The holidays are always a make-or-break time for retail sales. The season presents retailers with a disproportionate opportunity to drive sales and gain share—and if they get it right with consumers, it can deliver a crucial win. But the window to make the right moves is narrow, the stakes of failure are high, and a poorly executed holiday sales season can amount to a beautifully wrapped disappointment, even for the strongest brands. Readiness in 2025 depends on agile planning and executional excellence, with little room for error amidst forecasts of lower consumer spending this year.

Holiday 2025 Will Unwrap New Challenges

The holiday season is inevitably an intense period for retailers, but new and unique challenges are compounding the pressure this year. Some are macroeconomic, with elevated uncertainty affecting consumer spending behaviors and shifting tariffs adding to inventory headwinds. Other challenges relate to winning the last mile, as consumers shift back to malls and other brick-and-mortar shopping experiences. Still others are connected to the accelerated adoption of AI and to expectations around it that both consumers and marketers have developed.

Macroeconomic Uncertainty Affects Product Availability and Consumer Decision Making

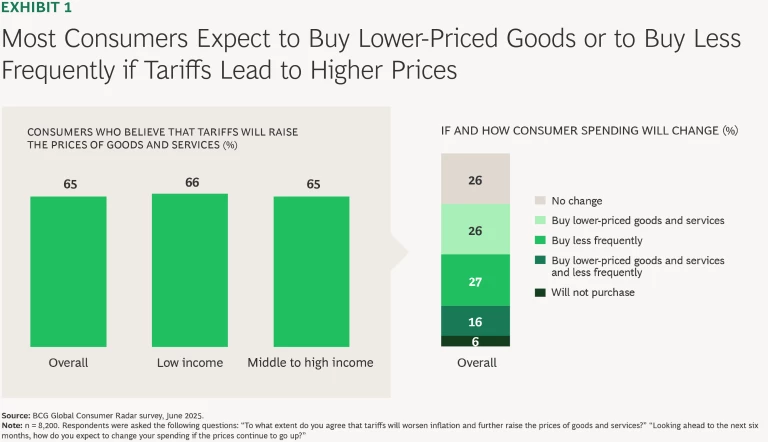

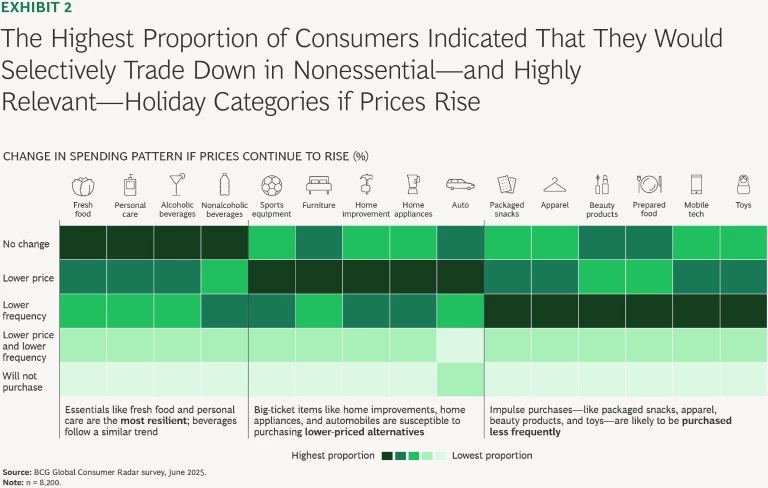

Starting in Q2 2025, the introduction of a patchwork of tariffs added complexity and uncertainty across businesses while raising the specter of rising prices among consumers. Accordingly, we expect consumers to spend less and to selectively trade down in critical holiday categories. (See Exhibit 1.) In a June 2025 survey conducted by BCG, 65% of US consumers said that they believed tariffs would lead to higher prices. In response, consumers plan to take action: approximately 75% of those surveyed said that if prices continue to rise, they will amend their behavior to buy lower-priced goods, to buy less frequently, or to do both. Furthermore, they indicated that they plan to trade down in nonessential categories—specifically on discretionary items like sports equipment and home improvement—if prices continue to rise and instead will purchase beauty products and toys. (See Exhibit 2.) We expect this behavior to be more pronounced in lower-income markets, disproportionately impacting mass and nonpremium specialty retailers.

