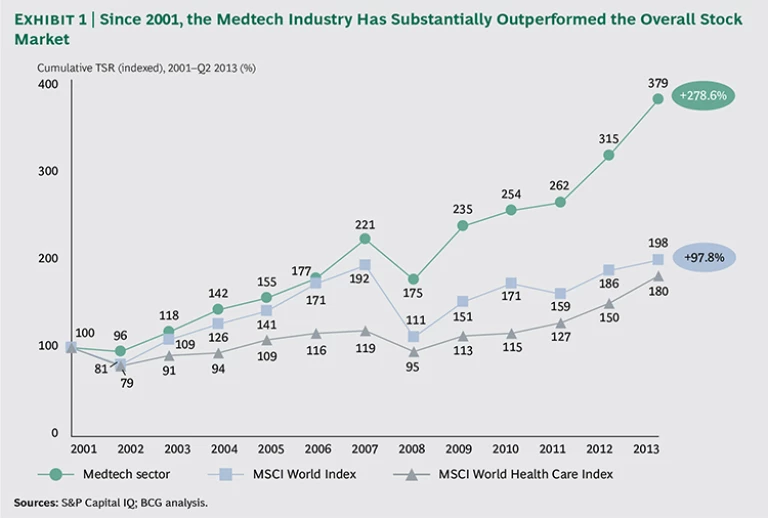

For more than a decade, the medical technology (medtech) sector has outperformed the overall capital market in terms of financial performance. It has generated a total shareholder return (TSR) of 279 percent since 2001, substantially beating the MSCI World Index, which returned 98 percent over the

Despite that strong run, however, it appears that recent investor optimism is outpacing the operational performance of medtech companies. Growth has slowed, for several reasons. Cost containment measures in Western health-care systems are leading to a reduction in spending on medical technology. The global shift to a value-based health-care market—in which purchases and pricing will face much greater scrutiny and competition than in the past—will likely accelerate this trend. Medtech companies, like all health-care operators, will be assessed on their ability to deliver value to patients and providers, rather than just superior technology or features. In the past, medtech companies were able to raise prices based on incremental innovations, but that is no longer the case. Finally, while growth has shifted to emerging markets, many Western companies are not yet set up to fully exploit that growth, whether because of problems with distribution, product portfolios that don’t meet patient or customer needs in lower-cost countries, or other issues.

In the years to come, slowing sales growth and margin pressure will pose material challenges for medtech companies. Much of the sector’s strong recent TSR performance has been driven by the expansion of valuation multiples—that is, investor expectations. If pressure on sales and margins persists, it could potentially affect operations while also dampening investor expectations—a two-pronged effect that would have serious consequences for the value creation outlook at many medtech companies.

We believe these shifts create a mandate for change in the sector. The majority of companies in other health-care sectors have already undergone significant cost transformations, yet medtech companies, by and large, have not. They have implemented cost reduction measures, but these efforts have tended to be incremental instead of transformational. If the medtech sector is to continue to reward investors and generate value that outperforms the overall market, it will need to fundamentally rethink its operational and sales cost structures. Given growing health-care demands, such as an aging population and an increase in chronic diseases worldwide, there is still considerable potential for growth in the medtech industry. To drive TSR outperformance, however, companies will need to revamp their cost structure and their commercial model, along with several other strategic imperatives.

How Medtech Companies Create Value

To understand these issues, we analyzed the capital market performance of medtech companies over the past five years. Based on that analysis, we drew conclusions about what investors are looking for in their medtech holdings and identified specific actions that companies can take to create value. (Similar BCG studies have analyzed the value creation records of the biopharmaceutical and health-care-services

Specifically, we looked at the value creation performance of 65 companies in the medtech sector, breaking them down into the following four

- Medical-device companies manufacture complex medical products, such as implants and hearing aids, that tend to stay in or on the body for extended periods. Examples include, among others, Zimmer, Edwards Lifesciences, Stryker, Boston Scientific, GN Store Nord, and Smith & Nephew.

