Demographics, digitally driven interactions, and consumers’ desire to mix shopping trips with lifestyle experiences are changing the foundations of shopping mall operators’ business models. Amid these pressures, market leaders are using digital capabilities for key strategic actions—including de-risking expansion plans, tapping new revenue streams, and managing tenants better.

Stay ahead with BCG insights on urban planning

Over the next five to ten years, however, AI will shake up the competitive landscape in a more profound way, transforming how operators generate growth and build resilience. AI will deliver sharper insights about shoppers and tenants. It will enhance business decisions and enable companies to execute their plans more rapidly. And AI-based solutions, such as footfall tracking tools that enable operators to improve the layout of their malls, will become increasingly important.

Operators can still improve their performance with basic steps like retenanting and introducing loyalty programs. Nevertheless, we believe companies that aren’t investing in AI today are taking significant risks with the future of their business.

How Leading Players Are Staying Ahead

Mall owners and operators can no longer afford to be passive rent collectors; they must adapt and respond to the megatrends that are transforming retail real estate. (See the sidebar, “The Five Trends Reshaping the Industry.”)

The Five Trends Reshaping the Industry

Demographic Shifts. By 2030, Gen-Z and millennial consumers, both digital-native cohorts, will account for almost half of worldwide retail spending. Meanwhile, the share of the global population aged 60 and above is projected to reach 20% by 2050. And across emerging markets, the affluent middle class will double in size by 2034. As a result, operators need to prioritize investments tailored to each group, including digital touchpoints, age-friendly mall designs, and family-friendly features.

New Commercial Relationships. In many locations, operators are reinventing their malls as experience hubs. They are offering lifestyle-focused activities, by installing cinemas and art exhibitions; adding community-based services, such as libraries and coworking spaces; and developing food halls and gourmet markets to drive evening and weekend traffic.

Because of this shift, operators are moving from traditional tenant-landlord arrangements to more flexible ones that incentivize both parties to improve sales performance. Digital technologies that support better data sharing are creating greater trust between landlords and tenants and enabling these new relationships.

Digitally Driven Interactions. With the advent of e-commerce and omnichannel, most shoppers today take a customer journey that combines online and offline elements—they may research a product and place an order online but examine their potential purchase and pick up the item in store.

For mall operators, this change in consumer behavior requires them to become omnichannel enablers: by creating spaces for order fulfillment, providing the IT infrastructure to support retailers’ digital capabilities, developing experience-driven zones with lifestyle features (such as food halls, gyms, and work spaces) and live events, and partnering with retailers on cross-channel marketing initiatives.

New Sources of Value: As well as supporting the developments above, AI and digital tools are redefining value creation for mall operators. These technologies are enhancing more traditional activities, such as mall design and tenant curation. But they are also providing new data-based monetization opportunities for operators, including selling performance and customer insights to retailers, providing loyalty programs and fee-based click-and-collect hubs, and selling programmatic ad space on digital displays to mall tenants.

The Sustainability Imperative. For the real estate companies that own and operate shopping malls, sustainability is no longer just a reporting requirement—it’s part of their license to operate. Malls must prove their environmental and social credentials to investors, tenants, and consumers or they risk being sidelined. To meet mounting sustainability expectations, malls have to build digital capabilities that enable them to monitor and accurately report emissions across their assets and share energy usage and environmental data with tenants.

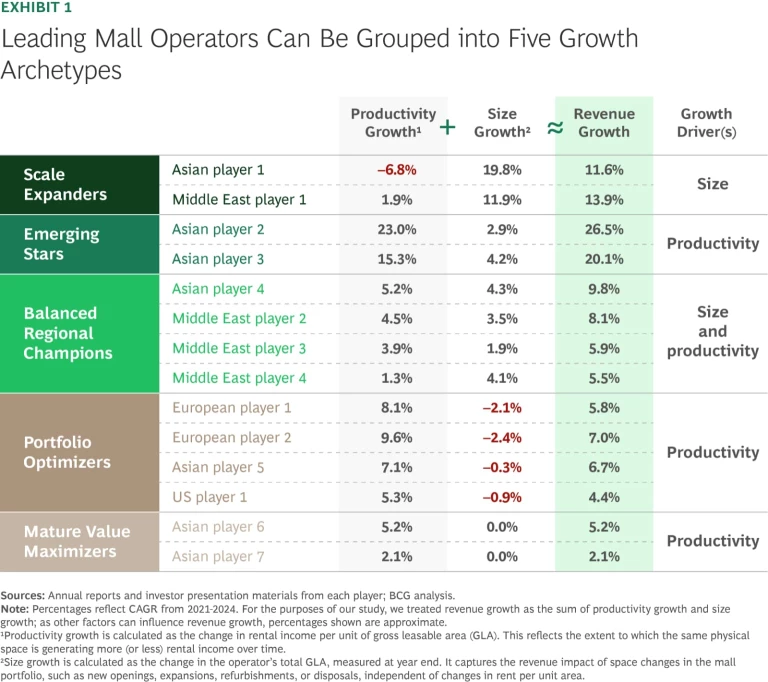

To understand how mall operators are navigating the challenges of this new world, we analyzed 14 leading players across Asia, the Middle East, Europe, and the US. These companies are all delivering good top-line growth for their particular markets: of the 14 players, 12 are increasing annual revenues by more than 5%, and half of them are increasing revenues by more than 7% annually, largely through productivity gains.

