This article is part of a series of publications offering practical guidance on business ecosystems. Other installments address more key questions: “How Do You Design a Business Ecosystem?” “Why Do Most Business Ecosystems Fail?” “How Do You Manage a Business Ecosystem?” “How Do You Succeed as a Business Ecosystem Contributor?”

The term “business ecosystem” has firmly established itself in the dictionary of management buzzwords. For example, research by the BCG Henderson Institute found that in annual reports the term “ecosystem” occurs 13 times more frequently now than it did a decade ago. All of a sudden, new business ecosystems seem to be popping up all around us. For example, Walgreens Boots Alliance CEO Stefano Pessina early this year declared that his company’s partnership with Microsoft will help create an “ecosystem” connecting its drugstores to patients, their insurers, and local medical care providers; SoftBank founder Masayoshi Son announced his ambition to create an “ecosystem” of companies for a second Vision Fund that can collaborate to accelerate growth; and the government of Canada announced support for a new aerospace innovation “ecosystem.”

Many managers, fearful of missing out on this trend, feel compelled to come up with their own business ecosystems—or at least to become part of some large emerging ecosystems. But they struggle with the broad scope of the concept, unclear definitions, and the lack of practical advice.

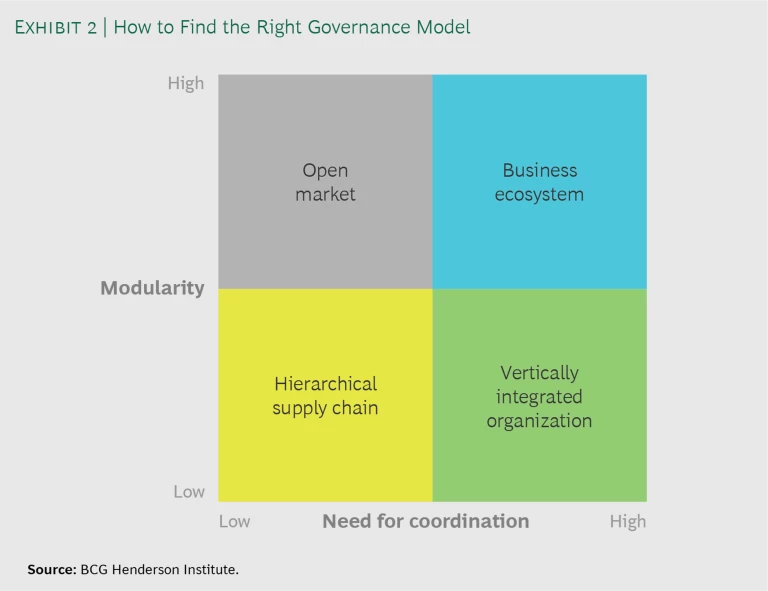

We suggest thinking of a business ecosystem as a solution to a business problem, as a way to organize in order to realize a specific value proposition. To this end, a business ecosystem is a governance model that competes with other ways of organizing the creation of a product or service, such as a vertically integrated organization, a hierarchical supply chain, or an open-market model.

We suggest thinking of a business ecosystem as a solution to a business problem, as a way to organize in order to realize a specific value proposition.

To help managers find their way through the confusing jungle of ecosystem thinking, we aim to address the following questions:

- What is a business ecosystem, and how is it different from other governance models?

- What are the basic types of business ecosystem?

- When is an ecosystem the right governance model?

- What are the benefits and drawbacks of organizing in a business ecosystem?

What Is a Business Ecosystem?

The confusion about ecosystems starts with the question of what they are and how they differ from other forms of organization. We use a simple definition: a business ecosystem is a dynamic group of largely independent economic players that create products or services that together constitute a coherent solution.

This definition implies that each ecosystem can be characterized by a specific value proposition (the desired solution) and by a clearly defined, albeit changing, group of actors with different roles (such as producer, supplier, orchestrator, complementor). The definition excludes some of the more diffuse concepts of ecosystems that describe mere affiliation, such as geographic industry clusters (Silicon Valley or the Boston biotech cluster) or company partnership networks (Toyota and its suppliers or Google and its broad network of partners) without a clear relation to a specific business problem.

