It used to be enough to deliver a better or cheaper product or service than the competition. Not anymore. Today’s marketers need to demonstrate that their products and services are relevant—personally relevant to consumers at different times and in different places throughout the day. But providing relevance requires access to data, especially first-party data. Gaining and keeping this access depends on earning and keeping consumers’ trust. The most effective way to build trust is through a fair and transparent value exchange.

Research shows that consumers are seeking personalized offers, communications, and treatment. In a 2019 survey by Harris for Redpoint Global, for example, 63% of consumers said they “expect personalization as a standard of service.” BCG’s research has shown that the most sophisticated digital marketers—those that have reached what we call “multimoment maturity,” or the ability to deliver relevant experiences to customers at multiple moments across the purchase journey—achieve cost savings of up to 30% and revenue increases of as much as 20%.

Research also shows that for consumers, trust is a key consideration and it’s easy for them to lose confidence in companies if their data is mishandled. Salesforce.com’s 2019 “State of the Connected Customer” survey found that 83% of consumers are concerned about sharing personal data online and 72% would stop buying from a company or using a service because of privacy concerns.

Since publishing our 2019 report on the dividends of digital marketing maturity, we have continued to explore with leading marketers how they use data and technology to stay close to customers and how they tailor offers and communications to personalize the customer journey. One of the biggest drivers of digital maturity—and of marketing results—is the use of first-party data. Sophisticated marketers understand that first-party data is differentiating (because it is proprietary), relevant (it directly relates to the company and its customers), and consistent and high quality (it comes from the source). They believe first-party data is critical to better understanding consumer behavior, segments, and trends; to delivering more tailored and meaningful messages to customers; and to measuring effectiveness at multiple touchpoints along the customer journey.

First-party data is critical to better understanding consumer behavior, segments, and trends.

Our most recent study (conducted before the onset of the COVID-19 pandemic) involved more than 70 interviews with leading companies in seven markets in Europe. We sought to build on our existing digital marketing maturity benchmark of more than 500 companies globally and better understand how companies are using first-party data to improve their ability to customize their relationships with customers and deliver better experiences. We focused specifically on the key success factors that enable companies to best use first-party data to create value for consumers and competitive advantage for the business.

This report examines the advantage that mature digital marketers can gain through the responsible and proper collection and use of first-party data to drive better customer experiences.

First-Party Data: Benefits and Barriers

Marketers value first-party data because it improves their ability to execute basic digital marketing functions, such as customer segmentation. (See “About First-Party Data.”) It is also a key requirement for more advanced uses such as cross-channel orchestration and personalization, which enable companies to serve customers better. The most advanced marketers link all relevant data sources, online and offline, to define their target audiences and build a more complete picture of customers. BCG’s global digital marketing maturity survey has shown that companies that link all of their first-party data sources can generate double the incremental revenue from a single ad placement, communication, or outreach, and 1.5 times the improvement in cost efficiency over companies with limited data integration.

ABOUT FIRST-PARTY DATA

ABOUT FIRST-PARTY DATA

We define first-party data as data that companies can collect directly from consumers. This includes information about the intent to purchase that customers provide in order to improve the shopping experience. First-party data sources include browsing behavior on a company’s website or mobile app, transaction history from a CRM database, e-commerce sales, loyalty program activity, and information about consumers’ future preferences gathered from surveys, games, and contests.

First-party data comes with restrictions on how it used—restrictions that require explicit permission from consumers to override. Many consumers are happy to have their data used in ways that benefit them, as long as the uses are communicated by advertisers in a clear, simple, and transparent way. Others are cautious, especially in light of several high-profile data breaches. Consumer concerns have led regulators to step in with new rules. The major web browser designers are trending toward more automatic blocking and user control of cookies. Responsibility and best data practice have become prerequisites in data-driven marketing.