- Medical-equipment manufacturers develop durable, high-tech products, such as dialysis machines, endoscopes, and ultrasound and x-ray technology, that require a significant capital investment from providers. Examples include Sirona Dental Systems, Intuitive Surgical, Olympus, Elekta, and Fresenius Medical Care.

- Medical-supply companies produce and sell disposable products, such as syringes, catheters, and gloves, that are usually used repeatedly and involve little risk. Examples include Terumo Medical, Cooper, Top Glove, and Teleflex Medical.

- In vitro diagnostics (IVD) companies sell instruments, diagnostic equipment, and reagents for laboratory use, such as in gene, protein, and metabolite analysis. Examples include Sartorius Stedim Biotech, Bio-Rad Laboratories, Qiagen, and Life Technologies.

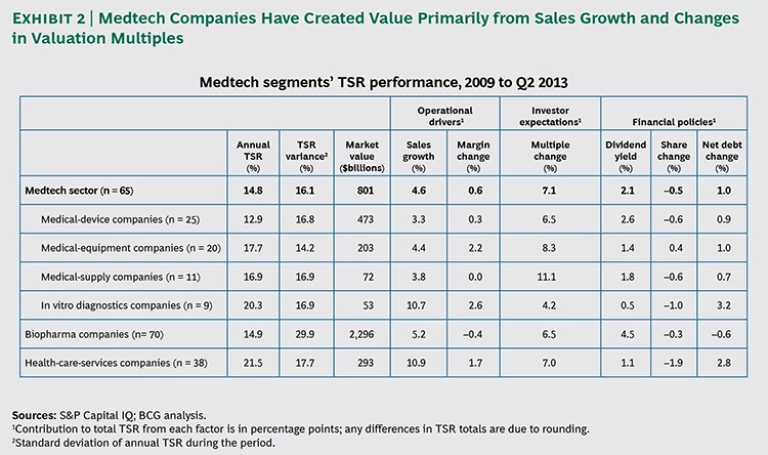

For each of these segments of the medtech sector, we looked at the key drivers of value creation from 2009 through the second quarter of 2013. Drivers included those related to operational measures (sales growth and margin change), investor expectations (change in valuation multiples), and financial policies (dividend yield, change in the number of shares, and change in net debt). (See Exhibit 2.)

Key Drivers of Value Creation

In the aggregate, the 65 medtech companies we studied generated 14.8 percent TSR per year. Of the drivers we analyzed, the biggest contributors to TSR were changes in the valuation multiple (7.1 percentage points) and sales growth (4.6 percentage points). Margin change over this period had comparatively little impact (0.6 percentage points). Similarly, drivers related to financial policies were not sufficient to have more than a limited impact on TSR. Dividends contributed 2.1 percentage points, changes in net debt contributed 1.0 percentage points, and measures affecting outstanding shares resulted in a 0.5 percentage point drag on TSR.

Looking at individual segments of the medtech sector revealed largely the same pattern. For example, the medical-supply segment posted a TSR performance of 16.9 percent, nearly all of which came from multiple changes (11.1 percentage points) and sales growth (3.8 percentage points). Medical-equipment companies showed better TSR performance (17.7 percent), but again, that was driven largely by multiple changes and sales growth, with a smaller contribution from margins.

IVD companies were the outlier among the four medtech segments. Their performance was strongly affected not only by sales growth (10.7 percentage points) but also by rising multiples (4.2 percentage points), with margin improvement making a smaller contribution to TSR (2.6 percentage points).

The conclusion: while medtech companies have taken some operational and financial-management steps to drive value creation, their TSR performance is primarily the result of the positive market expectations of investors, which, in turn, are partly due to the ongoing recovery in equities and are characteristic of many other sectors as well. However, we think the effect is stronger in medtech and among health care companies in general.

