Smart marketers have long understood that word-of-mouth recommendations from consumers—“brand advocacy”—have greater impact on sales than any other source of information. And it’s not just that positive buzz moves the financial needle forward. Negative word of mouth from brand critics can push results in the opposite direction.

The Most Recommended Brands 2013

BCG’s new Brand Advocacy Index shines a spotlight on the brands that consumers are talking about the most. See the results in five diverse product categories and countries.

Despite the relevance of brand advocacy, companies have struggled to measure it in the marketplace, demonstrate its top-line impact, and develop tactics that improve word of mouth. To address these gaps, The Boston Consulting Group has created the Brand Advocacy Index (BAI), a strategic metric that measures advocacy with much greater precision than existing approaches. Extending beyond those measures, BAI displays a strong correlation with top-line growth and helps identify concrete actions for improving advocacy.

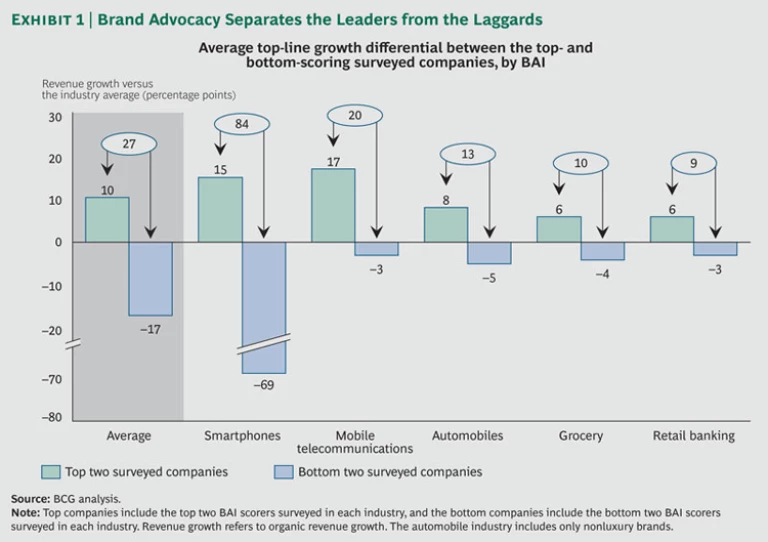

In fact, our research shows definitively that brands with high levels of advocacy significantly outperform heavily criticized companies. In the sample of brands studied, we found the average difference between the top-line growth of the highest- and lowest-scoring brands was 27 percentage points.

In addition to using advocacy to drive measurable growth, brands can also pinpoint the identities and motivations of often overlooked advocates, uncovering the relative influence of both customers and noncustomers in driving recommendations, as well as the rational and emotional factors that motivate both groups to recommend a brand. Companies can determine who recommends a brand and who does not, helping them identify the most and least successful tactics for improving advocacy.

Although the level of advocacy varies widely by industry and country, we have not found a single category in which advocacy is irrelevant. In this report, we open a window onto the precise mechanisms for measuring and managing brand advocacy. By harnessing these insights, any brand can fuel growth.

Advocacy Drives Growth Across Industries

BCG’s analysis shows that the revenue growth of the brands with the highest advocacy levels is far above the industry average. Over time, that difference separates the leaders from the laggards. (See Exhibit 1.)

