It has been a challenging couple of years for investors in unlisted infrastructure assets. High inflation, rising energy prices, interest rates spikes, and supply chains disruptions have combined to create a volatile macroeconomic environment. Fundraising and dealmaking have slowed considerably.

Yet investments in the asset class have provided strong returns over the past five years, and our analysis shows that fundraising is already recovering from its 2023 low, with dealmaking sure to follow. After all, the need for new and revitalized infrastructure has never been greater. The global infrastructure funding gap will exceed $15 trillion by 2040, according to the World Economic Forum, and estimates of the money needed to slow climate change rise as high as $50 trillion over the next 25 years.

Investors in private infrastructure will play a critical role in meeting these needs. In what follows, we summarize the results of our in-depth analysis of the current and future state of private infrastructure investing, trends in fundraising and dealmaking in three major sectors of the asset class, and investment performance over the past five years. The analysis shows that boosting portfolio companies' operational performance will be key to improving returns, and our experience suggests three essential tactics to achieving it.

Ready for Action

From an investor’s point of view, the greatest attractions of infrastructure are the asset class’s stable returns and low cyclicality, the ability to pass through cost inflation, a stable and predictable operating environment, a strong asset base, and high barriers to entry. Indeed, private infrastructure assets under management grew at a compound annual growth rate of 18% from 2018 to 2023, faster even than private equity.

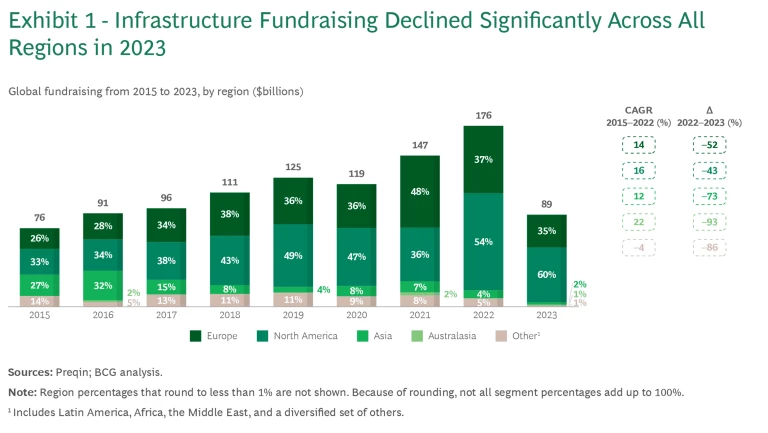

Yet fundraising fell substantially in 2023—to just $89 billion, from a high of $176 billion in 2022. (See Exhibit 1.) Dealmaking, too, has been on the decline, with just 2,098 deals completed in 2023, far below the peak figure of 3,387 in 2017, although deal size has remained fairly constant.

The reasons for the slowdown are clear. Investors faced a range of challenging economic conditions in 2023, including a surge in inflation across the globe that led to significantly higher interest rates. The potential for recession across developed Western economies and geopolitical disruptions further increased risk levels for investors seeking secure places to invest their capital.

Despite these challenges, we expect both fundraising and dealmaking to recover soon, given the asset class’s attractiveness and the need for general partners (GPs) to deploy fresh capital while returning money to current investors. The amount of dry powder awaiting investment remains high, at $296 billion, and much of that dry powder is concentrated in core plus and value add strategies that seek higher returns. Moreover, limited partners (LPs) plan to increase their commitments to infrastructure by more than $600 billion through 2027.

Follow the Money

Private investment in infrastructure spans the globe and covers a wide range of infrastructure types. Most of the private infrastructure investment activity in 2023 occurred in Europe and North America, and almost 75% of the world’s infrastructure portfolio companies were located there.

Breaking down the data by key sector reveals where investors are placing their bets now, and where the best opportunities are likely to be found in coming years.

Energy and Environment. This sector is composed of a variety of subsectors, including conventional heat and power, energy services, renewable energy and energy storage, water and waste management, and recycling. Several of these subsectors are playing outsized roles in driving the energy transition and will be responsible for much of the future growth in the sector, but overall demand for energy will also increase going forward. Aggregate deal value in the sector totaled $1.1 trillion from 2018 to 2023, accounting for almost 45% of all private infrastructure deal value during the period.