Key Drivers of Valuation Multiples

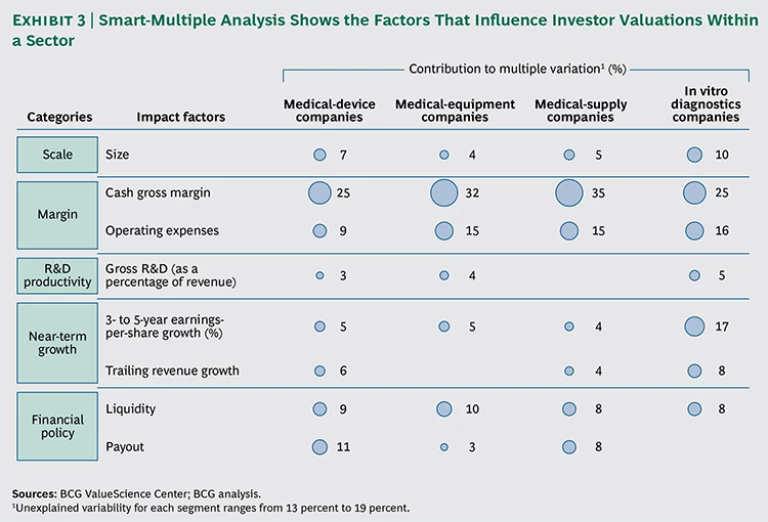

Given the importance of valuation multiples—that is, investor expectations—in driving TSR, we also sought to identify the major drivers behind those multiples. To that end, we applied BCG’s proprietary smart-multiple methodology, which explains roughly 80 percent of the variation in valuation multiples for a given medtech segment and provides critical insights for companies seeking to improve their value-creation

The biggest drivers of multiples in the medtech sector—the factors that hold the greatest sway over investors’ expectations—are margins, broken out into cash gross margin and operating

To a lesser degree, near-term growth in earnings per share and company size also drive multiples, while dividend payout and liquidity (which indicates the potential of share buybacks) are significant drivers for all four medtech segments except IVD companies (which, like most fast-growing businesses, typically invest cash in future growth rather than to pay back investors). In addition to operational performance, financial policy is thus a crucial tool for attracting the right investors and creating sustainable value in the capital markets.

Two Distinct Periods of Performance

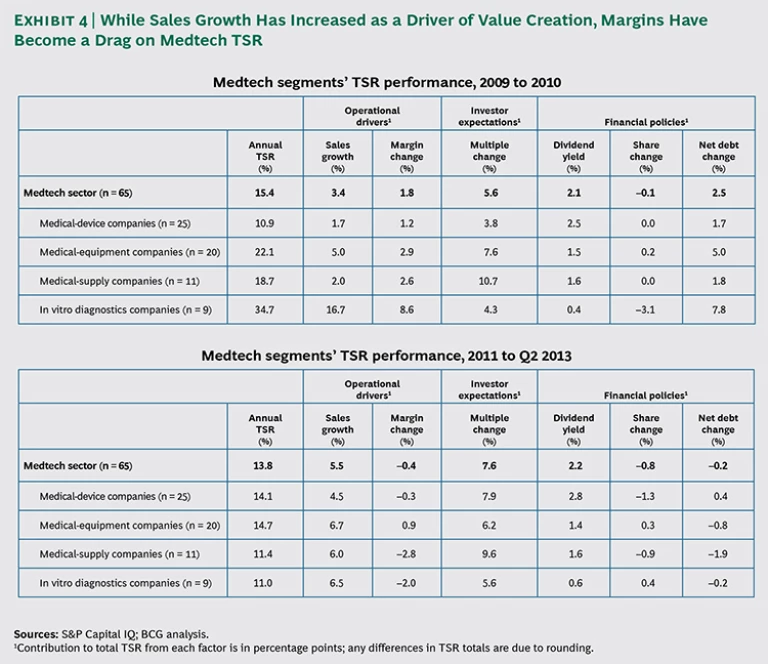

In addition to analyzing the medtech sector over the nearly five-year window from 2009 through the second quarter of 2013, we looked at performance specifically in the two smaller periods of 2009 through 2010 and 2011 through the second quarter of 2013. (See Exhibit 4.)

During the first period, the industry posted an overall TSR of 15.4 percent. During the second period, it managed to largely sustain that rate of value creation, dipping slightly to 13.8 percent. In contrast to the biopharma and health-care-services sectors, TSR performance in medtech over both periods was markedly consistent, underscoring the sector’s generally attractive risk-reward profile.

