The construction industry is a paradox. The annual global growth rate is more than 3%, but the sector is in crisis: prices are soaring, jobs remain unfilled, and demand far outstrips supply. The crisis can be attributed to one broad shortcoming: unlike almost every other industry, construction has been reluctant to modernize and thereby boost its productivity. The car factory of 2019 looks nothing like the car factory of 1919, whereas the construction site has hardly changed during that time.

Of course, construction is not easily amenable to mass production, but it could certainly exploit modern industrial techniques more than it does. Offsite construction, or “prefabrication,” is the key: creating in a factory various parts of a building before assembling them on the building’s actual site. The parts can be either precast (concrete) or made from compound materials (such as sandwich panels). The offsite factory of today may produce flat-pack components (such as walls or beams), volumetric modules (bathroom pods or bedrooms), or even entire buildings. The practice of systematically constructing houses offsite goes back to the 20th century: builders in the US began selling “kit homes” in the early 1900s, for example, and European governments on both sides of the Iron Curtain turned to offsite construction after World War II to address housing shortages.

Despite its history, however, and despite the pressing need, offsite has remained a niche approach. That is changing at last. Offsite construction is now being adopted for projects as varied as high-end condos, hotels, and airport terminals. The disruptive potential is huge. Industry executives, as they weigh their options, need a clear understanding of the offsite phenomenon—why it is gaining in popularity, how companies are participating in it, and what it implies for the industry.

The Advantage of Offsite

Offsite construction alleviates several problems associated with traditional “onsite” methods. By moving a large proportion of the work from a messy, exposed open-air setting with limited working hours into a safe, controlled indoor factory setting with 24/7 production uptime potential, offsite construction offers five main benefits.

- Shorter Building Times and Lower Risk. Offsite construction is far less affected by the vagaries of the weather and by the heavy burden of onsite project management. It is also far less subject to the risks—legal and financial—inherent in complex collaborations with subcontractors. So offsite typically reduces building-completion times by more than a third and improves punctuality, with best-in-class builders approaching 100% for on-time delivery. That can be of great value to project owners; a hotel, for instance, can begin taking reservations earlier, and the risks of overspending and delays are reduced.

- Higher Quality. Thanks to standardization, a controlled environment, and in-factory quality checks, the defect rate can be halved; at best-in-class producers, the defect-free rate on new buildings is now above 95%.

- Lower Costs. The controlled, weatherproof workplace raises the productivity of individual employees, while also allowing economies of scale, optimized logistics, and lean manufacturing. The result is a saving of up to 10% on overall construction costs—savings that can be passed on to customers or reinvested in higher-quality finishes, for example.

- Improved Working Environment. Workers are protected from the weather and from many of the traditional dangers (such as working for long periods at great heights or underground), and their daily commute remains unchanged from project to project. Workplace accidents are halved, and recruiting becomes easier as the jobs are now more desirable.

- Reduced Environmental Impact. Construction waste and emissions can be halved, by virtue of production efficiencies and increased recycling.

These benefits merely mirror those of other industries as they modernized. With offsite construction now gathering pace, the industry is advancing into the 21st century.

Barriers to Adoption

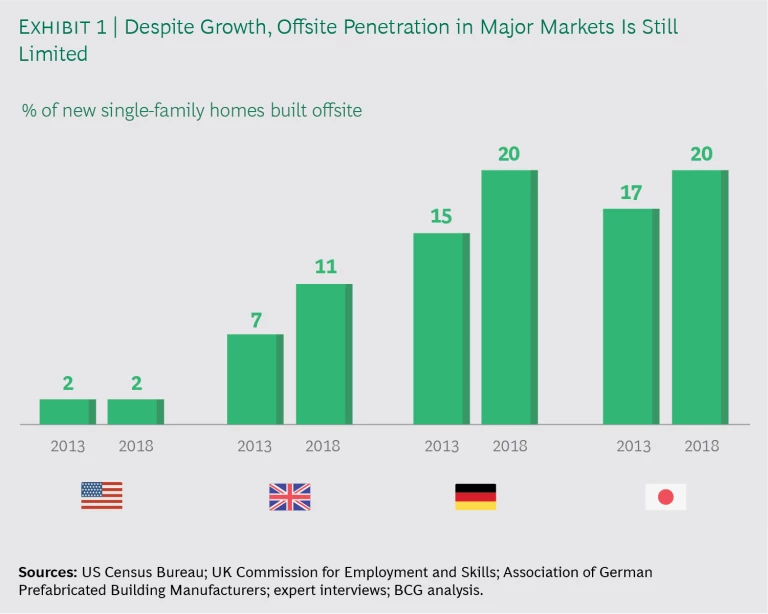

The global penetration of offsite construction is difficult to quantify. Analysts define offsite construction in different ways, according to the proportion of offsite content—50% versus 80%, say—and according to the techniques for measuring that offsite content. The data is most reliable for single-family homes, the segment that historically has been the main beneficiary of offsite construction. In some smaller markets, such as Sweden, more than 80% of new homes are now built offsite. But despite an upward trend, no major market yet exceeds 20% penetration; in the US, offsite barely registers at all. (See Exhibit 1.)

