The global pandemic has been ongoing for more than 16 months and has influenced nearly every aspect of our world. While consumer behavior is always evolving, the profound changes seen during the pandemic have been industry changing.

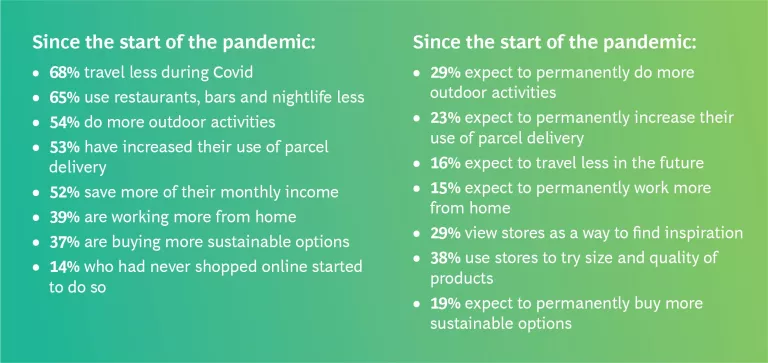

Norwegian consumers have been profoundly affected by the pandemic. Government ordered lock-downs and social restrictions not seen since World War II disrupted established behavior patterns and rendered entire industries idle. Unemployment and temporary layoffs surged within weeks of the onset of the pandemic, household consumption declined some 7%, and the household savings rate doubled.

The impact on household purchasing power, however, was mitigated by salary growth and higher than usual social transfers, with real income increasing by 2.5% during 2020.

In May 2021, BCG surveyed 1,000 consumers each in Norway, Sweden, and Finland to learn more about their behavioral changes, consumption patterns, and preferences during the pandemic and what they anticipate once restrictions are lifted.

Norwegian consumers are moving back to the new normal. What will that normal look like and how should retailers and consumer companies respond to win the new normal?

At a glance

The pandemic has forced consumers to form new habits and patterns that will influence what consumers spend their income on and how they spend it after the pandemic is over. Our research reveals five key insights that can make retailers and consumer goods companies winners in the recovery.

Consumer spending will recover post pandemic

Although Norway saw a drop in consumption during the first 16 months of the pandemic, household purchasing power has been largely protected by salary growth, governmental transfers, and increased savings. Households’ disposable real income growth is expected to get a rebound boost in 2021 before returning to similar levels as before the pandemic of 2-2.5%. There is significant fuel to drive a recovery in consumption.

Moreover, consumers seem willing to spend. Our research suggests that most of the Norwegian population have a positive outlook for the future. The majority expects unchanged or increased income, and return to pre-pandemic consumption levels. Most optimistic are young consumers and people living in larger cities. Male consumers are also notably more positive than female.

As restrictions are lifted, we expect different recoveries for different product and service categories. Our research suggests that several categories where demand has been elevated during the pandemic will see strong demand also after the restrictions are lifted. Examples of such categories are sporting goods, home renovation, consumer electronics, health & beauty, and fresh foods. We call these product categories “future winners”.

We also see several categories with significant drop in demand over the last 16 months making a real recovery. Examples of such categories are travel, restaurants & bars, live entertainment, and fashion apparel. We label these categories "bounce back".

Online growth has accelerated; penetration permanently increased

With physical retail severely limited or fully closed during large parts of the pandemic, most product categories have seen significant growth in the online channel. Even consumers that were loyal to the brick-and-mortar channel have been forced to move online, explaining part of the accelerated online growth we have seen during the pandemic. Indeed, 93% of the Norwegian consumers surveyed reported to have shopped online at least once, compared to 79% before the pandemic. About half of the first-time online buyers reported that their choice of channel as due to the governmental restrictions; about a third stated that it was the most convenient alternative.

Many consumers will work more from home post pandemic, which influences their spending mix and drives overall growth online. ~40% of the surveyed population has been working from home during the pandemic; ~40% of them expect to make this a more permanent habit after the pandemic. Among remote workers, ~60% have increased spending on food delivery. These consumers have increased their spending on specific product categories and have a notable preference for shopping online. For groceries for example, our data tells us that all traffic growth is expected to come from online, and you will miss out on this growth if you do not meet consumers where they are.

It is too early to conclude, but it is likely that the last 16 months have delivered several years’ worth of progress on the online penetration in most markets. Successful retailers will build on the online momentum, find ways to keep new customers and baskets through improved service, customer communication, and better integration with physical stores.