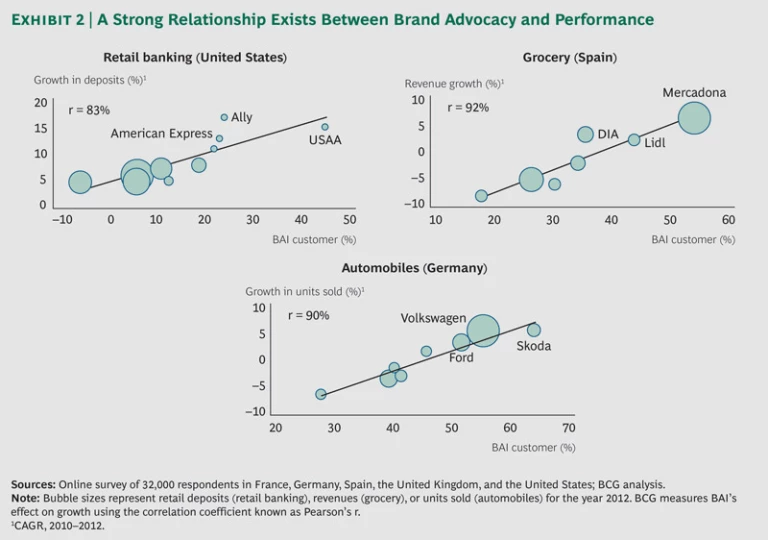

A recent BCG study of more than 300 brands in 12 industries found a very strong positive correlation between BAI and top-line growth—81 percent, or double that of other measures of customer promotion. (BCG measures BAI’s effect on growth using the correlation coefficient known as Pearson’s r.) Exhibit 2 shows the strength of that relationship for leading companies of four representative industries across markets.

It’s no mystery why advocacy both correlates with and drives growth. Measured accurately, advocacy provides a sense of the quality of a company’s operations and offerings. It also helps companies cut through the clutter in a world saturated with media messages. The average Western consumer is bombarded with up to 3,000 brand impressions in a typical day.

Our survey of more than 32,000 consumers also shows that people are losing their trust in traditional mass media. (See “The Growing Relevance of Brand Advocacy,” below.) When consumers are confronted with an important purchasing decision, they seek recommendations from sources such as friends, family, coworkers, and increasingly, other consumers. This is still a predominantly offline phenomenon, however: an estimated 90 percent of consumer conversations about brands take place in the real world rather than through the much smaller but growing source of social media.

The Growing Relevancy of Brand Advocacy

The results of a 2013 BCG survey of more than 32,000 consumers in Europe and the U.S. show that 66 percent of the respondents consult friends and family and 50 percent consult consumer opinions online before purchasing—two to ten times more often than they consult the media, for instance, and more than they refer even to company websites.

And the trend toward word of mouth has been accelerating. According to Nielsen, the number of consumers who trust purchase recommendations from friends and family and online consumer opinions has grown rapidly since 2009, surpassing the number of those who trust TV and print media, which has plummeted.

Effective brands in both consumer and business-to-business markets are able to shape such conversations among customers that go on every day. Companies tap into online and offline social networks to disseminate and amplify messages relevant to their customers, as well as allow customers to influence the development of products, services, and campaigns. (See Harnessing the Power of Advocacy Marketing, BCG Focus, March 2011.)