BCG Henderson Institute: Discover new thinking shaping the business landscape

Even defined in this stringent way, a business ecosystem is a broad concept and includes, among other things: marketplaces that bring together large numbers of producers of products or services and potential customers, for example, in retail (Amazon, eBay, Taobao), hospitality (Airbnb, TripAdvisor, Open Table), ride hailing (Uber, Lyft, Didi), and freelance labor (Upwork, Croogster, Fiverr); IT systems that integrate components and applications from multiple providers on a common platform (such as Microsoft Windows, Apple iOS, Android, SAP NetWeaver); offerings that integrate components from different players, for example, video games, e-readers, smart home systems, residential solar energy solutions, self-driving vehicles, 3D printing, IoT solutions; and offerings that integrate services from different providers, for example, credit card systems, disease management platforms, smart farming or mining solutions.

Despite the enormous diversity in business ecosystems, several characteristics distinguish them from other governance models:

- Modularity. In contrast to vertically integrated models or hierarchical supply chains, in business ecosystems, the components of the offering are designed independently yet function as an integrated whole. In many cases, the customer can choose among the components and/or how they are combined. Think of smartphone apps—some are pre-installed but most are selected by the user and downloaded from an app store.

- Customization. In contrast to an open-market model, the contributions of the ecosystem participants tend to be customized to the ecosystem and made mutually compatible. This implies that participation in the ecosystem requires some ecosystem-specific investments. For example, developers of video games need to program their games for a specific console platform.

- Multilateralism. In contrast to open-market models, ecosystems consist of a set of relationships that are not decomposable to an aggregation of bilateral interactions. This means that a successful contract between A and B (such as phone maker and app developer) can be undermined by the failure of the contract between A and C (phone maker and telecom provider).

- Coordination. In contrast to vertically integrated models or supply chains, business ecosystems are not fully hierarchically controlled, but there is some mechanism of coordination—for example, through standards, rules, or processes—beyond a simple open-market mechanism. In digital platforms, for instance, access and interaction are generally regulated by a set of application programming interfaces (APIs).

The concept of business ecosystems is not new. Indeed, the large fairs in many medieval cities at which merchants came together and exchanged goods for a given period of time each year can be regarded as early forms of ecosystems. Similarly, as early as the fourteenth century, the city of Prato, Italy, had established a textile industry as an ecosystem of independent craftsmen specializing in weaving, carding, spinning, fulling, and dyeing, and orchestrated by powerful wool merchants that acted as the trading hubs of the system and provided critical functions of production coordination, quality control, and even financing.

While many of today’s ecosystems are fostered by digitization, the concept of an ecosystem does not strictly require a digital business model.

These examples indicate that, while many of today’s ecosystems are fostered by digitization, the concept of an ecosystem does not strictly require a digital business model. Many successful ecosystems, such as the Visa payment card platform and the more than 100-year-old Hong Kong–based trading company Li & Fung, which orchestrates the production assets of thousands of manufacturers to serve apparel retailers all over the world, started without a digital backbone. Nor does our definition of a business ecosystem rely on the concept of a platform as an intermediating interface among different kinds of actors. There are many examples of physical ecosystems, such as electric vehicles, solar power systems, and 3D-printing solutions, in which the players interact directly and not through a platform. The concept of business ecosystems is thus more general than the concept of digital platforms, although many of the most successful ecosystems of our time are built on such platforms. Digital technology increases the speed, reach, convenience, efficiency, and scalability of many ecosystems and is thus an important driver of their current growth.

What Are the Basic Types of Ecosystem?

