The airborne intelligence, surveillance, and reconnaissance (ISR) sector is one of the fastest-growing segments of the defense industry, and it is ripe for disruption. The US Department of Defense (DoD)—and defense ministries elsewhere—have an insatiable appetite for ISR collection, increasingly so in challenging environments. Most ISR missions are currently carried out by expensive drones that are vulnerable in certain operating environments.

In response, several new technologies and platforms are emerging to meet the evolving collection requirements of the military. At the same time, armed forces around the world, and the DoD in particular, are adopting new procurement practices that are changing a traditionally stable industry. The benefits of these new technology, platform, and procurement options for defense leaders are clear: increased ISR capabilities and the ability to meet growing and evolving needs within a stable budget. The benefit for defense companies is even more compelling: access to a fast-growing segment with strong potential for the foreseeable future.

However, defense firms cannot rely on the business strategies of the past. Instead, they must radically transform how they design and develop new ISR platforms and technologies and how they get them to market. The ISR landscape is changing dramatically. To capitalize on this opportunity, defense contractors must change as well.

Next-Generation Drones

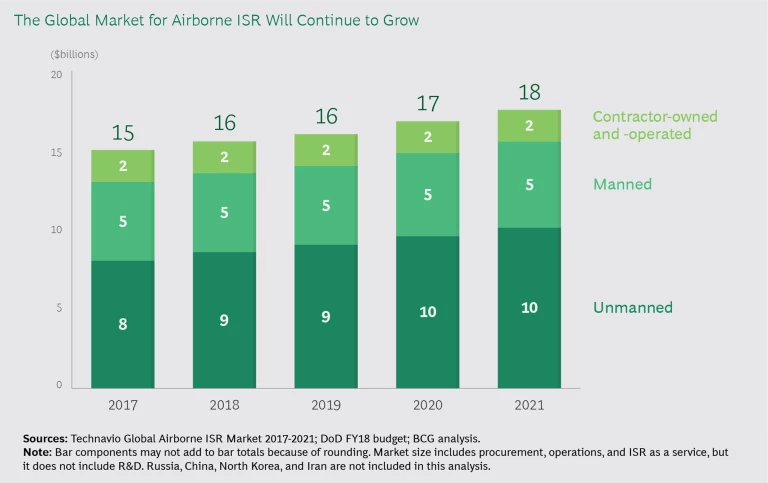

Growth in global defense spending has slowed to an average of just 1.4% per year over the past decade, but the airborne ISR market, with a projected growth rate of 3.9% per year from 2017 through 2021, is a notable exception. (See the exhibit.) Total sales in the segment are approximately $16 billion, and the US is the largest single market, with $6 billion in ISR appropriations in the 2019 DoD budget.

Growth stems largely from persistent demand for ISR collection, and particularly from drone-delivered ISR. Over the past decade, the DoD has steadily slowed its investment in manned ISR aircraft, including the Air Force E-8C Joint STARS and the RC-135 Rivet Joint. At the same time, its investment in drones, or unmanned aerial vehicles (UAVs), has grown at roughly 5% per year since 2013, outpacing the growth rate of the total airborne ISR market (3.9%).

The current generation of drones, which includes, for example, the Global Hawk and the Reaper, has been extremely successful in meeting ISR requirements since their introduction into service. After 9/11, the ISR operations taking place in Afghanistan and Iraq focused on counter-insurgency and counter-terrorism, and the military had the latitude to operate drones unfettered within those countries.

Because the US has shifted strategic priorities, the current fleet of drones is much more vulnerable.

In recent years, however, the US has shifted its strategic priorities, placing greater emphasis on the risks of conflict among major state powers. In this security landscape, the airspace is no longer permissive. As a result, the current fleet of drones is much more vulnerable. Additionally, many options for airborne collection in nonpermissive environments either cost too much or carry too much risk. In light of the strategic shift, defense firms have a clear market opportunity to provide the DoD and foreign defense ministries with new platforms to meet the collection requirements in higher-risk environments. In particular, defense firms can improve drone capabilities in two main areas: survivability and orbit optimization.

Increased Survivability. As one option, UAV manufacturers can better meet the DoD’s evolving ISR needs by designing drones with stealth capabilities. This can be accomplished by incorporating advanced materials and designs that lower the radar cross-section of a given platform, allowing it to evade radar and integrated air defense systems.

Another way to increase survivability is to include electronic countermeasures. Platforms can be equipped with hardened, jam-resistant data links to prevent enemy disruptions. In the case of UAVs, even a stealth-capable aircraft, without a robust electronic countermeasures suite, is still vulnerable to datalink disruptions of ground control stations and satellites.

Operating at altitudes beyond the range of most ground-based radars and surface-to-air missiles can also increase survivability. This requires platforms that have sufficient collection capabilities and the ability to operate beyond the troposphere (which extends to seven miles altitude) and even into low-earth orbit (up to 1,200 miles).