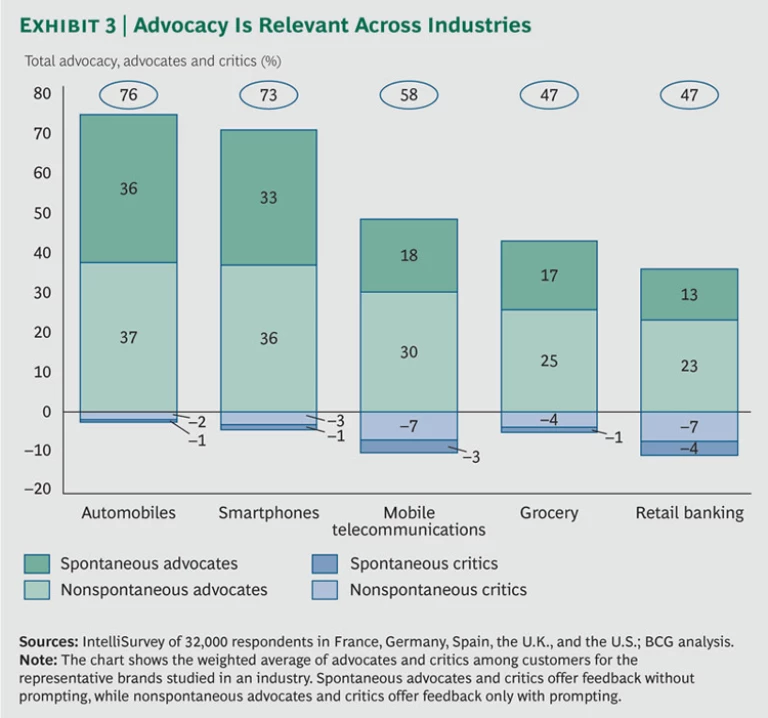

The importance of advocacy is evident in every industry. Across all the industries studied, we observed high levels of total advocacy, a measure that combines the number of people either recommending or criticizing a brand. At least 47 percent of consumers in our sample cared enough about a brand either to recommend or to criticize it. (See Exhibit 3.)

Positive advocacy tends to be higher in industries whose products or services evoke consumers’ greater emotional involvement. People feel more closely connected to their smartphone than to their toothpaste, for instance. Positive advocacy is also higher for “aspirational” categories in which consumers associate a purchase with a desire to improve their social standing. (Think luxury versus nonluxury automobiles.) Finally, positive advocacy is much more common with very visible purchases and purchases that involve significant money or time. People are much more likely to have conversations with friends and colleagues about a car, a prominent purchase on which they spend a large percentage of their income and, in many cases, a lot of time researching.

In contrast, negative advocacy tends to be much higher in service businesses, such as retail banking and mobile telecommunications. Service-oriented brands have much more difficulty maintaining a consistent customer experience than product-oriented brands. In service industries, every customer touch point has the potential to create a negative impression, whereas the experience of a product remains largely the same with each use.

Exhibit 3 also shows the differences in spontaneous recommendations among industries. (Spontaneous advocacy comes naturally without prompting.) In our survey, the automobile and smartphone industries had the two highest levels of total advocacy. Compared with the other industries studied, both of those also had many more spontaneous advocates praising the brand and many fewer people spontaneously criticizing it.

In general, we have observed that criticism damages a brand much more than praise helps it, while spontaneous advocacy has much greater impact on positive word of mouth than recommendations that are prompted.

Quantifying Advocacy and Pinpointing Its Sources

For the first time, organizations now have at their disposal a highly accurate metric for measuring advocacy with a proven link to growth. BAI also allows companies to understand the advocacy levels of their brands and those of their competitors. (For an in-depth comparison of leading brands across countries and industries, see “The Most Recommended Brands 2013.”)

BAI helps companies in any industry understand the segments, countries, regions, and populations in which their brand is weak or strong—and why. That’s an understanding companies often lack. Rather than just leaving brand perception to chance, companies can use these insights to assist them in developing a brand strategy that proactively influences how they are perceived in the marketplace. Ultimately, BCG’s approach to measuring advocacy offers insights that can be applied across countries and brands and that can help companies better deploy their resources.

Our approach offers executives two additional strategic benefits:

- BAI reveals what really motivates people to advocate for a brand. The metric uncovers the most relevant factors driving advocacy in a category, as well as how a brand performs on each of those factors.

- BAI uncovers often-overlooked sources of influence. Although customers’ advocacy is critical, in some industries and for some brands, noncustomers’ recommendations or criticisms can also be an important contributor to top-line growth or decline.