The principal change between the first and the second periods of performance was growing margin pressure. While the contribution to TSR from sales growth notably rose (from 3.4 percentage points to 5.5 percentage points), the contribution from margins turned negative, from 1.8 percentage points to –0.4 percentage points. That difference between an expanding top line and diminishing profitability reflects worsening pricing and operational performance caused by the many external pressures that medtech companies are now facing. Despite weaker fundamentals, however, the contribution from multiples grew from 5.6 percentage points in the first period to 7.6 percentage points in the second.

The same pattern held for the medical-device segment specifically. The contribution from sales growth increased and the contribution from margins fell to negative numbers, yet the contribution from changes in the valuation multiple more than doubled. As a result, overall TSR grew. This difference between value creation from operational performance and from investor sentiment is striking.

Among the four medtech segments, medical-supply companies are perhaps a harbinger of things to come. In this segment, the contribution to TSR from margins essentially reversed between the two periods, from 2.6 percentage points to –2.8 percentage points. This should be cause for concern. The products that these companies sell are less differentiated and require less innovation than those sold by companies in the other segments. As a result, we would expect medical-supply companies to face greater competition and be more susceptible to a deteriorating pricing environment. The fact that margins have eroded so rapidly could indicate looming challenges for the other segments. Differentiated products may be able to hold their margins longer, but in a value-based health-care environment, all products are likely to face growing margin pressure.

In the aggregate, these trends point to a mandate for change. Investors have continued to reward medtech companies by bidding up their valuation multiples, yet they appear to be at an operational plateau. Management teams will need to act if they are to deliver on the expectations of their shareholders.

Measures to Create Sustainable Value for Investors

To meet investor expectations and create sustainable long-term value, medtech companies must fundamentally transform the way they operate in order to ensure their ability to grow and sustain profitability in a more competitive health-care environment. The most immediate priority is to reduce operational costs, which will allow them to maintain margins despite pricing pressure. In addition, medtech companies must transform their commercial model to shore up sales. That combination—lower costs and a revamped commercial model—will position them to fund strong growth for the foreseeable future.

Imperatives for All Medtech Companies

How can medtech companies achieve these goals? Several imperatives apply virtually across the board.

Systematically reduce operational costs to preserve margins. First and foremost, medtech companies must evolve from their current high-cost operating model to one that will allow for more competitive operating-cost structures. Many companies have taken measures to reduce their selling, general, and administrative (SG&A) costs in recent years. More transformational, however, would be efforts to reduce the cost of goods sold (COGS) by improving manufacturing or supply chain operations. Such operational measures can make an especially significant contribution to preserving gross margins.

In a certain light, the lack of corporate transformations in medtech thus far makes sense. For the past several years, most medtech companies have enjoyed very strong gross margins, and top-line growth has been a key barometer of performance, with companies focused more on hitting their sales-growth projections and less on improving the efficiency of their operations. However, the shift to value-based health care means that such a strategy is no longer sustainable. Companies in all segments of the sector will need to produce high-quality goods at lower cost. Zimmer, for example, has holistically restructured its cost base by reducing the size of its workforce, optimizing its supply chain, and transforming its production facilities.

Other changes in the health care landscape are introducing new challenges as well. For example, the U.S. medical-device tax (2.3 percent) effectively increases the headwinds faced by medtech

Transform the commercial model to offer unique value-creating products and services. To succeed in a value-based environment, medtech companies—many of which are oriented around a traditional, high-intensity sales structure—must also change the way they go to market. In fact, BCG research has found that some companies spend two to three times more on SG&A expenses as a percentage of COGS than the typical industrial or technology company. Perhaps more unsettling, a global study of 4,500 employees at 38 medtech companies found that skills in critical areas such as key account management, marketing, and market access are at less than ideal

The evolving health-care environment will only exacerbate such problems. For example, more-sophisticated purchasing arrangements—often negotiated at the hospital or provider network level—will increase pricing scrutiny. This pressure is particularly acute in Europe, where governments are struggling to balance a growing demand for care (due to an aging population) with fiscal pressures, but ongoing hospital consolidation suggests that the U.S. will not be far

Pricing pressure will also increase as a result of growth in emerging markets, where patients and providers often require basic, less expensive products than those typically sold in more established markets. (Notably, all ten of the top-performing medtech companies in our rankings are based in mature markets.) In addition, as global players expand into emerging markets, they will face competition from homegrown upstarts, which often have a significant cost advantage and a head start in logistics and distribution.