Orbit Optimization. To maintain continuous coverage over a given ISR target, the military creates operational “orbits” that use drones to collect multiple forms of ISR, including electronic signals (SIGINT), images (IMINT), and full-motion video (FMV). FMV is the capability in highest demand by the military, yet it is the most limiting in terms of geographic coverage and operating altitude.

Current platforms such as the Reaper can support all three forms of ISR collection, but they are expensive to procure and operate and have limited range and “time on station” (endurance). Given those constraints, there is a clear opportunity for less-expensive, long-range platforms that can collect SIGINT and IMINT and integrate Reapers or other tactical assets as needed to support FMV requirements. By fielding drone fleets with mixed capabilities, military leaders can meet their collection requirements at lower cost, freeing up resources that can be invested in other types of ISR platforms.

New Types of Platforms

OEMs in the defense industry and ISR service providers will need to leverage, in addition to next-generation drones, several emerging technologies that have shown promise in delivering long-endurance ISR capabilities to meet growing demand in less permissive environments.

High-Altitude Balloons. The simplest and cheapest of the emerging technologies, high-altitude balloons operate in the mid-to-high altitudes of the stratosphere—from 60,000 feet to 120,000 feet—with extremely high endurance and long range. Tech companies such as Alphabet (with its Google Loon platform) and current defense players such as Sierra Nevada Corporation are developing and testing balloon platforms with ISR capabilities.

High-Altitude Pseudo Satellites (HAPS). Also operating in the mid-to-high altitudes of the stratosphere, HAPS platforms have endurance and range similar to those of high-altitude balloons, but they are more expensive and complex. Several US and foreign defense firms, including Boeing (through Aurora Flight Sciences), Airbus, AeroVironment, and Thales, are developing HAPS technology. HAPS are the least developed of the platforms described in this section, but they have attracted high interest from the industry as a means to collect remote imagery and data at a fraction of the cost of a drone and without the capital investment required for satellite constellations.

Low-Earth Orbit (LEO) Small Satellites. Operating in the mesosphere to the lower altitudes of the ionosphere (99 to 1,200 miles), LEO “small sats” have an unlimited range and very long endurance (essentially limited to their mechanical lifetime). They are more expensive to acquire than HAPS and high-altitude balloons but have lower operating costs once in orbit. The earth observation market is growing rapidly, with established players like Planet and Maxar’s DigitalGlobe adapting to a surge of new entrants, such as Black Sky and Capella Space, that offer new commercial sensing technologies and satellites that can revisit the same site more frequently.

Technological Innovation in Collection Capabilities

Another major area of technological innovation is in the collection capabilities of ISR platforms, particularly in how they analyze, exploit, and disseminate intelligence. For example, cloud-based systems (provided they are adequately secure) can increase access to data from disparate sources, enabling better information sharing and collaboration among multiple stakeholders.

Additionally, artificial intelligence (AI) can make the analysis of information far more effective, efficient, and accurate, synthesizing vast quantities of raw data into actionable intelligence at a scale that no human analyst could achieve. Given that increases in collection capabilities are leading to a corresponding increase in the amount of data captured, AI is becoming critical in enabling the military to sift through the raw data and effectively exploit sensitive information. Similarly, machine learning can refine the processing of raw data over time, increasing a force’s ability to distinguish critical signals from noise.

New DoD Procurement Models

Even as ISR platforms and technologies are evolving, the DoD is changing the way it sources these capabilities. Traditional procurement is notoriously slow and cumbersome; even accelerated programs take two to four years to reach full-rate production (and standard programs may take five to ten years). That is an eternity in terms of technological advancements, meaning that an advanced system may be outdated—and likely too expensive—by the time it enters operation. To bring promising technology into the field faster, the DoD is increasingly identifying emerging capabilities from sources outside of the traditional military-industrial base, seeking to evaluate prototypes and assess their potential early in the development stage. Once their prototypes are proven, providers can begin larger-scale production on an accelerated timeline.

Defense firms have two primary channels to access the DoD’s accelerated procurement models:

- Small-Scale Innovation and Development Units Within the DoD. The DoD has established units to identify opportunities and secure funding for emerging technology and innovative capabilities that are in the infancy stage of development. Examples include the Defense Innovation Unit, the National Security Innovation Network, the Strategic Capabilities Office, NavalX, and SOFWERX. In some cases, these entities can provide startups with seed money—akin to a venture capital investment—to develop, refine, and field emerging capabilities. The formal contracting process moves quickly, facilitating rapid development and the opportunity to learn from unsuccessful efforts. DoD leadership already appreciates the value of these innovation units in helping to procure and integrate rapidly evolving technologies and solutions, and the units will likely play a growing role in the deployment of new ISR capabilities and services.

