Services have long been an attractive area of growth for industrial goods companies . Spare-parts, modernization, and maintenance services typically have higher margins and growth rates than do sales of new equipment. These services also promote customer loyalty and lead to future equipment sales.

Digitization is now enabling service providers to reach a new level of performance and efficiency. Yet many original-equipment manufacturers (OEMs) and other service providers have been slow to make the transition to digital services. They doubt their ability to monetize digital services and recoup the investment. Digitization has two important benefits that are often underappreciated, however. It greatly reduces the cost of delivering services, and it facilitates closer, longer-term customer relationships that offer a variety of new service possibilities. We believe that taking these factors into account will change the calculation.

For OEMs, digitization poses a threat as well as an opportunity. By shifting the locus of value creation from servicing equipment to managing information and equipment, digitization expands the universe of potential competitors. Digitally savvy companies could take over parts of the service business despite having little expertise in industrial goods—and perhaps eventually commoditize the hardware elements of the value chain. To maintain a competitive position and boost prospects for growth, manufacturers need to move quickly.

Digital Technology and the Service Business

Digitization has been going on for a while, but new service and sales opportunities are arising from several recent technological developments.

- The cheap sensors and pervasive wireless communication that underpin the Internet of Things are enabling companies to receive massive amounts of data and manage equipment operations remotely.

- Cheaper and faster computing power—and scalable computing resources through cloud services—are enabling analytics software to capture and process large amounts of data so companies can better understand equipment (and customer) behavior, optimize operations and repairs, and predict potential failures.

- Mobile and augmented-reality devices are empowering service field personnel, making them more efficient.

- Advances in 3-D printing technology make possible cost-effective production at low volumes, so a field office can manufacture spare parts as needed.

- A variety of online platforms, channels, and sales tools is enabling companies to communicate much more easily with customers that are themselves becoming increasingly sophisticated.

Almost every kind of service-related information can be digitized, which means that existing services can be transformed and new services and new business models can be created. This shift’s potential value to customers is so great that many companies in adjacent industries are either pursuing or actively considering the opportunity. Monsanto, which makes seeds and chemical products, has developed software for capturing and presenting data so farmers can make better decisions. The company recently signed agreements with the three largest agricultural OEMs so farmers could have their tractors and other machines integrated into Monsanto’s Climate FieldView platform. As Monsanto continues to gather data and build its expertise, it may gain further leverage over the OEMs.

Digitization depends on implementing systems that capture, transmit, and process information. So large software companies are using their expertise with these systems to carve out segments of the service business. SAP, for example, has begun offering software that lets equipment owners carry out predictive maintenance. And niche software companies are developing applications for specific kinds of equipment. Like Monsanto, these large and niche companies can build on their foundations to develop full-fledged platforms that manage the equipment and communicate with the customer—squeezing out the OEM for most tasks.

The size of the opportunity will appeal to companies inside and outside industrial goods. OEMs that hope to maintain or increase their service business should be entering the field of digital services with conviction—and soon.

Digitizing Existing Services

Even though many OEMs are convinced of the value to be gained by digitizing existing services, they are moving cautiously. They see digitization as something they’ll have to embrace eventually. But they are concerned about the complexity of the shift and about recouping the investment, since customers might resist paying for digital upgrades.

There’s some truth in that perspective, but it overlooks the cost side of the equation. Digitizing existing services can eliminate some on-site visits, speed up others, and enable companies to handle the same number of customers with fewer technicians. So digitizing existing services can reduce labor costs substantially. (See Exhibit 1.)

Instead of having a technician travel to a customer’s site, for example, a service company can have the equipment send vital statistics to its technicians on a set schedule. And if the equipment malfunctions, technicians can run diagnostics remotely. Because software is increasingly being built into equipment, some problems can be fixed immediately simply by adjusting or updating the software—with little or no human involvement.

When technicians do inspect equipment on-site, they can proceed much faster and the quality of their work is much higher. Sensors send the technicians data, so they arrive knowing the equipment’s status. And when on-site, they can easily call up digitized technical manuals or repair records on mobile devices to diagnose and resolve problems quickly and precisely. The savings can be enormous. In the aerospace industry, radio-frequency-identification sensors have reduced the time needed for carrying out certain inspections to as little as 4% of the original time required. In other industries, we have seen time savings from 5% to 25%.

