President Obama’s trip to Havana this spring was the first visit from a US president to Cuba in nearly 90 years. It also represented the latest step in a series of measures to improve relations between the two countries. As Cuba has begun to liberalize its economy, US companies have begun to show significant interest—and for good reason. The experiences of China, Russia, Vietnam, and the countries of Central and Eastern Europe have shown that such liberalization can lead to rapid economic growth, along with opportunities for multinational companies and foreign investors to stake an early claim in an untapped market.

Yet there is a lot of uncertainty about the potential opportunity in Cuba. Despite the country’s proximity, most US executives know very little about how its economy functions. Quite simply, those considering a move into Cuba lack the facts needed to make smart business decisions.

We recently analyzed the principal factors that could affect the Cuban economy, including the potential impact of further market-liberalization measures by Cuba and additional measures by the US government. This article discusses the results of that analysis. (Two subsequent publications will analyze the country’s consumer and tourism industries.)

On the basis of our research, we believe that Cuba’s GDP growth will grow by 2% to 4% annually over the next five years. That is a conservative estimate; Cuba’s GDP has risen by 5% to 6% in recent years. But the country has the potential for even faster growth over the long term. For that to happen, however, Cuba will need to take decisive, comprehensive measures to overcome structural limitations on its economy—by improving infrastructure, attracting foreign capital, and continuing to open its markets. In addition, the US government will have to further ease trade and travel restrictions.

Setting the Context

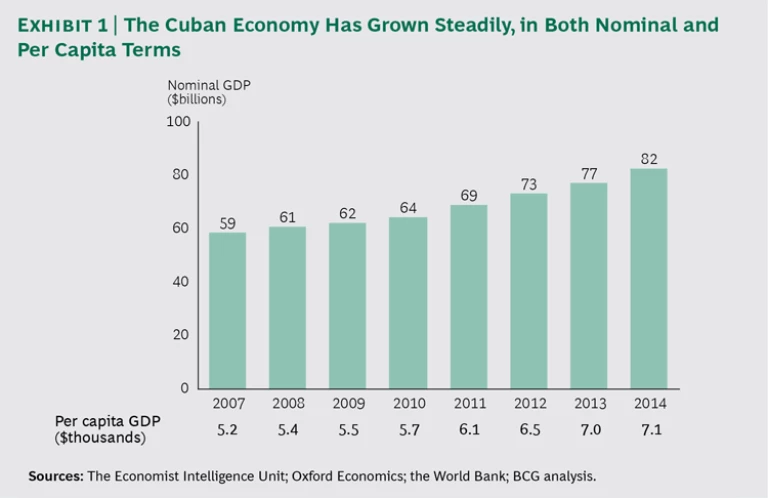

Cuba is one of the largest economies in the Caribbean, with 11 million people and an estimated GDP of roughly $82 billion as of 2014. (See Exhibit 1.) The country’s population is the same size as Belgium’s, and its current GDP is about the size of Hawaii’s. The economy has been growing at an estimated 3% per year in real terms. (Official economic data about Cuba is scarce and not easily comparable with that of other countries. In conducting our analysis, we looked at data from a variety of sources.)

While such growth is encouraging, Cuba’s economy has been severely limited by the policy choices made by the Communist government and by the resulting US embargo. The US government issued the embargo after Cuba seized all privately owned assets on the island in 1959, including those of US companies. The US has repeatedly renewed the embargo since then, most recently through the Helms-Burton Act of 1996, which states that the embargo cannot be lifted unless there is significant political change in Cuba. The embargo prohibits US companies from trading with Cuba unless they get a permit from the US government. And it has had the secondary effect of discouraging companies based in other countries from doing business with Cuba, owing to potential ramifications for their US operations. Cuba’s poor human-rights record may also discourage companies from establishing operations there. In Cuba, as in most Communist countries, the economy is centralized and the majority of the population works for the government. (Even foreign companies employ people through the government.) Salaries are approximately $20 to $25 per person per month, regardless of industry, job title, or qualification. The country has two currencies: the Cuban peso, which is used by Cubans, and the Cuban convertible peso, which is meant to be used by foreigners (although it’s increasingly being used by Cubans, too) and is pegged to the US dollar. The government recently announced plans to unify the two currencies. Overall, that is a positive step that will lead to greater transparency regarding the country’s economy. However, unifying currencies is difficult because it requires resetting the value of financial assets owned by individuals and institutions.