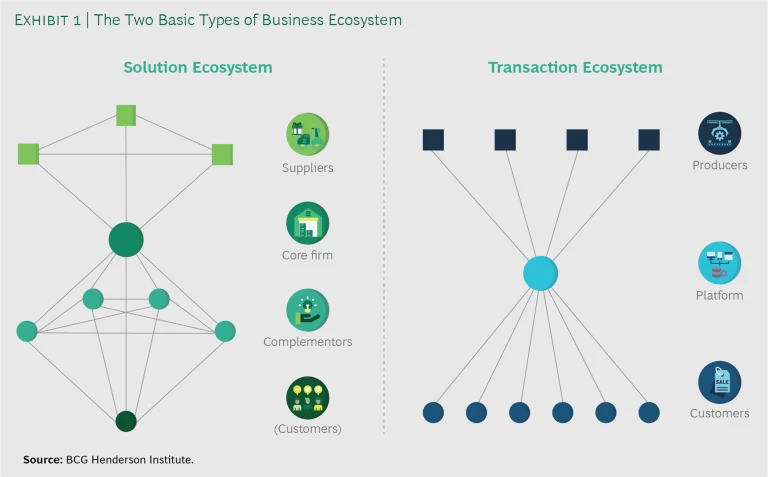

There are two basic types of business ecosystem that can be observed in practice: solution ecosystems, which create and/or deliver a product or service by coordinating various contributors, and transaction ecosystems, which match or link participants in a two-sided market through a (digital) platform. (See Exhibit 1.)

- Solution Ecosystems. In its most basic form, a solution ecosystem has a core firm that orchestrates the offerings of several complementors. During the development of a new solution, suppliers to the core firm or to important complementors can also be part of the ecosystem because they are independent and their innovation activities must be coordinated with the other players. Once the basic innovation is accomplished, such suppliers may be restricted to a reduced role in a hierarchical supply chain. In solution ecosystems, the customer is typically not an active member but has a big impact by selecting and combining the offerings of the core firm and the complementors. In addition, intermediaries (such as retailers and other sales agents) may participate in the ecosystem because their activities must be aligned with the other players (not shown in Exhibit 1). Consider semiconductor lithography—the process by which circuit designs are imprinted on a semiconductor wafer—as a simple example of a solution ecosystem. At the core of the ecosystem is the lithography tool, which includes an energy source and a lens system. For the lithography tool to create value, it needs two complements: a circuit mask, which holds the circuit design to be replicated, and a chemical resist, which reacts when exposed to the energy source to replicate the circuit image on the mask onto the silicon wafer. The enormous advances in semiconductor lithography over the past six decades, which enabled the doubling of the number of transistors that can be placed on a chip approximately every two years, required technology revolutions in all components of the semiconductor lithography ecosystem and close collaboration and co-innovation among the independent companies.

2 2 Ron Adner and Rahul Kapoor, “ Value Creation in Innovation Ecosystems: How the Structure of Technological Interdependence Affects Firm Performance in New Technology Generations,” Strategic Management Journal, March 2010. Other examples of solution ecosystems include credit card systems (linking merchants, consumers, and banks), smart home solutions (combining climate, lighting, entertainment, and security products and services), and 3D printing (integrating providers of printers, substrates, software, and services). - Transaction Ecosystems. Transaction ecosystems are characterized by a central platform (today in most cases facilitated by digital technology) that links independent producers of products or services with independent customers. Examples of such platform businesses are abundant. Think of eBay, which links independent sellers and buyers; Uber, which links drivers and riders; and Upwork, which links freelance workers with companies. Transaction ecosystems are two-sided markets that benefit from direct and indirect network effects. Direct network effects occur when participants value the offering more as the number of other participants on their side of the market grows (such as users of fax machines or social networks). More important, indirect network effects emerge when the value of the ecosystem for the participants on one side of the market increases with growing numbers of participants on the other side. For example, an increasing number of drivers attracts additional customers to a ride-hailing platform, which in turn will attract even more drivers, resulting in a positive feedback loop. In this way, and in contrast to solution ecosystems, customers are an integral part of transaction ecosystems. They not only create one side of the market but also contribute data and feedback to the ecosystem. Sometimes, customers even switch into the role of producers—for instance, when viewers on YouTube post their own videos or when tenants on Airbnb offer their own homes on the platform.

