Around the globe, public pressure to address carbon emissions is increasing. Yet the economic debate around climate action continues to be dominated by skepticism. Regulators and corporations remain reluctant to promote ambitious abatement for fear it might hurt economic competitiveness and growth. This reluctance is increasingly at odds with economic reality. While the projected negative impact and economic risks of unchecked climate change continue to escalate, the costs of taking action are declining. For many countries, reducing emissions is even a standalone business case, as it contributes to GDP growth.

In light of this mounting evidence and little short-term hope for an effective global emission reduction mechanism, governments should take unilateral action by pushing national policies that bring down emissions at scale across all sectors. Companies, in turn, should be proactive in climate-proofing their business models and operations to serve the long-term interest of investors—even if this means having to overcome short-term commercial disadvantage.

The Global Risks of Inaction Are Escalating

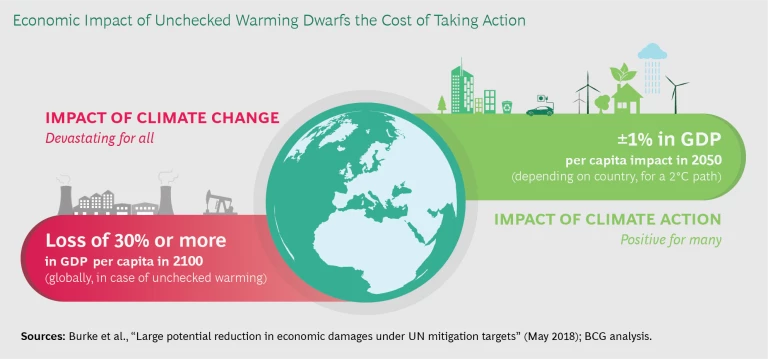

The debate in climate science is no longer about whether climate change is occurring or whether human activity is the dominant cause. It is about how bad its impact could become. On the economic front, several papers have attempted to quantify the effect of ecosystem changes on world GDP. A detailed analysis by researchers at Stanford University concluded that the current trajectory—which would see global temperatures rise by up to 4°C by 2100—would result in 30% lower per capita GDP than a scenario without additional warming. The IPCC projects that if the rise were instead limited to 1.5°C, GDP would be only 8% lower.

First, global GDP increasingly appears to be what is known as a “vanity metric” in the startup world. Cash-strapped entrepreneurs can go bankrupt despite positive growth and EBIT. Similarly, a world that currently achieves 3.3% annual GDP growth, but burns through resources at breakneck pace (“1.75 planets” worth of resources each year, according to the Global Footprint Network) and accumulates a rapidly growing carbon debt is in dire straits—environmentally and economically.

Second, we are still ill-equipped to grasp—let alone quantify—all of the ripple effects of a changing climate. But the more fully scientists understand these effects, the more dire their forecasts are becoming. For example:

- Sea Level Rise. The speed of sea level rise has been underestimated. The collapse of the Larsen B Ice Shelf in West Antarctica has dramatically demonstrated how rapidly underwater destabilization is already taking place today.

- Fires. This year has seen large-scale fires in the Russian taiga and the Brazilian Amazon, two of the largest global ecosystems and critical reservoirs and absorbers of CO2. Such threats will only increase as temperatures rise, but today’s climate models hardly reflect their follow-on effects.

- Heat Waves and Droughts. Forests are already dying and farmland is degrading. Yet what we have seen in the Middle East, Europe, and parts of North America over the past several years marks only the onset of longer-term decline.

- Water Shortages. In global megacities such as Chennai and Cape Town, increasingly severe shortages of drinking water threaten the physical and economic well-being of millions of citizens. More will follow, even if we limit warming to 2°C.

The rearview mirror is flattering, which means we likely underestimate the true force of what is coming. As the frequency and scale of such events will only continue to increase, their full economic impact almost defies quantification. Worse yet, we must accelerate the transformation to a carbon-neutral economy at a time when societies are under increasing ecosystem stress, putting further pressure on the very political systems that need to enforce this transformation.

The Costs of Taking Action Are Vastly Overestimated

On the other hand, remarkable advances in low-carbon technologies are putting emission reductions in most sectors well within economic reach. For many countries, this transforms a technical challenge into a societal one—and an economic challenge into an investment and regulatory one.