Despite its long history and its compelling value proposition, offsite is only now gaining traction. The reasons for the slow uptake are complex and vary from market to market. But four particular barriers apply very widely:

- An Image Problem. In continental Europe, people often associate offsite with low-quality, uniform, communist-style housing. In the UK, offsite evokes memories of the cheap “prefab bungalows” built to solve the postwar housing shortage. In the US, many people confuse offsite with low-income mobile homes, which are often termed “manufactured homes.” One notable exception to this tendency is Japan, where offsite-constructed houses are considered premium, high-quality products.

- Inflexibility and Uniform Design. In the past, to keep costs down, offsite-construction companies adhered to a policy of standardization. This cookie-cutter approach tended to conflict with building-site constraints and with the individual owner’s preference for some degree of customization.

- Regulation and Local Building Codes. Traditional construction is widely subject to tight labor rules regulating who can do what onsite, for instance, or specifying the minimum number of workers for a particular task. Such rules contravene the offsite labor model, which is based on small teams of broadly trained workers. Other rules, including health and safety regulations, planning codes, and mortgage or insurance requirements, have similarly hampered the development of offsite construction. To make matters worse, the rules are often local, and thus difficult to change, so no easy scaling of solutions has been possible.

- Risk Aversion. The construction sector is historically risk-averse, for good reasons. Construction is expensive when done right and potentially ruinous when done wrong, as recent high-profile cases such as Berlin’s new airport can attest. On the supply side, construction is a project-based and cyclical business, with constant cost pressures and low margins, and hence an aversion to heavy capital expenditure and to R&D. (Contractors, in particular, are certainly unaccustomed to investing hundreds of millions or even billions of dollars in factories.) Builders and clients alike have therefore been wary of experimenting with new methods and technologies. (See Shaping the Future of Construction: A Breakthrough in Mindset and Technology, a World Economic Forum report, prepared in collaboration with BCG, May 2016, pp. 13-15.)

In combination, these barriers had the effect of forcing offsite construction into a vicious cycle. The barriers kept demand for offsite weak; the weak demand discouraged investment into offsite, so the supply remained very limited; and in light of the limited supply, there was little impetus to break down the barriers that kept demand low. Fortunately, this cycle is at last starting to collapse.

Breaking Down the Barriers

Three new factors have come into play that are now bringing offsite construction to an inflection point.

The first factor is the long-running skills shortage. The construction workforce in wealthy countries has been declining rapidly as current workers retire, since traditional construction jobs hold little appeal for younger workers today (see Shaping the Future of Construction: A Breakthrough in Mindset and Technology , pp. 15 and 36). The old solution—importing workers from abroad—is becoming less viable, as the importing countries are tightening their immigration policies and the exporting countries are generating more attractive jobs for their own workers. Offsite construction is an obvious remedy—appealing to local construction workers while increasing overall productivity in the sector.

The second factor is the surging use of digital technology. This development is helping to erode the barriers to offsite, in particular the barrier related to inflexibility. Thanks to digital tools, such as building information modeling (BIM), it is becoming easier to integrate offsite components into conventional builds and to create more sophisticated and flexible systems of offsite components. (See “ The Transformative Power of Building Information Modeling ,” BCG Perspectives, March 2016.) Moreover, advances in digital production methods, such as robotics and 3D printing, should one day be able to turn the ideal of “mass customization” into a reality. (See “ Will 3D Printing Remodel the Construction Industry? ,” BCG article, January 2018.)

Thanks to digital tools, it is becoming easier to integrate offsite components into conventional builds and to create more sophisticated systems of offsite components.

The third factor is government support. Governments around the world are now backing offsite construction far more vigorously than before. Faced with serious housing shortages and chronically tight budgets, governments in Australia, Singapore, and the UK are making offsite construction a strategic priority and are favoring offsite in procurement. Others will doubtless follow their lead, and in doing so will create stable demand, help to standardize designs, shape new regulations, and publicize the benefits of offsite. Private companies will then have the incentive to get seriously involved as well.

