Making hay while the sun shines is a breeze. The real test is in doing the same when the weather turns stormy. After several years of stellar performance, the asset management industry found in 2018 that it had to adjust. Bouts of financial-market volatility, tightening monetary policy, and slowing global growth created a more challenging environment. Active managers in particular felt the squeeze, several announcing job cuts in response to accelerating outflows. The MSCI World Index dropped 9% during 2018, while the MSCI Emerging Markets Index lost 15%. Bond funds and many alternative investment funds also posted negative returns.

These factors, among others, placed assets under management (AuM), net inflows, and revenues under considerable duress. In a sample of 30 managers from around the world representing AuM of $39 trillion—roughly half the industry—we found that AuM fell by 4% in 2018, a marked turnaround from the 12% rise seen in 2017. (See Exhibit 1.) AuM over the year rose by 5%, however, compared with an 11% increase from 2016 to 2017. This apparent anomaly was the result of the timing of inflows and outflows over the period. Net new flows, meanwhile, were 0.9%, which was considerably weaker than the record 3.1% seen in 2017. The historical average is about 1.5%.

The shifting patterns of AuM were reflected in revenues. Aggregate revenues rose by 3%, still somewhat less than the 9% gain seen in 2017. This was a better result than may have been expected, reflecting a moderate product shift among some managers and the fact that AuM dropped off sharply only toward the end of the year.

Costs, meanwhile, continued to rise as the industry struggled to adjust to the macroeconomic environment and firms invested in areas such as data and analytics. Regulatory measures, such as the updated Markets in Financial Instruments Directive, were also major drivers of increasing costs. The average cost-to-income ratio of our sample was 66% in 2018, up slightly from 65% 2017.

The most likely scenario for the coming year—absent a sustained market turnaround—is one of continuing volatility.

Given the tighter pressure on fees and the rise of related costs, the most likely scenario for the coming year—absent a sustained market turnaround—is one of continuing volatility, despite a rise in markets around the world early in the year.

Active Asset Managers Are Feeling the Heat

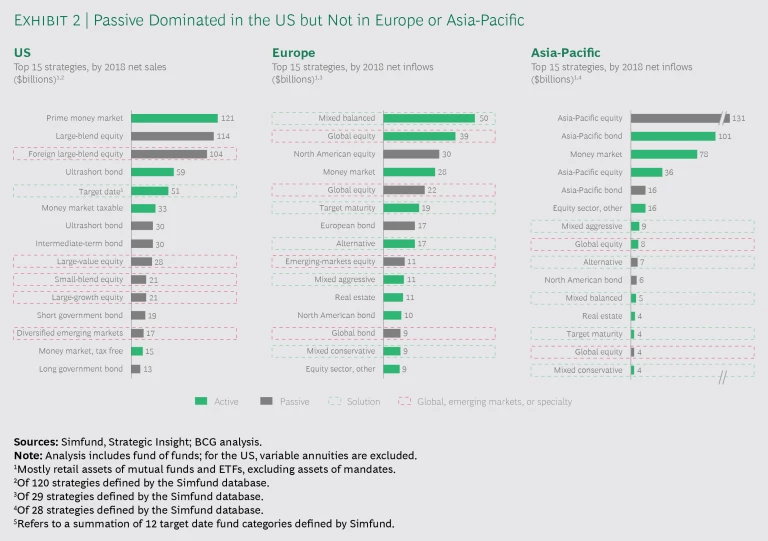

The battle between active and passive strategies continued to play out in 2018, with passive grabbing most of the net inflows in the US while active held its own in Europe and Asia-Pacific. (See Exhibit 2.) Ten of the 15 most popular strategies in the US were passive, with global, emerging-market, and specialty themes continuing to prosper. One-third of the top 15 were dedicated to such motifs. The European market continued to lag behind the US in that respect. Just 5 of the top 15 strategies were passive, while the remainder were active. The highest-ranking active strategies were balanced funds and global equity. The highest-ranking passive strategy was North American equity.