To meet these challenges, medtech companies will need to transform their commercial model and deliver greater value to health care providers and payers (possibly through integrated offerings such as advisory services). They may also need to establish risk-sharing price models or expand into other parts of the value chain, possibly by partnering with payers or providers. Medtech companies may also need to invest in new selling capabilities to reflect the shift in decision-making power. This holds true particularly for clinical selling, where many hospitals have already professionalized purchasing processes and shifted decision making out of the hands of clinicians.

Moreover, since the top 10 percent of customers in medtech can represent up to 50 percent of the sales in a given product category, successful key account management is of utmost importance. While competition is often most intense for these accounts, their profitability is not necessarily much lower than that of smaller accounts. These customers are often early adopters of innovative—and, therefore, higher-priced—products, and their experience and sophistication can significantly reduce the sales, training, and support effort required, rendering them less expensive to serve relative to their size.

Accordingly, marketing functions must take on the primary role in developing winning commercial strategies based on deep market and customer insight. In today’s market, it is crucial to build a robust case for the value offered by individual products and to provide compelling value propositions to mitigate the mounting pressure on prices. In the medtech sector, as in all areas of health care, it is no longer enough to offer the “best” product in terms of efficacy. Products must deliver true and measurable value, or they will not find a market. The companies that understand this shift and act accordingly in reshaping their commercial model will gain a

Use mergers and acquisitions to increase scale and build complementary offerings. The medtech sector is entering a period of consolidation thanks to several factors, including high levels of liquidity, the increasing cost pressure noted above, and regulatory headwinds that will likely make product approvals more difficult to obtain. Large companies can turn this tide to their advantage by leveraging their high liquidity and commercial capabilities to buy up acquisition targets that can help build scale and efficiency.

There is a second strategic objective to M&A. Large companies can acquire innovative products just being developed (as well as already approved products) that complement their current portfolio and give them a stronger platform for future growth. For example, while the leading orthopedic-implant companies face increasing pressure in the traditional large segments of hip and knee implants, smaller adjacent areas like extremities and sports medicine still offer attractive prospects. Moreover, the recent contraction in venture capital financing in medtech creates a unique opportunity for medtech companies to target start-ups and smaller players with compelling products in development.

Whether undertaken to build scale or to gain access to complementary products, acquisitions can help companies sustain their growth profile over the long

Drive growth through innovation and expansion into emerging markets. Companies will need to drive organic growth, in addition to M&A, across a number of initiatives. For example, they should emphasize innovation aimed at developing products that offer clear value and a distinct advantage in outcomes. Such products will be increasingly attractive to both payers and providers in a value-based health-care environment. Innovation at this level often requires reconfiguring the R&D function. Thus, some companies are dispatching their researchers into the field to observe and interact directly with patients and clinicians. Others have developed company-wide innovation centers that help pollinate ideas across projects and business units. Still others are investing in on-the-ground R&D in emerging markets to ensure that their products meet the needs of local

Even more significant is the growth opportunity offered by expansion into emerging markets and a focus on tier 2 regions—smaller cities that are growing fast. Success in emerging markets requires more than merely stripping out features and functionality from existing products and offering a no-frills version at a lower price. Instead, companies must design and develop products and technologies specifically for the requirements of local markets. If they cannot build the required capabilities quickly enough, they should consider M&A. But because there are relatively few high-quality targets of meaningful size in many emerging markets, companies will need to be aggressive in their pursuit of acquisitions—as demonstrated by some of the recent emerging-market transactions in orthopedics.

