A wide range of industries, from media to transportation, have been disrupted by digital forces. We believe that commodity trading could be next in line. Traditional competitive advantages are being challenged; traders are facing increasing pressure as their role changes; and trading businesses are being forced to rethink long-successful business models and practices.

In this article, first of a series on the impact of digitalization on commodity trading, we discuss how digitalization is driving what we term hyperliquidity in commodity markets and how it, in turn, can compound the effects of digital forces. In future articles, we will detail the hurdles facing traders in this environment and describe how businesses can position themselves for success amid the challenges.

More from this series: Digitalization in Commodity Trading

- Hyperliquidity: A Gathering Storm for Commodity Traders

- Attack of the Algorithms: Value Chain Disruption in Commodity Trading

- Capturing Commodity Trading’s $70 Billion Prize: How Digitalization Is Changing Commodity Trading

Digitalization as a Disruptive Force

Publishing, accommodation and hospitality, transportation and logistics, banking, and the recording industry are among the businesses that have already been disrupted by digitalization. In each case, many incumbents were in a state of denial until it was too late. Such is the nature of disruption—it can often be hard for the businesses most immediately affected to recognize or accept what is happening. For long-established successful industries such as commodity trading, this can be especially difficult.

In commodity trading’s purest form, traders make money by identifying and exploiting pricing imperfections in the market related to quality, time, and location. Historically, traders’ most potent sources of competitive advantage in this pursuit have been access to higher-quality market information, control of critical assets, and the possession of superior trading capabilities, such as strong trading systems, agile and entrepreneurial teams and individuals, and the ability to assess risk-reward tradeoffs adequately. Together, these levers have allowed traders to capture dynamic advantage.

Either way, traders will have their hands full. Numerous examples exist of how digital forces can marginalize human capabilities. Consider the evolution of equity trading, for instance. Not long ago, a stockbroker would take orders by phone from customers and place those orders in the trading floor, or the pit, where brokers and market makers would shout orders to one another and make lucrative margins. Today, the pit is a largely ceremonial place: the real trade matching is done by machines in New Jersey. People like Charlie Sheen’s character in the movie Wall Street, stationed at a data screen in suspenders and a tailored suit, are disappearing.

In short, commodity traders cannot ignore the risk that they may soon confront the same technological challenges that have upended numerous industries and laid waste to many long-established ways of conducting business.

The Emergence of Hyperliquidity

Digital forces are both reducing the market inefficiencies that traders have long relied on and lowering the barriers for entry to the commodity trading business. These forces are intertwined with a constant stream of new developments in the marketplace, shifts in technology, and ongoing regulatory changes.

The convergence of these factors makes for a highly fluid environment that increasingly requires traders to move outside their comfort zone. Big data and predictive algorithms expand the rigor of fundamental analysis and make the generation of results more “real time” than ever. Information specialists are providing structured data directly to trading systems. Cloud computing is eroding the traditional advantage that trading firms have derived from their in-house IT systems and computing power. Social media has introduced an entirely new channel of information and potential sources of value creation, including sentiment analysis. Regulatory changes are forcing greater transparency in the market, and more widespread use of common technological standards is improving the ability to compare commodities in some markets.

One way of gauging the effects of these factors on commodity markets is to look at market efficiency. As the level of standardization and the transparency of information rise, commodity markets approach increasingly high levels of liquidity and competition, reflected in a faster pace of trading and reduced bid-ask spreads.

Hyperliquid markets have several defining traits:

- Information is highly standardized and accessible, and trading is governed by relatively few standards.

- Market activity is handled almost entirely through an electronic platform (one that handles mainly exchangetraded futures or very liquid, platformtraded, over-the-counter contracts) and underpinned by an efficient infrastructure based on algorithmic trading.

- Decision making is increasingly controlled by algorithms fed by automated data feeds; human intervention is limited.

- The bid-ask spread is tiny, typically just 1 to 3 basis points. Buyers or sellers who come in with a large order, however, may not be able to secure such a bid-ask spread: competitors’ trading algorithms might detect the position and take steps to exploit it. For market participants, this places a premium on smarter trade-order management.

