Using artificial intelligence (AI) to grow revenue demands human imagination. As the first wave of AI-based applications (such as data analytics and robotics) gain ground, it’s evident that companies are deploying the technology primarily to replace people and reduce costs. Although cost cutting may be unavoidable in these trying times, playing defense with AI is unlikely to be enough for companies to thrive in the postpandemic world.

Digitization, the rise of the big data era, and the growth of the Internet of Things (IoT) have created conditions in which AI-based applications and services that generate revenue can flourish. As business emerges from the COVID-19 crisis, it must go on the offense and find ways of using AI to generate more revenue. BCG finds that revenue growth generates up to 70% of total shareholder returns in a five-year period.

Almost 90% of executives agree that AI represents an opportunity, but a mere 18% have tried to use the technology to generate revenue, according to a 2019 MIT Sloan Management Review and BCG AI survey of more than 2,500 executives. Even though deploying AI can be challenging, more companies need to focus on using the technology to create value. On the basis of our studies, we provide a framework in this article that will help executives think through the key issues, so that they can use AI to recover, rebound, and find new roads for growth.

Almost 90% of executives agree that AI represents an opportunity, but only 18% have tried to use it to generate revenue.

How AI Boosts Revenue

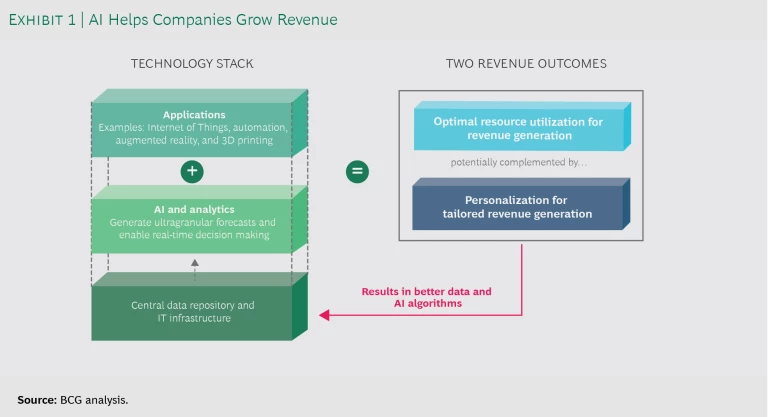

Broadly, AI improves companies’ capabilities to grow revenue in two distinct ways. First, AI’s ability to detect very weak signals helps companies develop, refine, and generate numerous forecasts (such as those for demand, supply, inventory, prices, and logistics). Second, the speed at which AI works provides companies with the ability to analyze large amounts of data to make decisions in real time. By improving the accuracy of forecasts and by enabling real-time decisions, AI helps companies generate more revenue. (See Exhibit 1.)

Companies can use ultragranular forecasts and real-time decision making to deploy resources for the best results. Although optimizing resource utilization can reduce costs and boost revenue, this article will focus on the latter because it is the main source of long-term value creation.

Think of AI-based resource utilization as a continuum, with macro-level resource optimization (such as for manufacturing) at one end and micro-level resource optimization (such as for personalizing products) at the other end. Personalization applies mainly to consumer-facing businesses, but it’s a useful way to understand the many ways in which companies can deploy AI.

For example, companies can use AI to ensure that, on the basis of real-time price forecasts, they are constantly producing the quantities and mixes of products that will generate the most revenue. Companies can also use AI to create personalized products or tailor offerings to individuals.

As customers respond to an AI algorithm’s suggestions, it will trigger feedback loops that are continuously amplified by learning effects. Because AI can learn, the more feedback it receives, the better the outcomes will be. That will encourage AI usage, creating a virtuous cycle of happier customers and a greater willingness on their part to share data with the business.

The AI Revenue Matrix

How quickly a company can scale its use of AI is relative to the amount of human intervention that’s required for AI to operate. The less human intervention, the faster AI can be scaled. Deploying AI at scale increases the value that a company can generate, as long as, of course, the quality of its products and services meets customer expectations.