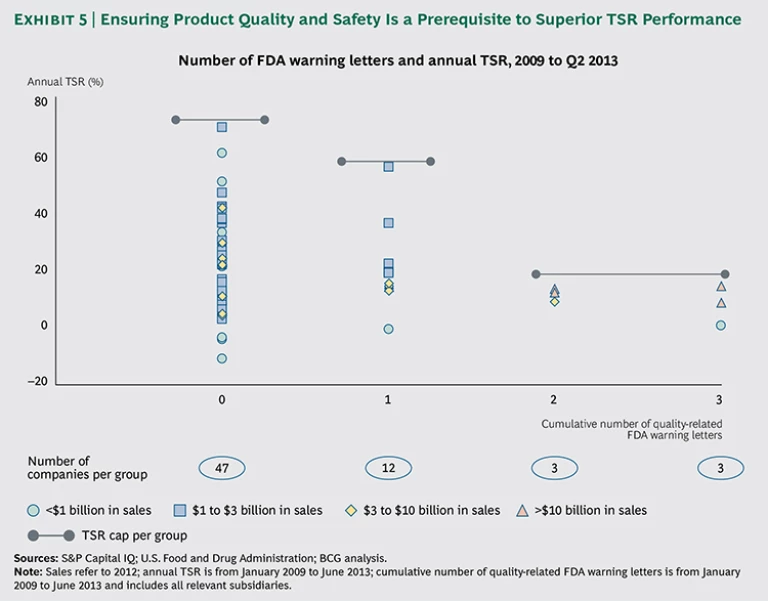

Focus on quality management as a must-have for superior value creation. Finally, medtech companies must continue to focus on developing and producing quality products, in some cases through upgrades to their organization and processes. This is not an operational driver of TSR—rather, quality is a requirement that companies must meet. Recent incidents have caused patients and investors to think of product quality as a negative selection criterion, and companies that have received warning letters from regulatory agencies have a markedly lower TSR performance; clearly companies incur a risk discount for every warning letter they receive. (See Exhibit 5.) The bottom line is that quality issues affect medtech brands among payers, providers, patients, and investors alike.

Actively manage investors to ensure proper alignment between their objectives and the company’s overall strategy and financial policy. Medtech companies need to actively communicate with their investors in order to ensure that all stakeholders are aligned. Management teams should give clear guidance regarding the company’s strategy and financial policy and make sure that investors understand what differentiates the company from its competitors. When companies are clear about their strategy and take steps to support it—with an alignment that is clear to the capital markets—they will be rewarded.

For example, Medtronic acquired China Kanghui, the second-largest Chinese orthopedics company, for roughly $820 million in September 2012. The price was equivalent to 24 times Kanghui’s earnings and included a premium of about 23 percent above the company’s market valuation before the announcement. Yet analysts praised the deal as supporting Medtronic’s stated strategy of generating 20 percent of sales from emerging markets by 2016. Medtronic stock spiked on the news and was 3 percent above the preannouncement price two weeks later.

Financial management is particularly relevant for medtech companies right now, as they enter a period of potentially slower growth. During such periods, the investor base typically evolves from growth-focused funds to growth at a reasonable price (GARP) and value funds, which can tolerate slower growth but often require dividend payouts. This shift is already apparent for a number of medtech companies, such as Becton Dickinson and Medtronic. When the biopharma sector underwent such a shift, many companies found that they needed to fine-tune their financial policies to attract investors, and they did so by increasing their dividend payout. As a result, even as their operational performance slowed, many biopharma companies were able to shore up their TSR performance and maintain investor interest. (Of course, being too aggressive with dividend payouts can signal a pessimistic view of future growth by management, which, in turn, can unsettle investors and depress multiples.)

Imperatives for Individual Segments of the Medtech Sector

In addition to the strategic imperatives that apply to all medtech companies, there are others that are specifically applicable to the individual segments of the sector.

Medical-device companies should position themselves as catalysts of health care efficiency and should expand into other parts of the value chain. In terms of overall value creation during the nearly five-year study period, device makers have lagged the other medtech segments since 2009, although they are the only companies to have improved their TSR performance, from 10.9 percent to 14.1 percent, over the two periods studied (from 2009 through 2010 and from 2011 through the second quarter of 2013).