To be sure, some challenges remain. Offsite construction can ease the labor shortage, but it requires new skill sets and training programs, and these are still under-developed. BIM will help to integrate offsite into the planning and building process, but not while incompatible standards persist and not until adoption rates increase. Robotics and 3D printing need considerably more investment and R&D before they can realize their full potential. And most governments still need to assign offsite a higher status; in the US, for instance, only a few city- and state-level authorities have formulated a comprehensive policy on offsite construction.

Nevertheless, the momentum is unstoppable. Companies that emphasize the opportunities rather than the challenges, and quickly consolidate their base of talent and technology, will enjoy a competitive advantage. That is something that smart investors recognize. Venture capital is pouring in, and two startups, Katerra and Revolution Precrafted, have already attained “unicorn status,” with valuations exceeding $1 billion each. Private equity funds run by Bain Capital, PIMCO, and others have invested hundreds of millions in offsite companies such as Consolis and Polcom Modular. The veteran UK contractor Laing O’Rourke is hurriedly building yet another offsite manufacturing plant. Even Google has invested $300 million in offsite construction to produce homes for its employees. All the signs are that this wave of investment will grow even stronger.

The Markets and the Prospects

Although the trend for offsite construction is undeniably upward, the pace of its development is difficult to determine. The landscape could change dramatically if an individual participant makes the right bold move—an offsite construction company acquiring a large traditional contractor, for example, or a major building materials company opting for a switch to offsite. The detailed changes are impossible to predict, but there are some rough guidelines for gauging how offsite will evolve in any particular market.

First, offsite in general will likely grow fastest in regions that emphasize new buildings rather than renovations and that have key market shapers, such as a major developer or active government support. The UK and Japan, for instance, fulfill both of these conditions and have fast-growing offsite ecosystems accordingly. In contrast, Germany skews toward renovations, and the US lacks any major national offsite champion, whether private or public. Growth of offsite in these markets is therefore likely to be more subdued or localized.

Offsite will likely grow fastest in regions that emphasize new buildings rather than renovations and that have key market shapers, such as a major developer or government support.

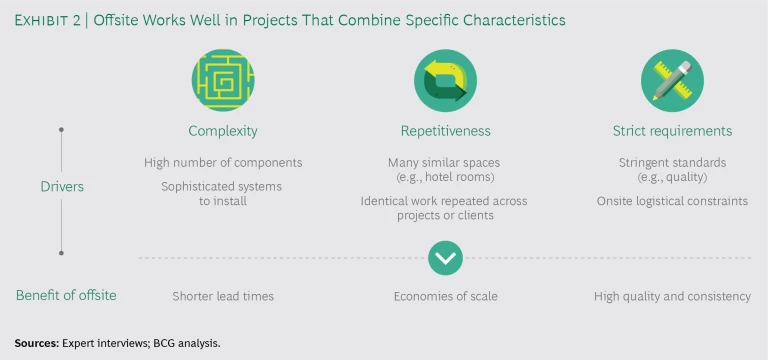

Second, within any region, adoption will be highest in construction segments that feature one or more of the following factors:

- A high degree of complexity, with multiple and/or sophisticated components that would benefit greatly from the time savings derived from offsite methods

- A high degree of repetitiveness, either within or between projects, facilitating standardization and economies of scale

- Strict requirements regarding quality, cost, or onsite logistics

(See Exhibit 2 for a schematic representation of these factors.)

The segment that is currently the main application for offsite construction is that of residential buildings, and it will likely continue to be so. Houses are not unduly complex, but they are characterized by a high degree of repetitiveness. And they often are subject to strict requirements, in the form of buyers’ expectations concerning quality and price. So most of the major offsite-construction companies have a strong housing presence, or even an explicit preference.

In nonresidential segments, the prospects are more varied. Hospitals, hotels, schools, and prisons, for example, are in general prime candidates for offsite construction. They are highly standardized, follow strict requirements in regard to safety or branding, and are time-constrained and labor-intensive when it comes to furnishing and outfitting. For other types of building, offsite can sometimes be the optimal approach on account of project-specific factors: for example, for the Leadenhall Building, a towering office block in the City of London, more than 80% of the components were built offsite, in order to meet the double challenge of a tight construction site and a tight delivery timeline.

