Technology is a crucial ally for insurance leaders as they seek to capitalize on new insights gained from the implementation of International Financial Reporting Standard 17 (IFRS 17). The standard, which went into effect on January 1, 2023, establishes accounting principles for insurance

IFRS 17’s new granularity requirements, metrics, and measurement logic provide novel ways to interpret an insurance company’s performance and will significantly influence discussions with investors. (See “Highlighting the Management Implications.”) To operate effectively under the standard, management teams must become technically equipped for the new and often more complex environment.

Highlighting the Management Implications

Highlighting the Management Implications

- Value Creation. The standard will heighten the volatility of key drivers of total shareholder returns. As a result, insurers may struggle to maintain their traditionally steady and predictable performance results.

- Strategy. The forward-looking accounting under the standard will shift CEOs' and CFOs’ focus toward strengthening the balance sheet, particularly in life insurance.

- Management Toolkit. The standard's adoption of fair value logic will reduce the number of managerial levers available to influence yearly profit and loss results.

- Financial Processes. Given increased earnings volatility, maintaining predictable cash generation, robust financial practices, and strong steering and control processes will be vital in delivering dividend targets.

- Product, Sales, and Pricing. To curb volatility and manage the profitability of underperforming portfolios, managers will need to tighten operating practices in areas such as customer segmentation and new-product development.

- Organization. The increased interdependency between finance and actuarial activities under the standard calls for reviewing and strengthening the organizational setup.

Empowering leaders to steer for value under the standard requires a fresh strategic approach to data and technology. Data integration, planning integration, and user-friendly simulation capabilities are the key technology pillars for insurers in the IFRS 17 era.

IT Architecture Is Affected from Top to Bottom

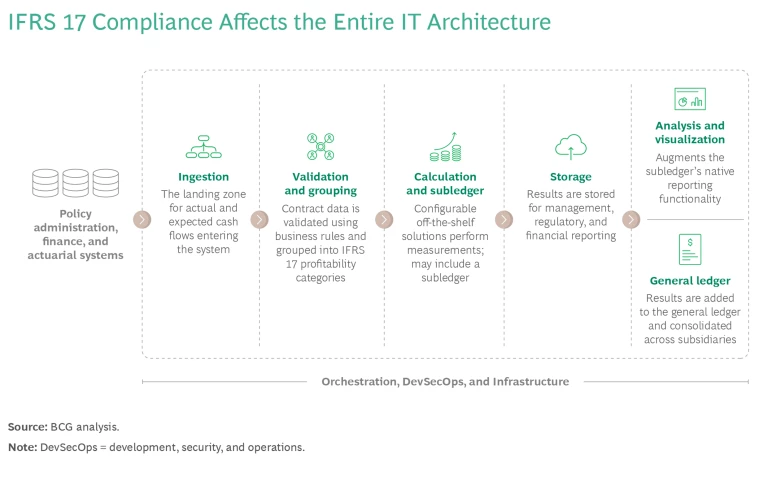

When considering their new technology needs, insurers should recognize that IFRS 17 affects all aspects of their IT architecture. (See the exhibit.)

Ingestion. Actual and expected cash flows for insurance contracts are ingested into a central repository from policy administration, financial, and actuarial systems. Insurers that operate in multiple regions need to address latency issues when collecting this data. Equally critical is the need to consider data residency requirements in each jurisdiction.

Validation and Grouping. Ingested cash flows are checked for accuracy and consistency using predetermined business rules. IFRS 17 requires grouping contracts based on their profitability and collectively managing those with similar risks. This process typically entails implementing grouping rules within an extract, load, and transform pipeline or within the insurers’ data management tools. These rules operate on the ingested cash flows, ensuring that they are grouped according to the nature of the underlying contracts.

Calculation and Subledger. After grouping and discounting the cash flows, the insurer calculates key IFRS 17 metrics, such as contractual service margin and loss component. These calculations are typically conducted using a combination of commercial off-the-shelf actuarial solutions, specialized tools acquired for IFRS 17, or, in some cases, proprietary end user computing tools. The choice of technology largely depends on the size and nature of the business. Multiple calculation runs are usually necessary to ensure that movements in results are explainable (such as by financial or nonfinancial factors) at the required granularity. This layer can optionally include a subledger that stores the results at the level of granularity needed for financial, regulatory, and management reporting. To use this approach, the insurer must customize the chart of accounts based on its specific needs.

Storage. Once the results, including liabilities and key IFRS 17 metrics, are calculated, they are typically stored in a schema optimized for analytics (such as a star schema). This approach allows stakeholders to reference results from various runs, including those that were ultimately approved.

Analysis and Visualization. Analyses and reports are created to cater to financial, regulatory, and management reporting under IFRS 17. Some tools within the calculation layer can produce standard or custom reports. However, if the workforce is accustomed to a specific business intelligence tool, it may be preferable to continue using it in order to avoid retraining on new tools created for IFRS 17. These tools often augment the subledger’s native reporting functionality.