- Control over a commodity’s traded volume is held not only by industrial commodity players and merchant traders but also more and more by hedge funds and a variety of proprietary traders and market makers that possess algorithm-based trading capabilities.

- Trading strategies are increasingly based on speed, execution, and cross-asset trading. These strategies include automatic arbitrage, high-frequency trading, and cross-asset (for example, gas-to-oil) arbitrage.

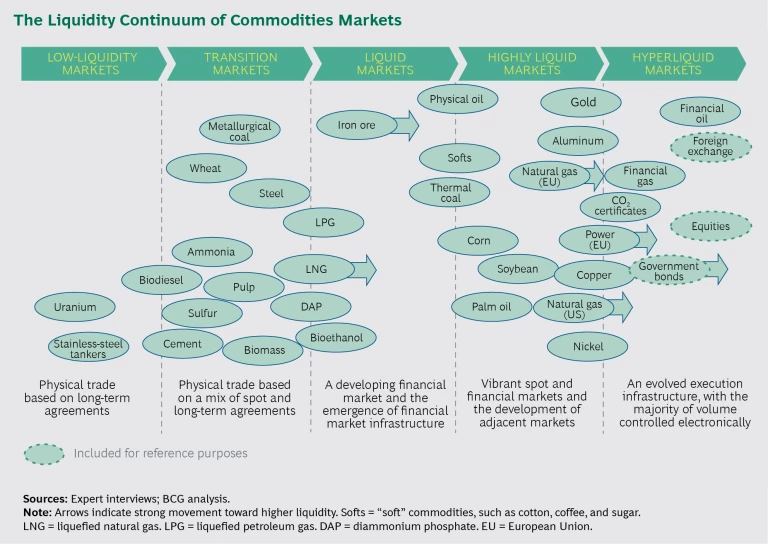

We assessed 32 commodity markets, plus those for foreign exchange and equities, on the basis of these characteristics to see where they fall along the liquidity continuum. We slotted each into one of five categories: lowliquidity markets, transition markets, liquid markets, highly liquid markets, and hyperliquid markets.

A number of these markets are moving quickly toward increased liquidity. These include markets of vastly different commodities, such as European power, liquefied natural gas, and government bonds, which currently have very different dynamics and degrees of liquidity. At the same time, some highly liquid commodity markets, such as the corn market, are moving relatively slowly to the right on the liquidity continuum.

European natural gas and iron ore are interesting examples of markets that, while at very different stages, are moving strongly toward higher liquidity. Natural gas is a relatively standardized commodity that was traditionally sold in Europe through long-term contracts linked to oil prices. There was limited scope for market expansion and increased liquidity, given pipelines’ volume and geographic limitations. The deregulation of Europe’s gas markets in the past decade, however, coupled with the current oversupply of natural gas and the growing use of liquefied natural gas on the Continent, has created much more liquidity in the European market. Simultaneously, the emergence of spot pricing has attracted more players to the market and greater pricing transparency. As a result, liquidity in Europe’s trading hubs, including the Netherlands’ Title Transfer Facility and the UK’s National Balancing Point, has grown steadily. Contracts are now traded in digital platforms, and the ever-increasing need for short-term balancing of supply and demand has helped speed the market’s ongoing transition to hyperliquidity.

Iron ore was a typical low-liquidity market until the emergence of a spot market for the commodity in 2010. Since then, liquidity has grown rapidly, enhanced by the reporting of iron-ore prices by publications such as Metal Bulletin and by the increased prominence attached to iron ore on China’s Dalian Commodity Exchange. We expect the liquidity of the iron ore market to continue to grow and note the commodity’s now very tight bid-ask spread.

Drivers of Hyperliquidity

What pushes a commodity market toward hyperliquidity? We believe that there are three main forces: an increasing degree of standardization, greater transparency of information, and the emergence of an advanced digital infrastructure.