Digitization also speeds up the submission of reports, because they can be done right on-site. And 3-D printing enables service offices to quickly print spare parts on demand, rather than store costly inventory or wait for delivery from warehouses. Meanwhile, workflow management software can optimize service calls both to minimize idle time and ensure service consistency.

A leading elevator manufacturer, for example, installed sensors in its equipment to measure operating speed, vibration, and the physical condition of the cabins and doors. The intent was to detect issues before customers noticed. The sensors send data to mobile apps in the cloud that alert field personnel of failures. Other apps in the cloud bind together real-time data with the repair history of a particular elevator, the appropriate repair manuals, and the spare-parts order system to provide a technician with all necessary information. Once the work is done, these apps let the technician see if any nearby elevators require maintenance work, thus reducing total travel time.

The elevator company also made the monitoring data available to its customers through an easy-to-use interface. Facility managers can check on their elevator fleet, looking up historical and scheduled repairs or accessing statistics on elevator uptime and availability.

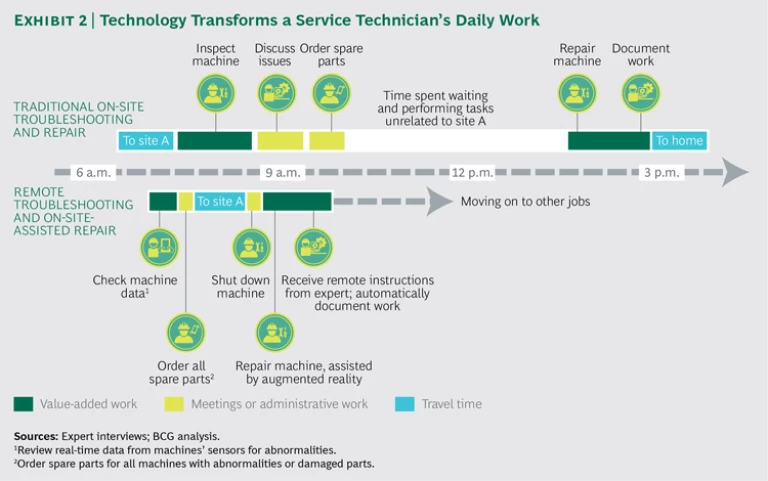

Likewise, a wind turbine OEM found that digitization cut its technicians’ time by more than half. (See Exhibit 2.) Remote diagnostics allowed the technicians to arrive with spare parts in hand, rather than first diagnose the issue on site, place the order for spare parts, and wait for them to arrive.

Whether done remotely or in person, digitized service interventions are not only cheaper but also faster and better. That means less unplanned downtime for customers’ expensive equipment and greater safety for technicians. The customers are delighted, and the savings from higher productivity cover the payoff on the digital investment, without raising prices.

Offering digital services does require some staff training, but the costs here are outweighed by the lesser need for specialized knowledge. In many cases, service providers will be able to send technicians with only general training, rather than specialists, because technology will enable technicians to communicate in a richer way with specialized support or will fill in the gaps. A major car manufacturer, for example, provides augmented-reality glasses so technicians can receive step-by-step instructions and see in 3-D the repairs to be carried out. Being able to use general technicians will also reduce worker downtime, because workers can service a wider range of machines.

New Digital Offerings

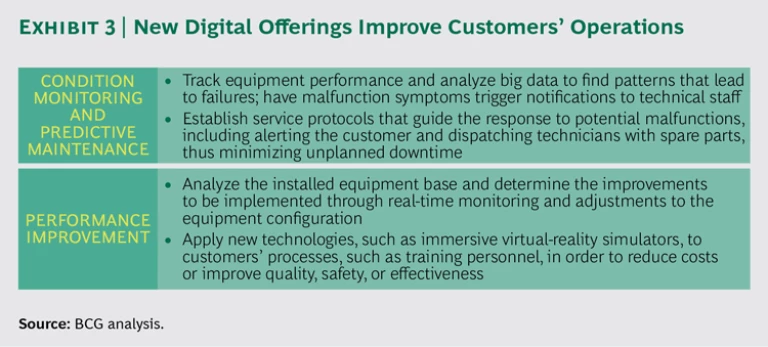

Customers may resist paying higher prices for digital versions of existing offerings, but a package of new digital services can offer a provider a clean slate and new pricing opportunities. More important, new services give providers the opportunity to change their relationship with their customers. Rather than offering services on a one-off or as-needed basis, providers can introduce services that are performed on a continual basis, improving customers’ operations and becoming an integral part of customers’ businesses. (See Exhibit 3.)

