This report surveys the dealmaking landscape in one of the world’s most dynamic and fast-growing regions, providing private-equity professionals with a detailed overview of the opportunities and challenges to be found there. In addition to reviewing recent dealmaking activity and the investment theses driving the transactions, BCG describes the unique aspects of culture, business practices, and government policy that make Southeast Asia unlike any other global marketplace.

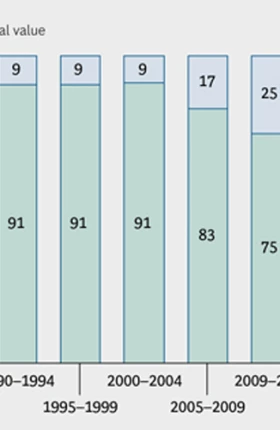

Over the past decade, Southeast Asia has become a dealmaking hot spot, drawing an influx of private-equity (PE) firms from the U.S. and Europe. The fast-expanding wealth, abundant natural resources, and rapidly developing business sectors of the ten members of the Association of Southeast Asian Nations (ASEAN) make it fertile ground for investment, and many firms have already prospered there by pursuing a growth thesis.

The very popularity of that thesis, however, has intensified competition for deals and driven multiples upward. Outside the bounds of that thesis, however, are attractive opportunities premised on the region’s rapid economic development. Gathering robust empirical data and the observations of seasoned regional experts, this is a valuable guide to Southeast Asia for PE professionals, investors, and global executives.