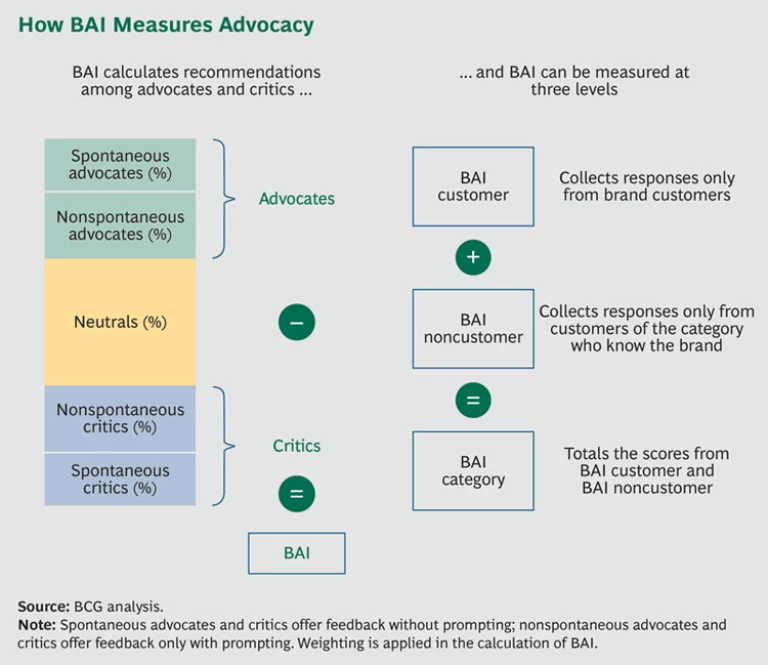

BAI does all this because, unlike other measures, it looks at actual advocacy, not intention. We have observed that what people say they will do and what they actually do can be quite different. For example, people might say that they will recommend a particular full-service airline for the quality of service, but, in fact, they recommend a low-cost competitor because price matters more. Instead of asking hypothetical questions, our survey asks about actual behavior. In addition, BAI polls both customers and noncustomers to include everyone who is talking about a brand. (See the Appendix for a detailed description of BCG’s unique approach to calculating brand advocacy.)

Revealing What Turns Consumers into Brand Advocates

Because the BCG methodology asks explicitly for the reasons consumers recommend or criticize a brand, BAI uncovers the exact factors that drive positive and negative advocacy. Our methodology measures up to 12 industry-specific factors—both rational and emotional—that influence recommendations. Factors include performance, customer service, social responsibility, brand identification, design, and value for money—that is, the right combination of price and quality.

Our research shows that a small number of these factors have an outsize influence on recommendations across industries. In all five countries studied, value for money was consistently among the three factors that most influenced recommendations. Customer service was in the top three for grocery, mobile telecommunications, and retail banking, and both performance and design were in the top three for the smartphone and automobile industries. Some factors—such as assortment of products in the grocery business or network quality in mobile telecommunications—are primarily relevant to a subset of industries.

For many businesses, such technical or functional benefits are the “table stakes.” They remain the top drivers in every industry, and without outstanding performance on such factors, a brand is unlikely to earn consumers’ high recommendations. But we find that once companies in many industries master these rational drivers of advocacy, an emotional connection can separate the most recommended brands even further from the rest, particularly in categories such as apparel, in which an emotional connection remains a strong differentiator.

When consumers have a strong emotional connection with a brand and their rational needs are met, they are likely to recommend a brand spontaneously and without prompting, providing what is, by a wide margin, the most powerful form of advocacy. Take the case of two retailers that both deliver good value for money. The one that is differentially better at connecting with people’s emotions and treating consumers as individuals, in many cases, achieves higher levels of word-of-mouth recommendations—particularly, unprompted recommendations.

Even in industries that do not score as high in advocacy, some companies have found ways to far exceed their industry’s average, thanks to a combination of rational and emotional factors. Trader Joe’s, Mercadona, and USAA score particularly high on emotional factors, helping them outperform their industry’s BAI. For some companies, that comes by establishing a connection with consumers’ lifestyle, passions, or interests. For organizations such as USAA, for example, the connection comes from its alignment with the values of the U.S. military community. (See “The USAA Way,” below.)

The USAA Way

Some rare companies rank high in many factors measured through BAI. An exemplar is USAA, which ranked the highest in advocacy among U.S. retail banks, with a BAI of 44 percent in the U.S. and the third-highest overall in our international sample of banks.