Stay ahead with BCG insights on the retail industry

The upshot is that consumers will be smart on price during the coming holiday season. Given the pervasiveness of savvy consumers who have both the motivation and the tools (such as AI) to understand price ranges and to make trade-down decisions, retailers can expect their customers to buy more judiciously—searching for the best discounts and deals, focusing on staples rather than discretionary items, and watching for product bundles that offer better deals. These challenges paint a very different picture from the one that retailers saw last year, with a forecasted deceleration in the growth of holiday spending. EMarketer has projected that total US retail sales will rise by only 1.2% in November and December 2025 (versus 4.3% in the same months of 2024), and it has lowered its forecast for holiday sales by anywhere from about $36 billion (2.5%) to about $100 billion (7%) due to tariffs.

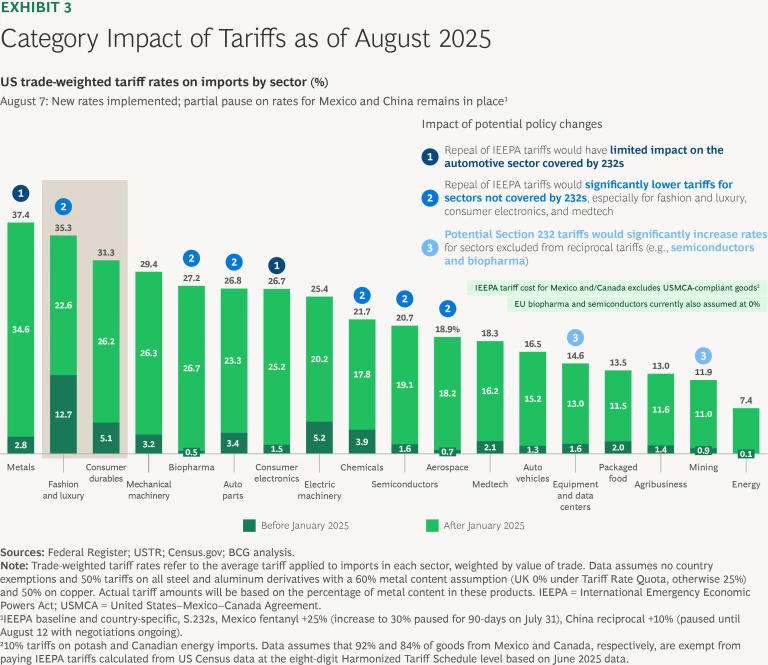

For consumer brands, tariffs will most acutely affect inventory positions and availability, as many retailers pulled back on purchases during the first half of the year, creating relative inventory scarcity and narrower assortments during the holiday season. Goods in the fashion and luxury and consumer durables categories face the highest exposure to inventory constraints, given their weighting toward China and countries like Vietnam and Cambodia, which are projected to be subject to incremental tariffs of 20% or more as of August 2025—an economic headwind that could produce a dip of 5 to 7 percentage points in gross margin. (See Exhibit 3.)

Brands need full visibility in their inventory positions and on tradeoffs between volume and margin that to build successful holiday pricing, promo and marketing plans. EMarketer reports that brands feeling margin pressure have already adjusted their promotional plans and inventory purchases, which will translate into shallower promos and narrower assortments around the holidays. For example, one major clothing brand is limiting its assortment during the holiday season to focus on its top performers, and a well-known upscale household goods retailer is planning strategic inventory pull-forwards to absorb tariff headwinds.

A Resurgence of Malls and Stores Is Driving More Complex Customer Journeys

Consumers demand convenience and connection. They look for “what I want, when I want it”—an expectation conditioned by the ease of online buying. Paradoxically, however, they are unwilling to abandon the tactile experience of in-store shopping. As a result, e-commerce is slowing following the post-pandemic boom, and the importance of physical retail and customer experiences has grown in the past few years. Although e-commerce grew impressively (by about 8%) in holiday 2024, nearly 80% of holiday sales that year occurred in-store or via wholesale, according to EMarketer. We expect this pattern to continue in holiday 2025, buoyed by the resurgence of stores and malls. According to a Placer.ai report, visits to all three mall types—indoor, open-air shopping centers, and outlets—rose year on year in 2024, by 6.4%, 4.8%, and 3.8%, respectively. In addition, average visit duration was up in April 2025, indicating potential basket building and growing consumer demand for mall-based shopping and typical accompanying activities, such as dining out.