Passive is increasingly popular with both retail and institutional investors, and a price war is proceeding apace. However, passive’s weaker contribution to overall revenues created a challenge for the industry. Passive assets that represented 20% of industry AuM in 2017 generated just 6% of revenues in 2018. (See The Digital Metamorphosis, the 2018 BCG Global Asset Management report, July 2018.)

Some active managers have responded by restructuring fee schedules, shutting underperforming funds, and launching new products. One leading manager, for example, reduced fees by 20% on its top ten US and international equity mutual funds and implemented variable fee reductions on others. In Europe, fees posed more of a conundrum. The reason is that low-cost distribution models are harder to implement because of the more active role played by intermediaries and distributors. Over time, however, we expect this bias to dissipate: the low-cost model is too compelling to be kept on the sidelines for very long.

The Winners Take All—Again

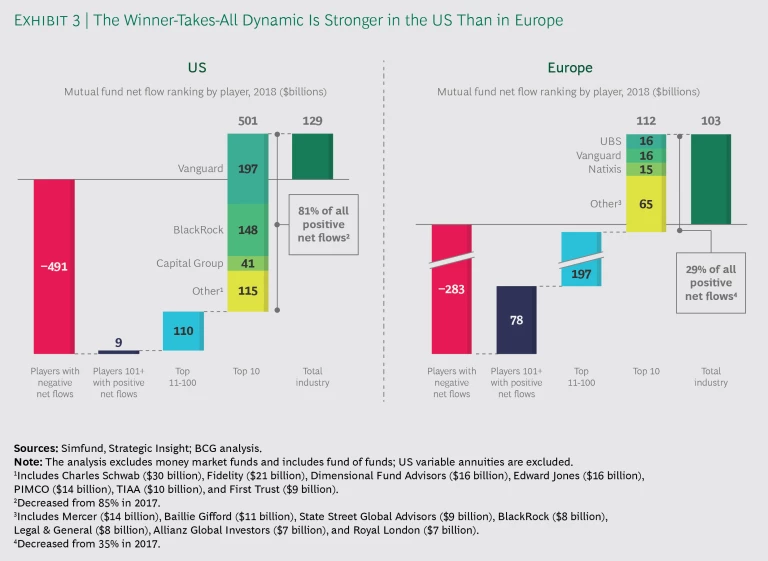

Overall, in terms of flows, it was a challenging year. In the US, $620 billion of inflows were offset by $491 billion of outflows. The trend in recent years has been for winning firms to capture the lion’s share of inflows, and that continued in 2018, albeit at a slightly slower rate—and mainly in the US. The top ten US players captured 81% of net mutual fund flows of firms with positive flows, compared with 85% in 2017. A few large managers saw outflows in the fourth quarter, but they more than made up for those during the rest of the year. Vanguard and BlackRock, for example, saw net inflows throughout 2018 of $197 billion and $148 billion, respectively. Four of the top ten—Vanguard, BlackRock, Charles Schwab, and Fidelity—saw most of their inflows directed at passive strategies.

In Europe, the top ten accounted for 29% of inflows in 2018, compared with 35% in 2017. The winner-takes-all trend was less entrenched there, mainly because both the market and distribution methods are more fragmented. (See Exhibit 3.) We expect this to remain the case for the foreseeable future.