The company sets itself apart from others in the industry with its relentless focus on customer service. All its employees agree to follow “My Commitment to Service,” which it bases on six cultural pillars. Additionally, USAA ranks high on value for money, offering free checking accounts and limiting extra fees—both of which are unusual features among banks these days.

Because its U.S. military customers are spread around the globe, the company has been a pioneer in delivering its products and services remotely, first using the mail and now mainly using the Internet and telephone. Given its low-cost model—it does not have a large branch network, and it markets itself directly without agents—USAA can invest in its customer experience, most notably in its superior online capabilities across a range of banking, brokerage, and insurance products.

But the company is not good only in terms of these functional features. Through its ongoing communications and everyday actions, it also goes the extra mile to build a deep emotional connection with its military customers. They have a strong identification with the brand: they respect the organization’s unique history of serving primarily military personnel and their families, and they recognize that USAA assigns high value to their military service. The company engenders a powerful feeling of community. For example, life-insurance claims representatives are part of a “survivor care team” that offers to help a bereaved customer plan a loved one’s funeral.

In recent years, USAA’s deposits have grown at more than twice the average rate of large financial institutions in the U.S. And an increasing number of consumers who are not even in the military report being highly aware of the brand’s reputation, showing how far word of mouth can travel.

Besides these factors, brands can differentiate themselves in many other ways. Some brands have defied convention in their industry, driving recommendations on the basis of factors that did not initially seem relevant. For example, good customer service has driven advocacy in banking for many years. Although this factor is still important, it is no longer the only basis of competition. A wave of challengers such as online banks have focused on delivering solid value for money in addition to good customer service. (In banking, value for money often refers to lower commissions or higher interest rates.) For instance, ING DiBa’s advocacy level was the highest of all retail banks in Germany. The online bank strongly separates itself from the competition on the basis of both an excellent online experience and good value for money, due to its low fees and high returns.

One company on the most recommended brands list built that position by focusing on value for money instead of customer service and the quality of the network as was standard in the industry. French provider Free earned the top spot on the list of most recommended mobile-telecommunications brands in France, with a BAI of 50 percent. Its consumers recommend it most for its value for money, and more often for that than for its customer service or network quality. Free has gained more than 10 percent of the French market since the company launched its mobile-phone service in January 2012, thanks to recognizing that needs of a significant segment of consumers were shifting towards value for money.

Individual markets have their own nuances, of course. What works well in one may not work that well in another. Consider the case of the Samsung and iPhone smartphone brands in Germany. Samsung slightly leads on consumer recommendations for technical performance and slightly lags behind on design, but it is much farther ahead of the iPhone brand on value for money. Even though technical performance and design rank above value for money with the average smartphone buyers we studied, value for money ultimately matters the most to German consumers, contributing to Samsung’s lead on advocacy in Germany, while it ranks second in other countries we studied. For the past three years, sales of Samsung smartphones in Germany have exceeded sales of iPhones by nearly 70 percent, in part a result of that lead.

Uncovering Overlooked Sources of Influence

In addition to explaining what drives advocacy, BAI also helps companies understand the motivation of everyone who recommends a brand. As we mentioned earlier, spontaneous advocates have a significant impact on recommendation levels. We have also found that critics matter much more than advocates, owing to the ability of negative messages to drown out those that are positive.

Our approach to measuring advocacy also sheds new light on the importance of noncustomers in driving advocacy. We have learned that companies may have a blind spot when they measure word-of-mouth recommendations strictly on the basis of what customers say. Noncustomers can be particularly influential in certain industries, such as those in which consumers purchase products and services infrequently or in which only a small number of consumers purchase. The luxury-automobile industry is an example: even though relatively few people own luxury autos, a large number of people feel entitled to share their opinions about the leading brands.

In some industries, such as those with high levels of churn, the noncustomer population might actually include many former customers, which gives their criticisms extra credibility. One major U.S. telecommunications company faces significant negative advocacy from noncustomers, many of them former customers, with 16 percent of noncustomers being critics. That skews its total-advocacy scores downward, since total advocacy accounts for those recommending and criticizing a brand.

