could be and felt that OP wasn’t as responsive as it needed to be to address changing customer needs.

OP embarked on an enterprise-wide restructuring to be nimbler and more responsive, starting with creating separate business units for each of its three core customer segments. As part of the restructuring, the company adopted agile ways of working across the board to give people more flexibility and autonomy to deliver on strategic goals.

During an enterprise-wide restructuring, the company created separate business units for its three core customer segments and adopted agile ways of working

Although the transformation is ongoing, OP already has made great strides toward achieving its goals, including streamlining decision making and improving employee engagement. When the COVID-19 pandemic forced most of the company’s 12,000 employees to work remotely, they found that agile methods brought structure to their work and led to better cooperation. Agile also helped people quickly refocus priorities and redistribute resources to deal with a massive increase in the demand for customer service—a pivot that helped bolster public perception of the company’s customer service.

THE NEED FOR CHANGE

OP is part of the fabric of Finland. Many small cities and towns that no longer have a grocery store or post office still have an OP branch, part of a network of 350 locations that stretches from Helsinki to Utsjoki, well north of the Arctic Circle. (See “OP Financial Group at a Glance.”) Established in 1902, OP has been an innovator from the start. In recent years, that has meant investing in online and mobile banking to maintain market share in Finland’s progressive retail banking sector, where a large percentage of customers primarily use their mobile phones for banking.

OP Financial Group at a Glance

Established in 1902, the company has grown to become Finland’s largest bank and insurance company. It has:

- A cooperative network of about 140 independent banks with 350 branches

- A 40% market share of the Finnish retail banking sector

- Separate divisions for corporate banking (40% market share) and nonlife insurance (34% market share)

- 2 million owner-customers, approximately 40% of the Finnish population

- 12,000 employees

- €92 billion in loans originated, €64 billion in deposits, and €838 million in pretax profits in 2019

- For fiscal year 2019, net promoter scores of 62 for customer service and 26 for brand

To stay competitive, OP couldn’t keep doing the same things but a little better. As the business environment became more competitive, the company needed to identify and react to potential threats faster. It needed to figure out how to help employees, who, as the survey found, were frustrated with their job roles. They worked well within their respective functions but didn’t collaborate effectively across departments. They also were put off by a hierarchical leadership culture that included multiple management layers and steering committees.

OP already had taken steps to change. The company had previously centralized operations and learning processes and expanded into adjacent businesses. The IT function had begun using agile ways of working. OP’s retail bank division and IT department had launched a small pilot to create an online mortgage product, and the company had hired leaders with agile experience.

MAKING THE CASE FOR AGILE

OP’s transformation picked up steam in 2018 when the company restructured into separate units for its main businesses: retail banking, corporate banking, and insurance. Adopting agile ways of working across the organization was a critical next step. Agile is a team-centered, iterative, cross-functional approach to work that can be applied to many business contexts. Organizations adopt agile to streamline decision making and break up siloed functions in order to improve customer value, employee experience, and operations. Agile boosts collaboration among functions and helps people work to their full potential as members of multidisciplinary, autonomous teams—a scenario where the gains exceed the sum of their parts.

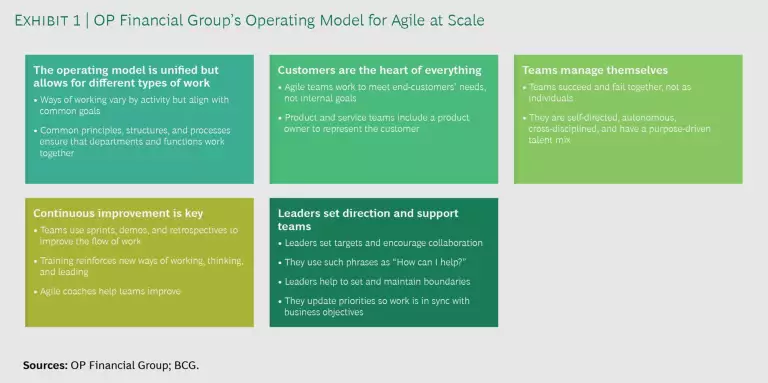

OP designed its own agile operating model, which is grounded in several guiding principles. (See Exhibit 1.)