- Contractor-Owned, Contractor-Operated (COCO) Approach. Rather than using the traditional, acquisition-based procurement approach, the COCO model positions the business to provide ISR capabilities as an ongoing service to the government. It transfers risk from the government to the company, while allowing the company to demonstrate capabilities with prototypes. Additionally, COCO removes some of the constraints from development contracts, allowing the company to integrate, test, and refine early-stage products. It is particularly applicable to new products in the ISR market, and it has been used successfully by companies such as Sierra Nevada Corporation to deliver ISR on demand to DoD customers, including regional combatant commands and the Special Operations Command.

Four Imperatives for ISR OEMs and Service Providers

To compete effectively in such a rapidly evolving space, ISR OEMs and service providers should focus on four imperatives that, collectively, will transform how they get products and services into the market and how they sustain growth over time.

1. Adopt an agile operating model. Agile focuses on iterative value delivery and continuous improvement, which are critically important in the early stages of developing a product or service. This represents a significant change for many legacy defense contractors, which have deeply engrained cultures built around standard, sequenced development processes. In contrast, agile assembles multidisciplinary teams with members from business development, R&D, and other functions and business units; establishes high-level objectives; and gives the teams significant autonomy to develop new products and services. Rather than a perfect product design, the goal is to produce a prototype quickly and then refine it through rapid iterations. New ideas that emerge from line employees are rewarded to promote a culture of innovation.

Once a product or service is on the market, an agile operating model can help organizations sustain growth by ensuring that they focus on customer needs—rather than on internal processes—and that they continue refining the offering by soliciting feedback and making incremental improvements. Critically, this approach can also reduce run-rate costs by generating profits from iterative upgrades, without the need for large-scale capital investments.

To adopt an agile model, organizations need to ensure that leaders “buy in” and support the large-scale changes required. The changes are significant in terms of culture; traditional manufacturing-based firms need to shift to faster-paced development processes and a focus on results. In particular, companies must strike the right balance between the horizontal collaboration in the cross-functional teams and the vertical integration needed to master and deploy new technologies.

2. Focus on emerging technology. The second imperative is to focus on identifying and integrating emerging technology. During the product development and market entry stages, defense OEMs and ISR service providers can build partnerships with other technology firms to gain critical insights into what’s coming. By staying ahead of market trends, identifying potential disruptors, and improving adoption protocols, firms can ensure that they are able to incorporate new technologies as their systems progress through the R&D cycle.

During the subsequent phase of sustainment and growth, organizations need to avoid the temptation to become passive. They must relentlessly continue to seek competitive advantage through innovation. Existing platforms can be modified to integrate new technologies, which will help expand the supplier base.

To foster this proactive mindset and turn emerging technology into proprietary advantage, companies should forge partnerships with suppliers and create an ecosystem of vendors that generates mutual benefit. Leaders should constantly work to remove the barriers to technology adoption in the organization. And firms should link incentives to growth-related metrics.

3. Revamp R&D and manufacturing to incorporate Industry 4.0. Industry 4.0 (I4.0) technology can create a digital engineering environment that accelerates product design and development and shortens the time to market. For example, I4.0 can support early prototyping and proof-of-concept efforts—facilitated by additive manufacturing where possible—allowing project teams to reach the go/no-go decision much sooner, reducing wasted resources. For products and services that advance to production, increased use of automation helps companies improve the reliability of manufacturing processes and leads to lower costs and higher product quality.

I4.0 will be the industry standard by 2025, and defense OEMs and ISR service providers need a clear plan to get there. Firms that progress quickly will generate a clear competitive advantage. A vital intermediate step is to develop internal capabilities in critical areas such as additive manufacturing and rapid prototyping.

4. Invest heavily in advanced analytics. Finally, advanced data analytics supports the other three imperatives by increasing a firm’s opportunities to leverage emerging technologies, evaluate design effectiveness, manage the performance of production cycles, and reduce materials and manufacturing costs. Additionally, advanced analytics provides a quantitative basis for analyzing and making R&D decisions. During the sustainment and growth phase, advanced analytics and predictive capabilities improve product life cycle management and help companies identify opportunities to enhance manufacturing efficiencies.

To succeed, firms need to ensure that they have the right talent on board to leverage advanced analytics, and they must redesign their R&D processes to capitalize on the new tools. To continue to meet the needs of the market, firms must also understand how customers’ design and prototyping demands are evolving.

An agile model helps OEMs and service providers deliver iterative value and continuous improvement.

The ISR market is at an exciting inflection point. Demand, both global and domestic, continues to grow at a faster rate than overall defense spending. US strategic priorities are shifting and threats are evolving, redefining the capabilities that the military needs. At the same time, technologies are evolving rapidly and new platforms are emerging, and the industry’s largest customer, the DoD, is changing its R&D and procurement practices.

These changes add up to a clear opportunity for defense firms and ISR service providers, but only if they take decisive action to change how they operate. Organizations that take the steps we describe will remain competitive in a rapid-prototype, rapid-production ISR industry. Those that don’t will be overtaken.