Without a view of both negative and positive advocacy among noncustomers, companies may be missing the complete story. Consider the case of a large U.S. bank with a very low BAI—33 percentage points below average, by far the worst performance in the U.S. The score was surprising because the level of advocacy measured by more traditional mechanisms showed only moderate underperformance compared with competitors. These metrics had, however, failed to take into consideration the criticisms of noncustomers. When the critics’ voices were incorporated into a BAI analysis, the company’s advocacy level dropped significantly. The volume of critics and the intensity of their comments were the legacy of years of losing dissatisfied clients, who actively shared their frustrations about the brand in conversations with friends and colleagues.

However, positive advocacy among noncustomers can boost a brand’s overall performance. We have found two categories in which noncustomers can be influential advocates: automobiles and smartphones. In both categories, the leading brands have invested heavily in creating an aspirational feeling around their products—to the point that, in many cases, even noncustomers feel attracted to the brands. In addition, the products in both categories are heavily experiential: noncustomers are easily able to see and feel their technical and functional benefits, and they often share their opinions about a product’s advantages with others.

For an example of the positive effect of noncustomers, consider the case of Mercadona, Spain’s leading grocery retailer. Mercadona boasts the highest BAI (54 percent) of all the grocers in our international survey even though the retailer has spent nothing on media advertising over the past two decades. We have found Mercadona to be one of the most sophisticated advocacy marketers in the world, actively driving advocacy with customers and noncustomers through a range of programs designed in-house. For instance, to boost word-of-mouth recommendations about its refurbished cosmetics section in 2005 and 2006, Mercadona launched a campaign, inviting close to a half-million women to attend sessions in the stores, where professionally trained staff explained the features of a new range of private-label products, performed demonstrations, and handed out generous samples of the most appealing products.

The results of such efforts have been spectacular. Over the past ten years, Mercadona has opened 50 to 100 new stores each year while delivering same-store sales growth in the range of 5 percent in a market deeply ravaged by the effects of the economic recession. The key to its success has been Mercadona’s consistent ability to achieve intensely positive word of mouth in a target location well before opening new stores there. This not only leads to a density of sales superior to that of competing retailers in the new location, but it also allows the new stores to ramp up sales faster, improving return on capital.

Using BAI to Drive Growth

With BAI data in hand, companies can make fact-based decisions as they identify and prioritize critical areas of brand strategy and customer experience as part of a larger effort of brand-centric transformation. (See Brand-Centric Transformation: Balancing Art and Data, BCG Focus, July 2011.) More concretely, BAI can assist decision makers in their resource-allocation and advocacy-marketing efforts.

We have identified three primary actions that brands can take after exploring advocacy using our metric.

- For areas in which the brand is weak, executives should prioritize actions that have the highest potential to transform the business and drive advocacy. Retailers might develop programs, such as for lowering prices or improving product quality, on the basis of what drives advocacy. For brands that have low levels of consumer identification, companies can showcase innovation and burnish the company’s image. For those with weak results in terms of value for money, transformational efforts may be needed to improve the cost structure, use of assets, sourcing and procurement, and pricing. Structural weaknesses may require significant improvements in both the design and the execution of the customer value proposition. Chief marketing officers and chief financial officers can also prioritize brand investments that are likely to have the most positive impact on sales.

- For areas in which the brand is strong, companies should build on specific brand advantages to drive advocacy. If a company’s brand is not being recognized by consumers for a particular strength, the company can find strategic opportunities associated with areas in which its brand already leads and with specific factors that matter in its industry. A brand can also involve its network of existing customers and, potentially, noncustomers as advocates for its strengths in a way that can be more effective than other methods. A combination of targeting the right consumers, creating powerful and disruptive messages that strike an emotional chord with consumers, and building long-term relationships that are based on an understanding of the dynamics of advocacy has, in many cases, proved the key to success.

