Thanks to the rapid adoption of digital technologies, the proliferation of data, skyrocketing costs, and the ongoing pandemic, software as a medical device (SaMD) is poised to be a big opportunity in health care. Yet even companies with compelling products struggle to scale, let alone find a commercial model that is repeatable and sustainable.

We’ve found from working with clients that to get ahead, SaMD manufacturers need to focus on three success factors—a robust business model, an effective operating model, and solid stakeholder support. Building trust is key to gaining adoption and unlocking future traction for reimbursement from payers.

What's Different About SAMDs

SaMD is defined as a software that’s regulated as a medical device. SaMDs are used in prescription digital therapeutics, disease management, and decision support tools.

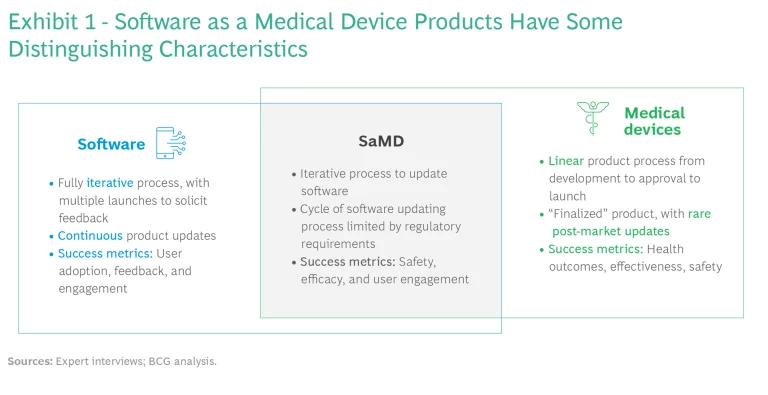

Although SaMD companies sit at the intersection of the software and medical industries, their business and operating models are unique in some important respects. (See Exhibit 1.) Compared with the typical drug or medical device company, product development time is shorter, revenue curves have a different shape, and substantially lower investment is required for extra features and in-market expansions.

At the same time, SaMD companies are meaningfully different from consumer health companies, which sell wellness, oral health, nutrition, and skin health products directly to the consumer. While SaMDs have much higher barriers to entry in the form of upfront R&D costs and regulatory requirements, they can target specific populations and make claims about benefits. Moreover, they have access to the reimbursable market and a much greater value pool. By contrast, consumer companies have access to a larger population, but they also have to deal with challenging competitors like Apple, with its smartwatch apps.

The global SaMD market is ready to take off. The Insight Partners projects a five-year CAGR of 21.9%, reaching $86.4 billion in 2027. Several SaMD companies have attracted major investment over the past three years, and a few, including Livongo, Noom, and Biofourmis, have achieved unicorn status.

Eager to capitalize on the opportunity, hundreds of companies have developed at least one SaMD product. But most of these companies are not positioned to see stable, long-term growth. Only a few have had high valuations, even fewer have generated meaningful revenues, and almost none are profitable. That’s primarily because payers are reluctant to reimburse for a SaMD without sufficient clinical evidence of efficacy at scale, so it’s difficult to engage significant numbers of patients and physicians.

How to Get the Most from SAMDs

To realize the potential that SaMD offers, three ingredients are critical. First, a strong business model will provide a clear path to revenue and profit through tried and tested channels while the company pursues potential insurer, provider, and regulatory pathways. Second, creating a well-defined operating model will ensure high-quality product development end to end, with robust clinical results and launch within the desired time frame. Third, building stakeholder trust in those clinical results will help promote providers’ adoption and use of the product in practice.

A Robust Business Model

Although software is the product being sold, the innovation that differentiates successful SaMDs lies not in technological breakthroughs but in the business model. Developing a scalable and repeatable model that maximizes a product’s value in its intended use cases is key to commercial success.

Pricing. Like traditional software companies, SaMD companies need to consider two kinds of pricing: access (such as for an app store download or for licensing) and recurring (subscription and pay for use). But given the nascency of the market, establishing the optimal price (or prices) is challenging. There are simply too few analogous products in market to use as benchmarks in the price discovery process.

Moreover, the bar for reimbursement is high. The company needs to demonstrate that the device meets a need in the insurer’s population, changes outcomes, and lowers costs. To expedite the process, companies go directly to consumers to build the evidence, engaging payers as evidence emerges. As a result, companies often launch multiple software products in parallel across a variety of channels—direct-to-consumer, business-to-business, business-to-business-to-consumer—starting with a payment model that is out of pocket and later reimbursed through health insurance plans. So it’s possible that multiple pricing strategies will end up being developed for each channel.

