This is an excerpt from The Comeback Kids: Lessons from Successful Turnarounds.

In 2012, Olympus was at one of the lowest points in its history. The company’s imaging unit in particular suffered from the introduction of smartphones, which dramatically cut camera sales. Olympus’s medical unit also saw a drop in profits as a result of government constraints on health care spending. Revenue and profits for the company overall had been flat or falling since 2008.

To respond, the company’s leadership team launched a turnaround with four main objectives:

- Streamline the business portfolio. Olympus restructured around three product segments: cameras and audio, medical, and industrial and life sciences solutions. (This entailed selling off noncore assets, such as the company’s information and communication business.) Olympus also reoriented the cameras and audio business away from low-cost consumer cameras toward more expensive, higher-margin models. It invested in R&D to build up its medical business and improve its performance in markets where it was already strong, such as gastrointestinal endoscopy (where Olympus has a 70% share). To reinforce that position and expand into new markets, the company built four training facilities in China and other Asian countries, which help physicians improve their endoscopy skills.

- Cut costs. Olympus consolidated production facilities (closing nine plants in Asia and North America), restructured its procurement function, and reduced head count by about 4,500. By reducing the cost of goods sold, the company was able to steadily increase both gross and operating margins.

- Restore financial health. Management set ambitious financial targets: operating margins and return on invested capital of at least 10%, and free cash flow of about $650 million. By 2017, the company had hit its goal for operating margins, and it would have exceeded the free cash flow target except for a one-time charge.

- Build up the governance structure. Last, Olympus strengthened its compliance system and sought to create a culture where people could discuss concerns more openly. “Devoted to once again realizing a strong Olympus,” said president and representative director Hiroyuki Sasa, “we proceeded to restructure corporate governance systems and achieve substantial improvements in our financial health.”

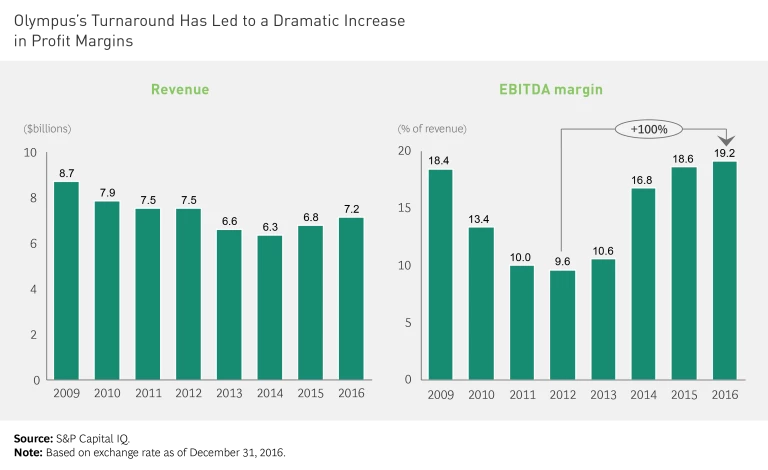

Olympus’s revenue is roughly the same, but the company is far more profitable.

The operational focus has paid off in dramatic fashion. From 2012, when the turnaround started, to 2016, the share of revenue from the medical imaging business grew from 56% to 76%, and that division now represents nearly all of the company’s operating profit. It is the main growth engine for the company, and it has the resources and managerial attention to thrive. Overall, Olympus is roughly the same size in terms of revenue, but it is far more profitable, with a 100% increase in EBITDA margins. (See the exhibit.) Since 2012, the company’s market cap has increased 12-fold, to nearly $13 billion.

By focusing on its strengths, aggressively reducing costs, setting clear financial objectives, and putting the right governance and culture in place, Olympus has emerged from its turnaround program stronger than ever.