- Decision makers should focus on the right segments. Getting a complete view of advocacy helps companies as they target specific brands, product and service categories, countries and regions, and groups of customers and noncustomers. A detailed analysis using BAI can reveal areas that could be improved with digital marketing to underpenetrated segments. Or it may inform brand-repositioning efforts in which focused attention can generate significant value for a relatively small investment. The analysis can also help companies focus on increasing word of mouth among their most profitable customers.

In addition to guiding brand transformation, our approach to measuring advocacy offers unique insights into broader issues of, for example, operations, customer service, and loyalty programs that could be improved with a better understanding of the specific brand attributes that customers value.

BCG designed and launched an advocacy-marketing program for one of the smaller brands of a European packaged-goods company. Although this brand had a strong emotional connection with consumers and ambitious expansion plans, it lacked the critical mass of customers to support the high levels of media advertising required to match the competition.

The advocacy-marketing program for the brand took advantage of its powerful brand equity to build a connection with the passions and interests of important consumers in the regions targeted for expansion. Relying mostly on experiential offline and digital efforts, we designed a multiyear plan that required a media investment that was just 25 percent of that of the brand’s key competitor.

Less than a year after launching the program, the company was already seeing impressive results. Recommendation levels had increased significantly in the regions and target segments that the company had aimed to influence. This in turn drove BAI up 25 percent to twice the score of the company’s main rival. It also increased brand affiliation by 50 percent and multiplied purchases by a factor of three.

In an environment of constrained resources, some smart companies are looking to add advocacy to their traditional marketing mix. These forward-looking organizations want to build long-term relationships, not just hits and buzz. But many still labor with obsolete metrics and struggle to discern which actions produce results.

BAI offers brands an efficient way to measure this vital leading indicator, while maximizing scarce resources and driving growth. For companies ahead of the curve, our approach to measuring advocacy confers a significant advantage. For those relatively rare brands that can build an emotional connection with consumers in advance of the competition, that competitive position can be difficult to dislodge.

Appendix: Methodology

The BAI survey asks a series of simple questions that gauge whether a person is a customer or noncustomer of the company, determine whether he or she has recommended or criticized the brand in the recent past, and assess the reasons behind his or her sentiment toward the brand.

We apply a rigorous weighting system—which is based on the demonstrated influence of different types of advocacy—to the answers. Because critics tend to overwhelm the influence of fans, we subtract scores for negative advocacy from those for positive advocacy to produce BAI. (See the exhibit below.)s.

Two distinctions in the way BAI measures advocacy are important. First, spontaneous advocates and critics matter more to a brand than those who advocate or criticize a brand only when prompted. People who speak up about a brand without prompting tend to tell more people and to be more influential than those who respond only when prompted. Likewise, spontaneous brand critics unhappy with their experience tend to talk about their experience with twice as many people as do customers who are satisfied. And their voices are, in many cases, more powerful than those of advocates.

Recommendations or criticisms are expressed by brand customers as well as noncustomers. Therefore, BAI is calculated at three levels: customers of the brand, customers of other brands in the category who also know the brand, and customers and noncustomers for the entire brand category. To calculate the latter BAI category score, we add together BAI scores for customers and noncustomers. BAI can be adjusted to account for shorter or longer buying periods in a sector as well, to ensure that the results are applicable to the same product version or model.

The list of countries and industries studied continues to grow. BCG has created detailed BAI rankings for 14 countries: Belgium, Canada, China, France, Germany, India, Israel, the Netherlands, Portugal, Spain, Sweden, Switzerland, the U.K., and the U.S. Furthermore, we have developed rankings for more than 20 industries and categories, including apparel, automobiles, beverages, consumer durables, cosmetics, credit cards, dairy, do-it-yourself, grocery, health care, insurance, mobile telecommunications, pharmaceuticals, restaurants, retail banking, smartphones, tablets, televisions, travel and tourism, and utilities.