These trends are creating more complex consumer journeys that combine online and brick-and-mortar channels to maximize convenience and connection. Nearly three-quarters of holiday shoppers bought gifts in-store in 2024, even if they researched or ordered online. Compellingly, Salesforce asserts that 75% of Gen-Z shoppers plan to shop in-store at some point this holiday season. Those consumers identify immediacy as their top reason for doing so—but they’re also the most likely cohort to discover and research across digital channels. The implication is that retailers should take an omnichannel approach to planning and marketing. They should also develop strategies to win the last mile and get holiday shoppers into the store. And these imperatives, like nearly everything else in 2025, must take into consideration the power of AI technologies.

AI Impact

Heightened consumer expectations regarding tailored content and personalization are reshaping how consumers discover products and engage with retailers. Forbes indicates that in the past year, GenAI-led consumer searches have risen steadily as a share of incoming retail traffic—most notably in specialty retail, mass or fast fashion, and luxury—indicating that consumers are experimenting with new and more tailored ways to discover products.

As much as consumers are using AI for product discovery, brands are using it to make themselves easier to discover. In the past year, GenAI has permeated all facets of the marketing organization, and 58% of CMOs believe that AI will be conducting most creative workflows (such as personalization and adaptation) within the next two to three years, according to proprietary research that BCG did in partnership with the Mobile Marketing Association on AI disruption. Direct-to-consumer native and attacker brands have been fastest to adopt GenAI to drive personalized, agile content, posing a challenge for large, institutional brands this holiday. Recent advances in GenAI tools make it easier for brands to quickly generate copy, product images, and—most notably—video at scale. For example, this summer, Meta unveiled a suite of GenAI tools that can enable animated video generation from images and video highlights to spotlight product benefits. These innovations offer retailers the opportunity to create a more robust, personalized and timely suite of video offerings, but they require companies to have the right tools and engagement strategy in place to adapt quickly to trends, consumer insights, and product availability.

Recurring Trends and Consumer Expectations

Trends from last season will continue to affect purchasing timelines, scopes of influence, and consumer expectations:

- Consumers will begin shopping earlier in the season and do more weekday shopping. The peak shopping season (Thanksgiving to Christmas) will still be short at 28 days—just one day longer than last year—so consumers and retailers will pull holiday purchases and events ahead of the traditional

start.1 1 According to a recent CivicScience poll reported in the New York Times, 21% of people had already begun their 2025 holiday shopping in July, with approximately one-quarter of younger shoppers anticipating buying gifts earlier to avoid possible price increases, according to EMarketer’s 2025 holiday shopping forecast. We expect large retailers to kick-start the season in the fall, with Amazon holding an October Prime Day and with Target and Walmart holding competing events. - Social channels and influencers will continue to play outsized roles. From 2020 to 2023, retailers’ holiday content generation, earned media value, and impressions grew at twice the nonholiday rate.

- Consumers have come to expect big sales—with price reductions in excess of 30% for the biggest draws—on Black Friday, and their expectations will continue to grow as they anticipate getting the best offers of the season at these events. Brands may struggle to satisfy consumers, given the narrower assortments and supply challenges they face, which will rule out the blanket promos of years past.

Coupled with recurring trends, these new challenges mean that in order to win, retailers must realize the power of the offer. How? By breaking through early and adapting throughout the season via multi-moment marketing, holiday lists, evolving fulfillment options, and targeted promo plans to guide consumers toward assortments where the retailer has surplus or margin advantage. (See Exhibit 4.)

Unboxing the Solution

Retailers can use a three-pronged approach to address these unique challenges: reshape the plan to demand, execute with excellence, and tune and scale with agility. To drive outsized impact, consumer brands must differentiate and be smart on promotions and marketing across all three steps, leveraging every tool and channel at their disposal.

Reshape the Plan to Demand

Retailers should appraise their existing holiday plan against the challenges of holiday 2025 by conducting a rapid reevaluation and gap assessment, which should consist of four steps:

- Reassess targets to ensure that goals and channel mix forecasts align with the business’s current momentum, as well as with market dynamics and future strategic areas of growth.

- Align hero products—the products that consumers want to buy and that are priced to sell—with inventory positions, key customer segments, and marketing investments. The hero product strategy requires supportive marketing capabilities and a disaggregated assortment so that the retailer can monitor and shift to the next-best option if the assortment depletes, or if the hero doesn’t meet its targets.

- Refine the pricing and promotions plan to focus on winning the consumer budget early and driving consistent purchase frequency throughout the season, with sustained attention to tradeoffs between revenue and margin.