HOW OP IMPLEMENTED AGILE AT SCALE

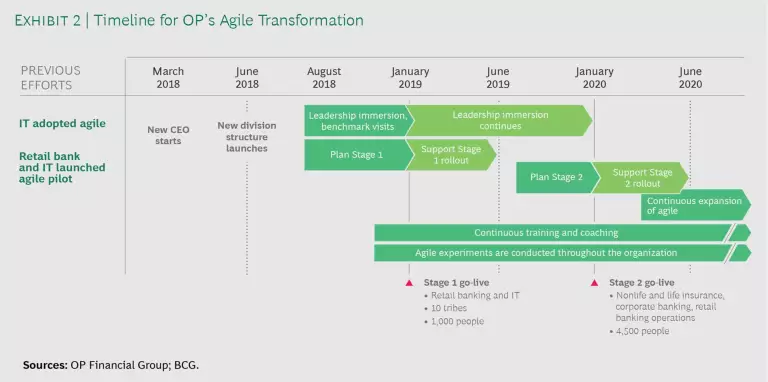

OP introduced agile in waves, beginning in the summer of 2018, with a commitment from senior leadership to support the change. Leaders took part in an eight-week immersion program on the subject, which included seeking advice from management at other banks that had adopted agile practices. In the first few months, the company also mapped out what agile would look like, designed the implementation journey, assessed the potential risks that could arise from the change, and identified the actions the company could take to minimize those risks. (See Exhibit 2.)

To model the behaviors that they wanted the rest of the organization to adopt, senior leaders changed how they collaborated with one another and led their own teams. They also decided to launch the new operating model in an agile way. They spent two months creating a minimum viable product (MVP) of the operating model, enlisted design teams to help create the model, refined it in short sprints, set up a situation room that anyone could use to see how the transformation was progressing, and invested in communications about the project.

The full rollout of agile practices began in January 2019, when all employees in the company’s retail banking headquarters and IT functions—about 1,000 people altogether—made the switch. The retail banking division created six agile tribes that included IT staff. The IT staff that was not part of the new retail tribes replaced its previous agile setup with four new tribes and adopted the new operating model. All OP employees involved in the new ways of working were trained in the new operating model, and the company hired and trained coaches to help teams adopt agile philosophy, practices, and skills.

OP spent the rest of 2019 supporting the new tribes and preparing for the January 2020 launch of agile ways of working in its insurance and corporate banking divisions, and in the retail bank division’s centralized customer service call centers and back-office functions. OP expects to spend the rest of 2020 and 2021 introducing agile practices to central support functions, including HR, finance, strategy, communications, legal and risk management, and internal audit.

The company invested time and resources to familiarize employees with agile concepts. In addition to being invited to help create the company’s agile operating model, employees were encouraged to apply to join a 40-person renewal tribe whose members act as agile stewards and ambassadors. The renewal tribe is restaffed with each rollout wave, allowing people with different backgrounds and roles to help lead the change. Former tribe members who return to their respective departments ensure that the agile model stays true to its roots as it expands to other parts of the company.

OP shares information and leads discussions about the transformation through intranet-based collaboration platforms, such as Yammer; weekly coffee sessions; and an information booth designed to look like a traditional Finnish sauna where people can gather and discuss the change. To help spread the word, OP held planning workshops and sessions and encouraged employees to share stories about the transformation.

POSITIVE EARLY RESULTS

The early results of OP’s ongoing transformation have been positive. By reorganizing around agile teams, the company eliminated two layers of management and discontinued tens of steering committees, which sped up decision making. Eliminating redundant positions, along with other changes, helped OP reduce operating expenses by approximately €100 million.

Employee engagement also improved. In a fall 2019 personnel survey, 92% of respondents said that they prefer working under the new model. They said that they take more responsibility as a team and get better directions, which helps them prioritize work. They also collaborate more, encounter less bureaucracy, and have more autonomy to make decisions. And the new practices allow them to devote more time to resolving customer issues and to introduce new products faster.

During the COVID-19 crisis, agile helped OP adapt quickly to changing market conditions. The experience of working in agile teams helped employees stay aligned and maintain closeness even after they switched to working remotely. Despite the pressure of operating during a crisis, OP’s net promoter score—a measure of how a company is regarded by the public—jumped to a record high of 65 for its customer service.

Agile teams helped employees stay aligned and maintain closeness even after they switched to working remotely.

LEARNING FROM OP’S AGILE EXPERIENCE

OP faced multiple challenges while adopting agile at scale and gained insights that other organizations can learn from.