The More Uncertainty, the More Potential Outcomes

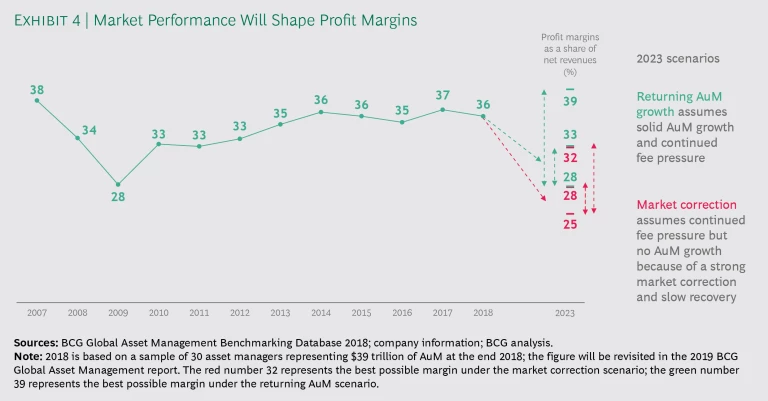

Several large fund managers, citing weak investor sentiment, reported profit declines in 2018. In many locations—particularly the US—concern over the pace of interest rate increases and slower growth depressed market confidence. The negative mood was reinforced early in 2018 by expectations that higher borrowing costs would dampen consumer spending, leading to pressure on corporate profits. In the UK, uncertainty over the implications of Brexit led to a decline in investment, and talk of trade wars added to the gloom. In early 2019, many economists were predicting slower global growth into 2020. The length and depth of that slowdown is likely to be a key determinant of the performance of underlying markets.

Uncertainty in the macroeconomic environment means that there is a fairly wide distribution of potential outcomes in terms of margins and AuM growth for asset managers. We see two main scenarios:

- There is a return to AuM growth, and profit margins as a percentage of net revenues fall from the 36% posted at the end of 2018 to 28% to 33% in 2023. (See Exhibit 4.)

- A market correction sets in and the recovery is slow. In this case, margins could drop to the range of 25% to 28% by 2023. That would mean a fall of nearly one-third by 2023.

1 1 Numbers apply to traditional asset managers, excluding alternative investments.

Watch Out for the Squeeze

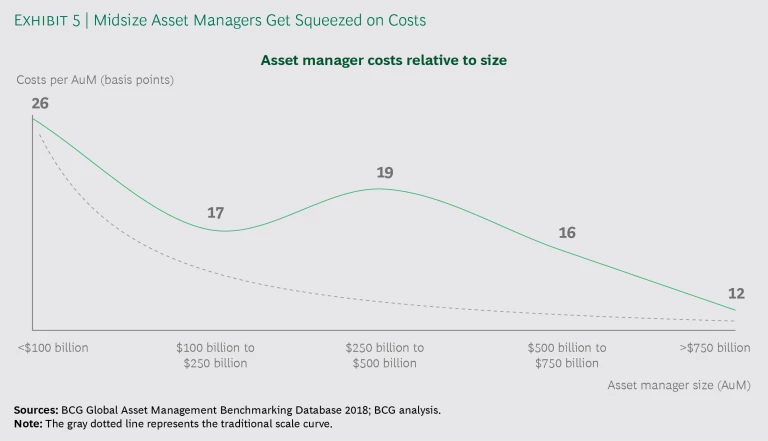

In harsh environments, it pays to be nimble—able to respond quickly to changing market conditions. But there is also merit in scale, which can help firms absorb pressure. This makes sense because, according to BCG analysis, from a cost perspective, both large and small firms perform relatively better than those in the middle. (See Exhibit 5.) For example, firms with $100 billion to $250 billion in AuM post average costs of 17 basis points of total AuM while those with assets exceeding $750 billion incur average costs of 12 basis points. Firms in the $250 billion to $500 billion range, however, incur average costs of 19 basis points, more than either their larger or their smaller peers.

As margins and fees continue to be squeezed, firms that operate at scale will likely have greater freedom to make game-changing decisions. However, that does not exempt smaller firms, which must also be willing to focus on where they play strongest and to allocate sufficient capital to compete.