- Update the marketing budget, refreshing the marketing plan to match the revised strategy by aligning hero products to key growth channels and ensuring that the marketing investment is set up to maximize ROI across channel strategy, holiday funding, and media mix ratios.

It is essential to pursue big, bold ideas that break through the noise, particularly in view of the increasingly complex and disrupted nature of consumer journeys. Mindful distortion of each retailer’s channel allocation strategy, coupled with the ability to dynamically reallocate throughout the season, will be critical to breaking through. This means playing in the right places across channels, funnel stages, products, and moments, as well as investing in the in-store experience.

Amplifying is crucial, too. This involves proactively addressing revenue gaps by exploring and prioritizing opportunities for expanded distribution:

- Expand distribution and win the last mile with in-store events and pop-up stores.

- Introduce new products and collaborations to create excitement throughout the season.

- Go big with celebrity influencers who can make a splash on social.

- Launch new surprise sales events that create urgency and unlock demand.

This holiday season, deploying a rapidly maturing AI set of tools has the potential to critically accelerate businesses, unlocking consumer insight, creativity, content production, and connection. Consumer insights can enable rapid analysis and synthesis of consumer data from multiple channels. Creative tools can power development of rich, expansive marketing, and content production can optimize at-scale deployment across key channels. AI tools can also help brands assess and optimize how to meet holiday shoppers at the most relevant touchpoints throughout the season.

Execute with Excellence

The next step is to move from articulated plan to scaled action by setting up a cross-functional command center dedicated to sales and operations excellence. The command center should comprise key business leaders and functional teams who make timely decisions that drive the business. The role of the command center is to drive agile execution on the basis of a thorough understanding of performance against revenue versus margin goals and trigger actions. The steps taken may result in unlocking additional discounts, for example, or marketing to accelerate performance.

The right functions and KPIs must be in place to size and sequence opportunities, test and evaluate different pricing and promotional constructs, measure effectiveness, and—most importantly—pivot quickly based on test results. The sales and operational excellence command center should be an “all hands” endeavor, with leadership involvement and visibility critical to unlocking dynamic decision making. We often see brands fall down at this juncture.

Tune and Scale with Agility

With the plan set and the command center in place, retailers should scale and execute the product, planning, marketing, and promotional strategies in October, before holiday season begins. During this phase, the company’s orientation should always have a bias for action. Focus on identifying solutions and streamlining decisions, not obsessing over issues and obstacles. Strategists should be comfortable with ambiguity: good enough is, in fact, good enough. Another key point involves stamina because retailers need to maintain their intensity throughout the holiday season to drive the business and capture all demand.

This three-pronged approach offers retailers the opportunity to achieve significant gains. (See the sidebar, “Case Study: Value at Stake.”)

Case Study: Value at Stake

We redesigned the company’s holiday promo calendar to focus on effectively clearing inventory and driving consumer demand, correcting for missed opportunities to create demand moments in October and on weekdays. We also helped the retailer reassess its marketing content and calendar with the goal of driving high-frequency, coordinated communications across marketing, site, and store—an effort that yielded an increase in incremental revenue of approximately 7% (about fivefold ROI).

We also set up a holiday accelerator command center, allowing the retailer to align key stakeholders across more than ten functions, recognize gaps before the season began, and identify “speed boats” that would enable them to achieve quick wins early in the season. We encouraged the retailer to launch in September—while some tests were still underway—in order to scale before holiday officially began and capitalize on the full opportunity of the season. After launch, the command center continued to meet regularly to assess results across full price, outlet, and online venues and quickly pivot the promotional, pricing, and marketing plans as needed.

By diligently planning and executing for holidays, the retailer saw an improvement of 2% to 7% in annualized run-rate revenue and a gross margin improvement of 2% to 6%.

Conclusion

Faced with elevated uncertainty and a projected downtrend in consumer spending, retailers need big, bold ideas to close anticipated revenue gaps in the holiday season. Sustained discipline and cross-functional transparency and collaboration are vital. The same new AI technologies and platforms that are reshaping the holiday shopping experience for consumers can be powerful tools for retailers—and can make the competitive difference when it comes to sparking the right connection with customers. With a mindset oriented toward early action along with a commitment to excellence and agility in execution, retailers can celebrate wins in the months ahead.

This publication marks the first article in BCG’s holiday insights series, setting the stage for our upcoming Black Friday report.