After a decade of plummeting costs and ambitious expansion, the offshore wind sector now finds itself at a crossroads. Inflation, rising interest rates, and supply chain disruptions have driven project costs up by 30–40% since 2022, putting investment returns under pressure and stalling project pipelines across Europe. Auctions in Denmark and the UK have even failed to attract a single bid, raising questions about the sector’s economic viability.

Yet, the imperative for offshore wind has never been clearer. The European Union’s target of 360 GW of offshore capacity by 2050 underscores its critical role in both energy security, net-zero ambitions, and meeting the increasing consumption driven by economically efficient electrification.

Introducing Win-Cost: A Competitive Rethink of Project Economics

To meet this challenge, BCG introduces the Win-Cost approach, a bold rethinking of how to achieve competitive Levelized Cost of Energy (LCOE). Rather than incrementally trimming costs, win-cost reframes the question: What must our cost base be to win in this market?

Inspired by methods proven in other capital-intensive sectors like automotive and oil & gas, this approach shifts offshore wind towards a competitive, target-oriented design.

Types of savings levers observed include design and process standardization, delivery schedule flexibility, new supplier collaboration models, expanding the original equipment manufacturer (OEM) supplier base, and extended system integration concepts.

Levelized Cost of Energy (LCOE), is a key metric that represents the average cost of generating one unit of electricity, typically in €/MWh or $/MWh over the lifetime of an energy project such as a wind farm or a solar park.

Three Steps to Competitive Advantage

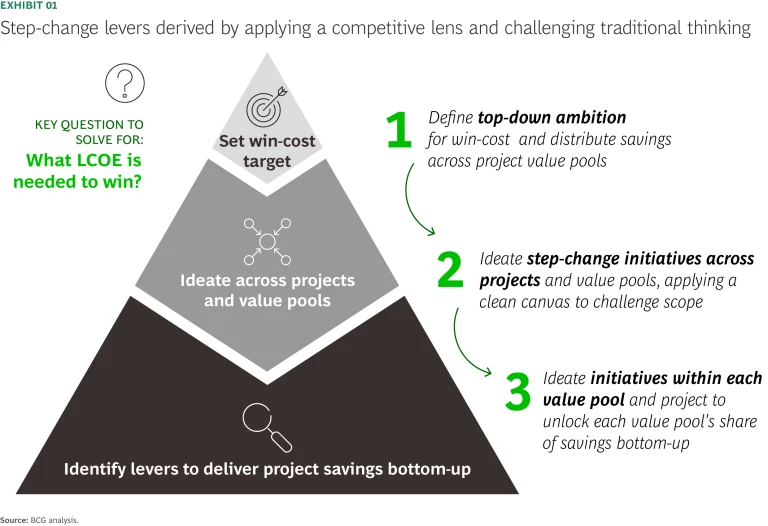

BCG’s win-cost methodology equips developers with a rigorous process to define, unlock, and realize ambitious cost targets.

- Define a competitive win-cost target

Developers define the LCOE they require to win auctions or take investment decisions using external benchmarks such as expected auction prices, competitor data, and internal IRR thresholds, then set sub-targets distributed across cost areas such as capital expenditures (CAPEX), operating expenses (OPEX) and development expenses (DEVEX). - Ideate across projects and value pools

Instead of focusing solely on project-specific tweaks, the approach encourages ideation across entire pipelines. This could include standardizing turbine platforms, rethinking operations and maintenance strategies, and collaborating differently with suppliers. - Identify levers to deliver project savings bottom-up

Once top-down ambitions are set, traditional bottom-up levers are reprioritized and aligned with strategic initiatives. This dual lens ensures a comprehensive scope, feasibility, organizational buy-in, and clarity on trade-offs—ensuring that large savings are not only identified but realized.