The Call to Action: Optimal Next Steps for Asset Managers

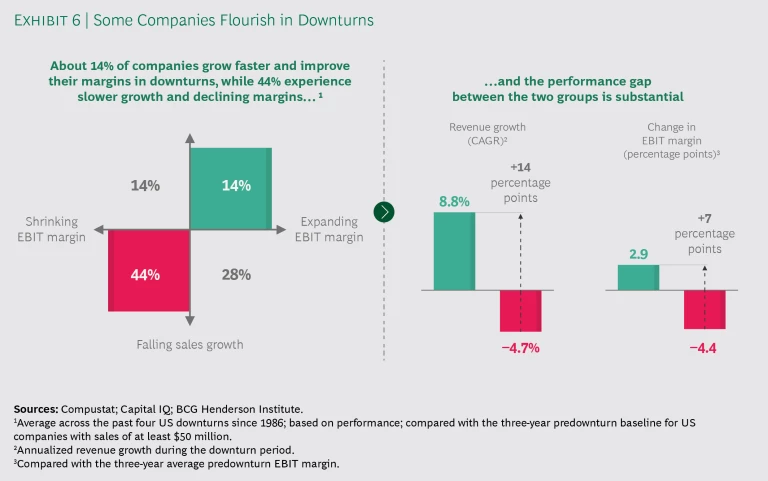

The predominant view is that there will be a downturn in the global economy relatively soon. As asset manager leadership teams consider their options, a review of past market cycles can be useful. BCG research shows that the stakes for all industries are usually higher in downturns and that only a few companies buck the dominant trend. (See Exhibit 6.) During the past four downturns in the US, some 14% of companies across industries grew faster and enjoyed higher margins. About 44% saw slower growth and shrinking margins. Furthermore, the gap between winners and losers was significant. Winners posted CAGR revenue gains of 8.8%, losers saw declines of 4.7%, and the winners’ margins rose 2.9 percentage points while losers saw declines of 4.4 percentage points.

With the winner-takes-all dynamic in mind, leaders should set priorities and forge a strategy. Some strategies may need little more than a tweak, but others must be redesigned for more concerted efforts. We believe that a two-pronged approach would be productive—on the one hand, defending the firm’s franchise, and on the other, taking aggressive steps to move forward.

Defensive Strategies Can Enhance Performance

We see three key defensive strategies that can help firms shore up their performance metrics and ensure that they operate as efficiently as possible.

Focus intently on costs. Asset managers can combat margin pressure and free up investment capacity by paying more attention to costs. Most managers already focus on reducing the workforce and adjusting bonuses. However, a more structured approach may be required in tougher times. One powerful tool is zero-based budgeting, which can generate significant savings, create transparency around the cost base, and help foster a culture of cost consciousness. Successfully implemented, zero-based budgeting can free up significant funds that can be redeployed or reinvested in the business. In addition to revising their budgets, firms should undertake a root-and-branch review of management frameworks, delayering where necessary. There will likely be opportunities to tackle sources of spending, such as market data, that are growing and are not always well controlled.

Asset managers can apply technologies, such as automation and artificial intelligence, to drive costs lower and can pay down the technology debt accumulated by legacy IT infrastructure. Of course, such investments in structural change might be hard to justify in a downturn. One way to sweeten the pill is to consider outsourcing and offshoring middle- and back-office functions. Such moves can reduce costs, allow for greater scale, and bring about such tangential benefits as enhanced capabilities.

We estimate that a firm with AuM of $100 billion can save 15% to 20% of total costs through such initiatives—a $16 billion to $21 billion opportunity across the industry.

Review the portfolio. Asset managers need to adopt an investor mindset, ruthlessly assessing the value of existing positions and being decisive about cutting losses. We propose three key areas of focus: presence, products, and projects.

The first, presence, calls for exiting or consolidating underperforming and nonstrategic markets and client segments.

Second, fund products that no longer meet profitability expectations or offer no strategic value should be closed. This portfolio approach should be reviewed regularly to ensure that capital allocation is aligned with strategy and that the firm is striking an appropriate balance between leveraging its core strengths and placing strategic bets in adjacencies or new frontiers.

And third, leaders could find it beneficial to undertake a review of key projects across the organization and drastically reprioritize to focus on only the most critical and strategically aligned.

