Most retail banks assert that they’re “open” to open banking. In several markets, regulations have forced them to be. In other markets, fintech innovation is driving the trend. But what counts for being open varies. Too many banks remain stuck in a tactical mindset focused on compliance and on fending off the risk of disintermediation.

Yet, a few retail banks view open banking differently. They believe that it offers more opportunity than risk, so they are embracing it with bold plays centered on strong third-party relationships and innovative business models. They recognize that creating an open-banking ecosystem creates tremendous opportunities for improving the overall customer experience and that third-party partnerships will be a source of competitive advantage.

An open-banking ecosystem creates tremendous opportunities for improving the overall customer experience.

BCG data shows that open banking has the potential to add or erode retail-banking revenues by 15% to 25%. Therein lies the real threat to established players. Although some industry observers point to fintechs’ disruptive potential, the real disruptive force will be generated by incumbents that seize the potential of open-banking ecosystems to create long-term differentiation and growth.

Instead of Opening Channels, Banks Keep Closing Opportunities

In developing their open-banking programs, many retail banks are stymied by roadblocks of their own making. Too many continue to approach innovation narrowly and incrementally, focusing on financial-services-related opportunities that fit within their current offerings or on low-hanging improvements stemming from compliance with regulations such as the second Payment Services Directive, known as PSD2.

In addition to letting near-term, defensive concerns dominate, many banks silo initiatives under IT, leading to an overemphasis on technical details and too little attention on building out the broader business model. The commercial model is also frequently misunderstood. Many banks equate open banking with application programming interfaces, but APIs constitute just one piece of the open-banking ecosystem.

Incumbents that fail to change their course risk becoming little more than regulated infrastructure utilities, their experience mirroring what happened in the telecommunications sector a decade ago, when established players failed to recognize the disruptive potential of over-the-top entrants. The new players were able to dominate the lucrative mobile-app business, leaving incumbents to compete over undifferentiated, lower-value products.

Defining a Winning Open-Banking Strategy

When it comes to acting on the opportunities that open banking presents, retail banks have clear advantages. They can use their trusted-advisor status and institutional depth to build new services, enter new markets, and expand their customer base.

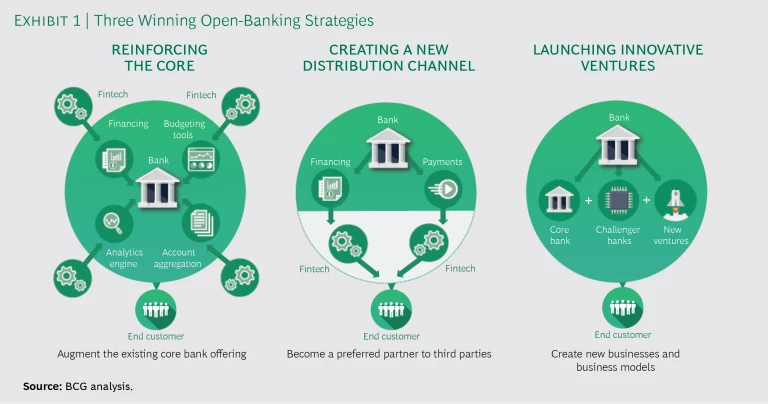

Exhibit 1 illustrates three effective ways to turn open banking into a long-term avenue for growth:

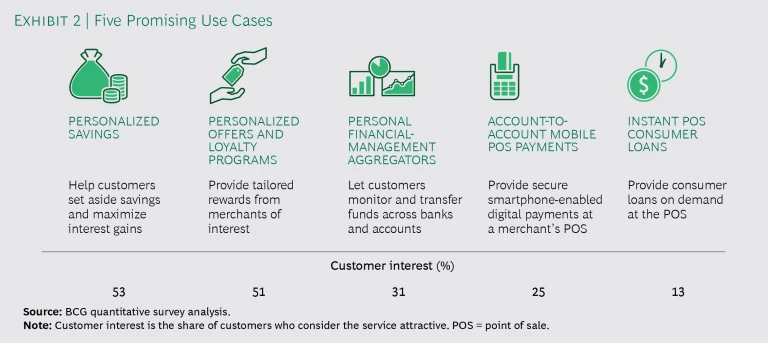

- Reinforcing the Core. Banks that do a good job of integrating third-party functionality can significantly strengthen the core bank and acquire market share from less responsive competitors. Many joint solutions of banks and third parties require little technical investment and allow banks to breathe new life into existing services faster than they could using traditional in-house developments. Services that make use of transaction data and analytics, as well as account aggregation and personal-financial-management tools, are particularly attractive to individuals and small businesses. (See Exhibit 2.) Banks that are early movers have seen positive results. A collaboration with Tink, a Swedish aggregator, for instance, allowed ABN AMRO to add online budget tools and a personal-financial-management solution to its existing daily-banking-product suite, and a similar partnership with Kabbage allowed Santander to provide seamless origination of small-business loans.

- Creating a New Distribution Channel. As they mature, the most successful fintechs will become powerful distributors of financial services. Some are already well on their way. Ant Financial leveraged its huge user base of payments to become one of Asia’s largest distributors of investment funds. The UK’s MoneySuperMarket is evolving from a price comparison website to, among other things, an online distributor of financial products, including mortgage loans, credit cards, and even current and savings accounts.

Still, while fintech growth raises the risk of disintermediation, it also brings opportunities. Strategic partnerships with fintechs help open up third-party networks, providing banks with an important new distribution channel for their products and services. (See “The Wells Fargo Experience.”) They also allow banks to enter growing niches in which they may lack experience or permission, giving banks business volume they might not otherwise be able to tap.

The Wells Fargo Experience

The Wells Fargo Experience

Recognizing that open banking could become a primary digital interface, Wells Fargo was among the first banks to create a formal open-banking ecosystem—with a well-aligned structure, partnership model, and technology platform.

To ensure governance and accountability, the bank established a separate organization for its open-banking channel, with dedicated product and technology teams. Expanding its API portfolio, Wells Fargo entered into formal partnerships with promising fintechs. Then, to provide flexibility and make the platform especially attractive to developers, it built a secure developers’ API portal entirely from open-source software.

These strong third-party relationships and the thoughtfully designed developer-centric platform helped the bank usher a variety of APIs to market, including those that made it easy for customers to access their Wells Fargo bank accounts from other financial services platforms and to open accounts for different types of services. Wells Fargo also partnered with specialists in key niches, such as accounting-software providers for small businesses. In addition, corporate-banking customers can now use the Wells Fargo Gateway developer portal and its APIs to easily integrate their corporate-account data with their business’s enterprise resource planning and accounting systems.

Secure, tokenized “handshakes” between the bank and third-party servers allow Wells Fargo customers to choose exactly which account information they want to share with partners. These efforts helped Wells Fargo improve customer service and extended the bank’s reach into third-party networks. Today, the bank offers more than 25 API use cases across payments and data services, making it one of the largest open-banking platforms in the world.

Because attractive fintechs have lots of suitors, a savvy bank must become a “partner of choice.” Providing fintechs with top-end financial products, rich functionality, and critical integration support can help these young businesses extend their offerings while creating a source of business and competitive differentiation for banks. Fidor Bank and solarisBank, for instance, found a ready audience in fintechs and third parties that lacked banking backbones and couldn’t afford the steep costs of building and maintaining their own. By commercializing their infrastructure and selling banking as a service, the banks filled a critical void and created loyal partners.

- Launching Innovative Ventures. APIs and third-party relationships can help banks build disruptive new business models that operate outside the bank’s core business. This approach might include, for example, launching independent challenger banks or new businesses devoted to a specific vertical market or product. Although this strategy is not a new one for banks, open banking makes it easier to start and scale disruptive businesses.

