The years-long recovery of building construction in Europe and the building boom in the United States should be a rising tide that lifts all boats along the value chain. Yet many building materials producers remain moored to the docks, taking on water as their input costs rise.

The question that producers face is clear: Will they continue to rely on conventional marketing approaches that are liable to constrain their growth and endanger their margins? Or will they seize the opportunity afforded by favorable market conditions and do the hard work required to protect and improve their profitability?

Building materials producers that choose the latter option will not need to make any revolutionary, groundbreaking changes. What they will need is a cleaner, more structured approach to pricing, one that is data-driven, pragmatic, and repeatable. If they put such a process in place now—at a time when they can act from a position of relative strength in growing markets—it could make a significant difference in their profitability. These producers will not only be set up to raise prices when conditions warrant it. They will also be less vulnerable to the risk of price wars and volume-based competition when growth inevitably slows.

The Case for Raising Prices Now

Several factors create a strong case for building materials producers to raise their prices. They include robust overall demand for new construction, rising input costs, sustained higher capacity utilization, and higher downstream prices, especially in residential construction. While these factors do not apply in equal measure to all countries or all building materials industries, the overall mix of factors is compelling.

Because pricing has traditionally remained outside of their strategic focus, however, building materials producers have not fully developed and entrenched the capabilities required for a more data-driven, professional approach to pricing. As a result, they struggle to translate today’s favorable environment into higher prices and profits. Let’s look at each factor separately.

Demand for new construction remains robust. In Europe, the economic recovery since the debt crisis has led to a modest but steady demand for new construction, which has grown at an inflation-adjusted rate of 1.3% annually since 2012. The US market for new construction, meanwhile, grew at a compound annual rate of roughly 6% from 2012 to 2016, bolstered by strong demand in the residential sector. The European market is expected to grow by more than 2% in 2019, in line with expected European GDP growth, as contractors meet pent-up demand. In many European countries, construction output still remains below the levels seen in 2008 or 2009. The strong growth rates in the US market, meanwhile, are expected to flatten out.

Yet the profits from the ongoing recovery in Europe and from the US construction boom are not well distributed along the value chain. BCG’s research and experience show that one underlying cause of this uneven distribution is the actions of building materials producers themselves. Many have neglected to emphasize pricing sufficiently in their marketing mix, believing that pricing is governed by trends and market forces that are largely beyond their influence.

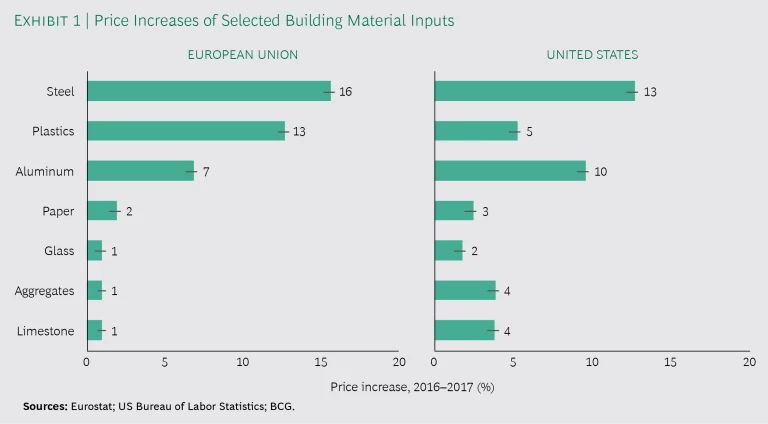

Input costs spiked in 2017. From 2012 through 2016, prices of major inputs for building materials in Europe and the US either declined from year to year, on average, or saw only slight increases. That dynamic changed suddenly in 2017, when European prices for raw materials spiked: steel by 16%, plastics by 13%, and aluminum by 7%. The US market experienced similar price spikes. (See Exhibit 1.) These increases put the margins of building materials producers under considerable pressure.

Raw materials are not the only source of cost pressure. Energy prices also spiked in 2017, after declining between 2012 and 2016. In Europe, for example, electricity prices increased by 14%, while natural gas soared by 21% and oil increased by 9%. Labor costs added to the margin pressures. While not spiking in the same way as raw materials and energy, they have risen by 8% since 2012.