Consumers expect retailers to deliver to their doorstep

Consumers report that they choose online over brick-and-mortar stores due to the wider product range, better availability, and extensive product information online. However, many still find delivery and and returns both cumbersome and expensive. Specifically, they state that delivery options limited to ‘Click and Collect’ and shipping to pick-up points is no longer enough. In fact, 42% of consumers across demographic groups prefer delivery to doorstep at the current prices and delivery options. This number jumps to more than 60% provided that the price and service level is the same as other delivery options. This stands in stark contrast to the fact that only 30% of consumers had their previous online order delivered to their doorstep. Available, affordable, and fast delivery to doorstep is important to position yourself for the future – and it is a position that remains largely unclaimed in most markets.

The role of the brick-and-mortar store will change

Our survey data suggests that the frequency with which consumers will visit to brick-and-mortar stores will recover to pre-pandemic levels. However, the motivation behind store visits have changed: it is no longer about getting the best price or product selection; consumers will look to stores to find inspiration and receive in-store recommendations and advice.

Omnichannel retailers must respond by evolving their physical store concepts from mere sales generators to service and loyalty stations; to points of contact with the consumers where they can build loyalty and awareness. For some it also means optimizing, and in many cases reducing, their store networks and formats.

For pureplay online retailers and direct-to-consumer players, this highlights the few remaining obstacles for further penetration. We have seen successful examples in the fashion industry of virtualizing this during the pandemic through live streamed exploration and shopping events. Successful pureplay retailers will build on these experiences to develop concepts that further challenge the physical store purists.

Sustainability is no longer a “nice to have”, but a very clear “need to have”

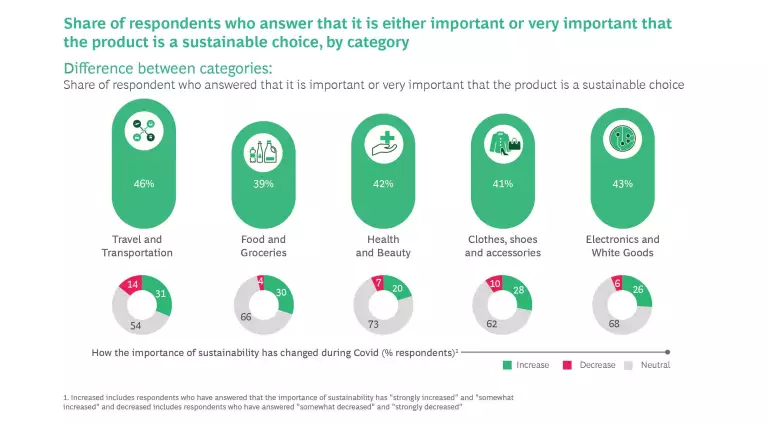

Sustainability awareness has increased significantly over the last 16 months. Across product categories and customer demographics, ~40% of respondents say that the sustainability of the product is important for their purchasing decision. The importance of sustainability is even higher for categories like travel, consumer electronics & white goods, and health & beauty – and it is significantly higher for younger consumers. This new normal requires retailers to adapt both their climate footprint, product and service offering, and communication.

Key insights

Consumer spending will recover post pandemic

Consumers have significant dry powder and are optimistic about the future

Across all ages and income levels, approximately 35% of Norwegian households stated that they had reduced their overall consumption compared to before the pandemic. The Norwegian economy is expected to recover soon as unemployment rates decline, income growth returns to pre-pandemic levels, and consumption increases.

Norwegian unemployment rates are forecasted to decline steadily towards the historic average of 3.7% by 2024.

Our survey data suggest that most of the Norwegian population have a neutral to positive outlook for the future. Only 4% of the respondents expect a decline in household income post pandemic, and 21% expect an increase. Most optimistic are young consumers and people living in larger cities. Male consumers are also notably more positive than female: 63% of men believe the pandemic will end within a year, whereas only 49% of women share the same view.

Permanent shift creating ‘future winners’

As restrictions are lifted and Norwegian consumers return to pre-pandemic spending levels, we expect different recoveries for different product categories. Our research suggests that several product categories where demand has been elevated during the pandemic will see strong demand also after the restrictions are lifted. We call these product categories “future winners”.

