For over 25 years, BCG has published an annual review of value creation patterns for global companies, with additional reports for specific markets and sectors.

This is our latest report on value creation in Australia, looking at Australian companies that have been listed on the Australian Stock Exchange (ASX) for 20 years to 30 June 2025. We have chosen this timeframe to allow us to understand trends over a period that included unprecedented regional growth and two major disruptions to the global economy: the Global Financial Crisis and COVID-19.

BCG’s Value Creators series focuses on a review of the annual average total shareholder return (TSR) of sectors and companies over the period. TSR is calculated using earnings growth, change in multiple valuation and free cash flow contribution – the main levers available to management teams. In this report we’ve added a layer of local context from interviews with company executives, board members and asset managers with experience of the last two decades. This approach has some drawbacks, including survivorship bias, the exclusion of companies not listed locally (e.g. Atlassian) and major events outside the timeframe. However, this framing is consistent with our approach in all markets and allows us to compare TSR across regions, sectors and companies to reveal key drivers of performance.

Key insights from two decades of data

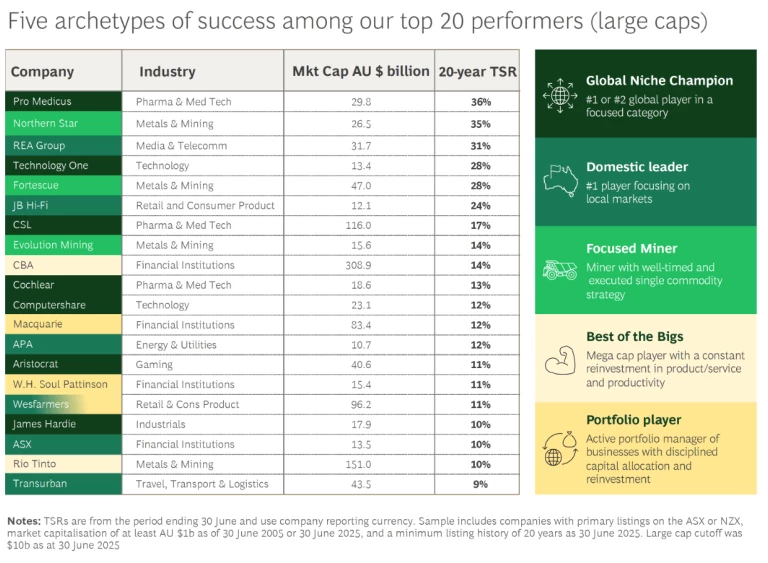

Our Australian findings tell a story of growth and resilience across the economy – and it isn’t just the traditionally strong sectors of metals and mining and financial institutions that make up our list of top performing companies. Standout value also came from the tech, med tech & pharma, and consumer goods sectors.

Among our top individual performers, there have been different paths to outstanding value creation, but also clear patterns. The most successful companies exhibited strong, self-funded revenue growth. They often achieved this with a clear focus on differentiated products and services, a targeted approach to M&A and portfolio strategy, and above average investment in product excellence and productivity.

- Global niche champions

A remarkable number of our success stories fall into the global niche champion archetype. These companies are typically product-led and have succeeded in establishing a global footprint, but operate in a ‘Goldilocks’ niche market, which means their markets are big enough to allow sustainable, above-average growth but their niches are small enough to allow them sufficient share to reinvest with scale. - Domestic market leaders

The second most common archetype in Australia’s top performers is the domestic leader. These companies have their niche, but focus on one, or only a few, local markets. They have strong competitive positions and constantly reinvest to keep growing. - Focused miners

Mining companies that topped the list of Australia’s top performers generally had two main features. They experienced strong tailwinds in commodity demand and price, and they had the operational and project success to capitalise on these strong prices. - Best of the bigs

Size creates its own challenges to generating TSR. It is always harder to grow off a very large base. Our successful ‘big’ names, Rio Tinto and the Commonwealth Bank of Australia (CBA), have focused on improving internal operations, spending significant effort and capital to improve productivity. - Portfolio players

Companies such as Wesfarmers followed a deliberate approach to M&A, building internal capabilities in capital allocation and portfolio management. These firms did not rely on single big-bet deals. Instead, they treated M&A as a repeatable discipline – acquiring with clear strategic intent, integrating effectively, and actively pruning underperforming assets.

A roadmap for the next 20 years

Based on these insights, we provide some advice for the next two decades.

- Keep your portfolio fit for purpose: Be willing to sell businesses that dilute value or attention

- Use M&A as a scalpel, not a sledgehammer: Buy only the right businesses at the right time from motivated sellers

- Protect your position: Constantly re-invest in the products, services, assets and capabilities that make you competitive

- Lead with value in mind: Make sure your management and board understand, track and agree on your company’s key levers of value creation

Stay ahead with BCG insights on corporate finance and strategy

Explore the full insights

The full Value Creators report offers deeper analysis across 14 sectors, detailed TSR rankings, case examples and lessons from Australia’s top-performing companies.