The two ecosystem archetypes differ not only in their structural form and types of members, but also in their purpose, success factors, and value creation mechanism. The purpose of a solution ecosystem is to create a coherent solution. The core firm is an orchestrator that must motivate and coordinate the innovation activities of the complementors, ensure continuous improvement of the overall product, and safeguard fair value sharing among ecosystem members. Value is created by identifying and removing bottlenecks in the overall system and by exploiting supermodular complementarities (which exist when more of component B leads to increasing returns for component A). Solution ecosystems typically capture the value they create by selling their solution as a product or service.

The purpose of a transaction ecosystem is matchmaking: identifying the best fit between the specific needs of a customer and the specific offering of a producer, and facilitating the subsequent transaction.

By contrast, the purpose of a transaction ecosystem is matchmaking: identifying the best fit between the specific needs of a customer and the specific offering of a producer, and facilitating the subsequent transaction. Value creation in a transaction ecosystem is thus driven by the number of successful transactions and their benefits to both sides of the market. For example, a ride-hailing platform creates value by finding the nearest driver for a given passenger, establishing trust between the two through curation and insurance, and performing financial settlement. In addition to establishing and facilitating the matchmaking mechanism, the role of the platform orchestrator is to manage access to the platform, establish standards and rules, and set incentives for both sides of the market in order to grow the ecosystem and exploit network effects. Monetization of transaction ecosystem value is frequently based on transaction fees, charging for advertising, or both.

When you consider building or joining a business ecosystem, you need to be clear about what type would be the best way to realize your value proposition. Sometimes both solution and transaction ecosystems are viable, and we increasingly see shifts between the models and hybrid forms. For example, the Apple iPhone started as a solution ecosystem, with Apple as core firm coordinating a coherent solution with component suppliers, app developers, and telecom providers, but after the introduction of the App Store, it also became a platform and marketplace for selling apps. On the other hand, Airbnb was established as a transaction ecosystem but has recently started to build a solution ecosystem by inviting outside developers to integrate additional applications and services into the platform (such as tools to make travel arrangements or to simplify guest check-in, cleaning, or linen delivery). Similarly, LinkedIn has moved toward a solution ecosystem model after its acquisition by Microsoft.

When Is an Ecosystem the Right Governance Model?

Let’s assume you have identified an attractive business opportunity and are reflecting on the best governance model to realize it. You have multiple options for organizing the required activities:

- A vertically integrated model, in which you perform all key activities within your own organization

- A hierarchical supply chain, in which you outsource certain activities to suppliers from which you buy and/or intermediaries to which you sell

- A business ecosystem, in which you coordinate with other, largely independent economic players in order to create a coherent offering

- An open-market model, in which the customer selects and buys the required components from independent and uncoordinated providers in an open, competitive market

Under which conditions is a business ecosystem the advantaged governance model for your business opportunity? To start with, unpredictable but highly malleable business environments may lend themselves to an ecosystem approach. Such environments enable “shaping” strategies, which define the profile of an industry before its rules have been written or rewritten. Shaping strategies require you to collaborate with others because you cannot shape the industry alone and you need others to share the risk, contribute complementary capabilities, and build the new market quickly, before competitors mobilize. Moreover, business opportunities in such environments are often characterized by both high modularity of the required product or service solution and a high need for coordination among players—ideal conditions for business ecosystems. (See Exhibit 2.)

A product or service solution exhibits high modularity if its components can be combined easily and flexibly and integrated at low (transaction) cost. For example, the production of an iPhone from its components (main I/O, battery, display, camera, and so on) is characterized by low modularity and must be done by the OEM (in this case in a hierarchical supply chain), while the use of an iPhone by combining the device, the telecom provider, and apps exhibits high modularity and can be done by the individual consumer.

Highly modular offerings lend themselves to an open-market model. However, there are some situations in which the customer clearly benefits from closer coordination among the components, and these are the sweet spots for business ecosystems. Such a need for coordination can have various causes:

- It is not easy to identify and match the required partners, which is the value proposition of most matchmaking platforms.