Finally, hard infrastructure is likely to remain less receptive to offsite construction. Of course, small standardized components, such as sewage pipes or railroad sleepers, are frequently precast offsite. But major components—of a bridge, for instance—are often large and awkward to transport from an offsite location, so it might be more cost-effective to construct them onsite. Once again, however, project-specific factors will sometimes favor offsite construction: the Geneva airport is resorting to offsite methods for its new intercontinental terminal, which has to fit into a site barely 20 meters wide. Such specialized offsite projects will likely increase in frequency, especially since infrastructure is the most international branch of construction, with many contractors operating across borders.

Business Models and Participants

No specific business model or company has yet emerged as the winner in offsite construction. But current participants can be classified into two broad groups: end-to-end providers and ecosystem coordinators.

The first group, end-to-end providers, consists of asset-heavy, vertically integrated generalists, which participate all along the value chain. Companies of this type have their own design and engineering departments; they manufacture and preassemble most components in their own factories; and they actively manage the final onsite assembly. They believe that having a seamless, integrated manufacturing system is crucial for producing top-quality results, and they are willing to invest capital to secure it. This model is currently the most common one. Among the leading examples are Katerra in the US, Laing O’Rourke in the UK, and Daiwa House and Sekisui House in Japan.

The second group of companies, ecosystem coordinators, consists of asset-light overseers. Having developed an offsite-construction system, they then coordinate an ecosystem of specialized partners to deal with individual aspects of it. They may, for example, limit their own direct role to that of overall design and customer-relationship management, while relying on partners to make the various components to their specifications. They favor flexibility in manufacturing over sophisticated machinery. For instance, Bryden Wood and Skanska, two leading ecosystem coordinators, have developed the “flying factory” concept: they find an underused building, such as a barn, close to the construction site, and convert it into a temporary, low-tech plant to assemble components supplied by third-party partners. The ecosystem coordinator model is fairly new, but many new entrants might be attracted to it because of its asset-light nature.

The two business models are distinct in theory, but companies do not stay neatly within the confines of one or the other. End-to-end providers, such as Sekisui House, readily revert to independent suppliers for some components. Conversely, the ecosystem coordinator Bryden Woods initially operated its own factory for testing and learning purposes. Moreover, both types of companies rely on specialized third parties for key technologies. (See “The Surrounding Community of Technology Companies.”) Still, most offsite companies have very clear strategies regarding which parts of the value chain they want to own and where they want to invest.

THE SURROUNDING COMMUNITY OF TECHNOLOGY COMPANIES

THE SURROUNDING COMMUNITY OF TECHNOLOGY COMPANIES

A rich and growing community of technology companies plays an indispensable auxiliary role in offsite construction. The two types of company that arguably make the greatest contribution are those providing software and those involved in robotics.

Software. Software developers offer vital support in fields such as design and engineering (Tekla and Aditazz are prominent examples) and project management (GenieBelt and Sablono, for instance). Some areas are still maturing, notably software that can really integrate some of the links in the value chain, especially design and production; at the moment, it still takes considerable manual intervention to translate a design intent into production instructions. The experience of other industries—as in the case of printed circuit boards—suggests that the solution will not be easy to find but will have a dramatic effect once it is found.

Robotics. Most robots currently used in offsite construction are generic ones, performing basic manufacturing or assembling tasks. The potential here is two-fold— refining the performance of these generic robots, and developing construction-specific robots.

First, the generic robots could be optimized for construction-specific tasks. Consider the task of assembling a building frame, for example: today it is still a nontrivial task for robots because they are not situationally aware, and without the right instructions they often crash into parts of the frame that have already been built. Given that the designs keep changing, the programming needed to resolve this issue is particularly complex. But it should eventually be possible to do such programming at scale, and promising work is under way at research labs such as the Swiss National Centre of Competence in Research for Digital Fabrication at ETH Zurich.

Second, construction-specific robots should soon become more common and more versatile—able to work with awkward materials such as concrete and to cope with many current challenges, such as the weight of very large components and the proximity of human workers. Developers can derive much encouragement from the successful adaptation of related technologies: 3D printing, notably, is now being exploited very productively to build complex components for construction projects. (See “ Will 3D Printing Remodel the Construction Industry?,” BCG article, January 2018.)

It is too early to tell which of the two models will predominate, if either. They might well continue to coexist on roughly equal terms. Would-be entrants should consider which model best suits their strengths and risk tolerance. An end-to-end provider will boast a proprietary and differentiated offering, but faces the worry of having underutilized factories whenever business takes a downturn. An ecosystem coordinator has a different worry: how to retain ownership of its system, given that its IP necessarily has to be shared among multiple third parties.