Transport and Logistics. This sector includes toll roads, ports, airports, container terminals, bus and rail operators, cold chain logistics, and electric vehicle charging. Among the factors affecting its future growth are urbanization, aging infrastructure, electrification, and increasing demand for urban last-mile logistics and e-commerce. Private investment in the sector totaled almost $510 billion from 2018 to 2023, or approximately 20% of total private infrastructure investment.

Digital Infrastructure. This sector includes fixed and mobile networks, such as fiber rollouts, towers, data centers, subsea cables, and satellites. Relevant technological trends include IoT, digitization, big data, cloud computing, AI, and the need for broader mobile data and wireless coverage as internet usage continues to grow. Investment in the sector totaled almost $420 billion from 2018 to 2023, accounting for nearly 20% of all private infrastructure investment during those five years.

Creating Value Through Operational Excellence

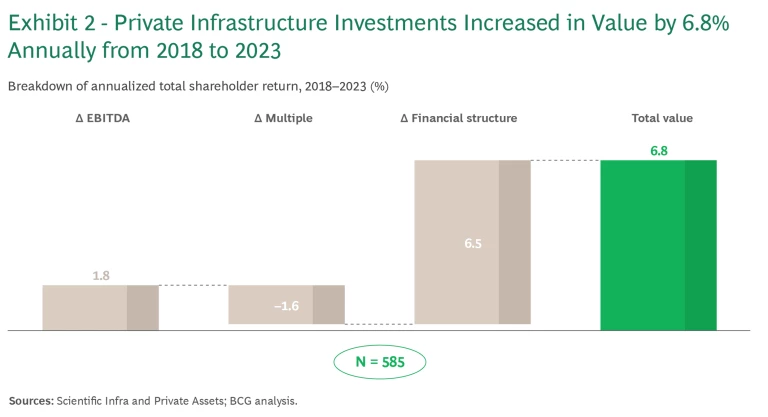

Although opportunities for future investments in infrastructure are numerous, the key to generating strong returns lies in boosting operational performance. Our analysis of performance data for 585 infrastructure companies held in private portfolios shows that annual total shareholder returns on these investments averaged 6.8% from 2018 to 2023 across all investment strategies. That’s an impressive figure, given the challenging economic conditions that investors faced during this period.

A closer look at the data, however, reveals that EBIDTA contributed growth of just 1.8% to the total—and the contribution from multiples decreased considerably, reflecting the macroeconomic outlook generally and increased interest rates in particular. In fact, portfolio companies’ financial structure was responsible for the vast majority of the growth—6.5%—largely due to consolidated payouts to shareholders. (See Exhibit 2.)

Clearly, GPs and LPs alike could realize considerable gains by improving the operational performance of their portfolio companies. In our experience, investors that create operational value most successfully take a very systematic and institutionalized approach to the challenge. As a rule, they put into practice three key principles:

- Focus on value creation throughout the investment cycle. Develop and quantify plans for improving operational performance throughout the ownership cycle. Identify early quick wins to target the key middle- and long-term value levers. Carefully prepare companies for their exits by developing revised value creation plans a year or two prior to the planned exit, thus demonstrating to prospective buyers that relevant initiatives have already gained traction and that the potential to create even more value still exists.

- Take a comprehensive view of all value creation levers. Consider every potential operational lever in the value creation framework in light of the portfolio company’s future positioning, including both top- and bottom-line levers. Choosing which levers to concentrate on requires detailed discussions of where to play and how to win, with special attention to determining how to position the company for its future exit. It is also crucial to get the enablers right, including factors such as the operating model; IT and digitization; and any environment, social, and governance issues that could affect the company’s success.

- Establish the prerequisites for delivering operational value. Create a clear, comprehensive, and systematic framework for operational value creation. Develop strong management teams with capabilities across all business functions. Institute effective mechanisms for overseeing and governing the value creation effort at the fund level and the portfolio level. Build an organizational culture and incentive systems that prioritize high performance by setting clear expectations and goals for both deal and management teams, giving them full ownership of and accountability for their efforts and the opportunity to profit from the operational upside.

Better operational performance is essential not just for investors looking to create more value, but also for those aiming to allocate the capital they invest in infrastructure as effectively as possible.