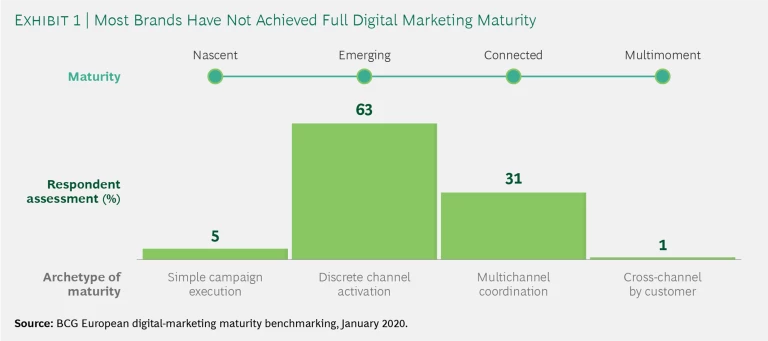

And yet, while nine out of ten marketers say that first-party data is important to their digital marketing programs, our research has shown that less than a third of marketers are consistently effective at accessing and integrating data across channels, and very few are good at using data to create better outcomes for customers. (See Exhibit 1.)

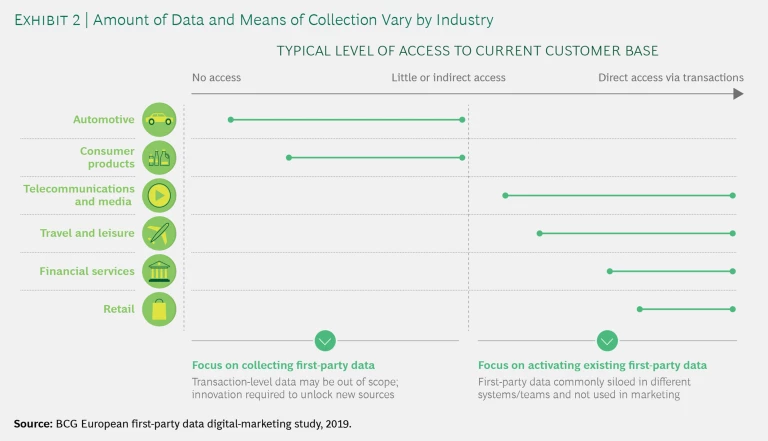

There are multiple reasons for this. The most common may be simple access, which is determined in large part by how companies engage with consumers and their history of customer interaction. (See Exhibit 2.) Many companies, such as consumer products manufacturers and automakers, have limited direct customer interactions. Others are comfortable relying on partners, such as retailers, that collect relevant information about customers. “We rely on retailers to drive traffic for sales,” one beauty brand marketer said. “For us, it is a secondary priority to grow first-party data use and knowledge. Instead, we are looking at building data-sharing capabilities with partners.”

To improve access and offer better service to customers, lots of companies look for innovative ways to unlock new data sources. An automaker has developed an app for owners of its cars that provides such helpful features as locking and unlocking vehicle doors, preheating the car in winter, and trip-planning assistance. The company collects data that can be used in marketing, especially around customer segmentation and potential cross-selling or up-selling opportunities. Similarly, a personal-care brand created content-specific websites and a blog to tap into the more than 1 billion consumer searches for hair care information each month. The company provides tailored content for different types of hair care, including video blogs on styling tips. It collects first-party data from site visits and email addresses from newsletter sign-ups, which it uses to develop better audience segmentation and deliver more relevant messages.

Another barrier to first-party data usage is internal silos. While many companies use first-party data for tasks such as risk management (banks) or churn prediction (telcos), they are not yet leveraging these capabilities fully in their marketing efforts. Their collection efforts are not integrated, the data ends up in siloed systems, or it is not made available for broader use.

A third issue is caution. In a good number of companies, management is afraid that overly personalized communications could have an adverse impact and drive privacy-sensitive consumers away.

The Responsibility Imperative

BCG has been conducting research and writing about online privacy and consumer trust for the better part of the last decade. As early as 2013, we pointed out that trust is fragile and elusive, noting that “some organizations will excel at creating trust, and some will not.”

In 2016, our research found that more than 60% of consumers in five major European markets believed that opt-in or opt-out permissions should be required for most types of data use. The 2019 Salesforce.com study showed that consumers remain concerned about how their data is collected and used, even as lawmakers and regulators enact new policies and regulations. Moreover, a continuing stream of high-profile cases involving data theft and misuse keep the risks of data abuse front of mind.

