The space economy is growing rapidly, and countries are racing to build spaceports for launching satellites and rockets. However, these are complex and expensive projects to undertake at a time when technology and the economics of space are evolving quickly. New entrants will have to compete with strong incumbents, and many will operate for years before generating their target return on investment (ROI).

For that reason, spaceport developers need to consider a variety of factors, including pricing, operations, and talent. Some of these factors are unique to individual facilities, while others apply to all spaceports. We have developed a framework for how to think through these factors, giving commercial and public-sector organizations a structured approach to building spaceports with the attributes required to survive and thrive amid increased competition.

The next decade will reshape the competitive landscape for spaceports, but the fundamental principles of business will still apply. Facilities must effectively differentiate themselves, make a compelling case to their customers (launch service providers), and adopt a sustainable financial model. To secure their future over the long term, spaceport developers need to choose the right path today.

The Launch Market Is at an Inflection Point

The number of space launches has risen steadily over the past two decades, with 186 total orbital launches worldwide in 2022, the highest number in a single year. And more growth is coming. Low earth orbit (LEO) and medium earth orbit (MEO) satellites—which are less expensive and easier to launch than traditional geostationary orbit (GEO) satellites—are a key driver of this growth. They are being launched at a record pace, often in constellations.

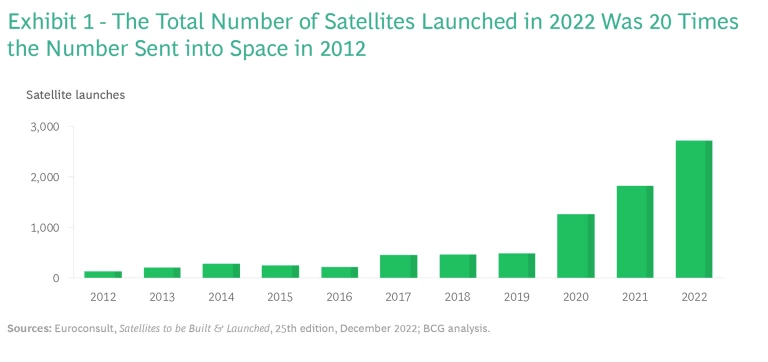

The number of satellites launched has steadily increased over the past decade, increasing fivefold in the last five years alone. (See Exhibit 1.) Our analysis of industry data indicates that there will be at least 24,000 satellites launched from 2023 through 2030, and that figure could reach nearly 40,000 depending on the progress of planned megaconstellations in LEO. Space exploration is gathering pace as well, with 170 missions projected from 2022 through 2031, more than three times the number that launched in the past decade.

The launch industry is growing nearly as fast, and capital is following. Although the market saw a dip in overall investment activity in 2022—especially for startups—nearly 430 companies received some investment that year, and the ten largest deals accounted for $700 million in funding, an 18% increase over the amount in 2021. Amid the hundreds of startups emerging in the new space economy, the market remains characterized by a handful of companies, such as SpaceX, that have strong positions. And these companies are rushing to secure capacity at capable spaceports.

Spaceports, therefore, are a linchpin in the space economy and will help determine its growth trajectory. Many entities, in both the public and private sectors, are chasing the opportunity to build new spaceports, but there are constraints on how many can succeed.

The Competitive Landscape for Spaceports Is Dynamic and Challenging

Approximately 53 spaceports currently operate worldwide; most are located in China, Europe, Russia, and the US. Roughly 30 new sites have been proposed—including at least 20 that will support orbital

Governments often view spaceport development as a means not only to boost the economy but also to achieve broader national objectives, such as establishing sovereignty in the increasingly important space domain. For this reason, new spaceport development will continue regardless of volatility in the launch market or investment climate. Yet the competition to secure customers will be fierce. New entrants will have to compete with strong incumbents and have the wherewithal to potentially operate for years before delivering hoped-for ROI.

Several well-established spaceports dominate the market. Among the countries and regions with the largest and most active space industries, several spaceports dominate their respective markets and have well-established track records of successful launches. China’s Jiuquan Satellite Launch Center has supported more than 167 launches since 1970, and Russia’s Baikonur Cosmodrome has supported nearly 1,500 dating back to Sputnik 1 in 1957.

New entrants face common challenges. The new spaceports that are in development have different revenue models and levels of institutional investment, they are in various locations, and they have different degrees of private- and public-sector ownership. But all spaceports share similar challenges.

- Funding the Initial Capital Investment. The capital expenditure required for construction—including building control centers, hangars, runways, taxiways, and launch pads, as well as installing communications equipment—can range from $100 million to $500 million, depending on the size, scope, and complexity of the project.