- The roles and responsibilities of the various partners are not fully specified. For example, effective disease management solutions require a clear definition and division of responsibility for patient treatment and data sharing among insurance companies, individual practitioners, hospitals, labs, pharmacies, and technology companies.

- The interfaces between the components are not well standardized, such as in the competing battery and charging technologies for electric vehicles.

- The specifications of the system or individual components frequently change, such as in many PC and mobile operating systems.

- The change of one component requires changes of other components to realize its value, as illustrated by the coevolution and continuous debottlenecking of the semiconductor lithography system over the past 60 years.

Shifts in the need for coordination, and in the level of modularity, signal the need for a shift in the governance model. The evolution of the governance model for the PC system serves as an illustration. IBM started developing the PC system in the 1970s. In the initial phase, low modularity and high need for coordination between components favored a vertically integrated model, so IBM kept almost all activities in-house, extending its R&D efforts to virtually every technological driver of computing performance, from research on glass ceramics to the design of efficient software algorithms. Once the basic design was established, the need for such close coordination decreased, and IBM began to outsource the development and production of some components (such as memory chips, storage devices, the operating system, and software applications), organizing in a hierarchical supply chain. However, IBM had not made exclusive agreements to control the core hardware components (such as the Intel microprocessor) and the core software components (such as Microsoft DOS). IBM’s architecture became a common good and the standard for all PCs (except for Apple). The increasing modularity of the PC system enabled an open-market model, in which PC clone makers used the IBM architecture and purchased components directly from Intel, Microsoft, and other suppliers. The open-market model spurred the production, commercialization, and adoption of PCs all over the world.

Shifts in the need for coordination, and in the level of modularity, signal the need for a shift in the governance model.

However, the open-market model restricted innovation. For example, Intel’s increasingly powerful microprocessors provided only limited benefit for users as long as the other component players did not redesign their products to take advantage of the new microprocessors. This potential for system-level innovation increased the need for coordination, but the open-market model limited opportunities and incentives for advancing the overall PC system architecture. To fill this gap, Intel created the Intel Architecture Lab (IAL), which set out to drive architectural progress on the PC system, stimulate and facilitate innovation on complementary products, and coordinate outside firms’ innovation to drive the development of new system capabilities. An early IAL project was the PCI (peripheral component interconnect) bus initiative, responsible for linking the many components of the PC system. By developing the PCI bus and establishing it as an industry standard, Intel removed an important performance bottleneck in the PC system and grabbed the position as orchestrator of the PC ecosystem.

The PC system example illustrates a pattern evident in many industries. On the one hand, product standardization increases modularity because dominant designs reduce the variety of potential components, and interfaces between components become more clearly defined. Digitization further simplifies these interfaces, lowers transaction costs, and fosters modularity. On the other hand, standardization of the process of combining the components to create the overall solution reduces the need for coordination because there is less variety in activities, more joint experience in aligning activities, and a higher number of suppliers that are able to provide the required components. In this way, many industries naturally converge toward an open-market model, and digital technologies may further support this development. However, as the example of the PC system also illustrates, discontinuous innovation may increase the need for coordination again because it introduces new components or new combinations of existing components, and a change in one component may require changes in other components to fully realize the benefits at a system level.

Many industries naturally converge toward an open-market model, and digital technologies may further support this development.

This observation may also explain the current focus on business ecosystems: on the one hand, digitization facilitates modularity and enables more open governance models, on the other hand, the resulting boom of business model innovation increases the need for coordination among players, making business ecosystems an advantaged governance model. Many digital platforms have reversed the widespread trend of disintermediation by replacing inefficient and nonscalable intermediaries with automated, data-based algorithms and social feedback. However, further advances in technology (such as blockchain) could conceivably challenge this trend of re-intermediation. As the technology behind many platforms becomes more standardized and commoditized, the need for coordination may decline and, with it, the importance of the orchestrator. Some ecosystems may develop into open-market models. To react to these pressures on their business models, many platform providers have begun to offer services beyond matchmaking on both sides of the market.