Consumers’ concerns should not be misconstrued as the outright rejection of companies’ collection and use of their data. While studies have shown that up to four in five consumers will walk away if their data is used without permission, our research has found that consumers are much more likely to share data with companies that they trust; they mainly just want to be asked.

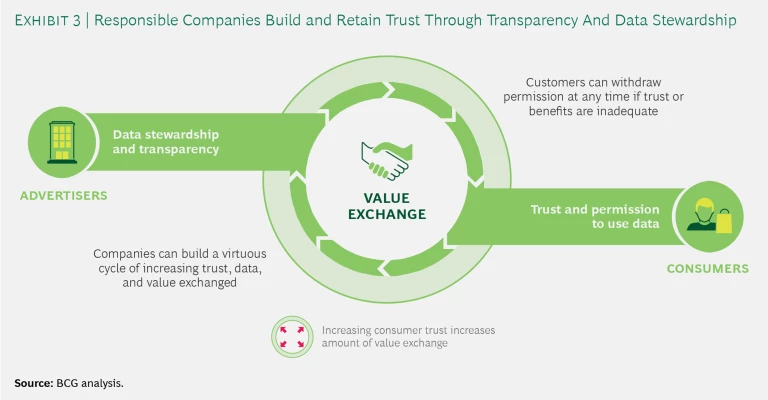

At its core, first-party data best practice is about a two-way value exchange: the company gains the ability to deliver a better customer experience and more effective marketing, and the customer gains useful information, assistance, and offers. (See Exhibit 3.) The burden is on companies not only to collect and use data responsibly but to make sure their efforts are visible to customers (while they also adhere to local regulations). The principles of good data stewardship are critical to sustaining this cycle. These involve a combination of internally focused practices that define how a company collects, manages, and uses data and externally focused practices that establish how it engages with stakeholders about that data collection and use.

Companies must also ensure that they are using data to create good experiences. One European telco established a global customer value management team that sets guidelines for the amount of personalization in company-owned communication channels such as email. “We want to respect our client,” a company executive said. A global financial institution goes beyond national regulations in most of its markets with a global standard for cookie collection more stringent than Europe’s General Data Protection Regulation (GDPR). A consumer marketer described her company’s efforts this way: “Consumer education is one of the cornerstones of our marketing policy, and this requires two-way communication.” Another said, “The only license we have to operate is through restoring trust and creating relevance for our customers.”

Mature marketers follow three best practices when asking customers for permission to use first-party data:

- Visibility. They don’t hide banners, they design the ask with a neat user interface, and they make it easy to withdraw permission by giving users control.

- Candor. They are upfront about the reasons for collecting data and the benefits of collection and usage.

- Value. They highlight the incentives, such as a better customer experience, that comes from sharing data.

Putting First-Party Data to Use

To make the consumer value exchange work, mature marketers follow a three-part process. The first step is setting a strategy that supports broader business objectives. The second is collection: gathering, storing, cleansing, and combining consumer data from multiple first-party sources. Ensuring good-quality data is an essential consideration at this stage. The third step is analysis and activation: putting the data to work for marketing activities at all stages of the purchasing funnel.

Strategy. Mature marketers start with a data strategy that supports their business objectives. They are clear about the data they need to reach specific business goals or to deal with specific problems. “Everything we do within marketing or sales should be executed with a very specific data acquisition strategy, of course within the guardrails of policy that exist within each country,” a consumer products executive said.

Digitally mature marketers also set priorities for each customer segment. For existing customers, where the objective might be to drive loyalty and share of wallet, first-party data can be used to up- or cross-sell, to predict and prevent churn, or to “wow” the customer with a tailored experience. For new customers, where the objective might be to find high value potential, first-party data can be used to assess the indicators of high customer lifetime value or to use the qualities of existing customers to find lookalike audiences. One retailer segments customers based on frequency of visits, the elapsed time since the last visit, the monetary value of each visit, and lifetime value. On top of this data, the company layers information on site engagement and behavior to assess its interactions with customers in order to create a more relevant experience.