Establish clear, measurable business rationales and goals. Agile is a tool, not a goal. Adopting agile requires a fundamental change to operations, so a company has to be committed for it to work. That includes being clear about the reasons for making the change and creating KPIs to measure progress toward specific goals.

Invest in leadership. When BCG polled 60 global leaders about the factors that contribute to successful agile transformations, leadership, culture, and behavior ranked as the most important. OP’s management team immersed itself in the subject, eventually designing the new model in more than 100 workshops during the first 18 months of the transformation. Still, turning initial insights into ongoing leadership behaviors can take additional months, or even years, of practice.

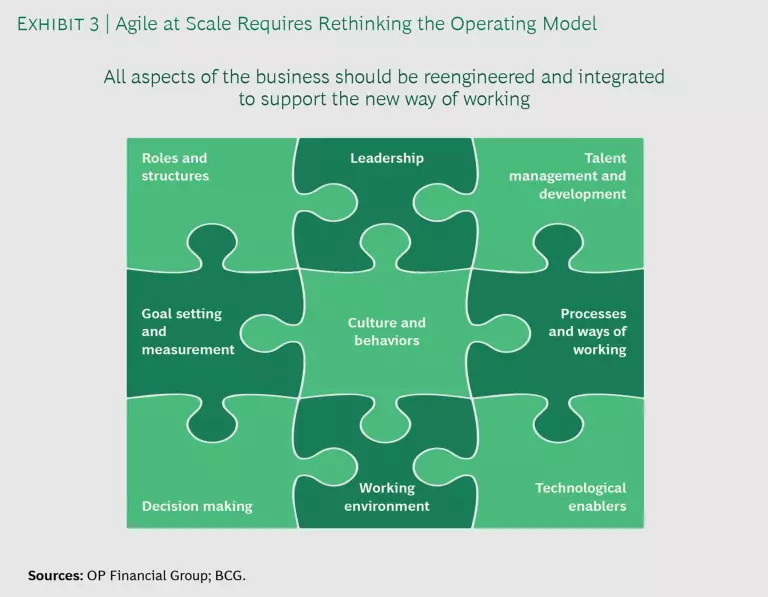

Learn from others, but create the agile model your organization needs. Adopting agile at scale isn’t easy. Although it’s important to study and learn from others’ experiences, companies must resist the temptation to copy what another organization is doing. Each company’s situation is different, so each one needs to tailor agile to its own needs and operating model. When updating the operating model for agile, address all components; don’t just redesign a new organization structure. (See Exhibit 3.)

Use agile coaches, but choose them carefully. Agile coaches support a company’s goals in several ways. In the beginning, they help teams learn and adopt agile practices. Down the road, coaches can help teams improve their performance. Because coaches have different backgrounds and philosophies, a company should prioritize recruiting coaches whose mindset is a good match for the agile operating model it’s created. OP, which has about 80 agile coaches, found that the best coaching mix includes business experts and coaches, IT agile coaches, and new hires with experience in change management.

Apply agile ways of working to your agile transformation. Just as agile teams build an MVP to test before a wide-scale product rollout, companies should build an MVP of their agile operating model. Starting small not only ensures that the foundation is right, it allows for agile practices to evolve over time depending on the organization’s needs and helps employees own the change. At the start of its agile transformation, OP decided that certain parts of its new operating model would be designed before going live, while others would be filled in over time.

Balance autonomy and alignment. Agile depends on teams being able to work autonomously, though within common boundaries. Companies can keep teams in sync by offering clear, concrete targets from leaders; encouraging active communication between teams and leaders; and adopting mindsets and shared ways of working that encourage collaboration.

Help employees through the transition. Moving to agile can have a tremendous impact on employees. Leaders need to show compassion as they guide people through the change and provide resources for everyone, including people who may be leaving the organization. Resources could include career fairs, résumé-writing services, skills sessions, and career guidance or other types of counseling. Employees are likely to need substantial upskilling, reskilling, and coaching to get through the initial transition period, which could last six to nine months. Beyond that, companies should anticipate allocating significant additional resources to maintain the momentum to adopt agile, including spending on training, and to further develop the operating model.

Adopting agile at scale is no small undertaking. But as OP’s transition shows, the resulting well-coordinated teamwork and faster decision making can lead to major improvements across the organization.