Two-Step Approach. Some companies develop a general consumer wellness product while working on a SaMD to get early experience and feedback without any regulatory challenges. They then shift their focus to the SaMD while ensuring that they have the regulatory capabilities needed for a seamless go-to-market approach with employers and potentially pharmacy benefit managers. This strategy has worked well for companies like Noom, which, after launching a weight-loss app, has expanded its focus to therapies for chronic conditions like diabetes.

An Effective Operating Model

Successful SaMD makers develop innovative operating models that follow best practices from agile software development while maintaining the quality, safety, and clinical rigor required for a regulated medical device.

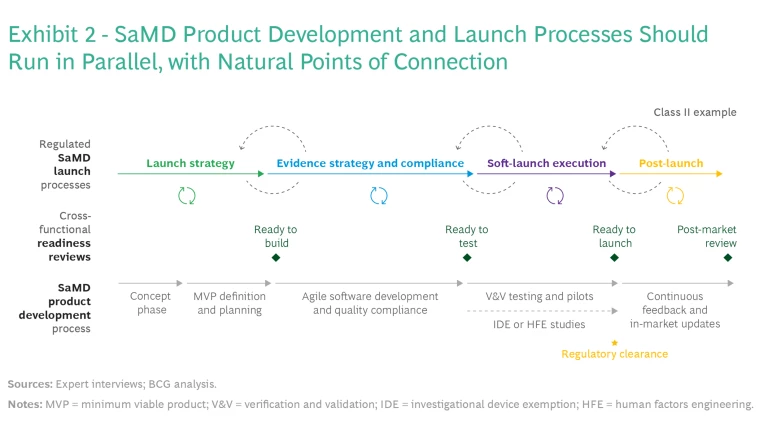

Connection Between Product Development and Launch. The business model has major implications for many product and launch decisions, such as use cases, evidence generation, and available commercial pathways. For this reason, SaMD companies should conduct product design in parallel with business model development and commercial launch strategies—such as launching the SaMD as a standalone solution, linking it to a physical device, or selling it as a service offering. BCG’s SaMD integrated launch and development framework (see Exhibit 2) includes four critical elements.

Cross-Functional Reviews. It’s important for companies to bring together a wide group of stakeholders as early as possible during development and then regularly as the development progresses. These include people with product, regulatory, clinical, and commercial expertise. Other functional areas such as privacy, health equity, human factors, compliance, and quality should also be involved.

During review cycles, cross-functional reviews are key to ensuring that all aspects of the product are on track to meet objectives. Quality management systems documents can be collaboratively authored and reviewed along with requirements and code to meet defined agile “ready and done” criteria. This approach will help limit decision paralysis and ensure rapid progress.

Clinical safety and efficacy reviews should be proactively managed to ensure that the device will perform as intended in studies. Proactive management will also reduce the risks associated with agency submissions and provider adoption, where the margin for error is small and where a redo can add a lot of time to the product development timeline.

It’s critical to ensure that the software release cycles are aligned with the clinical development plan.

“Medical Agile” Development. The SaMD product development process should be agile, with iterative build, test, and learn cycles that take into account the various requirements needed to satisfy patients, health-care providers, payers, and regulators. Rapid pilots are the ideal way to gather the real-world evidence from patients and caregivers that has become increasingly important for refining product features and data models during development. These insights should flow back to the product development process to inform not only the product roadmap but also clinical and regulatory strategies.

Since clinical plans have a bearing on software development, it’s critical to ensure that the software release cycles are aligned with the clinical development plan. This is challenging because software is developed in quick, continuous iterations, while clinical evidence is built over time. Successful SaMD companies develop the two simultaneously. They leverage agile processes and automation dry runs and cloud-based platforms to reduce risk and ensure that high-quality software is released on a quarterly basis, and they deploy usability studies continuously to lower the risk associated with formative, summative, and post-market studies.

Parallel Development of Regulated and Unregulated Product Features. To allow for flexibility and speed to market, regulatory compliance requirements for SaMDs are often greater for components with higher-level risk profiles. We recommend that companies modularize development so they can focus compliance efforts on components with higher-risk code and data. Since the FDA exempts regulatory enforcement on mobile medical apps in broad health categories that aren’t in the critical-care pathway, this modular approach can significantly lower the need for costly compliance efforts in certain parts of product development.