Condition Monitoring and Predictive Maintenance. Repairing machines quickly is one thing, but it is even better to prevent a breakdown in the first place. By using sensors and a monitoring system to continually track a machine’s performance, a service company can learn how equipment functions in a customer’s operation. Sophisticated analytics can isolate the main operating variables and find correlating events that lead to deteriorating performance or a breakdown. Armed with these insights, the monitoring system can anticipate when failures are likely to occur and schedule maintenance, assign technicians, and ensure that the workers will have the needed tools and spare parts in time.

Monitoring systems are now reliable and cost-effective enough to become a common part of a new offering of digital services. Customers may pay more in fees for continual attention, but service companies can draw on data previously accumulated to show how the higher level of service reduces unplanned downtime and therefore the total cost of ownership of the equipment. Additionally, predictive maintenance tends to be less expensive than outright fixes, since equipment failures often damage components that were working normally.

Not surprisingly, the airline industry has been among the first to adopt predictive maintenance. Sensors installed on jet engines continuously measure the temperature of and the pressure and vibration on various engine components, often sending more than 20 terabytes of data per hour to a service provider. If the data indicates that there is an issue, a specialized crew with the necessary tools and parts will be ready to repair the engine when the plane lands at its destination. The result is safer airlines as well as higher utilization of this extremely expensive equipment.

Performance Improvement. Service companies can perform analytics on equipment not only to watch for breakdowns but also to optimize its use. By combining this analysis with a deep knowledge of the equipment, service providers can propose improvements in customer practices that reduce the operating costs or maximize the output for both current machines and future purchases.

A leading wind-turbine manufacturer analyzes the power production of its installed base in real time and relates the data to current weather and geographic data. It uses the results to optimize operations at customers’ sites and to identify the most effective locations for future wind farms. By applying technology in these ways, the OEM has increased the annual energy production of its turbines by as much as 20%. Manufacturers of gas-powered turbines are doing the same: using real-time data to adjust power output, optimizing the generation of electricity. Even if these power- output adjustments reduce fuel consumption by only 1%, the boost to a customer’s profitability can be substantial.

Sometimes a customer can do such analysis itself using benchmarking information that is sold by OEMs and based on sanitized customer data. The information helps equipment owners to better calibrate their productivity against industry norms and adjust accordingly.

The following manufacturers have developed digital services that optimize customers’ operations:

- A large mining-equipment manufacturer can track the material excavated during most of the mining process. The manufacturer is now helping customers to optimize their processing operations for each type of ore and to better assess the performance of each mining site.

- An OEM for industrial processes has designed a software platform that integrates its equipment and that of other manufacturers into a single-line management system. Managers can use the system to better control the production batches and even make product changes on the fly. Customers are finding savings of up to two hours of production time daily.

- A leading machine manufacturer uses its data to offer customers immersive virtual-reality simulators to train plant operators and help them maintain their skills, just as flight simulators are used to train airline pilots and keep them on top of their game.

New Business Models

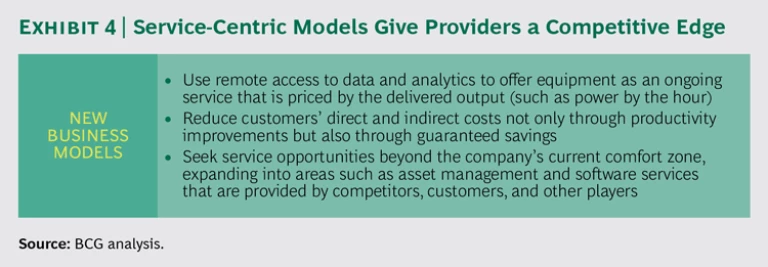

Digitization is eroding the fundamental distinction between products and services. Building on a deep understanding of a machine’s life cycle and customers’ typical usage patterns, some OEMs are offering their equipment not for sale but as an ongoing service. (See Exhibit 4.)