Optimize pricing. In an increasingly competitive pricing environment, fees can be applied as a critical lever for nuanced competitive plays. Rather than tactical cuts, therefore, firms should adopt a strategic approach, equipping themselves with analytics for continuously analyzing price elasticity and customer behaviors. In particular, firms should identify key gaps in pricing by channel and market relative to competitors. Pricing-efficiency programs are also useful for identifying “stickiness of money” and repricing selected products, mandates, and funds. The key is to standardize and industrialize to facilitate closer monitoring.

In general, we have observed that only a select few products—channel-market combinations, for example—are able to support sustained differentiated pricing. Everything else is in a race to zero. The onus is on the asset manager to identify and act on these combinations so that it picks its battles on the most favorable grounds.

Aggressive Strategies Can Provide Highly Effective Defense—and More

In some cases, attack is the best form of defense. Taking proactive, aggressive steps can be the key to unlocking value, particularly in a challenging macroeconomic environment in which often the strongest instinct is to retrench. Three key imperatives call for strategic action.

Combat client attrition. Firms have ever-expanding volumes of data and faster, more powerful algorithms at their disposal. These can generate deeper insights into client value and behaviors and help with the development of a more tailored proposition on a segment-of-one basis. With this approach, firms can spot signs that a client may be considering the withdrawal of funds and should focus on optimizing their responses to such a scenario. For high-value clients, this could mean initiating smart retention programs to identify pressure points and minimize outflows.

Leaders should give serious consideration to their desired business models.

Invest in data and analytics. A deep dive into the benefits of data and analytics is beyond the remit of this paper. However, data and analytics are becoming essential drivers of operational efficiency, smarter decision making, and better customer service. Firms that don’t invest will likely fall behind. More attractive and accessible customer interfaces can, for example, drive engagement, while digital tools can help customers review their portfolios, access research, and analyze their decisions. Internally, data and analytics can supplement decision making through, for example, strategies that are based on real-time sentiment analysis. In distribution and marketing, they can help advisors understand customers better so that they can offer products on the basis of individual needs. Data and analytics can drive efficiencies across the firm—in risk, compliance, reconciliations, collateral management, and reporting.

Consider M&A. Most leaders in asset management are either specialists or scale players that offer a full menu of products and services. With that in mind, leaders should give serious consideration to their desired business models. Is the firm an alpha shop, beta factory, distribution powerhouse, or solution provider? (See Doubling Down on Data, the 2016 BCG Global Asset Management report, July 2016.) The aims should be to exploit points of difference with competitors and to align operations and activities in a unique proposition. In short, firms need to be crystal clear on where they will play and how they will win.

Looking to the longer term, leaders may wish to develop a strategic view of their firm’s optimal footprint, benchmarked against its projected needs. When carefully prepared and well executed, consolidation is one high-impact option. Potential benefits include a broader product offering, new business lines, greater scale, cost efficiencies, enhanced distribution power, and access to new locations. At the same time, as part of the broad portfolio strategy, firms should look for opportunities to place select strategic bets focused on obtaining new capabilities, securing fresh talent, and capitalizing on enhanced technology.

The industry has seen several large deals over the past year, as well as increasing interest from private equity funds. Firms considering the M&A opportunity, particularly those in the squeezed middle, may wish to draft an M&A wish list and monitor valuations and competitors’ balance sheet positions. They may also create an M&A playbook, setting out funding plans for different scenarios.

In trying times, strong leadership is invaluable. As leaders contemplate a tougher future, the time has come to double down on strategy and determine the best way to streamline and become more efficient. Part of that exercise should be a rigorous focus on costs with a simultaneous focus on ensuring that clients are highly motivated to remain on board. However, firms may also consider more aggressive approaches, including leveraging advanced analytics, introducing products, moving into new locations, and merging with peers. A downturn brings inevitable risk. Viewed constructively, however, it may present an inviting window of opportunity.