A survey of dealmakers shows that technology companies can maximize the value from M&A by aligning their predeal strategy with their postdeal priorities.

The technology sector is entering a downturn, but BCG research and experience has found that these periods are an excellent opportunity for dealmaking —provided that companies can execute their mergers and acquisitions (M&A) strategy and achieve their value-creation objectives.

That’s a big challenge, as more than half of all deals across all sectors fail to meet those objectives. Tech companies in particular often confront a common challenge: they primarily buy businesses to fuel growth, but they don’t align planning measures and resources toward that goal until after the deal closes. Even then, the measures aimed at capturing growth are far less rigorous than the approaches companies use to reduce costs. As a result, value creation is delayed by 12 to 24 months—if it comes at all.

Tech M&A is unique in that driving growth is the primary dimension that matters in assessing deal targets. Tech leaders need to apply that same lens to post-merger integration (PMI) as well. By applying a more cohesive approach to M&A, taking advantage of the preclose period to create strong, executable plans, and aligning the original deal thesis with PMI, they can capture more value from each transaction—even in a downturn.

More than half of all deals fail to meet their value-creation objectives.

BCG recently surveyed more than 100 M&A decision makers and PMI managers in the global tech sector, seeking to understand the current mindset about deals and how they can be improved. We also conducted qualitative interviews with tech executives. Our research, which updates a 2019

survey,

points to four main ways to align PMI to predeal strategy:

- Make revenue growth the top priority.

- Put in place a leadership team that’s built for growth.

- Design the operating model to unlock growth.

- Align cultures.

Navigating M&A in a Downturn

The tech industry experienced an M&A boom in 2021, during which overall deal value for the sector increased 107% over 2019 (compared to 43% for all other industries). But that period is over. Macroeconomic factors are driving a correction in equity markets, with a disproportionate impact on tech companies. The NASDAQ-100 Tech Sector index fell 26% over the first five months of 2022, compared to an 14% drop in the S&P 500 over the same period. Moreover, central banks are continuing to raise interest rates in their attempt to slow inflation, which drives up the costs of capital and makes each deal more expensive to finance.

As with all market corrections, however, opportunities still exist for savvy dealmakers to capitalize by acquiring targets at lower valuations. Businesses with sound fundamentals and strong balance sheets will pursue opportunistic M&A by developing a deal pipeline that maintains a focus on their strategic imperatives. Just as important, M&A teams need to ensure that the deal thesis is effectively translated into a PMI strategy. As our recent research showed, that doesn’t always happen.

How Tech Companies Approach Deals

We surveyed tech M&A decision makers, looking specifically at deals of $500 million or more, to better understand how companies structure their M&A pipeline. That analysis points to five main objectives for tech companies as they evaluate and acquire target businesses:

- Acquire capabilities—both talent and technological—to bolster the existing product portfolio (cited by 99% of respondents).

- Acquire products to bring new solutions into the buyer’s portfolio (95%).

- Enter new markets or segments to expand the total addressable customer base (88%).

- Gain customers by deepening customer relationships in geographic regions or business segments where the company already operates (84%).

- Generate cost synergies through the scale benefits of combining two organizations (74%).

These are not mutually exclusive; many deals can accomplish multiple objectives. For example, acquiring new products can help a company enter new markets. But what’s most noteworthy is that four of these five objectives focus on growth. Cost synergies—the central impetus for deals in many other industries—are a lower priority for tech buyers.