Although there is great focus on the effect of the US embargo, Cuba has actively courted other countries over many years to expand trade. (Cuba’s biggest trading partner has recently been Venezuela—and, before that, Russia—although steep declines in oil prices and political changes have affected Venezuelan trade.) China has also made significant investments in Cuba, particularly in infrastructure. For example, many of the new buses on Cuban roads were manufactured in China. European companies have been reluctant to overcommit to Cuba, owing to the potential implications for their activities in the US, but the improving US-Cuba relationship is leading them to gradually increase their presence and investment. For example, Cuba recently renegotiated some of its outstanding debt to a group of 15 creditor nations (of the 20 known as the Paris Club)—a major step in normalizing relations with those creditors and paving the way for increased trade between Cuba and EU member nations.

Analyzing Cuba’s Prospects

To understand Cuba’s economic prospects, we looked at structural economic factors that affect both supply and demand, and we then considered the country’s political and business context. From that, we developed a projection for how the Cuban economy is likely to evolve—drawing heavily on the experiences of other former Communist countries that have opened up to outsiders. (For details, see the sidebar, “Methodology.”)

Methodology

We analyzed Cuba’s future prospects through various macroeconomic lenses. Specifically, we looked at the main factors that affect the overall supply of and demand for goods and services, and we grouped them into four categories:

- Factors influencing consumption, including demographics, government subsidies, property ownership, remittances, and Internet penetration

- Factors influencing government spending, including taxes; access to international financial institutions such as the IMF, the World Bank, and the Inter-American Development Bank; and other external sources of funding for public sector projects

- Factors influencing investment, including private-business ownership, the degree of government control over company activities and profits, and foreign direct investment

- Factors influencing trade, including the US embargo, the prices and availability of commodities and energy, and incentives for local production

We incorporated Cuba’s political and business context into our analysis, and we benchmarked our findings against the experiences of other former Communist countries that have recently shifted to more open markets, including Albania, China, East Germany, Russia, and Vietnam. We then estimated the potential impact of changes in each underlying factor and aggregated those impacts to determine how they would affect Cuba’s GDP.

Modest Growth in the Near Term. On the basis of our analysis, we believe that GDP growth of 2% to 4% is most likely over the next five years. Enough changes are under way, across a variety of political and economic areas, that Cuba should be able to maintain that trajectory, with the potential for accelerated growth in the longer term.

This projection assumes that the state continues to manage the economy tightly and retain control over most markets while also introducing additional reforms. In terms of investment, we see the easing of restrictions on the ownership of private property over time, leading to the development of new markets such as real estate. Since 2008, the number of private and cooperative businesses in Cuba has tripled. Management of some state lands has been handed over to farmers, and Cubans can now buy and sell vehicles and houses.

Our model also assumes that remittances from US citizens will continue to increase, to a potential $6 billion by 2018. (Notably, remittances and private enterprise are not evenly distributed across the population. Both are concentrated in wealthier areas in the North, primarily Havana.)

Finally, the model assumes that the US government will continue to ease restrictions on Cuba, such as making individual travel easier and allowing more US companies to operate there. Such moves would send a positive signal to non-US companies that may have been hesitant about investing in Cuba, creating a cumulative boost. (For example, Unilever recently announced that it would open a factory in

In the aggregate, these factors will all lead to greater capital flows into Cuba and allow more people to earn income beyond the low government salary.

Although our prognosis is modestly positive, it also recognizes that Cuba’s economic growth will likely be slowed because of several structural limitations. First, the country has minimal activity in sectors, such as manufacturing, that typically drive growth in economies that are opening up. Similarly, decades of underinvestment have led to decayed infrastructure, which will hinder productivity and require significant capital to upgrade. The country has limited information and communications technology (though the government could address that deficiency through regulation and incentives for private investment).

Cuba’s aging population is another factor. Low birthrates and increased emigration to the US and other countries have left Cuba with distinct “holes” in its young and middle-aged populations. This challenge is growing. More people left Cuba in 2015 than in any year since the mass emigrations of the Mariel boatlift in 1980.