It is too early to tell which of the two models will predominate, if either. They might well continue to coexist on roughly equal terms.

As well as pondering the business models, companies need to consider three strategic questions:

- How much standardization should we aim for in regard to design and manufacturing?

- How much automation and robotics should we use in manufacturing and in onsite assembly?

- Where and when should we use fully preassembled volumetric components versus flat-pack units?

The answers here will depend on local market circumstances and on the relevant segment. This variability has two important implications. First, companies should question any received wisdom or success formulas derived from other companies. For instance, the common mantra that “volumetric is just transporting air” is certainly not applicable when the project is a fully outfitted hotel or hospital. Second, companies should allow themselves some flexibility or else accept the inevitable tradeoffs. For example, if a company commits to a volumetric-only system—in pursuit of an overall cost advantage, perhaps—it should do so in the clear knowledge that some projects would then be beyond its reach, for logistical reasons.

In seeking the optimal responses to the three strategic questions, companies need to conduct a thorough analysis of their target market and an honest assessment of their strengths. And even then, they should be prepared to adjust their responses nimbly, in keeping with the rapid changes taking place in the market.

Offsite is going to be highly disruptive to construction as a whole, and existing companies are at risk of losing considerable value.

Strategic Implications

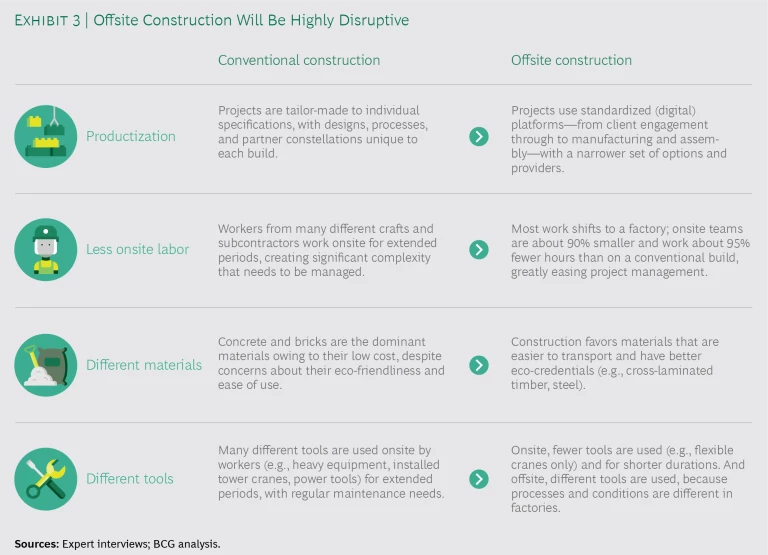

Offsite construction clearly has an upside potential that traditional companies cannot ignore. But there are other reasons for companies to participate in the offsite market. Offsite is going to be highly disruptive to construction as a whole, and existing companies are at risk of losing a significant amount of value. Specifically, offsite construction will mean more productization, less onsite labor, different materials, and different tools. (Productization refers here to the adoption of standardized, factory-made components, such as walls or even rooms, to replace the traditional process of constructing each individual component onsite.) See Exhibit 3 for some of the details.

These transformative developments will affect all companies along the value chain, to a greater or lesser degree. Here is the likely scenario:

General contractors will feel the impact most intensely. Their service offering will become commoditized. The pool of value that they can access will shrink as construction sites diminish in size and complexity; their current labor model, equipment, and subcontractor/supplier relationships will become redundant; and they will come under greater pressure than ever to reduce costs and delivery times. Global competition will sharpen: Poland’s Polcom Modular, for instance, is able to deliver offsite-built hotels around the world. The best survival strategy for contractors is to expand their offsite capabilities, in the way that Laing O’Rourke and Skanska did (using the end-to-end-provider and ecosystem coordinator models, respectively). Contractors are well-positioned to make this switch because they oversee the entire value chain—but they need to act quickly.

Producers of light-side building materials will see their business volume and margin premium decline drastically. As construction gets more productized, they will have to become offsite-compatible if they hope to win any contracts. Their current individual brands, customer relationships, systems, and distribution networks will lose their distinctive value in a productized market. At the extreme, they could even lose their status as original equipment manufacturers (OEMs) and instead become suppliers to OEMs, and have to submit tenders to them to produce specified components. If they are to remain specification makers rather than specification takers, they need to work proactively at shaping new offsite ecosystems, in partnership with other companies that have complementary expertise.