Digitally mature marketers set priorities for each customer segment.

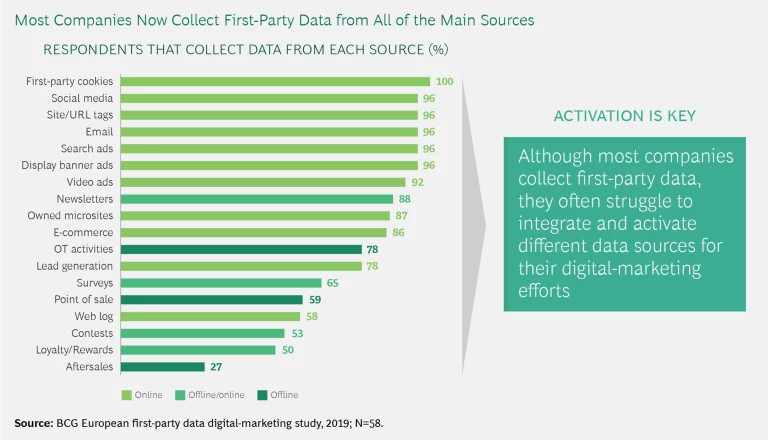

Collection. Most companies collect data from many different first-party sources. The ten most common sources are online and are used by three-quarters or more of the companies we surveyed. They include on-site browsing, interactions with digital paid ads, and the company’s CRM database. The two most common offline sources are point-of-sale and after-sale contact.

Only companies in the more advanced connected and multimoment stages of digital marketing maturity are consistently able to link the majority of their data sources and connect them to advertising technology platforms for automated activation. For example, many companies collect offline interactions, such as calls to customer service centers, but they do not connect this data (which may indicate satisfaction, frustration, or unresolved issues) to other data sources, nor are they using it to tailor messages in their digital channels. One fashion retailer has made a concerted effort to integrate customer service data through a virtual chat assistant that helps customers with queries. The collected data (including information about purchase intent) is then linked to the company’s demand management platform and used to increase conversion further along the funnel. Another retailer uses loyalty cards to link in-store purchases with online purchases.

Analysis and Activation. Simply collecting data does not unlock its potential, of course. Our research found that only when data sources are integrated and linked to marketing activation do companies see significant increases in ROI.

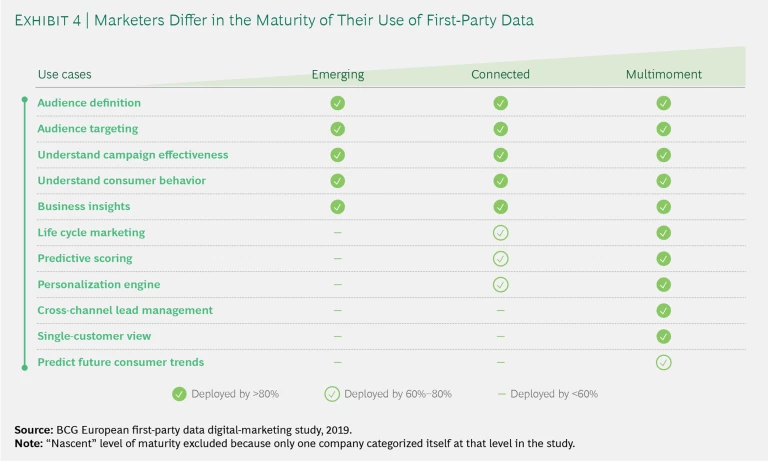

Companies can use first-party data in multiple ways, ranging from the basic (audience definition, for example) to the advanced (predicting future consumer trends). Companies exhibit a substantial range in the sophistication and extent to which first-party data is used. (See Exhibit 4.) Take audience segmentation and targeting as an example.

All of the companies we surveyed indicated that they differentiate to some degree between new and existing customers, which at its most basic requires only one source of first-party data (typically the CRM database or website analytics). More sophisticated digital marketers deploy a variety of tactics to retarget consumers who have already visited their website, to exclude existing customers from awareness-based campaigns, and to create lookalike audiences, based on the characteristics of existing customers, whom they can then pursue across other digital channels. The key for these companies is to make their marketing and segmentation more specific without sacrificing reach, while ensuring that the economics remain viable (by preventing oversegmentation, for example). For the companies that do this well, we have seen improvements in cost per action (CPA) of more than 25%.