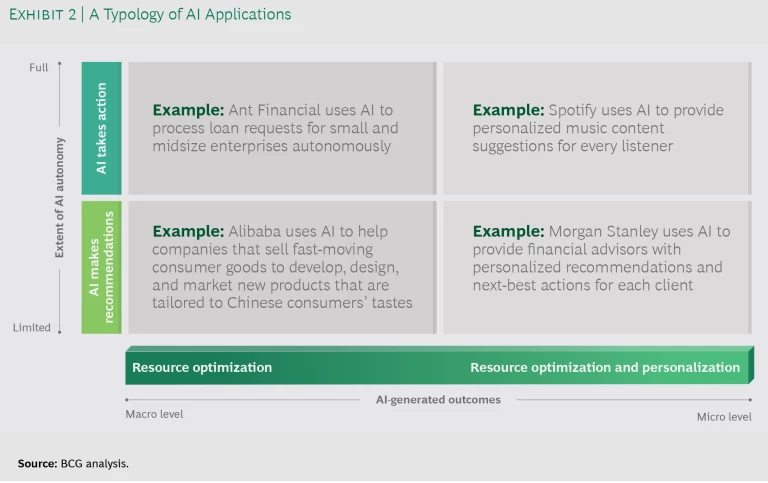

Depending on the extent of AI’s autonomy, two outcomes are typical: AI makes recommendations to help employees’ decision making, and AI takes actions on the basis of rules created by employees. Depending on the extent of autonomy and the degree of personalization, an application of AI typically falls into one of four quadrants in the AI revenue matrix. (See Exhibit 2.)

AI makes recommendations. AI can help companies grow revenue by suggesting how they can improve throughput, develop products, and deliver services in the most resource-optimal way. For example, when Exscientia, a UK startup, and Sumitomo Dainippon Pharma teamed up to treat obsessive compulsive disorders, their new drug was ready for clinical trials in 12 months, compared with the industry average of 36 to 48 months. The reason: the use of AI, which benefited the entire development process, from target identification to patient stratification and clinical engagement.

Meanwhile, Alibaba Group’s Tmall Innovation Center uses AI to help reduce the risk of product development failures and to get closer to Chinese consumers. Since its launch in 2017, the Tmall Innovation Center has helped more than 80 companies (including Johnson & Johnson, L’Oréal, Mars, Mattel, Procter & Gamble, and Unilever) cut the time to design and develop consumer products to one-third of the industry average.

AI offers a way of delivering the personalization of products and experiences that consumers demand.

AI also offers a way of delivering the personalization of products and experiences that consumers demand. Morgan Stanley’s wealth management business, for instance, uses AI to create a next-best action engine for 16,000 financial brokers. In addition to generating insights and choices that the firm’s financial advisors can pass on to clients, AI provides operational alerts and recommendations to deal with life events such as illness and weddings. Since the technology was adopted, the productivity benefits have been evident: the firm is seeing about five more outbound calls per day per broker and many more inbound ones. In addition, AI helps foster closer relationships between Morgan Stanley’s advisors and their clients.

AI takes action. Some companies go a step further and automate decision making, allowing AI to take customer-facing actions. Alibaba’s Ant Financial, for instance, has automated its loan authorization process. By using the so-called 3-1-0 model—where 3 is the number of minutes it takes to fill out its loan application form, 1 represents the number of seconds it takes the company to provide an answer, and 0 highlights that there is no human intervention—Ant Financial processes four times more loan applications for small and midsize enterprises than its rivals.

Digital giants such as Netflix and Spotify use AI to make content-related recommendations for each viewer and listener, respectively. There’s no human intervention in the process, and AI makes suggestions given the customer’s past behavior as well as the behavior of similar customers.

As manufacturing technologies evolve, AI is being used to orchestrate the manufacturing of personalized products. Procter & Gamble’s shaving supplies and razor blade division, Gillette, has started to experiment with the idea, partnering with the 3D printer startup Formlabs. Together, they offer custom-printed razor handles that cater to an individual’s grooming preferences, budget, style, and, of course, aesthetic choices. Gillette’s Razor Maker platform allows consumers to choose from 48 designs and numerous colors, and customers can get custom text printed on the handle.

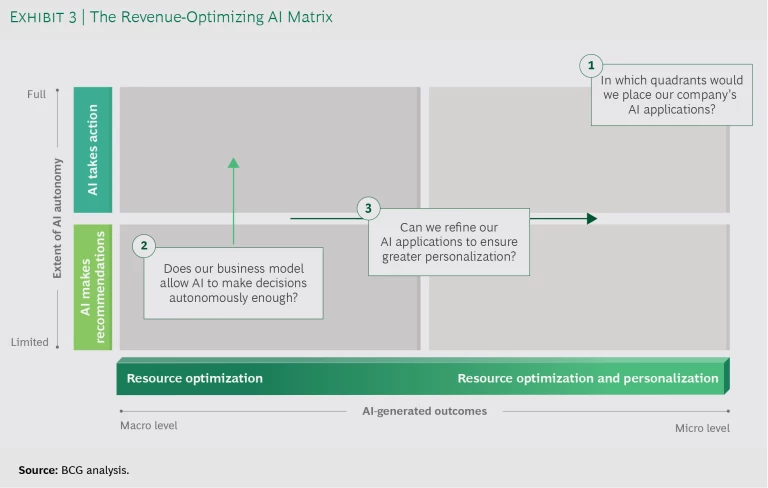

Effectively deploy AI. Leaders who wish to use AI to generate the most revenue can use the AI matrix as a starting point. (See Exhibit 3.) To move the needle, they should ask the following questions:

- In which quadrants would we place our company’s AI applications?