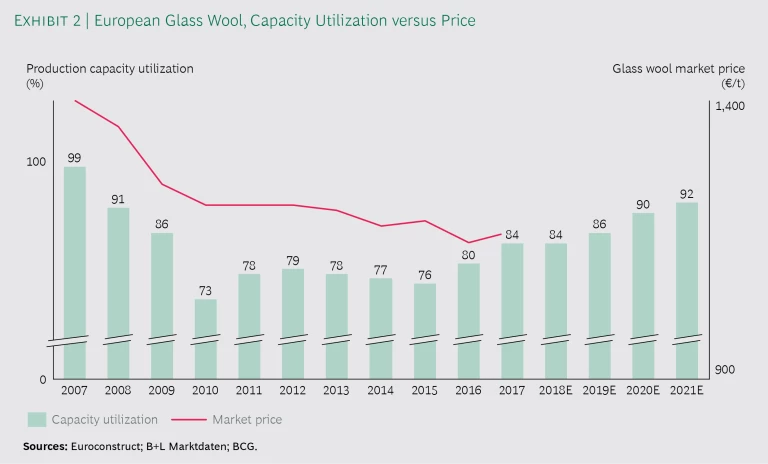

Capacity utilization is rising in many industries. It is common—and makes sense intuitively—for market prices and capacity utilization to move in lockstep in capital-intensive industries. Weak demand and excess capacity tend to drive prices lower, as producers seek to secure enough volume to cover their fixed costs and “keep the machines running.” Conversely, improved demand and higher capacity utilization (that is, tighter supply) normally manifest in higher prices.

We looked in detail at one specific industry to illustrate this link—which we believe is causal rather than a mere correlation—plotting the market price trend for European glass wool together with changes in the industry’s capacity utilization from 2007 to 2017. (See Exhibit 2.) The two trends followed a similar downward pattern between 2007 and 2015. Capacity utilization then improved in 2016 and 2017, with growth expected through 2021. The tight supply in the industry led to longer delivery times and stockouts in certain product categories. This increased confidence that the upward trend in capacity utilization would last, and prices started to move higher as well. We expect the link between price and capacity utilization to hold, with prices in the industry continuing to rise.

This link between price and capacity utilization is not limited to glass wool in Europe. Whenever demand starts to improve, producers in other building materials industries initially grow profits by filling their factories, reducing their average costs, and selling more volume. These are common and effective responses, which also explain the occasional lag between the uptick in capacity utilization and the corresponding uptick in prices. But volume growth inevitably reaches its limits as a source of profits, forcing producers to raise prices more sharply as capacity utilization increases.

Other parts of the construction value chain are prospering. Consistent construction growth over several years in Europe and the US begs an important question: Who profits from this expanding pie? Rising home prices in many European countries and regions of the US are one indicator that contractors, architects, real estate agents, and engineering firms are all benefiting from the growth in construction. In contrast to the profitability of building materials producers, many residential-construction companies are seeing profits at their highest levels since the recession of 2008.

Healthy downstream prices have contributed to that profit growth. Eurostat’s House Price Index has grown continuously since 2014, yet prices in some countries are still below pre-2008 levels. There is also latent housing demand in Europe. Euroconstruct, the construction market forecaster, expects completion of 1.7 million new dwellings per year in Europe from 2018 through 2020, reflecting the region’s new “cruising speed.” But this is still below the 2.5 million dwellings completed in 2007.

Discrepancies between supply and demand in the US increase the likelihood that home prices will continue to rise there as well, expanding the pie for downstream players even more. Data from two US trade associations show how sharp the current supply gap is. The National Association of Realtors reported that home inventory (including new construction) was at a record low in the fourth quarter of 2017. The National Association of Home Builders, meanwhile, forecast 2018 housing starts at fewer than 900,000 homes, around 400,000 less than the nation needs given population growth.

The postcrisis construction increase in Europe and the US has been a boon to almost all market participants—except building materials suppliers. Some producers may have been content to keep prices steady as growth drove higher volumes. But as their input costs and capacity utilization both rise, building materials producers can no longer depend on volume growth and periodic, undifferentiated price increases to sustain their businesses while others reap greater benefits downstream.

Taking a Clean, Structured Approach to Pricing

As noted above, the case for raising prices on building materials in the current environment is compelling. BCG has identified three steps that will enable building materials producers to gain a more data-driven understanding of their position and pricing power, to choose more pragmatically among opportunities to raise prices, and to anchor these new processes within their organizations. (See Exhibit 3.)