Only a decade ago, wind and solar power were still prohibitively expensive, and significant concern existed that their volatility would threaten the stability of the electric grid. Today, both have become cheaper than coal, gas, and nuclear in most major countries—and the possibility of achieving 100% renewable power supply no longer seems to be a question of “if” or “how” anymore, but rather of “when” (at least in parts of Europe). Also, in other sectors, reducing emissions is no longer primarily a technical problem. BCG research shows that most countries can already meet around 80% of their Paris 2°C contributions without resorting to new or unproven technologies.

Even more surprisingly, fear of a “first-mover disadvantage” for countries taking early action on carbon abatement is largely unfounded. Many emission reduction efforts can create economic growth, even if countries act unilaterally. This is because for many countries the benefits from higher investment activity and reductions in fossil fuel imports outweigh the additional costs. And even in most places where this currently does not hold, the impact on GDP when a country takes climate action on its own seems unlikely to exceed –1% by 2050—a figure dwarfed by the potentially catastrophic impact a “no action” scenario would have.

This is not to trivialize the effort. Today, the companies and consumers that need to invest in zero-emission technologies are often not the ones accruing the benefits. Changing this will require significant regulation or collective action—both increasingly challenging in a world of change-resistant societies and increasing unilateralism.

The Imperative for Governments, Corporations, and Investors

As we write this, the progress of global climate action remains dramatically insufficient. Given the clear and growing economic case—let alone the moral one—it is critical for governments and corporations to intensify their efforts.

In the absence of an international regulatory framework and a global price on carbon emissions, national governments must act unilaterally. They should establish meaningful country-level carbon pricing and subsidize low-carbon technologies. They should establish forceful sector-level regulations—such as strong disincentives against coal and supportive policies for electric mobility—in tandem with protecting vulnerable industries such as steel from unfair, high-emitting competition (to prevent “carbon leakage”). Countries that move early may help domestic technology players gain a head start in a fast-growing global market.

Until this happens, the failure of governments to regulate puts corporations in a dilemma. In the absence of carbon pricing, investments in ambitious emission reduction measures lack an attractive short-term business case. For companies in high-emission industries such as steel, cement, shipping, and aviation, investments in zero-carbon alternatives still come at prohibitive commercial risk. Nonetheless, increasing pressure from shareholders worried about the long-term value of their investments—as well as from activists—will force all companies to demonstrate how their business model and operations can become compatible with a 2°C world. Those who don’t start to reinvent themselves today may lose their license to operate going forward.

Companies should tackle this dilemma proactively. They should outline their road to a zero-emissions business model. They should accelerate initiatives that are already economical or nearly economical today, while piloting new technologies that will play a growing role in coming decades. Companies in hard-to-abate sectors can take ecosystem action by partnering with competitors, customers, and suppliers on initiatives that enable risk sharing of large investments in the research and deployment of new technologies such as green hydrogen, synthetic fuels, and carbon-capture-and-storage. In parallel, they should shift their dialogue with governments away from preventing regulation and toward designing policies that will help achieve the needed transformation as efficiently as possible.

At the same time investors can and should play a pivotal role in triggering and facilitating the adaptation of corporate strategies. Their efforts should include calling for greater transparency and disclosure, recalibrating risk assessments on the basis of climate impact, and directing investments into low-carbon technologies and business models.

The next ten years will decide whether the world community has a fighting chance to achieve the goals it committed to in Paris. If we fail to make a meaningful short-term turnaround in global emissions, the trigger points this sets in motion will render further warming irreversible—with profound economic and humanitarian consequences over the next decades.

But if this challenge seems gargantuan, it may in part be because we have never seriously tried tackling it. The mounting economic case in favor of fundamental, large-scale change should help flip the script on climate action and intensify momentum across all stakeholder groups to address what is undeniably humanity’s greatest existential threat.

For a comprehensive and detailed blueprint on how to decarbonize a developed economy, see our January 2018 study Climate Paths for Germany, developed for the German Industry Association with Prognos AG and more than 200 experts from 70 companies and associations.