COVID-19 and its effects have introduced sizable hurdles to defense companies’ marketing and sales (M&S) efforts. Many of the challenges – including greatly reduced opportunities for face-to-face marketing – are likely to endure. To mitigate the impact of these and boost their company’s ability to weather and even thrive in this environment, defense industry M&S teams must take an array of actions. We surveyed a host of senior M&S executives at global defense

COVID-19 Changes the Game

The coronavirus has fundamentally altered the business calculus for defense industry M&S teams. For one, it has dramatically shrunk the size of the pie. Defense budgets are likely to be materially lower than they were projected to be in most pre-COVID-19 forecasts, with funds that might otherwise have gone to defense being redirected toward economic stimulus, vaccination programs, and other pandemic-related initiatives.

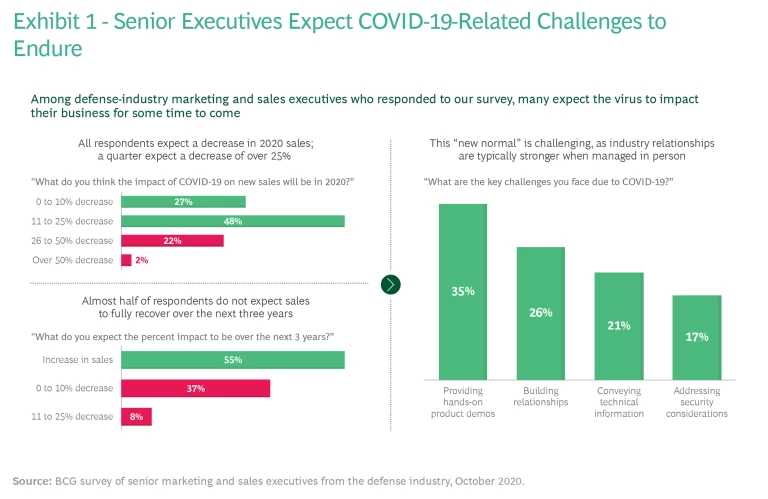

Many of the industry executives we surveyed said they expect defense spending and industry sales to remain subdued versus earlier expectations for at least the near to medium term. (See Exhibit 1.) All survey respondents reported seeing actual 2020 sales lower than pre-virus expectations. Nearly half described a shortfall of as much as 25%. And nearly half of respondents said they do not expect sales to recover fully within the next three years. Defense intelligence provider Janes predicts 2025 European defense spending will be 16% less than projected before the pandemic.

In parallel, the virus has greatly reduced the extent to which M&S teams can rely on established ways of doing business. Defense deals are, by their nature, large and complex. In-person negotiations, relationship-building, product demos, and discussions of technical specifications have long been the norm. But the virus has made participants on both sides of the deal understandably wary of face-to-face encounters. It has also created substantial hurdles to international travel. These realities are forcing M&S teams to rethink how they approach their task, from lead generation to contract signing and beyond.

The virus has greatly reduced the extent to which M&S teams can rely on established ways of doing business. Participants on both sides of the deal are understandably wary of face-to-face encounters.

For most players, this recalibration will ultimately force an overhaul of required skills. Most M&S teams recognize this. Nearly 60% of survey respondents said they believe that the skills profile of M&S staff must change in response to the industry’s new normal, and more than 10% said major adjustments are needed.

Among survey respondents who believe new skills are necessary, they deemed one category most vital: digital skills. Nearly 60% of respondents said their company had already expanded its use of existing digital tools, and more than half said it had adopted new ones.

These are steps in the right direction. But we believe most M&S teams would be wise to take this heightened emphasis on digital tools, platforms, and ways of doing business even further due to the likelihood of the virus having lingering long-term effects on their business and the enduring benefits of expanded digital investment. (Fully 99% of respondents said they expect to continue using their new digital tools and capabilities after the pandemic subsides.) To what degree M&S teams will need to expand their emphasis on digital, and precisely where a company’s focus should be, will hinge on where the company is currently and what its ambitions are.

Gauging Digital Needs – and Meeting Them

Digital advancement is M&S teams’ most potent means of countering the negative effects of the virus on their business. The digital realm offers powerful tools that can address most M&S challenges the industry faces, in fact. Reductions to in-person lead-generation opportunities can be surmounted through greater use of digitally enabled customer-relationship-management tools, for example. Fewer opportunities to participate in industry expos and demonstrate products to clients and prospects in-person can also be addressed through participation in digital expos and by conducting digital demos.

The digital realm offers powerful tools that can address most M&S challenges the defense industry faces.

