Back when Stirling Moss was winning Formula One races, the car and driver determined who won. Now the sport has become as much about processing complex signals and adaptive decision making as it is about mechanics and driving prowess. With as many as 200 sensors built into their vehicles, race teams continuously collect and process data on 3,000 different variables—ranging from weather and road conditions on race day to the RPMs of the car’s engine and the angles on the track’s curves—and feed them into dynamic simulation models that guide the drivers’ split-second decisions. A telemetric innovation by one race team can instantly raise the bar for all competitors.

Adaptation to incessant change is also essential in today’s business world, where key variables are volatile and difficult to forecast. Escalating levels of digitization, connectivity, and processing power are making the rapid interpretation of external signals increasingly possible—even as the avalanche of data has made it much more challenging. Smart competitors are already raising the competitive bar in many industries and pursuing signal advantage—the ability to rapidly capture, interpret, and act upon signals gleaned from rich and dynamic data.

The volume of data confronting organizations has risen dramatically—a nearly fivefold increase is projected between 2009 and 2013—as has its complexity. At the same time, the shelf life of data has declined dramatically as a result of rapid replication and diffusion. Storage capacity has also grown but not at a sufficient pace to accommodate the explosion of information generated.

Most businesses are effectively information businesses, although few are using information for competitive advantage. Many are still struggling to update and connect complex legacy systems to manage an overwhelming stream of incoming data. As a result, although IT spending continues to mount, several studies have demonstrated that it has not driven differential performance. Companies that fail to embrace signal advantage will likely be left behind by information-agile competitors.

Reaping the Benefits of Signal Advantage

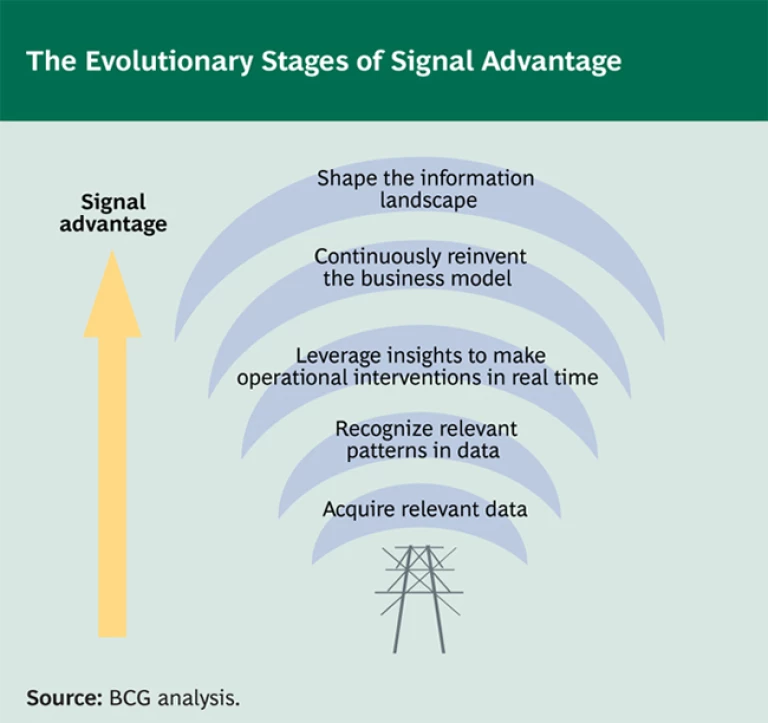

A handful of leading companies across many industries are already building signal advantage. They capture a ladder of benefits by focusing on the right information, extracting relevant signals, acting upon them rapidly, leveraging them to reinvent business models, and even reshaping the information landscape of their industries. (See the Exhibit “The Evolutionary Stages of Signal Advantage.”)

Consider, for example, the steps that the following advantaged players have taken:

- Acquire relevant data. In Japan, the global grocery chain 7-Eleven uses its point-of-sale systems to track sales by item, purchaser demographics, and even the weather and time of day. This approach allows them to test hypotheses about how these variables drive sales, allowing them to identify promising items and remove unpromising ones promptly. Thus pricing, assortment, and layout are optimized to local conditions several times a week.

- Recognize relevant patterns in data. A media company that was suffering from a high rate of customer churn restructured its customer database in order to use “neural networks” and other advanced data-mining technologies to understand patterns of customer loss. Hidden relationships among the variables driving churn were revealed, and the company launched customer-retention campaigns targeting at-risk customers. The accuracy rate in predicting churn was an impressive 70 to 90 percent—a huge benefit, since every percentage point in churn reduction was worth a considerable amount in net present value. The dedicated credit-card businesses, which pioneered the so-called “test and learn” approach, offer another example of companies excelling at pattern recognition. They run multiple experiments with different interest rates and promotional tactics, then use the outcomes to refine product offerings, segmentation, and pricing strategies. This approach has now become the competitive norm for the industry.