Solid Stakeholder Support

Despite recent progress, it may still be difficult to convince stakeholders in the health-care ecosystem that SaMDs are an effective mode of diagnosis and treatment. Companies therefore need to go the extra mile to make their products viable in the eyes of patients, HCPs, payers, and regulators.

Design products that meet the patient’s needs. In the wake of COVID-19, which highlighted the disparities that prevented certain segments of the population from having access to health care, companies need to make health equity a priority from early development on. Successful SaMD companies design clinical development and market-access programs that use health-equity criteria to ensure that datasets are applicable to broader populations. They then develop products with an understanding of the contextual nuances of the data, such as inequalities or cultural preferences, and ensure that the testing population is diverse. These precautions are especially important for developing products that use artificial intelligence: if biased data are used to train an algorithm, the product could end up making flawed diagnoses or recommendations.

Like health equity, privacy issues have assumed a new urgency. As security breaches grow increasingly common, consumers are especially resistant to big corporations having control of any of their data. Hence, med tech companies need to invest in cybersecurity and patient privacy infrastructure to ensure that they have a robust architecture for all markets.

Successful SaMD companies make health equity a priority.

Reduce the burden on providers. Companies need to design SaMDs that are convenient for health-care providers (HCPs) to use, since even the most effective solutions won’t be used if they require additional work or time. To get HCPs to buy in, obtain meaningful numbers of prescriptions, and expand the number of claims executed over time, the products need to be easily integrated into existing clinical workflows and pathways. New SaMDs must also be interoperable with providers’ existing health IT systems, tools, and processes so that routine activities, such as entering patient information in electronic medical records, don’t create bottlenecks.

To ensure that products meet these requirements, the development process should include frequent feedback and continuous product testing with providers and caretakers who are actively engaged in patient care. Some SaMD companies have found that co-promotion partnerships with current providers of available drugs and devices can help accelerate HCP adoption by physicians and enable reimbursement from payers.

Engage payers early and regularly. Winning over payers requires proof that the SaMD provides outcomes that are worth paying for. Companies therefore need to develop robust clinical and economic evidence and translate it to compelling value propositions. This requires running dozens of rigorous studies that demonstrate that, compared with conventional treatments or therapies, the SaMD leads to better health outcomes and reduced overall costs, shorter time-to-diagnosis and -treatment, or greater patient throughput.

In addition, since clear reimbursement pathways still don’t exist at scale, SaMD companies should develop reimbursement strategies early in the product development cycle and regularly engage key payers throughout the development process. One possible strategy would be to leverage remote patient monitoring codes to reimburse physicians for the time they spend using SaMDs; another would be to classify physicians who use SaMDs as virtual service providers with the appropriate medical code.

Use the same rigorous trial controls as traditional products. When it comes to meeting regulatory requirements, SaMD makers, unlike traditional medical device companies, are permitted to tailor clinical trials to the specific product. Despite this flexibility, SaMD companies should uphold the same rigorous controls as traditional trials. That means abandoning the use of smaller, academic trials that lack proper controls in favor of approved trial protocols, registration with health authorities, and dossier submissions. Although the timelines and costs of running traditional clinical trials may be arduous, it will provide the robust body of clinical evidence that regulators require.

Companies must also keep in mind that data security, privacy protection, and quality management are baseline requirements for regulated software. To achieve regulatory approval, therefore, it’s important for organizations to carefully document their legal, regulatory, quality, and cyber-security processes.

How to Get Started

Before SaMD companies can put these guidelines to use, they need to conduct development and commercialization processes in parallel. That’s because the regulatory and commercial strategy will inform product decisions, and product development testing will inform regulatory and commercial decisions.

It’s important to include diverse groups of stakeholders throughout commercialization and launch to ensure that all perspectives are considered and to avoid delays later. It may be necessary to add stage gates and cross-functional checks that stipulate the participation of certain stakeholders at different decision points, as illustrated in the launch-readiness reviews summed up in Exhibit 2. For instance, getting input from health equity teams throughout development and piloting is key.

To boost engagement and reduce risk, some decisions around the initial launch that are made early in the product development cycle may need to be revisited as more evidence become available. The team must have the courage to re-evaluate areas where development is not fully aligned with strategy or changing market forces.

SaMDs hold tremendous promise for patients and the providers who treat them. The companies that focus on developing and commercializing compelling products today can help us address some of health care’s most vexing challenges in the years to come.