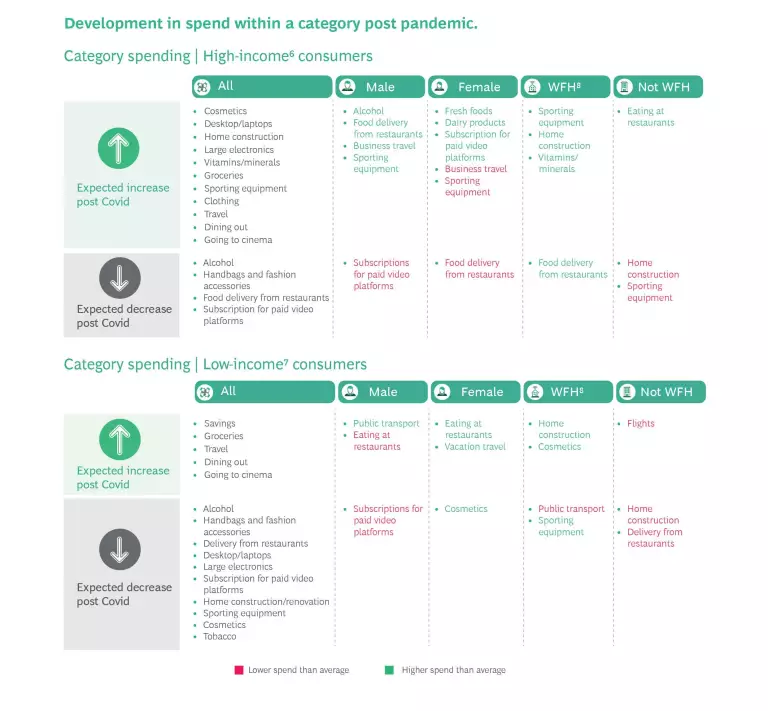

Among high-income consumers increased spending within sporting equipment, home renovation, large electronics, desktops, and laptops are here to stay. Around 30% of the high-income group

Lower-income households

Lifted restrictions creating “bounce back” categories

We see several categories with significant drop in demand over the last 16 months making a real recovery. We label these product categories "bounce back".

Unsurprisingly, categories such as travel, cinema, and restaurants have seen the largest decline during the pandemic driven both by restrictions and an overall reduction in consumption. Our research suggests that these categories will have a strong recovery, riding a wave of increased self-indulgent consumption. The most significant growth will occur in restaurants, vacation and leisure travel, spas, concerts, and movies at cinema halls, as consumers start to return with lifted restrictions. Looking at a broader aspect, returning to work with offices, stores and face-to-face meetings opening again, additional force is added to the rebound. These activities require a mean of transportation, more formal and fashionable clothing and social arenas, further driving the consumption of travelling, restaurants, bars, and clothing.

Comparing the rebound between income groups, some differences are evident. Lower-income consumers expect lower post-pandemic spend on restaurants and cinemas, compared to high-income consumers.

6 Household income over 80,000 NOK/month

7 Household income lower than 40,000 NOK/month

8 PostNord, “E-commerce in the Nordics”, September 2019.

Online growth accelerated; penetration permanently increased

More consumers have made their first purchase online

Consumers that were loyal to the brick-and-mortar channel have been forced to move online, explaining part of the accelerated online growth we have seen during the pandemic. 93% of the consumers surveyed reported to have shopped online at least once, compared to 79% before the pandemic. About half of the first-time online buyers reported that their choice of channel was due to the governmental restrictions; about a third stated that it was the most convenient alternative.

Food and groceries, health and beauty, electronics, and white goods have made great strides online. One in five consumers report shopping online at least once a week. This share is consistent across demographic variables such as gender, geography, and age, underscoring the importance for all businesses and segments.

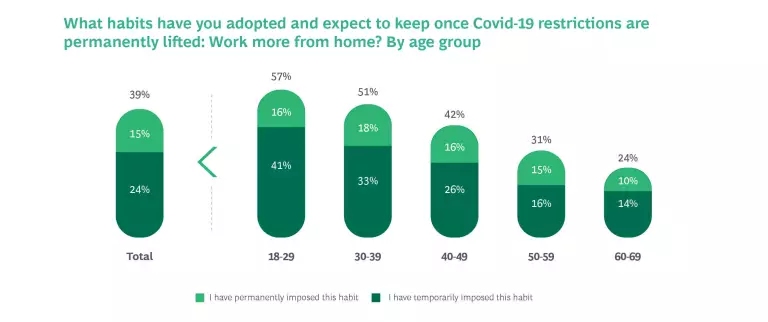

Many consumers will work more from home going forward

Since the onset of the pandemic, working from home has become the new norm in many industries. About 40% of consumers have been working more from home ~40% of these expect to make this a permanent habit - representing ~15% of all consumers. Over 50% of those under the age of 40 are working more from home during the pandemic, and they are more willing to work more from home post pandemic. In response to this, several global employers have announced a “remote-first” model, and many more have said that they will allow more flexibility than before.