Step 1: Understand Pricing Power Discretely

The prevailing pricing schemes for building materials are a byzantine mix of legacy list prices, discount programs, and incentives. This mix obscures producers’ true pricing power and the extent to which they can exert it.

The best measures of pricing power are not at the market level, but rather on a discrete or disaggregated basis. When a producer achieves transparency around true net prices at a discrete level, it can understand and isolate its pricing power, the drivers behind it, and the associated profit potential. This analysis may reveal wide variations among regions or segments, and ideally among individual customers as well.

Once a producer understands its relative position at the segment or customer level, it can start to define specific price increases that have the best chance of success. One straightforward way to do this is to segment customers according to metrics such as pricing power and buying power. The producer uses the resulting customer stratification to target segments with customized price increases. This approach may seem overly simplistic, but it has the advantage of facilitating sales teams’ understanding of price increases and their rationale.

These analyses should also address how a producer charges for services and solutions. Many services are differentiated and provide customers with significant added value, but producers often offer them free of charge, failing to consider their value when setting or negotiating product prices.

Step 2: Manage Prices Pragmatically and Systematically

Setting prices discretely at the regional or customer level with a data-driven rationale should become a way of life for producers, replacing traditional across-the-board price increases. Done right, the new approach allows producers to achieve higher prices and margins with minimal decline in volume. It also allows them to understand where and to what extent they can pass on higher input costs to customers or charge higher prices as supplies tighten and capacity utilization rises.

The next step is to untangle and replace the convoluted legacy criteria traditionally used as the basis for discounts and incentives. This work starts with list prices, which serve as the umbrellas under which the producer sets prices at the account level. Regular list price increases are a must, but they should now be region- or segment-specific, taking factors such as differentiation, input costs, and capacity utilization into account.

The producer can then manage customer prices individually, using specific pricing rules in line with a customer’s buying power. The new guidelines for account planning will also help sales teams define new parameters around project pricing. Managing project pricing more systematically will ensure that teams meet minimum profitability thresholds but still have the pricing flexibility required to remain competitive.

Producers also need to adopt alternative tactics to capture more value from their services and solutions. They can unbundle services from products, allowing the former to establish standalone value in the eyes of customers. They can also tap into upselling and cross-selling opportunities by bundling services into packages or offering a freemium model, under which the customer receives a base service for free but must pay for additional premium features.

Step 3: Make the New Process a Habit

Steps 1 and 2 should not be one-off exercises. Producers will be better prepared to manage prices in good times and bad when they institutionalize a pricing process built around value and data, rather than resorting to the reactive, volume-driven approaches that have prevailed in building materials and other capital-intensive industries for decades.

Pricing must become a comprehensive annual process, linked to finance and control and supported throughout the year by tools and processes for monitoring, transparent reporting, and ongoing education. Sales force training helps hardwire the new processes into the organization. It enables sales teams to embrace a more nuanced, data-driven approach that determines price changes at the regional, segment, or customer level.

No new pricing approach will work without adjusting incentive schemes for the sales force and also for management. Sales incentives need to shift from traditional schemes that rely heavily on volume or revenue toward schemes that reward salespeople for success in implementing price increases in line with the key metrics of the new approach.

Implementation Challenges

Making the new approach permanent will be a challenge for most building materials producers. Data-driven, systematic pricing has not historically been the sector’s strength. Most producers are volume-focused, not value-focused, owing to low growth (before the recent recovery) and pressure to cover fixed costs. Producers have also tended to raise prices uniformly, which ignores stark differences in pricing power and buying power across regions and segments. Existing internal approaches—from complicated list price systems to massive discounts to tiered bonus schemes—make it hard to isolate the impact of pricing and manage net prices. Finally, fierce competition and price wars are common in many building materials industries, especially where differentiation potential (such as through innovation or brand) is limited and barriers to entry are low. The alternative approaches described above mitigate these implementation risks.

The current market conditions in new construction are ideal for building materials producers to make the shift to a systematic value-based pricing approach and finally move away from the traditional pricing approaches that constrain their revenue and profit growth. A conducive market environment in construction, widespread cost inflation, and increasing capacity utilization rates create a rare convergence of factors that producers should seize as an opportunity to adopt and institutionalize better pricing practices and thus protect and improve their profitability.