For manufacturers, cost savings are a never-ending focus, even in the best of times. But today, the global manufacturing sector is facing a new reckoning. Geopolitical disruption, energy volatility and labor shortages are pushing margins to their limit, while the pressure to digitize and decarbonize continues to intensify. In such a unique environment, cost management isn’t just about survival, but about building the foundation for a competitive edge in the years ahead. The companies that will thrive are those prioritizing cost management, supply chain resilience, automation and AI to turn today’s challenges into a long-term advantage.

Costs are climbing while demand is falling

Margins are under pressure as demand softens. Bloomberg Intelligence notes that “solid backlogs have primarily driven revenue, with new demand remaining muted,” and the ISM Manufacturing PMI has lingered in contraction since early 2023. Tariffs now dominate industrial earnings calls, signaling rising uncertainty and higher input costs.

“Everybody's trying to figure out how to cope with tariffs right now,” says Harvard Business School professor Willy Shih. Manufacturers are being forced to rethink sourcing. According to Daniel Küpper, Managing Director and Senior Partner at BCG, sectors such as wood, paper and furniture could see half of their trade discontinued at a 10% tariff rate. “Even the most efficient factories can’t overcompensate for the impact from tariffs,” he warns.

Mentions of material costs are also climbing as companies seek quick profit relief. “Material costs are always the first cost buckets that companies address,” Küpper says.

Conventional cost-cutting measures are falling short

Conventional levers like offshoring and labor arbitrage are losing power. Rising wages and shipping costs, coupled with tariff barriers, are eroding the advantages of low-cost regions. Meanwhile, pandemic-era spending freezes are stifling innovation. “Companies need to start investing in advanced Western facilities built for the next generation of manufacturing,” says Küpper.

US firms aim to rebuild supply chains with cost in mind

Reshoring and nearshoring are accelerating as U.S. manufacturers rebuild domestic capacity. Imports from Mexico, China and Canada remain vital, but production closer to home offers more control and tariff protection. According to the Federal Reserve Bank of St. Louis, reshoring has more than doubled U.S. construction spending since 2022. Dual-sourcing strategies are also rising to avoid single points of failure.

“We need to double down on local manufacturing sites,” Küpper says. “There is no future in simply closing sites and shifting them abroad.” Companies that reshore must offset higher costs through automation, intellectual-property protections and scale efficiencies. “How am I going to harness technologies that let me reduce my capital costs?” Shih asks.

AI and standardization can drive smarter operations

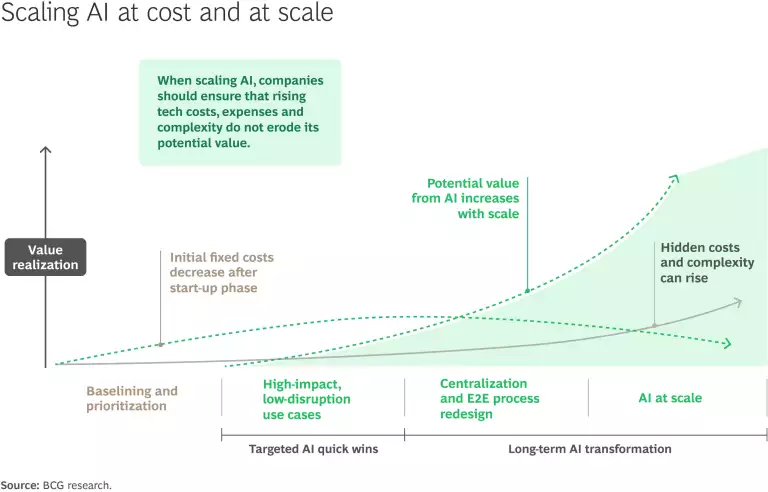

AI and robotics are now central to cost-management strategy. Predictive maintenance, digital twins and AI-driven forecasting help optimize production and limit downtime. But scaling these tools brings its own tech expenses—cloud, data storage and integration. Still, standardization and automation are expanding margins for some manufacturers even amid falling revenue.

Stay ahead with BCG insights on cost management

Cutting costs to fund the factories of the future

The most forward-thinking companies are reinvesting savings from these initiatives into modernization and workforce upskilling. As Küpper puts it, “it will not be sufficient to just do what we have already done in the last 30 years.” The next era of manufacturing will reward those who treat cost management not as austerity, but as transformation.

Read the full article here. Created by BCG and Bloomberg Media Studios.