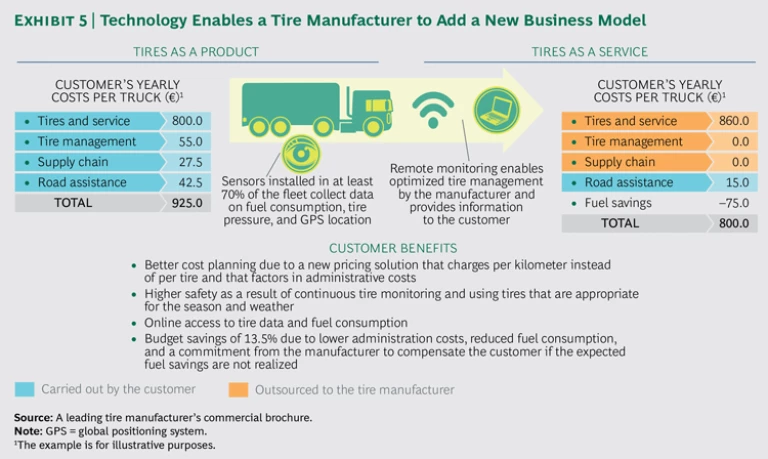

A large tire manufacturer offers tires as a service for which customers pay on a per kilometer basis. The customers agree to put telematics and sensors in a large part of their fleets to enable remote management. A customer’s immediate costs are higher than if it purchased the tires outright, but the total cost of ownership is lower. That’s partly because the customer is no longer responsible for monitoring and replacing its tires. But the management and overall costs are also lower because the manufacturer guarantees the customer’s fuel savings. Having tracked tire-deployment data in the past, the OEM has learned the kinds of savings that are likely from optimizing it. Shifting the customer from a product-centric model to a service-centric one gives the OEM full control over how those tires will be deployed. (See Exhibit 5.) The more customers the manufacturer signs up, the richer its accumulated data set becomes, giving it a leg up on any rivals that appear later.

Jet engine manufacturers have been offering a similar arrangement for years with their power-by-the-hour packages. In the pulp and paper industry, one service provider has gone so far as to take full control of a customer’s manufacturing assets, assuming responsibility for the operation and maintenance costs through extensive service-level agreements for plant management.

Besides creating new business models around equipment and operations, service providers can also offer to host platforms. A leading equipment manufacturer has created a cloud service that enables customers to connect its equipment and third-party equipment. The platform sends, receives, stores, and processes information in a secure and reliable way, with a pay-per-use pricing model. Similarly, in the transportation industry, carriers and logistics companies can upload their availability to a Web-based marketplace. By filling empty spaces with partial shipments from other customers, they can reduce both costs and emissions.

We expect that such business models will soon become the “new normal” in many sectors of industrial goods. Failing to deliver such services may well mean losing out not only on service contracts but also on new-equipment sales.

Monetizing Digital Services

Pricing new digital services is often trickier than expected. Which parameters—for example, equipment usage or output—should a service company use to establish a rate schedule? And if the pricing assumes a boost in the equipment’s productivity, customers may be skeptical, since they think they know their own equipment better than the manufacturer does. Pricing solutions are still developing. In the meantime, service providers should consider several factors when tackling this task.

The solution to customer skepticism is to make the new services a clear win-win—for the customer and service provider. Service companies that promise a customer a certain level of savings in order to sell a service should guarantee reimbursement to the customer for any shortfalls. Over time, as the customer starts to trust the service, the service provider may be able to drop those guarantees.

Predictability is essential. Even when pricing is based on a customer’s use, cost predictability matters. In the tire example, the manufacturer charged according to the number of kilometers driven. To minimize unprofitable agreements while still attracting new customers, service providers must develop a new set of pricing

capabilities.

It’s also important to remember that the payoff from investments in digital services will come not only directly through increased revenues but also indirectly through improved customer relationships. Whenever a customer switches from a discretionary, as-needed service to an ongoing service package, the service provider gains in lower sales costs, more efficient service planning, and a lower risk of customer attrition. Service packages also increase the number of services provided, whether in the form of spare parts or maintenance, and protect service companies from losing customers to third parties. Earning that payoff requires a clear strategy that supports the service commitments as well as a long-term view of the market.