To examine the factors driving individual performances, we grouped these companies into five growth archetypes based on their revenue growth, portfolio strategy, productivity (measured by rental income per square foot), and market dynamics.

Scale Expanders. These fast-growth players operate mainly in developing markets with young populations, a growing middle class, strong tourism traffic, and supportive capital environments. They focus on rapid portfolio expansion rather than productivity gains, and capture market share through city-wide saturation, using different mall formats and sizes, and asset-light growth strategies.

Emerging Stars. These players also operate in high-growth developing markets and consequently, like scale expanders, generate strong revenue growth. However, their markets are typically impeded by cumbersome regulations and they have limited access to affordable capital, making it difficult to scale up. As a result of these factors, operators are faced with modest portfolio growth and so concentrate on maximizing the productivity of their assets.

Balanced Regional Champions. These players generate more moderate revenue growth, operate in retail markets that are transitioning from being fast growing to more mature, and serve a diverse range of consumers. They benefit from stable, reform-driven regulatory and capital environments and are thus able to grow both the size of their portfolios and their productivity in a sustained fashion.

Portfolio Optimizers. These players are active in mature, often saturated markets with affluent but aging consumers and relatively tight capital constraints. They prioritize extracting value from existing assets through improved productivity rather than expanding their portfolios, and generate moderate overall revenue growth. To boost productivity, they turn to strategic asset disposals, capital recycling, and balance sheet management.

Mature Value Maximizers. These players generate modest revenue growth and operate in highly mature, largely urban markets with high-income but slow-growth populations. These markets are capital-efficient but tightly regulated and offer limited opportunities to expand. Because of these factors, players focus on unlocking maximum value, through productivity gains, from largely static portfolios.

The Importance of Advanced Digital Solutions

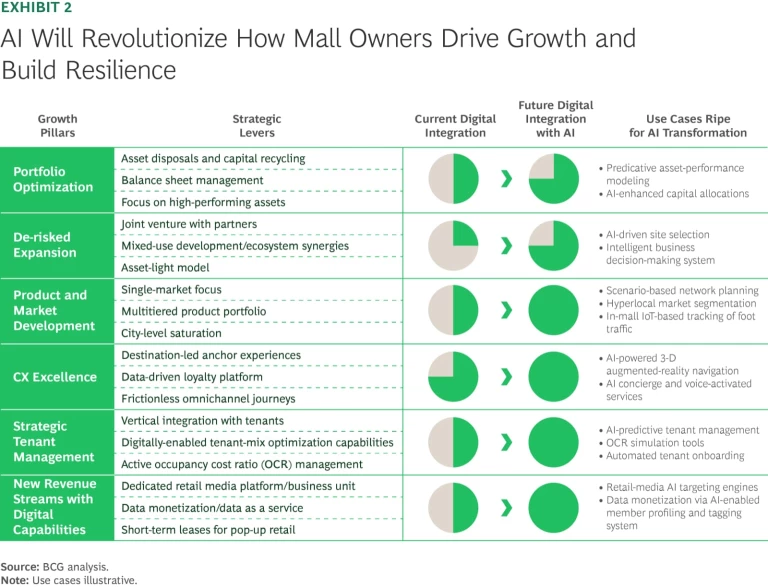

While these 14 players have tailored their strategies to the markets in which they operate, they all depend to varying degrees on six growth pillars: portfolio optimization, de-risked expansion, product and market development, customer experience (CX) excellence, strategic tenant management, and new revenue streams.

Digital tools already play a significant role in enabling mall operators to activate the levers required to optimize these six growth pillars. For example, data-driven predictive modeling of an asset’s future performance, as well as AI-enhanced capital allocation methodologies, can help operators to achieve better balance-sheet management and a greater focus on high-performing assets in their portfolios. Similarly, automated tenant onboarding can reduce tenant management costs, while scenario-based planning can boost operators’ product and market development.

Digital tools are also being used by operators to standardize mall design and construction, to develop retail media networks and create customer apps, and to select landmark customer attractions such as indoor skiing centers and 3-D cinemas.