Spending more time at home changes consumers’ consumption patterns

Working more from home has changed consumption patterns; some categories have been affected more than others. Among remote workers, ~60% have increased spending on food delivery. These consumers also spend more on groceries, in particular fresh foods and dairy, personal care products, and consumer electronics.

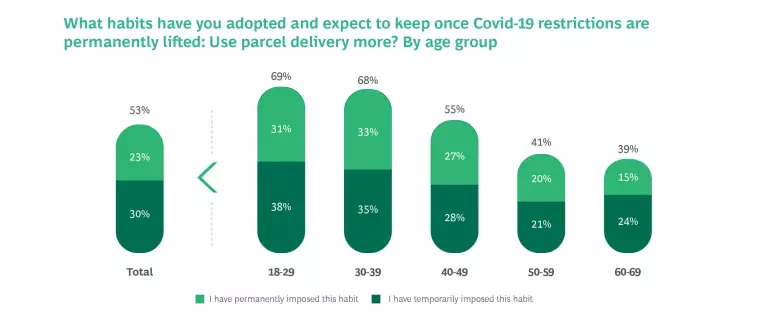

Moreover, working from home makes it easier to receive parcels, and online shopping becomes more attractive. Among consumers working more from home, ~40% say they will permanently increase their use of parcel delivery. This compares to ~20% for those who have not worked from home.

These consumption patterns are likely to taper off from their pandemic-induced peaks, but we believe the overall trend will continue as consumers have made new experiences and formed new habits. This will be an important driver of online growth going forward.

Consumers expect retailers to deliver to their doorstep

Consumers report that they choose online over brick-and- mortar stores due to the wider product range, better availability, and extensive product information online. About ~55% of consumers report using parcel delivery more during the pandemic, and ~45% of these, or ~25% of the total, expect this increase to be permanent. However, many still find delivery and returns both cumbersome and expensive. Specifically, they state that delivery options limited to ‘Click and Collect’ and shipping to pick-up points is no longer enough. Delivery to customer's doorstep is the new competitive frontier.

In fact, 42% of consumers across demographic groups prefer delivery to doorstep at the current prices and delivery options. More than 60% of consumers say they would prefer delivery to doorstep provided

that the price and service level is the same as other delivery options. This stands in stark contrast to a recent study by PostNord where they found that only 30% of consumers had their last package delivered to their doorstep.

Moreover, when asked what would improve the online shopping experience further the consumers are clear: they want lower shipping costs (33% of the sample), more convenient returns (29% of the sample), better delivery options (23% of the sample), better delivery windows (19% of the sample), and lower cost of returns (19% of the sample).

This means that there is room for retailers to differentiate themselves on an important part of the shopping experience. Retailers should consider the crucial last steps of the customer journey and address any pain points through smooth check-outs and fast, affordable and flexible delivery options – including delivery to doorstep.

It’s time to re-define the role of the brick-and-mortar store

Consumers will return to brick-and-mortar stores, but with new expectations

Consumers say they want to go back to brick-and-mortar stores, even if they might complete the purchase online more often than before. The top reasons consumers cite for returning stores are the possibility to try quality and size (38% of sample), finding inspiration (29% of sample), easier to find products (27% of sample), inconvenient or expensive delivery options online (25% of sample), and in-store recommendations (21% of sample).

These advantages of physical stores will play out differently depending on the category. Some will use stores as a combination of a physical store and online fulfillment center, others will use stores to tell the full brand story, create communities or as a place to get inspired and test the products. Retailers need a clear strategy for how they will interact and surprise consumers to build a strong position. Some categories will inevitably see their store footprint shrink while others will re-invent their formats to stay relevant to the consumers and stand to gain traffic.

Brick-and-mortar stores need to re-think their role and definition of success

A few retailers are already fundamentally rethinking the purpose of their stores. Some view stores as “shopper recruitment” vehicles, where store managers are rewarded for the number of attendees at store events and not for the volume of sales they generate. Lululemon is an example of a retailer that engages customers across channels and use stores for more than just sales. Through events and classes hosted by their store ambassadors, they attract shoppers both instore and online. Other retailers are using their stores as product showrooms – such as The Sofa Company at various locations in Norway – where consumers can socialize, touch, and feel the merchandise before committing to a purchase.