Producers of heavy-side building materials will suffer as demand shifts to other materials in certain segments. The product at greatest risk is probably cement, which is too heavy for widespread offsite use. To respond, firms can shift toward more offsite-appropriate materials, drawing on specialized know-how: the Austrian startup Cree, for instance, has developed a new wood-concrete hybrid material. Alternatively, firms can expand into offsite-related services, such as 3D printing of formwork, which enables mass-customization of precast concrete. (See “How Building Materials Manufacturers Can Integrate Down the Value Chain.”)

HOW BUILDING MATERIALS MANUFACTURERS CAN INTEGRATE DOWN THE VALUE CHAIN

HOW BUILDING MATERIALS MANUFACTURERS CAN INTEGRATE DOWN THE VALUE CHAIN

Traditionally, within the construction sector, building materials companies aspiring to vertical integration would look upstream. Cement companies would acquire the limestone quarries; asphalt producers strove to control aggregates production and bitumen logistics.

When downstream moves did occur, they would occur typically in a limited scenario: a cement company, for instance, leveraging its market power to gain control of the ready-mix and precast market in specific regions. One scenario that would not commonly occur was that of a cement or asphalt company acquiring a large construction contractor (although the reverse scenario might readily occur). It was as if the building materials industry regarded the construction business itself as a no-go area, one that suffered from three serious drawbacks: lower margins, higher risks, and an unfamiliar business model.

More specifically, the construction industry has always been under higher price pressure than building materials manufacturing has been; construction projects are subject to so many contingencies, and cash flow is difficult to manage; and a project-based business requires very different skill sets and thinking from those used in a manufacturing business. No wonder that building materials companies have shown little interest in moving into construction proper.

As the offsite construction trend gains strength, however, this traditional perception is sure to change. Building materials companies have various options for their move downstream: acquiring an established contractor, for example, or partnering with one, or creating an end-to-end offering of their own. A two-step approach seems to be gaining favor: first getting involved in the manufacturing of components and later moving into the market for actual construction services.

Equipment manufacturers will struggle as demand for conventional equipment plummets. Their primary strategy must be to shift their emphasis away from the building site and into the factory setting. That would probably involve acquisitions or partnerships, since the new type of equipment will likely be closer to industrial-automation solutions than standalone tools. A secondary strategy is to develop new types of onsite equipment, better suited to the stringent timelines and less-specialized onsite workers that will soon be the norm; and/or to develop new service models optimized for shorter and more flexible equipment usage during onsite assembly.

Architects and engineers will have to adjust their business model as construction becomes more productized. They will need to adapt their approach to customers and gain deeper expertise in the actual manufacturing process. Meanwhile, the design process itself will change, making greater use of standardized components and even automated design. To cope with that change, architecture firms are well-placed to become ecosystem coordinators, devising systems that allow customized designs based on standard components. At the very least, they should be able to integrate offsite components into their designs, and be competent in offsite-related skills such as DfMA (design for manufacturing and assembly).

Developers and real estate investors should generally benefit from the offsite revolution—specifically from the shorter delivery times, lower costs, and higher quality—without having to make major changes to their existing business model. This does not mean they can just stay still, however. Demand for best-in-class offsite manufacturers far exceeds supply; in fact, some of the leading manufacturers have long waiting lists. So developers should seek partnerships right away, to ensure that they have access to the best offsite manufacturers and to maximize their attractiveness to clients, buyers, and investors.

Time for Action

The offsite construction market remains a white space. There are still more questions than answers; more clarity on the broad trends than on the specifics; more promising newcomers than proven incumbents; more freedom to experiment than hard-and-fast rules. For some stakeholders, this unsettled picture might represent a counsel of caution. Better to wait and see, they would argue, when so many uncertainties remain and the offsite revolution has faltered so many times before.

Our view is that waiting on the sidelines is a greater risk than stepping onto the playing field. The value proposition of offsite construction is strengthening every day, and so are the factors fueling its growth—labor shortages, suitable technology, government backing. Hence the numerous sophisticated investors, not just from the industry itself but also from venture capital, private equity, and technology firms. They will have a head start over the bystanders—and perhaps an unassailable lead when offsite reaches scale.

Venturing into offsite does not yet mean “betting the firm.” With the obvious exception of startups, most of today’s offsite-active companies began their involvement with just a small side project and increased their commitment only when it looked safe to do so. Companies should think of offsite involvement as another tool in the toolbox rather than as a new start. Time is running out, though, and the companies that hesitate could be gambling with their future in a far riskier way than the bold companies are.