A strong semiconductor industry is critical to US global economic competitiveness and national security in an era of digital transformation and artificial intelligence. The US has long been the semiconductor leader, with a 45% to 50% market share. US leadership is grounded in a virtuous innovation cycle that relies on access to global markets to achieve the scale needed to fund very large R&D investments that consistently advance US technology ahead of global competitors.

Frictions between the US and China are already generating significant headwinds for US semiconductor companies.

Frictions between the US and China, whose device makers accounted for around 23% of global semiconductor demand in 2018, have generated significant headwinds for US semiconductor companies. Since the start of the bilateral trade war, the median year-on-year revenue growth of the top 25 US semiconductor companies has plummeted from 10% in the four quarters immediately prior to the implementation of the first rounds of tariffs in July 2018, to approximately 1% in late 2018. And in each of the three quarters after the US restricted sales of certain technology products to Huawei in May 2019, the top US semiconductor companies have reported a median revenue decline of between 4% and 9%. Many of these companies have cited the trade conflict with China as a significant factor in their performance. Although the “phase one” trade agreement signed by the US and China in January 2020 contains provisions related to China’s protection of intellectual property and its technology transfer practices, it does not address the issue of China’s direct state support for its domestic semiconductor industry. Meanwhile, restrictions on exports of US-based technology products to Huawei and other Chinese entities associated with US national security concerns remain in place.

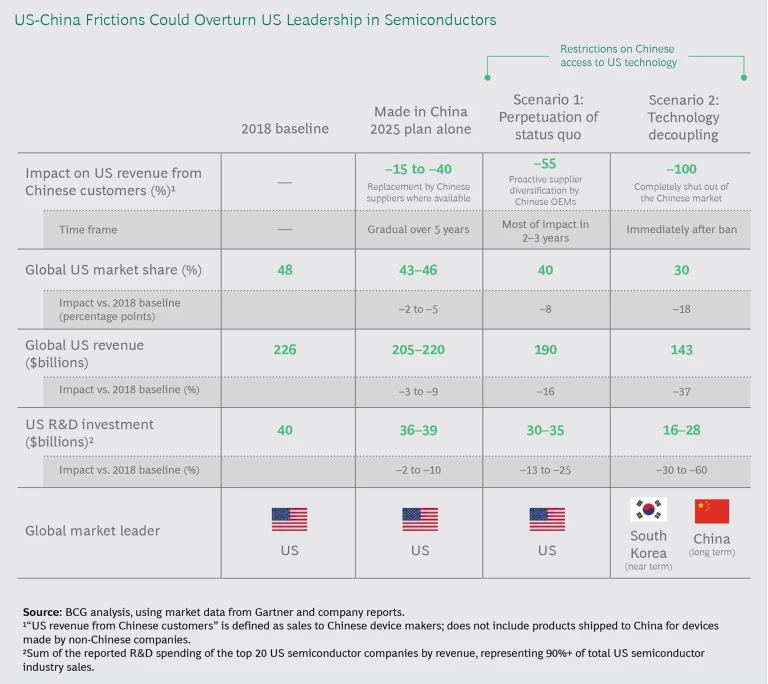

A further increase in bilateral tensions could amplify the negative impact on US semiconductor companies. In a new Boston Consulting Group report , we evaluated how these ongoing frictions may affect the US semiconductor industry under two scenarios. The first scenario assumes that controls on exports of US technology to the Chinese companies that are currently subject to US restrictions will remain in place, perpetuating the status quo. The second scenario considers a further escalation that results in a complete halt in bilateral technology trade, effectively decoupling the US and Chinese technology industries.

ABOUT THIS REPORT

ABOUT THIS REPORT

To assess how ongoing US-China trade frictions may affect the US semiconductor industry, the Semiconductor Industry Association (SIA) commissioned Boston Consulting Group to conduct an independent study. The work included detailed modeling of the global demand and supply dynamics across end application markets and semiconductor product categories. BCG is wholly responsible for the analysis and conclusions that appear in this report.

Either a continuation of the status quo or a complete decoupling of US and Chinese tech industries could have profound negative repercussions for the US semiconductor industry, well beyond the expected impact of the “Made in China 2025” policy.

Our analysis of the demand and supply structure across more than 30 semiconductor product lines shows that either of these scenarios could have profound negative repercussions for the US semiconductor industry, well beyond the expected impact of the “Made in China 2025” policy. Today, China’s semiconductor industry (not including the manufacturing fabs built by foreign semiconductor companies in China) covers only 14% of its domestic demand. We estimate that the Made in China 2025 plan could increase China’s semiconductor self-sufficiency to about 25% to 40% by 2025, reducing the US’s semiconductor share globally by 2 to 5 percentage points. Broad unilateral restrictions on Chinese access to US technology would significantly deepen and accelerate US companies’ share erosion. (See the exhibit.) Several projected consequences of the two scenarios are especially noteworthy:

- Over the next three to five years, US semiconductor companies could lose 8 percentage points of global share and 16% of their revenues if the US maintains the restrictions that are already in force on access to products containing US technology by Chinese companies included on the current Entity List. (The Entity List specifies which organizations are subject to such restrictions.)

- US companies could lose 18 percentage points of global share and 37% of their revenues over the same period if the US completely bans semiconductor companies from selling to Chinese customers, effectively causing a technology decoupling from China.

- These drops in revenue would inevitably lead US semiconductor companies to make severe cuts in R&D and capital expenditures, resulting in the loss of 15,000 to 40,000 highly skilled direct jobs in the US semiconductor industry.

As a result, in a scenario in which escalating tensions lead to further restrictions on US semiconductor sales to Chinese customers, South Korea would likely overtake the US as world semiconductor leader in a few years; China could attain leadership in the long term. As experience in communications network equipment and other tech sectors has shown, once the US loses its global leadership position, the industry’s virtuous innovation cycle reverses direction, throwing US companies into a downward spiral of rapidly declining competitiveness and shrinking market share and margins. Lower R&D investment would inhibit the US semiconductor industry’s ability to deliver the breakthroughs that US technology and defense sectors rely on to maintain global leadership; ultimately, it could force them to depend on foreign semiconductor suppliers.

Once the US loses its global leadership position, the industry’s virtuous innovation cycle reverses direction, throwing US companies into a downward spiral.

In order to avoid these negative outcomes, policymakers must devise solutions that simultaneously address US national security concerns and preserve global market access for US semiconductor companies. These dual objectives are fundamental to maintaining the proven innovation model that will allow the industry to continue to deliver technology breakthroughs that are crucial for US economic competitiveness and national security, and enable advances in electronic devices and digital services that benefit enterprises and consumers in the US and around the world.

ACKNOWLEDGMENTS

This report would not have been possible without the contributions of our BCG colleagues Abhinav Duggal, Ray Loa, Christine Jarjour, and Emily Horton.