Service providers are exposed to significant risk if they get the service business case wrong. Using analytics, they can gain a thorough understanding of the costs involved in the service, both the upfront costs and the recurring ones. In addition, service companies can compare the characteristics of a new customer with those of past customers whose cost savings fit the promised results. Providers should moreover assess the financial and reputational risks of failing to live up to their commitments or of costs generated by unexpected events. Safety risks may be relevant as well. Service companies should therefore develop the skills and tools for comprehensive risk assessments and, if necessary, have an exit plan.

Finally, service providers should insist on certain commitments from customers, including a minimum duration agreement, in order to recover the often-hefty initial costs. More important are mechanisms to align a provider’s interests with those of its customers’. Without such mechanisms, customers may change their behavior in response to the shift in responsibility.

A common danger is that customers will no longer care about costs that are fully borne by a service provider. For example, customers may run machinery above recommended levels to maximize production over short periods. To deal with this possibility, a leading gas-turbine manufacturer adjusts the pricing of its maintenance service depending on the length of time that its equipment is used at peak power. Peak power reduces the life expectancy of turbines, so customers pay more when they rely more on this setting than expected.

Increasing Sales Through Digitization

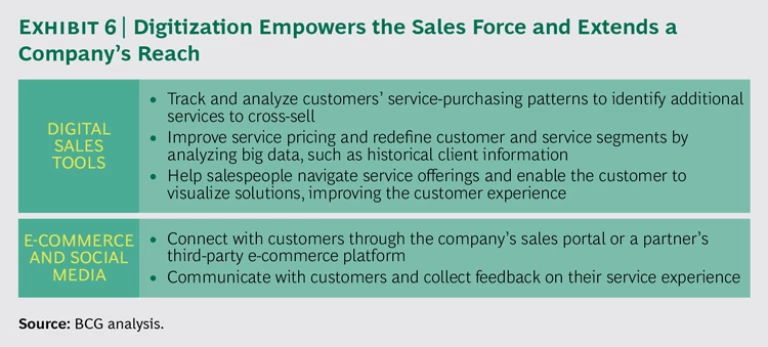

Although transforming current services and creating new digital services and business models are the main opportunities of digitization, it can boost service sales as well. It has already revolutionized the relationship between retailers and their customers in the consumer sphere, and it is poised to alter the dynamic between manufacturers and their customers in industrial goods. By combining data from equipment with new platforms for communicating with customers, service providers can better differentiate themselves from their competition and secure long-term ties. To boost digital service sales, however, service providers will also need to rethink their digital sales tools, sales channels, and marketing platforms, empowering the sales force and extending the company’s reach. (See Exhibit 6.) In some cases, service companies will be pulled along by customers that are technologically better informed and more sophisticated and that seek much greater transparency and collaboration from their providers.

Digital Sales Tools. Service providers can draw on the variety of data gathered from existing customers to determine the most appropriate upgrade or retrofit for a piece of equipment and when to pitch it. Diligent sales-support functions can go a step further and use that data to develop a profile of the most likely new customers. By matching that profile to the companies in the marketplace, the support staff can develop a list of likely prospects for the salespeople to pursue.

Indeed, by using big-data analytics to determine customer-acquisition patterns, management can define new customer and product segments on the basis of more specific, more sophisticated factors, such as equipment age, availability of third-party spare parts, or frequency of part purchases. Greater knowledge can also lead to more finely tuned discounts and other incentives that secure a sale without a lot of persuasion or hard data from the sales representative. In our experience, OEMs have increased their margins by 5% to 10% by implementing these initiatives. Providing data to salespeople raises their productivity without a big investment in training them how to use it.

Service providers can take a cue from other industries, which have made major strides in using purchasing information and history to enhance a customer’s immediate transaction and to generate leads. For example, a major auto-repair chain tracks the make and model of each customer’s car, the vehicle’s age, all service operations performed on the car, and the types of commercial offers (such as online coupons) sent to the customer. Applying big-data analytics to this data, the auto-repair chain’s system not only better diagnoses the issues with each customer’s car that is brought into the shop but also suggests products and services that the shop should cross-sell. These products and services are identified using each customer’s data or on the basis of what’s worked well for similar customers.

As customers and services become more sophisticated, the sales force has to follow suit. Mobile sales tools can greatly improve how a sales force interacts with customers. Tablets and other devices can help salespeople navigate among various service offerings for customers. In addition to enabling customers to visualize the proposed solution, mobile tools help salespeople address customers’ concerns in real time with value-based arguments and calculations. The tools should also simplify any ordering processes, improving productivity and ensuring consistent information.