In the coming years, device companies will need to learn how to win in a world of value-based health care. Primarily, that will mean integrating along the value chain to offer new services aimed at improving the efficiency of care. For example, Medtronic has made significant strides in developing a value-based business model. It now offers providers consultation services, such as helping to increase efficiency in financing, procurement, and outsourcing. In the U.S., Medtronic is partnering directly with hospitals to help them gauge and improve operational efficiency. It has even begun offering clinical services in the provider space (such as outsourced catheterization labs). Several acquisitions have helped Medtronic build its capabilities and scope in these areas.

Medical-equipment manufacturers should expand into new business areas, within their core competencies, along the value chain. Equipment makers posted a relatively strong TSR of 18 percent from 2009 through the second quarter of 2013, driven primarily by positive market expectations and sales growth. In the future, equipment manufacturers should consider expanding into new businesses, including areas traditionally dominated by providers, as device makers are doing. For example, Fresenius manufactures dialysis equipment and has continually expanded along the value chain by acquiring and managing dialysis clinics, entering into disease management services, and offering specific drugs for in-patient care. Fresenius now effectively functions as an integrated health company, with business units in medical devices, supplies, pharmaceuticals, and clinical services—all for critically ill patients.

At the same time, equipment manufacturers will need to compete with aggressive, low-cost players, such as China’s Mindray, a maker of diagnostic-imaging equipment. Success will depend on wringing out costs and offering differentiated services. To win against low-cost competitors in developed markets, companies should actively work to strengthen the tie between customers and products—for example, through attractive product bundling or other incentives to “decommoditize” their offerings. And they should find ways to provide additional value, such as help with integrating their products into their customers’ broader IT architecture and other add-on services.

Medical-supply companies should choose the right game to play. As noted above, supply companies have experienced notable margin compression, largely owing to pricing pressure on their less differentiated, commodity-type products. As a result, supply companies face perhaps the greatest pressure to establish lean operations, reduce costs, and develop efficient pricing schemes.

Like device makers, supply companies should pursue a differentiated strategy that, through the provision of integrated services, elevates them above the role of mere volume suppliers. For example, Coloplast—which generated a very high TSR of more than 41 percent from 2009 through the second quarter of 2013, putting it eighth out of the 65 companies we studied—differentiates itself through a patient-centric approach. Not being a pure-play medical-supply company, Coloplast sells only certain categories of consumable products, such as those for ostomy and continence care, and it is far more involved with patients than other companies in this medtech segment. Its goal is to generate loyalty and brand preference, and thus avoid being pushed into the commodity space.

In vitro diagnostics companies should adapt their innovation strategy to focus on customer needs rather than pure functionality. IVD companies posted the highest overall TSR (20 percent) during the five years of our study, but they have seen their operational performance deteriorate over the past two and a half years, leading to a sharp decline in value creation. Immediately following the financial crisis, companies in this segment showed strong sales growth and margin performance, but that proved to be unsustainable.

Given this challenge, IVD companies must prepare for increasing cost pressure, and they must revamp their approach to innovation in order to better serve explicit customer needs, rather than simply designing the most technologically advanced equipment and reagents. For example, IVD companies can work to realize measurable improvements in outcomes or processes, such as by helping labs optimize their workflows. Cepheid recently developed a line of unified-cartridge IVD systems that effectively shorten diagnostic-processing times. The cartridges can be used for multiple tests (from 1 to 80), conducted independently, without the need to batch specimens. Although Cepheid’s system costs more, labs have been willing to pay the premium because of the operational savings in reduced lab time and faster processing.

The medtech industry is undergoing a period of significant disruption caused by demographic trends, reforms in the U.S., a global shift to value-based health-care models, and new technologies that are altering the ways that providers deliver care to patients. These changes are creating a challenging environment but also opportunities for those medtech companies that can rethink their cost structures, operational models, and value propositions to both providers and patients. Medtech companies that address these challenges head-on have a good chance to also create sustainable value for their investors in the years to come.

Acknowledgments

The authors would like to acknowledge the contributions of Joe Brilando from the BCG ValueScience Center in San Francisco, a research center that develops leading-edge valuation tools and techniques for M&A and corporate-strategy applications, as well as the contributions of Philippe Dehillotte and Kerstin Hobelsberger of BCG’s Value Creators research team.