Whereas before, banks might have built a digital front-end or challenger bank from the ground up, today, with the help of open banking, banks can fast-track such development by combining features and functionality from several third parties and enabling third-party access to aggregated customer account information from many banks. For example, Santander revamped its original challenger bank, Openbank, adding a new cloud-based banking backbone by assembling various components from within the bank and across its network of partners, as well as a full API layer to provide new ways of distributing banking services. By keeping the venture at arm’s length, Santander was able to avoid legacy constraints and adopt a modern IT architecture, simultaneously developing an independent revenue source.

Banks can use open banking to pursue disruptive vertical plays: for example, setting up new independent ventures to grow niche products or services or running the business as a product factory for an open-banking distributor. ING used this approach to launch several businesses, including Yolt, which serves as an independent personal-financial-management aggregator for individuals; Payconiq, an account-based mobile wallet; and Cobase, an aggregator for small-to-midsize enterprises.

Retail banks must ramp up their API portfolios and engage the developer community.

In support of these strategies, retail banks must ramp up their API portfolios and engage the developer community. A bank that successfully forges a strong developer ecosystem can promote cross-collaboration with third parties to scale innovation and embed banking functionality into a variety of systems and services. Through marketplaces, development communities, and creative partner collaborations, a bank can expand its traditional service portfolio and build “sticky” customer relationships with third parties and individuals that increase total lifetime value.

A Different Approach to Strategy Implementation

Some banks have already discovered ways to make the most of open banking. (See “Open Banking Turned One Small Indian Bank into a Digital Leader.”) They have recognized that to achieve open-banking success they need to define, incubate, and scale businesses in ways that are fundamentally different from those of traditional banking.

Open Banking Turned One Small Indian Bank Into a Digital Leader

Open Banking Turned One Small Indian Bank Into a Digital Leader

A small—but rapidly growing—bank in India was eager to spearhead growth. It built an open-banking business unit from the ground up, hiring a new team with the requisite business and technical skills and establishing a sales rhythm that matched that of other pure digital financial services companies. To minimize risk and fast-track the effort, the bank partnered with outside experts. Together, they identified the most promising use cases, developed a supporting operating model, and crafted a comprehensive go-to-market approach.

To sustain a strong focus on implementation, the bank concentrated on six customer use cases that were backed by a portfolio that ultimately included 25 API-enabled products. The strategy proved extraordinarily successful. Within one year of the launch, the new open-banking business unit grew to represent a double-digit share of the bank’s retail deposits.

Smart partnerships and tailored innovations helped pave the way to growth. For example, a partnership with a core-banking-system provider gave the bank exclusive access to a vast database of customers of credit cooperatives across India. Using these connections to develop a suite of solutions tailored to small businesses, the bank accelerated growth. The bank’s APIs are now used to disburse 80% of the microfinance loan book in India, and the bank powers 40% of the mobile POS market.

The bank also created a unique business model that generated revenues in two ways: directly (through APIs); and indirectly (through deposit income, transaction fees, and data monetization). With industry-specific pricing models, revenues increased even more. In addition to contributing to the bank’s overall profitability, these moves burnished the bank’s brand and made it a rising star in the eyes of the Indian business press.

They need to consider the following imperatives as part of their strategy implementation:

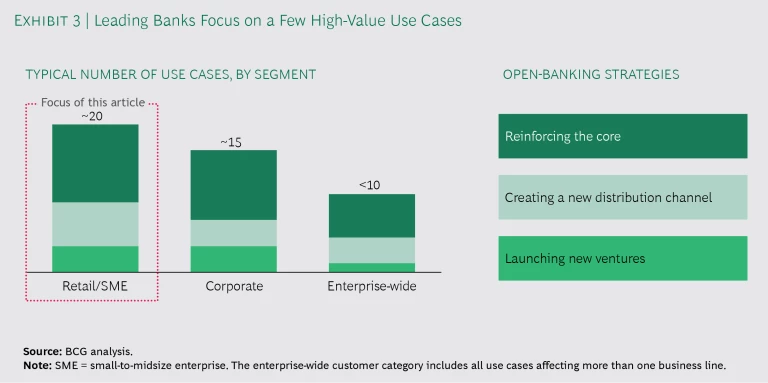

- Focus on true customer friction points. To carve out distinctive value, banks must delve deep into the customer journeys of key segments to identify areas that are fundamentally broken and to surface unmet needs. With a clear understanding of those customer opportunities, banks can determine which open-banking strategy holds the most promise, which APIs to develop, and which partners to pursue. One large European bank found 40 potential use cases for its open-banking program but retained only the handful that seemed capable of delivering the greatest customer value.