As the purpose of stores changes to complement e-commerce, retailers need to develop new metrics and attribution models to measure store effectiveness. This could include cost-per-loyalty-program-sign-up, customer lifetime value, or combined offline and online sales in a geographic area instead of traditional metrics like turnover rate or gross margin per square meter.

Online pure players and direct-to-consumer players must also adapt

Some retailers and consumer brands try to replicate these features of the store virtually. Augmented and virtual reality solutions offer promise but mass adoption of these technologies in retail is still relatively low. Chatbots and video calls are more easily deployed across consumer groups.

These have been seen used in product categories ranging from consumer electronics to fashion and health & beauty. Indeed, Johaug, the Norwegian womens-only sports apparel brand started doing live virtual customer events where the staff showcased new pieces, tried on different sizes, accessorized the looks, and answered questions – all in front of a live audience. They saw a ~10x increase in their daily revenue and remain committed to host similar events post pandemic.

Direct-to-consumer and digitally native brands have been using pop-up locations and showrooms to connect with consumers beyond digital interactions. Even Amazon has been launching physical stores in the United States. Consumers do not differentiate between the experience and the brand, just as they do not delineate between the online and offline touchpoints of a retailer. It is essential for retailers of the future to utilize e-commerce as well as physical spaces to build a holistic shopping experience that captures both online and offline shares of the wallet.

Sustainability is no longer a “nice to have”, but a clear “need to have”

During the pandemic Norwegian consumers have started to pay more attention to where their products come from and they are seeking more sustainable choices. Across categories ~25 to 30% of respondents believe the importance of sustainability has increased during the pandemic. Similarly, ~20% state that they have started buying more sustainable options, which they intend to continue doing post pandemic.

This coincides with the findings of a recent global BCG consumer survey, The Pandemic is Heightening Environmental Awareness, that showed that 70% of survey participants said they were more aware that human activity threatens the climate compared to before the pandemic. Furthermore, the survey found that 90% were equally or more concerned about environmental issues since the start of the pandemic.

Norwegian consumers demonstrate the importance of sustainability across all product segments, ages, gender, geography, and income levels. ~40% of consumers report that sustainability is crucial when purchasing a product, with higher levels for travel, health & beauty, clothes & accessories, electronics & white goods. The importance of sustainability varies with income and age, but the difference across other demographics (i.e., gender and geography) are limited.

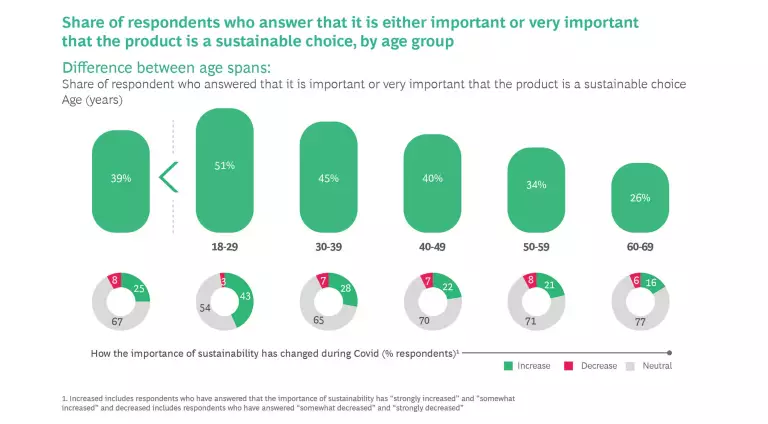

The importance of a retailer’s sustainability actions is likely to increase as younger consumers give more weight to social and environmental responsibility than older generations when making a purchase decision. Our research suggests that more than 50% of consumers aged 18-29 rate it as important or very important in the choice of product. In the same age group ~45% report that the importance has increased during the pandemic which is significantly higher than for the oldest age group. In view of this, it is not surprising that younger generations are also more interested in changing their behaviors to become more sustainable in their day-to-day lives.

Despite sustainable offerings usually come at a higher price point, the difference in preference for sustainable options between high- and low-income earners is limited.

Summary: Priorities to win in post-Covid Norway

While Norwegians anticipate a near return to pre-pandemic life by the end of 2021, our survey shows that many changes in consumer sentiment and spending will remain permanent even after restrictions are lifted. It is imperative for businesses to adjust now, to adapt to the new consumer behavior and ride the post-COVID-19 wave.