Companies that move up the maturity ladder are able to manage more fully personalized customer journeys by:

- Combining multiple online, and even offline, data sources

- Augmenting existing first-party data with third-party and other internal financial and sales data

- Enhancing their first-party data with predictions from AI-powered models that assess such factors as propensity to buy

We have seen personalization and more advanced audience definition result in significant revenue uplift. For major product launches, one consumer electronics company has a customer data platform that links with its CRM software to collect data from media campaigns, which it uses to define consumers’ likelihood to purchase and take them to personalized landing pages.

Only about 30% of companies, almost all in the connected or multimoment maturity phases, practice such advanced uses as single-customer view or life cycle marketing. We have observed in regions outside of Europe that brands that deploy these more advanced activation techniques achieve 1.5 to 3 times higher revenue uplift than those that don’t.

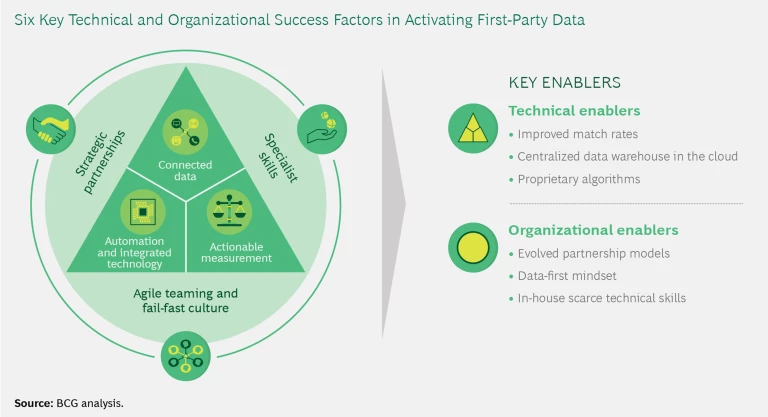

The Enablers of Digital Maturity

In our 2019 report, we highlighted six enablers of digital marketing maturity, three technical and three organizational. These are the capabilities that define the most advanced connected and multimoment companies. (For more information, see the Appendix.) Leading users of first-party data add a few key capabilities in each area, starting with the three technical enablers.

Automation and Integrated Technology: Centralized Data Warehouses. Many companies in the connected and multimoment stages make use of centralized data warehouses in the cloud that combine company data and marketing data seamlessly. This approach is more common among younger digital natives that do not need to deal with legacy systems. Older companies often try to build a data integration layer that can take in and manage data from both new and legacy systems.

Connected Data: Match Rates. First-party data users should look to improve their match rates among different data sources. These include matching communications or offers with the relevant recipients and stimulating customers to take action. One well-tested tactic, especially for companies that are starting from lower maturity levels, is consolidating the martech stack—using fewer integrated players as opposed to individual vendors for each activity. For those building such relationships, it is important to insist that just as consumers trust marketers when they hand over their data, marketers must be able to trust their partners to adhere to their data stewardship standards.

More companies are also giving customers incentives to “reveal” who they are to help improve match rates. One of the most common is simply being transparent about how data is used to generate value. Another is demonstrating value, such as by offering additional functionality or access. For example, retailers often encourage users to download their apps and log in using loyalty program information; as an incentive, they provide a streamlined order process, personalized offers, and product recommendations timed for replacement cycles.

Actionable Measurement: Proprietary Algorithms. Many emerging and connected companies take advantage of off-the-shelf measurement solutions, while multimoment companies tend to move beyond these tools, which typically lack transparency, in favor of developing their own algorithms in-house. These focus on a particular metric or metrics geared to the business, such as customer lifetime value or churn prediction. Companies with less transaction data can build a test-and-learn agenda to determine which tactics work best. A few mature brands adjust their automated bidding strategies based on customer lifetime value. A proprietary approach, of course, requires more specialist skills, either in-house or from partners.