- Generating an ROI. Some governments in the Persian Gulf and Europe are helping to capitalize spaceport construction, but they then face the next challenge—generating an ROI that can often take many years. Spaceport America in New Mexico, for example, spent $220 million in public funding from 2006 through 2012 for initial site construction and currently generates just $7 million in annual revenue. To justify the financial risk and large upfront investment requirements, investors will typically require an internal rate of return or ROI of 15% to 20%.

- Finding a Suitable Location. The science of space flight dictates that spaceports be built in locations that offer favorable launch angles (because of the Earth’s rotation) for spacecraft to reach their target orbits. Cape Canaveral in the US and Europe’s Guiana Space Centre, for example, are located close to the equator, where it requires less energy to launch into orbit than it does in locations at higher latitudes. Both are also close to water, minimizing the risks to bystanders, communities, and infrastructure on the ground.

These financial and technical challenges, combined with the volume of new spaceports on the horizon, will push both existing and emerging establishments to differentiate themselves and make a compelling case to launch service providers.

A Framework for Successful Spaceports

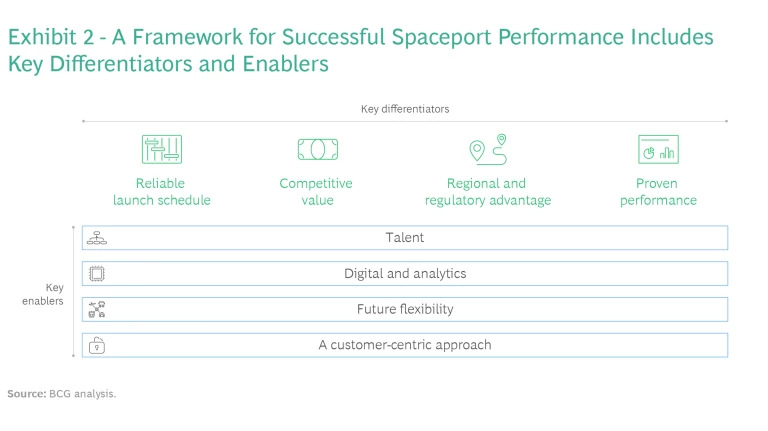

How can spaceports navigate this highly competitive landscape? Our experience points to a framework of four differentiators and four enablers. (See Exhibit 2.)

Four Differentiators For Individual Spaceports

Differentiators are specific to each spaceport and relate to the value that they offer customers. Successful spaceports must distinguish themselves from their competitors by using the four key differentiators. (See the sidebar “How a Spaceport in Japan Excels Across the Four Differentiators.”)

How a Spaceport in Japan Excels Across the Four Differentiators

How a Spaceport in Japan Excels Across the Four Differentiators

A Reliable Launch Schedule. TNSC has had 83 successful launches since 1975, more than any other facility in Asia except those in China. TNSC has a dedicated launch complex for the H-IIA, Japan’s most commonly used launch vehicle.

Competitive Value. TNSC’s infrastructure supports launch vehicles of all sizes, and onsite facilities—many supported by small local businesses—combine multiple operations such as test and assembly.

Regional and Regulatory Advantage. The facility is located at the southern tip of Japan, putting it close to the equator, yet still accessible via multiple forms of transportation, enabling the movement of staff and materials.

Proven Performance. TNSC has onsite facilities for all essential services, including launch, assembly, fitting, and inspection. It also has a large museum and a state-of-the-art launch simulation theater to engage visitors.

A Reliable Launch Schedule. A reliable launch schedule means placing satellites and other payloads into orbit on time. Spaceports that routinely delay launches—because of the weather or the failed launches of other customers (which can involve lengthy cleanups)—may have difficulty competing against rivals with more predictable schedules and a higher rate of successful launches.

Competitive Value. Commercial launch costs need to be competitive. At a baseline level, costs vary depending on a number of factors, including the square footage that is required and launch volume. Spaceports may be able to use local regulation to give them a financial advantage regarding costs. In the US, Florida passed a law in May 2023 that limits liability for commercial space companies. Launch service providers may be willing to pay extra for this protection. In addition, some customers are willing to pay a premium of 25% to 100% for a reliable schedule and flexible service. Such services can increase value for customers and, thus, maximize a spaceport’s revenue. (See the sidebar “Levers to Unlock Value.”)

Levers to Unlock Value

Levers to Unlock Value

The second lever is reducing costs and optimizing the use of facilities. Despite projections of strong demand for launch services in the coming years, customers are very price sensitive and will exert pressure on spaceports to reduce launch costs. There is room to do so: in a project to boost a spaceport’s competitiveness, BCG found that labor and fringe costs can account for more than 40% of operating costs in some markets, by far the largest source. Additionally, these costs were projected to grow in line with forecasted revenue, meaning that the port would not achieve scale advantages.