- If the company uses AI mainly for recommendations, does our business model allow AI to make decisions autonomously enough? If not, what changes are required to ensure that AI can act more independently?

- If the company uses AI mostly for optimizing resource utilization on a macro level, can we refine our AI applications to provide greater micro-level utilization (such as for personalization)? Would that boost revenue?

To stretch their thinking, companies can also use the AI revenue matrix to plot their rivals’ AI revenue streams.

Guidelines for AI-Driven Growth

To realize the full potential of AI to generate revenue, companies must go beyond focusing on individual applications of the technology and figure out how to deploy AI as a source of competitive advantage. Three guidelines will help to both augment current revenue streams and search for new ones.

Experiment to find the optimal objective function. Choosing the right objective function (or revenue-maximizing equation) is an important part of creating AI-enabled revenue streams. Doing so requires an iterative process of refinement, augmented by human experience and knowledge. For instance, when Netflix started building its recommendation algorithm, Cinematch, it offered $1 million in prize money to anyone who could develop an algorithm that would improve its recommendations by 10% or more. The winning team’s algorithm and features turned out to be different from those in Netflix’s original version, and the company was inspired by the team’s suggestions. Currently, Netflix’s recommendations contribute enormously to its revenue and customer retention, driving about 80% of the watched hours on its streaming service.

Similarly, an AI team developing a ride-sharing application in the US recently changed its objective function so that it maximizes the number of accepted rides rather than the amount that customers spend. Although pursuing the latter would deliver more revenue in the short term, optimizing for the number of accepted rides allows the company to focus on maximizing customer lifetime value.

Push boundaries through increased automation or more personalization. To maximize existing revenue streams, companies must develop the most autonomous and personalized AI-enabled revenue streams.

Companies must develop the most autonomous and personalized AI-enabled revenue streams.

If the value chain allows, companies must provide their AI systems with more autonomy. For example, Rio Tinto and Caterpillar are collaborating to create the world’s first intelligent mine in Australia. AI will be used not only for scheduling but also to enable real-time operating decisions. The pit-to-port mine will have automated trucks, drills, and trains, and AI-driven systems will connect all these elements for scheduling, from ore planning to delivery. The AI-driven system will boost revenue by increasing output, ensuring quicker deliveries, and providing more-accurate forecasts of customer demand. Automation does lead to workforce reduction, though, which makes the process dependent on local labor laws and unions.

Companies can personalize their offerings by getting to know customers—if they have access to their data. Companies that don’t have direct access must find novel ways to get data to feed AI algorithms. Companies that sell fast-moving consumer goods, for instance, usually don’t have access to customer data unless they use direct sales channels. Coca-Cola overcame this limitation by installing AI-powered vending machines that use the Coca-Cola app—in tandem with facial recognition in some countries—to deliver personalized experiences. The new vending machines have increased channel revenue by 6%, with 15% fewer restocking trips owing to personalization and better stock management.

Find new revenue streams by assessing AI capabilities. Companies can assess their existing AI capabilities to turn them into new revenue streams in several ways. Some companies have used AI capabilities to develop value-added services for existing customers. Companies such as Rolls-Royce and Caterpillar have increased their revenue by offering customers predictive maintenance contracts. The companies monitor engines and vehicles, perform checks regularly, and replace parts before they break down, boosting the availability of their industrial products to customers.

Other companies have benefited by selling internally developed AI services widely. After the Chinese company Ping An Insurance developed and refined its fraud detection capabilities, it created a technology-as-a-service platform, OneConnect, to sell the service globally to other financial services and insurance companies.

Still other companies have used their AI capabilities to enter new markets. Alibaba’s Ant Financial is disrupting China’s health insurance market with a novel crowdfunded mutual protection scheme. It developed the product by leveraging its existing customer base, AI capabilities, and digital platforms (such as Alipay and blockchain for fraud protection). Amazon, too, is tiptoeing into the financial services business because of its large data sets and technological capabilities. The online retailer has recently created a series of financial services around payments and small loans, luring consumers away from traditional banks.

As companies focus on growth after the current global health and economic crisis ends, they must consider not only cost cutting but also long-term revenue creation. AI is poised to help companies make faster decisions and create unique offerings that have a better chance of success. Using AI isn’t easy, though, so companies should start right away to prevent digital upstarts from disrupting them and to secure the best chance of winning the future.