The digital tools shopping mall operators currently use can only get them so far.

However, the digital tools operators currently use can only get them so far. We believe that by integrating leading-edge AI and data solutions across their operations, companies will be able to revolutionize how they create growth and build resilience. These tools will give them greater insight into which actions will be most effective in improving business performance and enable them to move faster in implementing them than players can today.

Over the next few years, we expect AI and data tools to have the greatest impact—through process optimization and automation—in product and market development, CX excellence, strategic tenant management, and new revenue generation. In portfolio optimization and de-risked expansion, these technologies will also bring considerable change, but the two pillars are likely to still require critical thinking and greater human involvement in decision-making.

Achieving a Successful AI Transformation

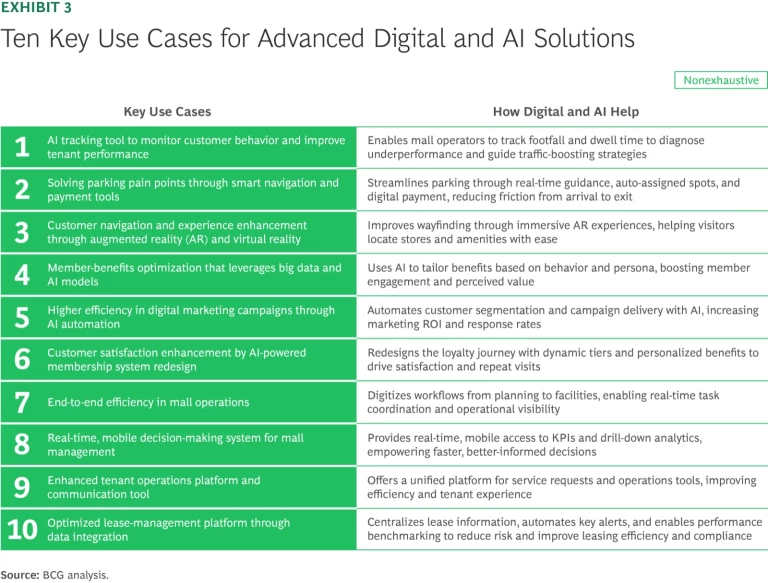

Forward-thinking players are capturing sizeable gains—including a 20% improvement in staff efficiency, a 50% increase in tenant revenue, and a 50% increase in customer lifetime value, based on our work with clients—by integrating advanced AI and data solutions throughout their operations. We’ve identified 10 use cases where advanced digital and AI solutions have a key role to play.

Among the use cases:

- An AI-supported tracking tool that enables operators to monitor customer footfall and dwell time across different mall zones, helping companies identify underperforming areas and develop traffic-guiding strategies such as adjustments to tenant mix or layout. Benefits include a 30% increase in revenues, on average, for pilot tenants.

- A one-stop, self-service portal that delivers operational efficiencies and enhances the tenant experience by streamlining tenant-facing activities, such as onboarding, renovation coordination, and property services. Benefits include a 30% reduction in operational costs.

- Automated customer segmentation and delivery of mall operators’ digital marketing campaigns, enabling more personalized outreach, better response rates, and higher return on investment. Benefits include a 30% improvement in conversion rates.

To ensure that advanced data and AI solutions are truly effective, companies can’t simply apply them in a piecemeal fashion. They need to digitally transform the entire organization. Mall operators should follow three imperatives to make their transformation a success.

It must be led from the top. An effective transformation needs to have the buy-in of the C-suite. Furthermore, because it is not simply an IT initiative, the heads of the different business units will need to take responsibility for building digital capabilities for their particular area.

It must be phased and purposeful. Leading mall operators that have digitally transformed their business haven’t done it by rushing to implement advanced digital solutions. They’ve sequenced the introduction of new tools based on maturity levels. Building foundational digital capabilities, such as digitally enabled loyalty programs, before layering on AI ensures companies are ready for business and can maximize returns.

It requires a fit-for-purpose team design. There’s no one-size-fits-all model for a digital transformation team. Centralized, decentralized, and hybrid approaches are all potential options. Selecting the right approach depends on factors such as the availability of talent, the urgency of digital change, and the importance of accountability and decision making at the business-unit level. What matters most is clarity of ownership and speed of execution.

As shopping malls become places where experiences are almost as important as transactions, leading players are focusing on what matters most: delivering the experiences that attract consumers and that enable tenants to thrive.

By using advanced digital and AI solutions, developers and operators can improve both how they connect with tenant and consumer stakeholders and how they anticipate their needs. In the process, they can ensure their malls remain relevant—and constantly refreshed—experience hubs.

The authors would like to acknowledge the contributions of their BCG colleagues Guillaume Lemoine, Andy Veitch, and Roger Zhu.