A Disconnect Between Deal Thesis and PMI Priorities

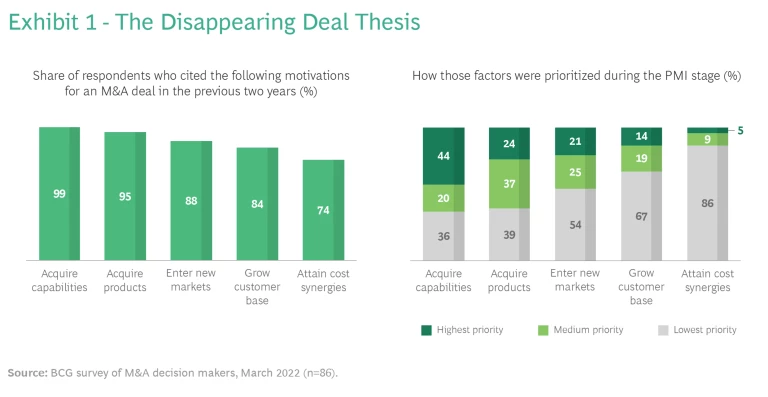

We also asked respondents about the PMI strategies they apply for specific deal objectives. In theory, these should be differentiated and aligned to the specific success factors for each objective, and growth should be the central lens for PMI. Yet, as Exhibit 1 shows, that’s not the case. Companies rarely prioritize their fundamental deal thesis when they execute a transaction.

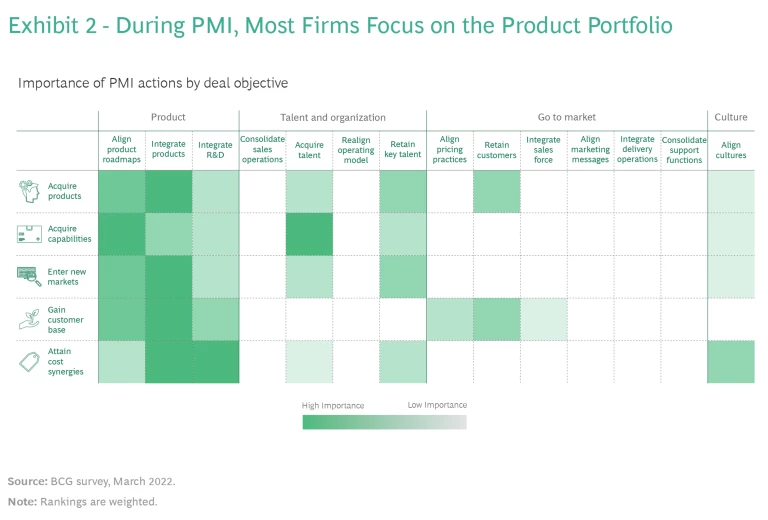

Regardless of deal thesis, companies typically focus on product integration after the close. That makes sense if the deal is aimed at acquiring products, but for three other deal theses—acquiring capabilities, entering new markets, and growing the customer base—the No. 1 priority in terms of PMI is also product integration. Go-to-market aspects such as sales and marketing is a distant second in most cases—and sometimes it’s third or fourth. (See Exhibit 2.)

Why the post-merger emphasis on product integration over growth? One possible explanation is that many tech companies are founder led and product-centric; at an organizational level, they’re good at sales and marketing, but they don’t prioritize that function at the level required to excel at integration. Other possible explanations include concerns about sharing sensitive data before the deal close or making changes that disrupt the target’s “secret sauce.”

When a company buys another business to unlock growth, that lack of emphasis on go-to-market factors slows its ability to generate from the transaction—and it likely limits the overall value that can be captured. Companies are executing deals for growth, but they’re not integrating those deals to maximize growth.

The Four-Part Plan to Improve

Based on our experience, maximizing value from a deal requires action in four main areas.

Make revenue growth the top priority. Our survey findings indicate that most PMI programs don’t focus on go-to-market aspects until 6 to 18 months after the close. Even when those measures are in place, they can take as long as a year to start generating meaningful changes in revenue. That’s too long to wait. Instead, companies need to think about the go-to-market integration—and engage sales teams in that process—as early as possible.

Tech M&A has several best practices to prioritize revenue growth:

- Dream big on revenue synergies. Downturns are the time to think big. Set aggressive sales targets and provide your teams with the resources to build customer-level plans that realize these sales goals.

- Don’t wait until the deal closes. Begin the go-to-market planning phase as soon as the deal is announced, giving you a critical head start before the close.

- Use clean teams to accelerate planning. Deploy clean teams to access sales data, with the goal of identifying white-space markets and opportunities from cross-selling and upselling, product bundling, and revamped pricing. The team also needs to build detailed plans to capture these opportunities, prioritizing them as appropriate and equipping sales teams for success—including the right incentive structure—starting on day one.