General Ledger. The results are ingested into a general ledger, which requires an IFRS 17-specific chart of accounts aligned with the chart of accounts configured in the subledger. The general ledger also consolidates the financial results across subsidiaries of conglomerate insurers.

Orchestration, DevSecOps, and Infrastructure. This layer spans all other layers to provide comprehensive capabilities, such as the orchestration required for data movement. Globally, insurers have implemented various solutions. These range from on-premises, batch-based processing to event-driven solutions that trigger data movement based, for example, on the availability of actuarial or accounting data. Because IFRS 17 reporting places a high demand on computing resources at the end of each reporting period, many insurers have chosen to transition from on-premises to cloud computing. This allows them to decouple computing and storage and tap into on-demand scalable infrastructure.

The Three Technology Pillars

In discussing IFRS 17 implementation with clients and other organizations, we have observed that both corporate functions (such as finance, actuarial, risk, asset liability management, capital management, and investor relations) and business functions (such as marketing and distribution and product design) are increasingly focused on several recurring challenges:

- Systems are taking longer than expected to produce data related to the new standard.

- Access to data is limited, often restricted to the finance function and, to a lesser extent, the actuarial function.

- There is a demand for integrated planning, simulation, and forecasting tools.

- Business units require assistance in converting industry or local GAAP figures to align with IFRS standards.

- There is a growing need to perform agile, recursive what-if simulations, such as rolling forecasts.

To address these challenges, insurers need to establish three technology pillars: data integration, planning integration, and user-friendly simulation capabilities.

Data Integration

Insurers need to integrate finance, actuarial, investment, and risk data at the maximum level of granularity. The data should be certified and auditable and housed within a single source of truth. Integration enables quick and simultaneous access to data by corporate functions and business units via cloud-based data aggregation and processing (for example, data lakes and no- or low-code integration tools). It also provides a common foundation for functions to access and process their analysis, eliminating the risk of redundancies or misleading information.

To design and implement integrated global platforms, insurers need to:

- Identify a common data model for group business units (for example, specific legal entities and business lines) and corporate functions (for example, finance, risk, and capital management). The model should combine traditional data domains, such as financials, with business and nontraditional domains, such as data on market trends and customer behavior.

- Establish a centralized definition of taxonomy, rules, processes, and tools, as well as a distributed data governance paradigm (for example, a data mesh) for each data domain. This approach combines the standardization and consistency of centralization with the flexibility and scalability of decentralization.

- Design a common KPI framework with a high degree of granularity (for example, at the product or segment level).

- Enable self-service access for functions by organizing data and information in data domains. The domains should be available to other platforms or use cases through data products—that is, architecture components that encapsulate functionality for the consumption of read-optimized data sets.

Stay ahead with BCG insights on corporate finance and strategy

Planning Integration

An integrated planning, forecasting, and performance management tool is needed to provide broad access to data via standardized solutions, configured to the requirements of key users. The tool should allow users to rapidly adjust their view of integrated data and create custom dashboards and reports.

To use the tool more effectively, insurers need to implement a collaboration workflow to synchronize plans across functions (such as capital management, sales, HR, and IT). This enables comprehensive views of financial statements. They also need to select and implement the tool’s functional and technical capabilities. Functional capabilities include managerial views across multiple countries’ GAAP requirements, integration with budgets, integrated forecasts, workflow management, and performance management. Technical capabilities include extended data sets, scalability, what-if analysis, traceability, and augmented analytics.

User-Friendly Simulation Capabilities

Finance and corporate-center functions need to perform what-if simulations in an agile, recursive way (for example, rolling forecasts) using advanced capabilities. Such capabilities include cross-organization workflows that collect and process data from all departments and a solution that consolidates figures, identifies scenarios, performs simulations, and reports to business users.

To enable functions to run complex simulations in a user-friendly way, insurers need to select the most appropriate approach for each type of user. For example, general business users might need a more intuitive interface, while technical specialists might need more advanced features. It is essential to democratize the logic underpinning IFRS 17 by making it understandable and accessible to the broader organization.

Finally, companies need to strike the right balance between "make" and "buy" solutions when considering the many products available in the market. We believe that planning and forecasting under IFRS 17 should be addressed with a combination of commercial off-the-shelf and bespoke solutions. Companies may need to tailor their solutions, because the logic itself is highly complex and the vendor community is still building its knowledge.

The implementation of IFRS 17 and additional regulatory changes, such as those related to sustainability, present an opportunity for companies to comprehensively reassess their information management frameworks. By fostering increased integration and information sharing across all functions, they can take significant steps toward becoming data-centric organizations. A robust technology and data strategy will facilitate this transition, thereby promoting more effective decision making and a competitive edge.