The third lever is having a clear and grounded business case, with the goal of achieving the 15% to 20% ROI that investors desire. The business case for a spaceport can be evaluated along six dimensions:

- Revenue. Spaceports should plan for increasing year-over-year revenue as they mature and grow, allowing them to recoup their large upfront investments.

- Launch Cadence. As with any fixed asset, utilization is key. The ability to perform more launches in a given period of time directly correlates to an increase in revenue.

- Average Revenue per Launch. Differentiating their launch offerings, such as offering premium launch windows, could allow spaceports to increase their average revenue per launch.

- Variable Costs. Variable costs should decrease as ports begin to benefit from economies of scale, ultimately improving their launch margins.

- Fixed Costs. Expenses such as insurance, interest, utilities, property taxes, and salaried employees are all costs that will be incurred regardless of whether the port is actively performing launches and generating revenue.

- Capex and Financing. Spaceports will have to make large upfront capital expenditures and will have to consider how they will finance these initial cash investments.

A Regional and Regulatory Advantage. As noted above, location is a critical element in determining the success of a spaceport. The ideal location gives customers access to favorable azimuths and orbits, along with sufficient land onsite or nearby to produce and develop launch vehicles and manage payloads. Additionally, a favorable regulatory environment facilitates the development of launch and range infrastructure to ensure launch safety.

Proven Performance. Spaceport customers look for overall operational excellence when selecting launch locations. High-functioning business operations and customer relations, world-class clean rooms and facilities, well-defined services and safety protocols, and hospitality for watch parties are some of the factors that demonstrate a high-performing, customer-oriented spaceport.

Four Key Enablers For All Spaceports

Key enablers are common across all spaceports and relate to internal business functions. (See the sidebar “The Virginia Spaceport Authority Capitalizes on the Four Enablers.”)

The Virginia Spaceport Authority Capitalizes on the Four Enablers

The Virginia Spaceport Authority Capitalizes on the Four Enablers

Talent. MARS has been able to draw on a strong pool of aerospace talent because of its proximity to the Washington, DC, defense industry. That gives it a key advantage, since new spaceports will increase the competition for talent.

Digital and Analytics. The facility has strong digital and analytics expertise, in part through strong relationships with industry and academia.

Future Flexibility. MARS worked with commercial firms to modernize its infrastructure and secure physical space to expand.

A Customer-Centric Approach. The facility built a regional economic plan that included a business-friendly approach to attract new commercial clients.

Talent. Spaceports require a talent pool with a diverse mix of skill sets—not only the technical expertise required for launches but also the ability to navigate complex governmental oversight systems. Recruiting and retaining the right mix of talent, along with building a strong talent pipeline, is a challenge for every spaceport because of the tight labor market and competition from other industries that need talent with science, technology, engineering, and math skills. Some organizations, such as NASA, tackle the challenge by creating rotational programs, term assignments, and project-oriented workforce structures. Others create new roles, such as executive-level workforce development officers, with an explicit mandate to develop relationships with industry, academia, and government to identify talent pools.

Digital and Analytics. Digital capabilities are critical to managing spaceports. Successful operations require digital offerings for improved development, production, launch, and in-flight services, as well as modern mission- and range-control equipment and clean rooms for integration. Advanced analytics should be integrated across all spaceport business operations, including real-time and postmission analysis, predictive maintenance, and resource optimization.

Future Flexibility. The rapid evolution of launch technology means that spaceports must be flexible, often by applying agile ways of working. Ready-to-use launch-support facilities are needed for a variety of vehicles and payloads, along with launch pads that can support multiple vehicle and payload types in quick sequence. Additionally, spaceports must be able to adapt to changing local and federal regulations.

A Customer-Centric Approach. Successful spaceports adopt commercially oriented governance that helps facilitate growth, including a clear mission statement, transparent reporting, financial controls, risk management, and a strong customer-centric strategy. Also, these spaceports develop contracting and financial structures that benefit themselves and the commercial sector. For example, having additional offerings such as payload-processing facilities and reception areas for launch viewing can make spaceports appealing to customers that prefer to have all their business needs fulfilled at a single location.

Featured Insights: Explore the ideas shaping the future of business

The significant growth of the space economy—coupled with the commercialization of the launch sector—is spurring demand for spaceport capacity around the world. But as public- and private-sector entities race to build new facilities, the competition for customers will grow more intense. By focusing on the elements in our framework and building a strong business model, new spaceports can generate sustainable returns and help their regions capture the benefits of space.

The authors thank Peter Bacon, Andrea De Blasi, Katie Kelleher, Matt Martinez, Nate Miller, Cameron Scott, and S. Sita Sonty for their contributions to this article.