As an example, one global software company applied this approach when it acquired another business. In advance of the close, it designated a clean team—a group of people with access to financial information about the new company—to identify 300 priority accounts in 20 geographic markets, along with specific programs to enable sales teams to focus on these priorities. As a result, the company was immediately able to collaborate on those accounts to boost revenue.

Put a leadership team in place that’s built for growth. The PMI steering committee needs to be composed of people with the right expertise for the deal thesis. For example, for transactions that involve acquiring new products or capabilities, the steering committee (and ideally the integration leader) should be someone with deep product or engineering leadership. For transactions focused on cost synergies, finance leaders need to be on the committee. But for transactions aimed at growth—which describes most deals in the tech sector—sales and marketing leaders need to be on the committee, if not leading it. In addition, the steering committee needs to set the right ambition and goals for each transaction—not just short-term synergies but also long-term growth targets.

For example, when a leading global enterprise software provider bought a target in a promising growth segment, the segment’s sales leader led the commercial integration. Moreover, the head of the overall integration was a senior executive with commercial expertise in the new market segment, and he was able to mobilize internal resources within the acquiring company in advance of the close. As a result, the sales team was armed with detailed, account-level playbooks and could launch coordinated selling initiatives starting on day one, leading to faster growth.

Design the operating model to unlock growth. A common pitfall in tech acquisitions is the failure to address the combined operating model. This happens because buyers often intend to run the target business separately. But even if the two entities remain separate in key ways—office locations, processes, and the like—there will be some points of integration, and these need to be thought through.

For example, how will the new entity fit into the buyer’s organization—as a separate product team? A standalone business unit? How will the two companies collaborate and sell as a combined entity? How will they leverage talent and technologies across companies effectively to improve product offerings? Who will “own” shared customers? How can they bring the full suite of capabilities to customers immediately after day one? How will support functions and overall governance be structured?

Addressing these issues in advance—and in sufficient detail—can ensure that the combined organization is set up for success right from the close. For example, when one organization acquired another, it redesigned the overall operating model for the combined entity across 10 elements, ranging from the organizational structure to decision rights, planning and budgeting, and—critically—the go-to-market model. Management then categorized these changes into three time periods: the first three months after the close, three months to two years, and beyond. Each window had a specific set of priority objectives, with the most detailed implementation plans for the most immediate priorities.

Align cultures. Our survey data indicates that culture is rarely the reason that a growth-oriented deal succeeds, but it’s the top reason why deals fail. Teams that can’t work together, or don’t work in the same way, won’t achieve the deal’s full potential. As with the operating model aspect above, companies often believe that they don’t need to address culture, thinking that they can run an acquired business separately. But the two teams will have to collaborate in some areas, and if cultures aren’t proactively designed by the company’s leadership they will evolve through luck or inertia—potentially in ways that don’t support the company’s business objectives.

The goal in PMI is usually not about integrating the two cultures into a holistic third culture but aligning them to a common strategic imperative, addressing elements that will cause unnecessary friction, and enabling collaboration. That’s important in any environment, but it’s particularly critical given the current labor market, where talent is increasingly hard to retain—particularly creative and technical talent. When companies are acquired, employees in the target company are often on high alert for any disruptive changes, and cultural mismatches can spur some employees to start looking for a new job.

When aligning cultures, it’s important to ask diagnostic questions along the way. How similar or different are the two companies’ cultures? What is the desired culture for the parent, target, and combined entity? How flexibly can the companies adapt to change? How are decisions made—through a centralized process or delegated to lower levels of the organization? How does communication happen, through formal channels or more organically?

The goal is to align on a common strategic imperative, avoid unnecessary friction, and enable collaboration.

For example, when one technology company acquired another with a distinctly different culture, it studied the target’s culture to understand the aspects that were most important to employees and it committed to keeping those in place. It also deliberately avoided importing major processes into the target, which prevented any disruption to software development and existing operations, reassured key talent that they would still retain some autonomy, and led to a smoother integration and lower attrition overall.

M&A remains a critical tool for driving growth and realizing strategic objectives, but buying for growth is only the first step. Successful acquirers also deliberately tailor the integration approach to the deal thesis. The result is a more cohesive approach to the deal during all phases—and faster growth overall.