Perhaps the most critical limitation is the government’s timid transition to a market economy. Former Communist countries like the Czech Republic that started with swift political change saw very rapid economic growth almost immediately. And countries like Vietnam that have had solid growth without such political change have implemented sweeping market-liberalization reforms far bolder than anything being contemplated in Cuba.

Accelerated Growth in the Longer Term? Looking beyond the next five years, accelerated economic growth is a real possibility, assuming that the US continues to ease trade restrictions and that Cuba addresses the structural limitations discussed above. Several factors will determine whether Cuba is likely to make decisive progress in opening its markets.

- The Seventh Congress of the Communist Party recently took place. Reforms announced at and following the event could signal the government’s stance on continued liberalization.

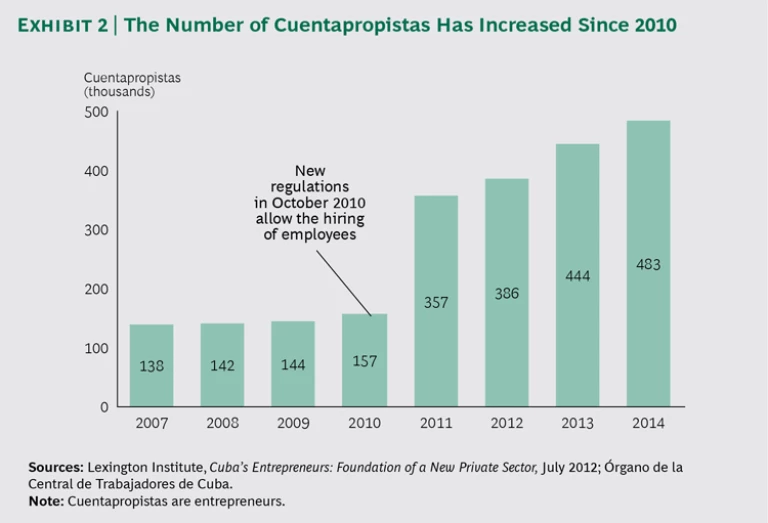

- Cuentapropistas may see some regulatory relief. After a steep increase in the number of Cuban entrepreneurs in recent years, rigid reporting requirements and predatory taxation have hampered their growth. Increasing the number of industries and professions open to private ownership, and reducing the regulatory burden on them, would be positive signs.

- The government could make more explicit overtures to international financial institutions. Although the path to Cuban membership at institutions like the IMF, the World Bank, and the Inter-American Development Bank is currently blocked by the US, Cuba has thus far hesitated even to push for membership. Access to capital from these institutions was an important factor in the transition and growth of many former Communist countries, including Vietnam.

- The government could be more transparent about political succession plans. President Raúl Castro has stated that he will hand over the reins of power in 2018. How that process happens, and how ambitiously the next president pursues market liberalization, will matter greatly.

The Role of the United States

The best scenario is one in which Cuba decisively liberalizes its markets and the US lifts the trade embargo. Normalized trade relations with the US would mean that Cuba could benefit from its large neighbor’s strong interest in investing in and doing business with it. Additionally, they would open the door for companies from other countries to increase foreign direct investment in Cuba.

But the US political environment is creating considerable uncertainty. There is no guarantee that the current trend toward warmer relations will continue. Several candidates in the US presidential-election primaries have openly stated that they oppose the current thaw.

Additionally, from the US perspective, a major sticking point remains the issue of compensation. Private US companies and citizens whose assets were seized in 1959 have filed claims for compensation that are still pending. At the same time, Cuba argues that it has suffered from economic damage as a result of the US embargo and thus deserves compensation in return. The two countries have their own valuations for what they say they are owed, and the valuations are orders of magnitude apart. Initial discussions have led to a commitment from both sides to continue negotiations, but the issue is complex.

Cuba’s economic evolution is intriguing to many US companies, yet we believe there has not been enough progress to present a momentous opportunity—just yet. If the Cuban government continues to liberalize its economy and the US further eases restrictions on trade and travel, the country’s economic potential will grow. Companies should continue to monitor economic signals coming from Cuba while laying the groundwork to quickly capitalize on opportunities as they emerge.

For companies looking for immediate opportunities, we have explored two industries—consumer goods and travel and tourism—in more depth, and we will present the results of our analyses in future publications.