The use cases were prioritized on the basis of projected customer outcomes, profit potential, scalability, and competitive differentiation; the bank applied those insights to pursue relevant third-party partnerships. (See Exhibit 3.)

- Think like a venture capitalist. Digital advances shrink the cost of experimentation, making it possible to fund a portfolio of initiatives, evaluate progress, and then channel resources toward the most promising opportunities. Venture capitalists have long operated with this understanding. Phased investments and ongoing monitoring let them embrace bold concepts that have the potential to deliver exponential returns—even proposed ventures that seem unrealistic at the outset. Banks can adopt a similar mindset with the help of agile development practices. Instead of an incremental approach to product development, which is pretty much the norm, minimum viable products (MVPs) give banks the latitude to experiment with novel strategies, present multiple early-stage ideas to customers, and solicit feedback in quick, successive test-and-learn cycles. Banks should not be tempted to wait for the “perfect” solution and should avoid conflating MVPs with minimal functionality. They should focus on determining what “great” will look like and give the business room to grow through experimentation and rapid course correction. Success requires a willingness to embrace long-term changes and to give the organization sufficient time to make those changes.

- Treat third parties as valued customers. In an open-banking environment, a bank’s customer is no longer simply an individual- or corporate-account holder. Increasingly, a bank’s customer is a partner or developer. When third parties are selecting banking partners, they are looking for two elements: access to a large client base and ready-made structural supports that facilitate collaboration. Meeting these needs requires that banks advance their business development, marketing, and outreach practices. Banks must invest time in understanding partner needs and expectations—much as they would any other highly desirable customer segment. By reflecting on the full customer journey, banks can pinpoint opportunities for adding value through, for example, software development kits, reference designs, and dynamic developer communities, and make it easy for partners to access test data under clear contractual terms that create an equal playing field for participants and define areas of exclusivity. BBVA’s API Market, for example, was built specifically with the needs of the bank’s external and internal developers in mind. It offers APIs, tools, and other supports that make it easy for developers to partner with the bank in commercial opportunities.

- Align governance and technology to manage competing businesses. The most successful open-banking portfolios include a mix of third-party and bank-branded offerings, independent ventures, and distribution networks, some of which may compete with one another. To manage that interplay and provide the strong steering needed, banks need to align governance and technology across the open-banking ecosystem. For initiatives that reinforce the core bank, oversight can be managed from within the bank’s existing business units, but in our experience, it is usually best to run open banking at an arm’s length from the legacy bank, operating it as a separate sales channel or business venture with a dedicated leader and P&L. Moreover, to ensure efficient management and oversight, banks should strive to put that portfolio on a common technology platform. More efficient data sharing can improve transparency, unlock commercial opportunities, and support better monitoring and analytics. Achieving this can be a challenge that could require banks to modernize their application environment.

To succeed in open banking, retail banks need to lay out a vision that is based on their current starting point, identify and prioritize use cases and commercialization opportunities, select potential partners, define their operating models and technology requirements, and develop clear plans for implementation. Given the complexities of this process, many banks benefit from outside expertise. The results, however, can be transformative.

Open banking will disintermediate retail banks. There’s simply no getting around it. Rather than see that as a risk, however, savvy institutions will use the opportunities that open banking offers to strengthen their existing offerings, attract the most desirable partners, and build bold and disruptive business ventures within and outside their core business.

Succeeding with open banking requires retail banks to avoid the temptation to jump into undifferentiated copycat initiatives. The banks that execute well-rounded and far-reaching strategies will build important channels for growth. Those that ignore the market’s direction, permitting the bold and fast-moving banks to widen the performance gap, will find themselves disintermediated, out of pocket, and eventually, perhaps, out of business.