Of course, the preferred governance model for a given business opportunity and business environment is often ambiguous. In many industries, we see competing governance models. Think of the classic example of PC operating systems, in which Apple followed a strictly integrated model while Microsoft built an ecosystem of independent software vendors for its Windows platform. Similarly, in electric vehicles, Tesla initially followed an integrated model, even building its own battery production and charging infrastructure, while Better Place tried to establish an ecosystem model by separating car ownership from the battery and offering battery charging and renting as a service. Better Place failed, but probably because of an overly optimistic expansion strategy rather than a flawed business model design. As product and process standards for building and operating electric vehicles are increasingly established, we can expect the usual trend toward higher modularity and lower need for coordination. Indeed, most traditional car OEMs that entered the EV market more recently use a hierarchical supply chain for their batteries, and even Tesla increasingly employs an ecosystem of partners (such as hotels, restaurants, and shopping centers) for its charging infrastructure.

What Are the Benefits and Drawbacks of Organizing in a Business Ecosystem?

If there is a certain flexibility in the choice of governance model for a given business opportunity, our final question is to what extent an ecosystem is an attractive way to organize. What are the advantages of a business ecosystem compared with an integrated model, a hierarchical supply chain, or an open-market model, and what are the potential drawbacks that need to be managed?

In many industries, we see competing governance models.

The Benefits

Business ecosystems offer three critical benefits: access to a broad range of capabilities, the ability to scale quickly, and flexibility and resilience. In particular during the startup phase, an ecosystem model can provide fast access to external capabilities that may be too expensive or time-consuming to build internally. Bill Joy, a founder of Sun Microsystems, famously said, “Not all smart people work for you.” However, while it is hard to find and employ smart people, they might find you if you open up your ecosystem and invite them to participate. This is particularly relevant when it comes to the speed and breadth of “open” innovation. Steve Jobs was initially opposed to opening the iPhone to third-party app developers, but it was only when the App Store was established about eight months after the launch of the iPhone that the ecosystem really took off with the explosion of innovative new applications.

Once launched, ecosystems can scale much faster than other governance models. Their modular structure, with clearly defined interfaces, makes it easy to add participants, and the asset-light business models that underlie many platforms permit rapid growth. Airbnb outperforms most large hotel chains in terms of revenue and market capitalization without owning a single hotel. Moreover, positive network effects can foster explosive growth for transaction ecosystems that solve the chicken-or-egg problem. Airbnb achieved its dominant market position only ten years after its founding, a trajectory that could hardly be imagined in the traditional, asset-intensive hotel business model and can largely be attributed to the self-reinforcing dynamics of growing numbers of guests and beds.

It is hard to find and employ smart people, but they might find you if you open up your ecosystem and invite them to participate.

Finally, part of the attractiveness of business ecosystems stems from their flexibility and resilience. Their modular setup, with a stable core or platform and stable interfaces—but highly variable components that can be easily added or subtracted from the system—enable both high variety and a high capacity to evolve. In this way, ecosystems are particularly attractive when consumers’ needs and tastes are heterogeneous or unpredictable or when technological trajectories are dynamic or uncertain. Consider the Windows operating system. Owing to its set-up as a flexible ecosystem, Windows managed to remain the dominant PC operating system for more than three decades, despite enormous changes in the underlying technology and in customers’ requirements.

The Drawbacks

Of course, there are also drawbacks to the ecosystem model. By definition, an ecosystem consists of largely independent economic players that agree to collaborate, which implies only limited control of the overall system by each participant. Even an ecosystem orchestrator has limited means to enforce or control the behavior of partners, compared with a hierarchical supply chain or an integrated model. Google experienced this in the Open Handset Alliance, where it struggled with several competing forks of its Android operating system—for example, from handset makers Samsung and Xiaomi.