Retailers will need to meet customer need for flexibility

Customers expect flexibility and optionality. They want the freedom to choose between their preferred delivery method and the option to enjoy in-store inspiration and recommendations. To deliver on these expectations, Norwegian retailers must:

- Ensure your customer journeys across online and offline channels support your mission, build on your category expertise, and offer the services expected (and maybe not expected) by your customers

- Go beyond ‘Click and collect’ and pick-up points to offer a delivery options that meets customer needs, with delivery to doorstep as a crucial component

- Reduce cost and time of delivery, and consider how to make returns as convenient as possible for the consumer, while at the same time minimizing costly returns through better product and sizing information

- Re-think the purpose and format of selected stores to meet consumer needs that cannot be met online – such as inspiration, holding the product and social interaction

- Re-think what constitutes success in physical stores and consider adjusting how colleagues are trained, measured, and incentivized

"It is about differentiation in a competitive market. The [delivery] price of 29 NOK is obviously partly subsidized by the store. Some look at it like a part of their marketing budget"

– Henrik Gerner-Mathisen, Chief Executive Officer at same-day delivery courier Porterbuddy

Adapt to a new normal with more consumers working more from home

With consumers working more from home, consumption patterns will shift and some of the

new habits will become permanent. Businesses need to be ready for new opportunities and strengthen their online presence. To thrive in the new normal, Norwegian retailers need to take four key actions:

- Position yourself to take advantage of more high-income consumers working from home, through advancing personalized communication and providing the right delivery options and value-adding services that can become new sources of income

- Find new ways to build connection to your brand through in-store experiences or events organized in local communities. Examples are Lululemon and Salomon organizing community sport events near their stores

- Take advantage of a more evenly spread-out delivery pattern to customers and nudge customers to choose delivery times and options beneficial to your capacity planning

- Consider reinventing the online shopping experience with live chat or video. Johaug is an example worth exploring

- Put sustainability at the core of your offering During the pandemic, sustainability has been placed at the core is and is crucial for all business, and the consumer companies play a central part

- Ensure that sustainability is at the core of major decisions being taken and involve your customers in the journey through two-way communication

- Put products and suppliers who share your vision front and center to influence more sustainable choices among consumers

- Prioritize change initiatives based on expected impact both short term and long-term impact, changing an industry will require some bold moves

- Utilize digital solutions to advance transparency and measurement of ESG impact to ensure that true progress is made

Capture your fair share of the new spending patterns

As Norwegian consumers now resume spending, the pattern differs between categories. The largest positive shift in consumption will be in the “bounce

"Our customers are more and more concerned with sustainability. It will permeate everything we do, and circular economics will become much more important"

– Kjetil Wisløff, Director of Categories and Procurement at Komplett

back” and “future winners” categories. These businesses must position themselves skillfully to take advantage of the rebound:

- Drive demand and brand awareness through investing in intelligent digital marketing efforts, unlocking personalization and customization at scale

- While investing to capture the rebound, stay agile through scenario planning, ensuring responsiveness in a still evolving future with a high degree of uncertainty

- Businesses in hard-hit industries need to be prepared to adjust plans and make big moves. Norwegian, the airline, at one point considered deleting their customers’ loyalty points but has now increased their passengers’ flexibility to change their bookings, to boost summer sales

- Projected winners need to ensure they have sufficient capacity to cope with the rapid rebound and the shift online. For example, Kitchenware retailer Kitch’n doubled their investments to manage a massive shift towards online during the pandemic.[10] Others must now be ready for the rebound.

"In times of social distancing, it is crucial to challenge the conventional ways and find new solutions to offer the customer both safety and flexibility. We have launched many new shopping and delivery alternatives during the past years and are today offering a unique mix of stores, e-commerce on our own, and third-party channels - all of which are accompanied by several flexible delivery options. I am very happy to see that we are now further improving the interplay between our online and physical stores with even faster deliveries."

– Stine Trygg-Hauger, former Managing Director at Clas Ohlson Norway

Closing remarks

After having seen a tough period of less spending during the pandemic, our sentiment survey clearly shows that brighter times are ahead. Consumer spending in most categories is expected to go back to pre-pandemic levels and lead to a much-needed recovery for several segments that have suffered especially hard.

However, the pandemic has changed us at our core. While some changed behaviors are only temporary, others are, as we have shown, expected to be here to stay. As society returns to normality in the coming months, it will determine what this new normal will look like, and it is more important than ever for consumer companies to be agile and flexible in finding their role in order to make it into the group of post-pandemic winners.