An Increasing Degree of Standardization. Standardization fosters commoditization and, ultimately, hyperliquidity by facilitating comparisons between and among goods on the basis of quality, time, and location. It also helps facilitate more accurate valuation of goods. Physical oil, for example, has hundreds of qualities; power, by contrast, has uniform quality by its nature and hence is more prone to hyperliquidity.

New digital technologies help drive standardization much more quickly. Pricereporting agencies are collecting information with mobile phones; physical exchanges are now relatively easy to create. Unprecedented types and quantities of data are now available. The typical evolution from a relatively illiquid market to a highly liquid or hyperliquid one has been sped up dramatically by these technologies. Metallurgical coal, for example, was a very illiquid market because of the wide variety of coal quality and contracts, the relatively small number of producers, and coal’s complex valuation economics. The emergence of electronic platforms such as globalCOAL, with its standard coal-trading agreement SCoTA, however, is causing metallurgical coal to become increasingly liquid.

The trend toward hyperliquidity in commodity markets is also being driven by a push from regulators and platform players for greater standardization and the establishment of trade repositories, which further increases transparency and makes the markets’ economics easier to quantify.

Greater Transparency of Information. Commodity traders seek to gain and exploit information advantage—that is, access to superior information. Indeed, the absence of full information transparency and availability is a precondition for traders’ traditional business model—and the lack of transparency concerning individual commodities can be sizable. Consider physical oil, for example. A fragmented pool of suppliers and buyers, logistical bottlenecks, and transportation limitations have long contributed to a significant lack of information transparency. The International Energy Agency notes that hundreds of thousands of barrels of oil go unaccounted for every day. Traders have long sought to take advantage of such phenomena.

Technology can significantly improve the transparency of information in commodity markets, pushing them toward hyperliquidity. More and better data allow market players to price quality and geographic differences more accurately. Specialist data providers gather information from sources such as satellite imagery, network frequencies, and truck traffic; pool it together electronically; and supply it to traders. Machines can run through this data in real time using algorithms and make recommendations to traders, or even initiate trades on their behalf, at speeds far exceeding human capabilities.

Regulation, such as the Dodd-Frank Act, can also push markets toward higher transparency and liquidity. Regulators can only do so much, however, without the industry itself pushing for greater transparency.

The Emergence of an Advanced Digital Infrastructure. To enable hyperliquidity, an extremely efficient digital infrastructure that can handle an exponential increase in the flow of information must be present or developing. Typically, this means creating efficient matching engines, which bring buyers and sellers together; incentivizing liquidity generation in new ways; and establishing direct market access to these matching engines through an application programming interface. The creation of such a structure allows players to send quotes to the platform directly. It also enables the use of machine trading for either improved execution of trades initiated by humans or the replacement of human traders altogether. Nearly all major commodity exchanges are pursuing these mechanisms to enhance market access. But many exchanges are still struggling to determine the specific capabilities necessary to handle the rapidly growing number of transactions.

Even in cases where an advanced digital infrastructure is already well established, new technologies keep pushing the boundaries—and pushing markets closer to hyperliquidity. Electronic communication networks revolutionized over-the-counter trading in equities; such platforms are now emerging in commodities markets. These platforms offer speedier, cheaper, and often better execution of trades than incumbent systems. Innovations, such as blockchain technology, offer solutions to age-old challenges related to trade clearing and reporting. Highfrequency trading, a particular subset of algorithmic trading, has also prompted exchanges to develop algorithm-testing facilities to prevent predatory behavior.

In digitally driven hyperliquid markets, information moves, and decisions are made, in a matter of milliseconds and the amount of data moved per day is measured in terabytes or even petabytes. Traditional market inefficiencies are shrinking, and computer algorithms are more and more likely to outperform humans. This evolution of the trading environment has profound implications for commodity traders, presenting both enormous challenges and substantial opportunities. In the following articles in this series, we will expand on those challenges and explain how hyperliquidity is testing existing business models in all parts of the commoditytrading value chain.