The challenge is to engage and orchestrate external partners without full hierarchical power or control. Such ecosystem governance can be achieved through the architecture of the ecosystem and through clear rules, standards, and norms that are established in a transparent, participative, and fair way and are adjusted as the ecosystem evolves. However, a certain constraint on control is simply the price of open innovation, flexibility, and resilience, so ecosystem governance must be finely balanced, leaving room for serendipitous discoveries and self-organized evolution.

The challenge is to engage and orchestrate external partners without full hierarchical power or control.

Related to the challenge of limited control is the problem of value capture. It is in the nature of an ecosystem that the total value it creates must be split among its participants. The core firm in a solution ecosystem or the platform orchestrator in a transaction ecosystem is responsible for ensuring that the ecosystem is economically attractive for all its important contributors. An ecosystem has to be a club that others want to join. Achieving this can require huge investments during the startup and scaling phase that can be recouped only once the ecosystem is fully established. Many large digital platforms that have achieved high financial valuations, such as Uber and Lyft, still struggle to earn substantial profits. However, limited initial value capture may be the price of the opportunity to scale fast and grow what can become a powerful oligopolistic position. Companies like Microsoft and Amazon became very profitable after many years of investing in building multiple ecosystems.

The more open the ecosystem, the more difficult is value capture, as Google experienced with its open Android ecosystem when compared with the more restrictive Apple iOS. Companies need to come up with new and unconventional ways to monetize the value of their ecosystem beyond charging for access or transaction fees, such as targeted advertising, charging for enhanced access or complementary services, selling data, or expanding into adjacent products or services.

Finally, the enormous success of a few large players should not blind one to the fact that ecosystems can fail. A recent study by the BCG Henderson Institute found that fewer than 15% of the 57 ecosystems investigated were sustainable in the long run. And this is probably an optimistic estimate given the impossibility of completely eliminating survivor bias. The odds of succeeding with ecosystems are thus not better than for other governance models, and the gains for those that initially succeed are often temporary, in spite of the impression created by successful incumbents.

The enormous success of a few large players should not blind one to the fact that ecosystems can fail.

The main reason for this mixed performance may be the many new strategic challenges that ecosystems pose: solving the chicken-or-egg problem during launch; ensuring that costs don’t explode during scale-up, which can be very fast when positive network effects kick in; preventing the erosion of quality during growth; defending against competitors that use the low entry barriers of many digital business models to copy and improve your model and encourage your complementors or users to multi-home, or even fully switch to their ecosystems. These requirements are new and unfamiliar to many companies. And even if you have established a strong market position, once you start losing share, network effects can quickly reverse and work against you, as illustrated by the fast collapse of the once-dominant BlackBerry and Myspace ecosystems. The dynamism and flexibility of ecosystems cut both ways: the model is evolvable and scalable, but it requires continuous adjustment. Sustainable success calls for permanent engagement with all stakeholders, improvement and expansion of the offering, and innovation and renewal of the ecosystem.

The Business Ecosystem Checklist

When you reflect on the best governance model for a given business opportunity, you should consider building a business ecosystem if

- You face an unpredictable but highly malleable business environment that requires you to collaborate with others in order to shape or reshape the industry.

- The individual components of the solution can be easily and flexibly combined, but a certain level of coordination is needed to identify the required partners, specify their roles, and align their activities.

- You can benefit from the access to external capabilities, fast scaling, and flexibility and resilience that an ecosystem offers.

If you decide to build you own business ecosystem, make sure that you are prepared for the challenges of limited control and constrained value capture and for the strategic requirements of building, growing, and protecting such an ecosystem.

On the other hand, if your business environment is rather predictable or you cannot really shape it, if your opportunity requires a highly integrated solution or coordination between component providers is not really an issue, or if you can rely on internal capabilities for launching, scaling, and flexibly adjusting your offering, other governance models such as vertical integration, a hierarchical supply chain, or even an open market may be better choices.

There are good reasons for the current hype around ecosystems, but managers should stay calm and dispassionately evaluate whether a business ecosystem is the best solution to their problem.

This article is the first in a series on business ecosystems. Subsequent articles will address how to design a business ecosystem, how to measure its success over time, and how to manage it.