This article is an excerpt from The Most Innovative Companies 2016: Getting Past “Not Invented Here,” (BCG report, January 2017).

The Most Innovative Companies 2016

- Innovation in 2016

- Casting a Wide Innovation Net

- Bringing Outside Innovation Inside

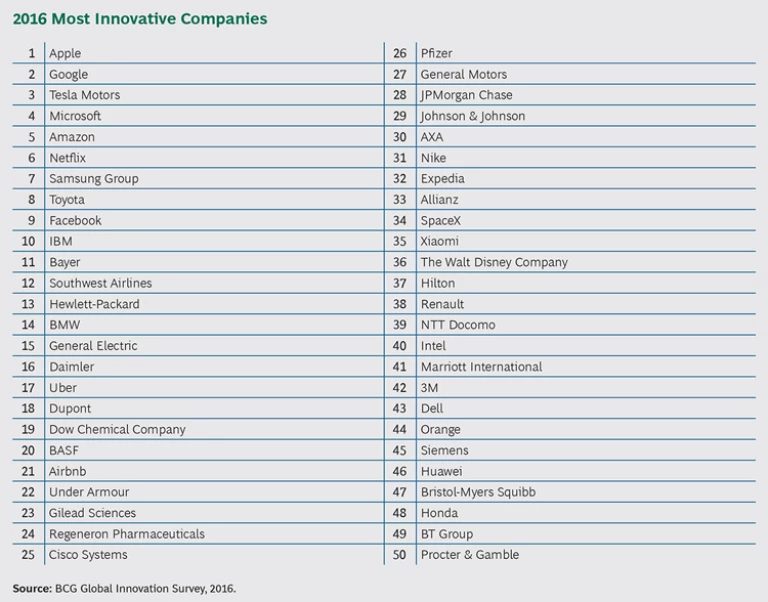

Even a quick scan of BCG’s 2016 list of the 50 most innovative companies highlights the impact of the digital revolution. (See the exhibit.) Long-standing tech giants hold down the top places once again, new digital disruptors such as Uber and Airbnb have joined the list, and the expanding role of digital innovation is readily apparent in the presence of some traditional manufacturers and process-driven companies, such as General Electric and Daimler. Our 11th annual global survey on the state of innovation shows that using technology to secure an innovation advantage is no longer the purview of tech companies.

The Challenges of External Innovation

The pace of technology-driven change is faster than ever before—we are seeing both more-rapid technology development and the quicker impact of new technologies in virtually all aspects of business (as well as daily life). To keep up, tech natives and nontech companies alike must continually be on the lookout for promising new technologies and then incorporate them into their operations in order to realize the market potential of these innovations. These are two substantial and distinct challenges: finding and developing.

First, consider the challenges in finding new innovations. There are gems and veins of ore out there, but there is also plenty of fool’s gold. Often the most exciting discovery is a diamond in the rough: an unexpected use for a new technology. The ability to prospect and to separate the valuable stone from the quartz is something that most executives responding to our survey believe that their firms could improve.

One solution is to apply data analytics tools that can boost innovation productivity by, for example, identifying trends and possible new directions from disparate external sources. Harnessing data from multiple sources—global patent filings and venture funding databases, for example—has helped scores of companies better understand the range of opportunities open to them and identify possibilities for product and business model innovation and moves into adjacent areas. (See the companion article “Casting a Wide Innovation Net.”)

Overcoming Internal Resistance

Bringing the fruits of a new technology to market is its own challenge. Many companies run into internal resistance to innovations that were “not invented here.” Feeling threatened, the organization’s organs of innovation seek to kill off external ideas before they can gain any traction.

But there are ways to marry the best of internal and external innovation. Different companies use different approaches. Some make acquisitions—Cisco Systems is a leading example—while others use commercial arrangements such as licensing to gain access to ideas and intellectual property, a practice that is common in health care. Manufacturers, retailers, financial institutions, and others have set up shop in tech centers such as Silicon Valley and Boston with the express goal of tapping into technology-based thinking and innovation. In recent years, big companies have sought to emulate startups by pursuing corporate venture capital and sponsoring incubators and accelerators. These are all viable approaches to overcoming the not-invented-here mindset, but the right method needs to be applied in the right circumstances. (See the companion article “Bringing Outside Innovation Inside.”)

Putting It All Together: Value Creation Through Innovation

Innovation is ultimately about creating value. Customers flock to novel products and business models. Investors bid up new revenue streams. Consider the case of Under Armour, which joined the most innovative companies list in 2016 at number 22. It is the top fashion and luxury company in our 2016 value creators study, with a 42.5% total shareholder return over the five years from 2011 through 2015. (See Value Creation Through Active Portfolio Management, the 2016 BCG Value Creators report, October 2016.)

Calling Under Armour an apparel company is somewhat akin to saying that Apple is a hardware company. Just as Apple innovates on the basis of empowering users, Under Armour innovates on the idea of making athletes better. It uses technology in all aspects of its business. This approach has led it from the high-performance fabrics that were the company’s genesis to connected fitness devices and wearables and, most recently, to a new venture, Under Armour Connected Fitness. This endeavor, a combination of internal and acquired resources, seeks to transform fitness and performance through an ecosystem of digital devices, tools, and data that help users plan, monitor, adjust, and enhance their fitness and athletic activities. Under Armour has 175 million users in its fitness community and reports that it is adding 125,000 new users every day.

Under Armour has been agnostic when it comes to the source of its innovations. Its founder and CEO, Kevin Plank, invented a material that would repel perspiration and stay dry during workouts. In 2013, he acquired the company MapMyFitness, which became the foundation of Under Armour Connected Fitness. (He had used MapMyFitness’s app when running.) As the company grew, Plank established an innovation lab. He also acquired two companies that brought not only products and technologies but also engineering capabilities and large communities of users, from which Under Armour seeks to learn. Plank understands that data is at the center of everything he is trying to do: he has focused intently on capturing and employing data both for the users of Under Armour products and for the company’s innovation and growth programs. The company has even launched an adjacent business that offers other brands access to its fitness community as a way to increase the visibility of their brands and create affinity among consumers concerned about fitness.

Under Armour is a young company that has ridden its innovations to some $17 billion in market value in less than a decade. As in many firms that are using digital technologies to disrupt their industries, innovation is central to what Under Armour is and what it does. But many bigger, older companies—more than half the top-50 list—have been just as innovative for decades, and some for more than a century.

Take BASF. A regular on our most innovative companies list, the chemical company makes a point of looking for opportunities outside its operations. According to the company’s website, a dedicated subsidiary, BASF New Business, “tracks down long-term trends and innovative subjects in industry and society, analyzes their growth potential, and checks whether potential new business areas fit in well with BASF.” A global scouting and incubation team identifies new business areas and assesses how BASF’s chemical and technology expertise can further their development. The company’s External Innovation Verbund facilitates connections with all manner of outside sources of potential innovation.

Despite growing into large, multiproduct, multidivision, multinational organizations, companies such as BASF have managed to keep the innovative lifeblood flowing. They have found ways to apply the benefits of the digital and data revolutions to the transformation of their own industries. There are opportunities for plenty of other companies to follow their example and do the same to transform their innovation performance.