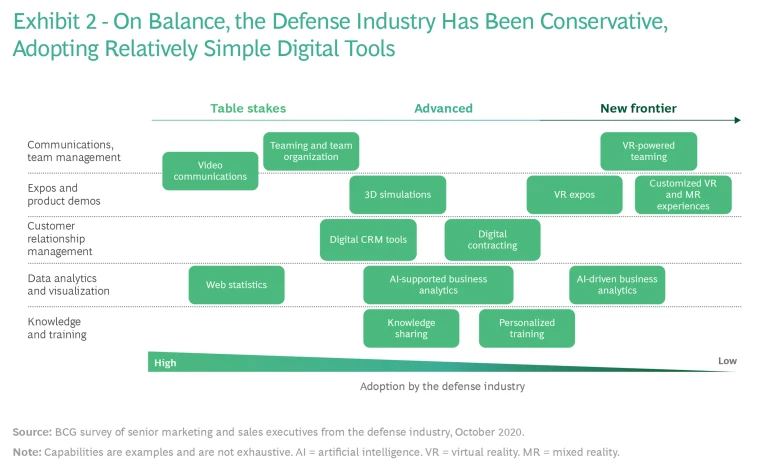

As noted, many M&S teams recognize the value of embarking on this course and are, at minimum, moving in this direction. But the pace and degree of change for most companies is far too gradual and small. Most players have adopted relatively simple tools, such as video conferencing. But few have embraced more advanced and cutting-edge tools, such as artificial-intelligence-supported business analytics and virtual-reality-powered teaming. (See Exhibit 2.)

There are players, though, that are consciously pushing the envelope on the digital front – and reaping the rewards. These players typically share common characteristics. They recognized the value of digital early and were investing in it before the pandemic. Their business has been greatly affected by the virus, which has strengthened their commitment to finding ways to mitigate the damage – and most have concluded that digital is at least part of the answer. They have the budget to invest aggressively in digital. And their customers have the willingness and ability to engage in an M&S process that involves digital tools.

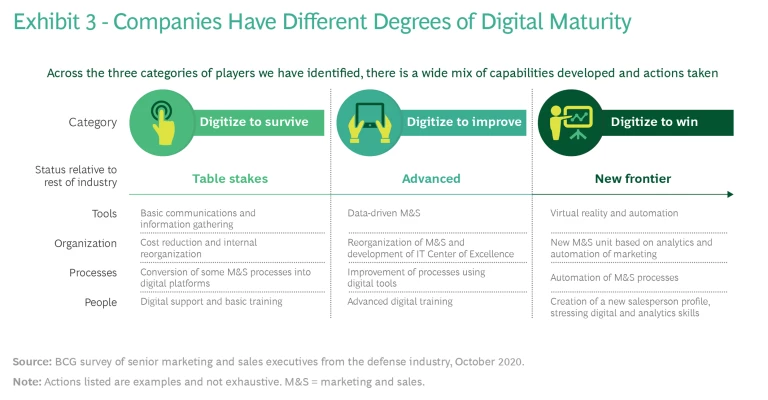

Where are most players? We group M&S teams and their companies into three categories with regard to their digital ambitions and where they are on the digitization journey. (See Exhibit 3.) The first is players that are embracing digital solely to remain viable amid the industry’s upheaval. These digital to survive players have made or are making basic moves on multiple fronts. They have embraced remote working, right-sized their staff and made other cost-cutting moves, and redirected unused marketing budgets toward accelerating digital initiatives. They have migrated at least some M&S processes to a digital platform. They have trained staff on basic digital tools and brought in a digital expert for support.

Digital to improve players take this a step further. They have adopted a centralized structure for M&S units and have created centers of excellence for IT, intelligence, and other critical functions. They have cut costs more aggressively (by right-sizing their organization, for instance) and made additional investments in digital capabilities. They have improved processes through automation and digitization (using CRM systems to enhance development and lead generation, for example). They have provided advanced digital training to existing staff and hired new talent with analytics backgrounds.

Digital to win players are at the cutting edge of M&S teams’ embrace of digitization.

Digital to win players are at the cutting edge of M&S teams’ embrace of digitization. They have expanded the scope of their centralized organizational structure to include IT, analytics, intelligence, and other key capabilities, and established localized salespersons in countries and regions of high strategic importance. They have made additional cost cuts and reallocated those savings to digital investments. They have committed to automating most M&S processes. They have installed or developed high-end digitization and analytics capabilities. They have hired new salespersons with expertise in such areas as business intelligence, cloud management, and data science.

Digitizing to Win

Digital to win players seem likeliest to reap a significant competitive advantage through their efforts. They can make decisions faster. They have a smaller, more nimble workforce. Their ability to nurture existing client relationships and build new ones is greater. Their costs are lower. Their heightened emphasis on digital marketing and sales makes them look more innovative to clientele.

Regardless of where an M&S team finds itself, though, it should acknowledge that the ground has shifted and that old ways of doing business are unlikely to return anytime soon, if at all. A team should also understand and accept that greater emphasis on digital capabilities is the necessary response.

M&S teams should also recognize that there are likely competitive advantages to acting boldly and soon. While much of the industry has begun to embrace a more digital model, much still has not or has failed to act with the necessary rigor. Moving with conviction could pay off in a big way.