A chemical company that implemented a mobile sales tool was able to increase sales by as much as 4% in only one year. Agile programming techniques enabled the company to have the apps ready for testing in the field in only three months. After the devices were deployed to the sales force, the higher margins and productivity improved the bottom line, enabling the company to pay off its investment within two years.

E-Commerce. Although e-commerce represents a small percentage of total revenues for service providers, online sales may become a major percentage in the future. E-commerce is spreading in business-to-business sales as a whole, and the services sector is likely to be next. Some non-OEM sales platforms are emerging, offering customers greater transparency on prices and service characteristics. The Shoup Manufacturing website, for example, lets agricultural vehicle owners browse its spare- parts catalog and check prices. Equipment owners may have a long-standing rela- tionship with one OEM or more, but accessible online providers that offer price trans- parency may win sales for smaller parts that customers can install themselves. Such transactions can foster a relationship that cuts into OEMs’ business down the road.

With this in mind, even OEMs with low expectations for online sales might consider launching their own sales portal. A sales portal offers OEMs the opportunity to connect directly with customers, leapfrogging traditional channels such as the distributor channel. Although connecting directly with customers might generate conflicts with channel partners, it also builds customer relationships that ultimately increase customer loyalty and sales.

If a third-party e-commerce site is particularly strong, a service provider may want to partner with that company rather than compete with it. By collaborating, a provider can prevent its service competitors from winning market share. But the provider will need to ensure good visibility on the third-party site, such as through minisites, as well as strong promotion of its offering, such as through search-engine optimization.

Social Media. Online forums are flexible, diverse platforms for presenting the values, expertise, products, and services of a company. These sites accommodate news releases, blogs, articles, event announcements, and product launches, with complex imagery and video as needed. Through frequent updates and clever use of celebrities in their videos, a leader in construction machinery has garnered millions of page views. Its Facebook profile is followed by close to half a million people.

This manufacturer has also set up algorithms to scan technical forums and social- media sites for mentions of the company name. These searches reveal issues and questions that customers may shy away from raising on the company’s website. These sites can even add value to the product. A home-automation equipment manufacturer has created an online community where users exchange experiences and tips to extract the most value out of its products.

Making It Happen

Digitization has the potential to transform services at industrial goods companies. But the learning curve can be steep, and many companies struggle with the change from the beginning. The digital transformation should start with a clear understanding of how digital services can generate value for the target customer and what that customer journey will look like. This knowledge will clarify the service company’s ambition and long-term vision. It will also define a digital-services roadmap, including an implementation plan.

Ongoing leadership and management support is essential. A separate business unit or organization that is focused on digitization may be necessary. Whether developed within the existing organization or separately, the initiative should be part of the overall corporate agenda, even at an executive committee level. A high-level manager, or even a chief technology officer or a chief digital officer, may need to spend significant time on the initiative.

Service companies may also need to acquire new kinds of talent, not only technology experts but also senior managers who can act as catalysts within the organization. The need may be so great that a company decides to acquire a digitally savvy firm, as much for the talent as for the products.

Finally, service providers will need to shift their overall culture toward agility and innovation. The new digital world is still in the making. Service providers need to embrace fast-paced, iterative processes and pilots that allow for quick testing and learning in controlled environments, with ongoing adjustments as needed. Each successful project will create momentum in the organization, strengthening the vision for digital services.

Most industrial-goods companies won’t have a choice whether to embrace digital services. Companies that hold back will eventually find themselves squeezed out of the marketplace, either by existing rivals or new disruptive entrants. Others may prepare now but wait to see how peers proceed before moving decisively. Such companies will lower their risk but find themselves playing a catch-up game.

Digitization gives service providers that act now the chance to lower delivery costs, offer new services, create new business models, and boost sales effectiveness. Providers that seize the opportunity will not only move ahead in digitization but also elevate their customer relationships.

Acknowledgments

This report is sponsored by the Industrial Goods practice.

The authors would like to thank the following BCG partners and colleagues for their insights and assistance: Amanda Brimmer, Jan Justus, Carlos Romartínez, Patrick Staudacher, Christian Thywissen, Jonathan Van Wyck, Manuela Waldner, and Skye Whiteman. Knud Lasse Lueth of IoT Analytics also provided valuable help.