Data-First Mindset. A data-first mindset is the first of three organizational factors that enable companies to better collect and use first-party data. Among companies at higher maturity stages, data governance and stewardship have become more important and visible throughout the organization. Advanced companies are explicitly defining their data strategy and establishing executive positions (such as chief data officer) around data and analytics as they try to establish a more data-centric culture across the entire company. One executive told us, “Our maturity transformation has been all about that mindset change within the company, and also about bringing on partners with this data-first mindset.” A global health and beauty company has data protection officers at the group and country levels, as well as a “mini-DPO” in every team. The company has experienced a “massive” improvement in data focus, in the number of ways the data is used, and in ease of activation.

Advanced companies are establishing executive positions around data and analytics.

Specialized Skills. The mix of internal and external capabilities and roles is evolving. For one thing, ownership of data and technology contracts is moving in-house. Data standardization, quality, and authorization are all critical and need to be closely managed. Companies that are closing in on the multimoment stage typically move specialist functions (such as data scientists and cloud engineers) in-house in order to build proprietary models that can facilitate more advanced use cases. One agency executive said, “We do a lot more training now than we used to, and client budgets for training have increased significantly as they are realizing that it’s more effective to develop in-house skills.”

Strategic Partnership Models. Among the most mature companies, we are seeing an increase in partnerships with technology providers and advanced analytics partners. These companies are increasingly working with adtech providers to better understand how to best deploy the available tools and achieve full functionality. “Now that AI and machine learning are becoming more common, it’s becoming a lot easier to do more with less data,” said a pharma marketing executive. Partners with specialist skills such as advanced analytics are in rising demand. A leading European telco recently worked with a top university to develop its attribution model.

We are also seeing a shift in the way many companies work with their partners, such as media agencies. This involves a change in focus from execution (media buying and advertising operations) to partners playing a more advisory role as advertising operations and media buying activities move in-house because of automation and larger digital media budgets that justify increased FTEs. Media agencies advise on specific topics or help train internal teams. “Ten years ago it was okay to have a standard analytics implementation underpinning your marketing, but now analytical capabilities are a commodity (like Word or Excel) and data scientists are fundamental,” one agency executive said.

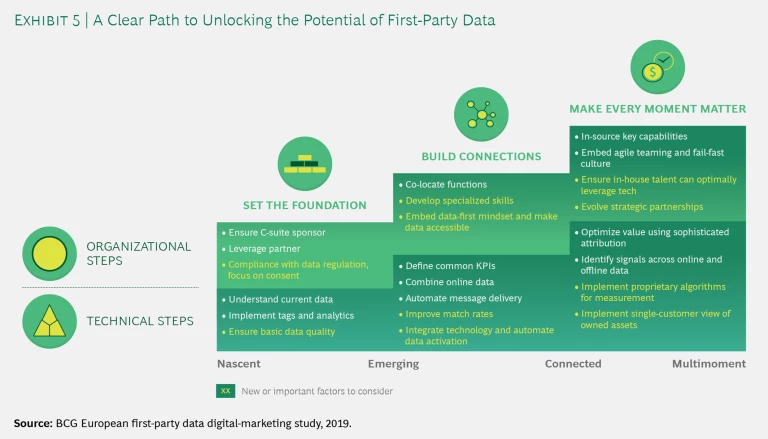

Each company’s circumstances and starting point are different, but all companies can speed their journey up the digital marketing maturity curve by unlocking the potential of first-party data. (See Exhibit 5.) Equally, the role of first-party data will be different for each company, but improving first-party data capabilities will increase overall maturity and drive business growth. Success depends on a clear data strategy that supports business objectives. Companies need to be precise about what data they want to gather and define the most efficient, effective, and transparent way of collecting this information with consumer permission. They must then use the data in a responsible way. They also need to demonstrate the value they offer and the steps they are taking to ensure responsible data stewardship. With a foundation rooted in responsibility, any marketing organization can start the climb to the next stage of digital maturity.

Appendix

The following exhibits provide more information on how companies collect and use first-party data.