- Leverage insights to make operational interventions in real time. Auto insurer Progressive uses demographics and accident data as well as real-time information on how vehicles are driven to segment its market and continuously optimize pricing. StreamBase Systems—which processes streaming data in real time and was named a “2010 Technology Pioneer” by the World Economic Forum—is one company that is making this capability possible. StreamBase’s complex event-processing technology provides e-commerce businesses, telecommunications companies, and intelligence agencies with real-time analysis enabling their rapid response to opportunities and threats.

- Continuously reinvent the business model. To both refine and also expand its business model, U.K.-based grocery retailer Tesco performs detailed analyses of the purchase patterns of more than 10 million members of its loyalty-card program. The findings enable Tesco to customize its product offering for each store and each customer segment and provide early warning of shifts in customer behavior. The insights support the development of Tesco’s online platform, enabling it to evolve its business model and escape the constraints of physical stores. By becoming a store without walls, Tesco can offer a broader range of products and services, including media and financial services. Furthermore, the online channel also enriches the data streams that Tesco taps into. Instead of being a pure cost center, the rich databases and analytical capabilities even constitute a small stream of direct revenue: For a fee, Tesco allows its suppliers to access its data-generated insights.

- Shape the information landscape. Google, which generates most of its revenue from advertising, has completely reinvented the way information is used in that industry. It uses algorithms to update the position of an ad on the basis of the ad’s relevance to a search or a Web site as well as the advertisers’ bids on key words. The more relevant an ad, the higher the click-through rate—and because advertisers pay per click, this translates into greater advertising effectiveness and more revenues for Google. By linking its advertising data directly to its operations, Google bypasses human intervention and organizational inertia, responding dynamically to changing ad conditions on a split-second basis. Google has therefore reshaped the information landscape to its own advantage by creating, exploiting, and monopolizing new sources of information.

Thinking Differently About Information

How is it that these companies have been able to embrace signal advantage so effectively? To be sure, some are harnessing state-of-the-art computing technologies, such as dynamic signal processing and neural networks. More importantly, however, companies have gained the capability to build and exploit signal advantage by rethinking their approach to information and embracing the following shifts in mindset:

- From an Internal to an Outside-in Perspective. Many legacy IT systems are focused on optimizing internal operations. By contrast, leading competitors focus on importing, interpreting, and acting upon external signals for adaptive advantage.

- From Reporting Information to Mining and Interpreting It. Signal-advantaged companies don’t merely capture, aggregate, and report customer and market data, they employ sophisticated analytical prowess in interpreting and translating it. That requires them to separate the relevant from the irrelevant, to recognize patterns, and to visualize complex information in new ways that facilitate decision making.

- From Episodic to Dynamic Processing. Rather than gathering and analyzing data episodically, signal-advantaged companies treat information as a moving stream that must be mined continually. In other words, they think about signals rather than data. To overcome the limits of human cognition in processing signals, they implement visualization techniques and decision-support systems. And to circumvent organizational inertia, they selectively enable external signals to directly modulate operations and strategies.

- From Local Efficiency to Global Advantage. Signal-advantaged competitors emphasize enterprise advantage, rather than functional efficiency. That is, instead of optimizing their functions independently, these organizations adapt to a dynamic landscape at the company level.

Developing Signal Advantage

Before setting out to create signal advantage, it is important to assess one’s starting position by considering the following questions:

- What types of data and data sources are we overlooking that could provide signal advantage?

- How quickly and deeply are we detecting and interpreting patterns about changing customer needs and conditions?

- How rapidly are our insights converted into action? What is our “clock speed” in relation to competitors, customers, and technology?

- How is our company reshaping the information landscape to its own advantage?

- Do we have the right human and technological capabilities, and has our leadership embraced signal advantage?

Of course, not every company will master these capabilities immediately, but we believe that all companies should chart a course to higher levels of signal advantage. Companies should advance at a pace determined by their starting position relative to competitors, the rate of external change, and internal barriers to change.

The power that has traditionally resided in merely possessing information is dwindling fast. Increasingly, advantage will come from an organization’s ability to rapidly interpret and act on signals. Information systems will become the central nervous systems of adaptive enterprises, as they shift from knowing and optimizing to learning and adapting.